Page 1 of 1

The Internal Revenue Service (IRS) recently released draft instructions for preparing, distributing and filing 2023 Forms 1094-B/C and 1095-B/C. These instructions largely mirror guidance the IRS has published in previous years, except that the electronic filing threshold has been reduced from 250 forms to 10 forms aggregate.

For 2022 filing, employers could mail their Forms 1094 and 1095 to the IRS if their submission included fewer than 250 forms. For ACA filing for 2023 and future years, employers that cumulatively submit at least 10 forms to the IRS, including W-2s, 1099s, ACA forms 1094/1095, and other common form series, the employer must now file all of those forms electronically.

For example– if you are an employer who issues five Forms W-2 for 2023, four 1095-B forms for 2023, and one 1094-B Form for 2023, this is a sum collectively of 10 total forms and this employer must file all of these forms electronically with the IRS when its due in 2024.

This change result from a final regulation the IRS issued earlier this year that officially reduced the electronic filing threshold for many forms.

Employers that have historically submitted their Forms 1094/1095 to the IRS by paper will need to consider overall how many forms they will be filing with the IRS (not just Forms 1094/1095) in 2024 to determine whether they can continue to file via paper. Even if your carrier prepares you with paper copies of your 1094/1095 forms as a courtesy for submission to the IRS, you will still need to evaluate if you need to file those electronically in 2024.

Ultimately the 10 form aggregate threshold will necessitate electronic filing for nearly every employer. Anyone who has traditionally paper filed their ACA forms to consider contracting with a vendor or speak with their payroll company to see if they can confidentially e-File on their behalf in 2024.

The IRS guidance regarding the filing threshold is available online at https://www.govinfo.gov/content/pkg/FR-2023-02-23/pdf/2023-03710.pdf

The IRS has proposed two significant changes to electronic filing requirements for various information returns including not just the Forms 1094-C and 1095-C filings required of many employers by the Affordable Care Act (ACA), but common payee statements like Forms W-2 and 1099. If the proposed changes are finalized – we expect that to happen by this autumn – all but the very smallest employers will be required to file these forms electronically for filing due dates falling in 2022 and beyond. Employers wishing to engage an ACA reporting and/or payroll vendor to comply with electronic filings requirements will need to begin making changes to comply.

Under current e-filing rules, an employer subject to the ACA’s employer mandate is not required to file its Forms 1094-C and 1095-C electronically unless the employer is submitting at least 250 of the forms to the IRS. When determining whether the employer crosses the 250-return threshold, the employer separately counts the different returns it files, such as its Forms 1094-C and 1095-C, and even payee statements like Forms W-2, 1099, etc.

For example, an employer with 150 ACA full-time employees and 50 part-time employees over the course of the calendar year may be required to file 200 Forms W-2, 150 Forms 1095-C and one Form 1094-C, but because the employer is not filing at least 250 of the same form, the employer is not required to file any of the forms electronically.

The new IRS proposal would drop the 250-return threshold to 100 for returns due in 2022 (and to 10 for returns due in 2023 or later years), and, most significantly, would require employers to aggregate the number of different returns it files when determining whether the 250-return threshold is reached. In the example above, for returns due in 2022, the employer would aggregate the 200 Forms W-2, 150 Forms 1095-C and the one Form 1094-C, for a total of 351 returns. Because the aggregated total of returns due from the employer is at least 250, all the returns must be filed electronically.

Many employers that until now have filed their Forms 1094-C/1095-C, W-2, 1099, etc. on paper will be required – assuming the IRS shortly finalizes the newly proposed regulations – to submit those forms to the IRS electronically for filings due in 2022. Almost all employers will be required to e-file by 2023. For employers wishing to engage a vendor to conduct electronic filing – particularly those for whom the e-filing status quo will change next year – the search for an e-filing vendor should begin.

The 2021 open enrollment season is quickly approaching. This week the IRS released Rev. Proc. 2020-36 which, among other items, set the affordability threshold for employers in 2021. In order to avoid a potential section 4980H(b) penalty, an employer must make sure one of its plans provides minimum value and is offered at an affordable price.

A plan is considered affordable under the ACA if the employee’s contribution level for self-only coverage does not exceed 9.5 percent of the employee’s household income. This 9.5 percent threshold is indexed for years after 2014. In 2021 the affordability threshold will be 9.83 percent which is up slightly from the 2020 affordability threshold of 9.78 percent.

An employer wishing to use one of the affordability safe harbors will use the 2021 affordability threshold of 9.83 percent when determining if the safe harbor has been satisfied. The first affordability safe harbor an employer may utilize is referred to as the form w-2 safe harbor. Under the form w-2 safe harbor, an employer’s offer will be deemed affordable if the employee’s required contribution for the employer’s lowest cost self-only coverage that provides minimum value does not exceed 9.83 percent of that employee’s form w-2 wages (box 1 of the form w-2) from the employer for the calendar year.

The second affordability safe harbor is the rate of pay safe harbor. The rate of pay safe harbor can be broken into two tests, one test for hourly employees and another test for salaried employees. For hourly employees an employer’s offer will be deemed affordable if the employee’s required contribution for the month for the employer’s lowest cost self-only coverage that provides minimum value does not exceed 9.83 percent of the product of the employee’s hourly rate of pay and 130 hours. For salaried employees an employer’s offer will be deemed affordable if the employee’s required contribution for the month for the employer’s lowest cost self-only coverage that provides minimum value does not exceed 9.83 percent of the employee’s monthly salary.

The final affordability safe harbor is the federal poverty line safe harbor. Under the federal poverty line safe harbor, an employer’s offer will be deemed affordable if the employee’s required contribution for the employer’s lowest cost self-only coverage that provides minimum value does not exceed 9.83 percent of the monthly Federal Poverty Line (FPL) for a single individual. The annual federal poverty line amount to use for the United States mainland in 2021 is $12,760. Therefore, an employee’s monthly cost for self-only coverage cannot exceed $104.52 in order to satisfy the federal poverty line safe harbor.

Obviously employers are dealing with a lot of issues as the COVID-19 crisis continues to impact almost every employer in the country. However, it is important for employers to remain compliant with the always evolving ACA rules and regulations. When planning for the 2021 plan year, every employer should check to make sure at least one of its plans that provides minimum value meets one of the affordability safe harbors discussed above for each of its full-time employees. It would not be surprising if individuals were more scrupulous with their healthcare choices in 2021 which could leave noncompliant employers exposed to section 4980H(b) penalties.

4. Available is also an excel sheet to help organize and calculate the loan amount. Please let us know if you need a copy of this.

As tax season begins, the IRS is urging employers to educate their HR and payroll staff about a Form W-2 phishing scam that victimized hundreds of organizations and thousands of employees last year.

“The Form W-2 scam has emerged as one of the most dangerous phishing e-mails in the tax community,” the IRS said in a January 2018 alert. During the last two tax seasons, “cybercriminals tricked payroll personnel or people with access to payroll information into disclosing sensitive information for entire workforces,” the alert noted.

Reports about this scam jumped to approximately 900 in 2017, compared to slightly over 100 in 2016, the IRS said. As a result, hundreds of thousands of employees had their identities compromised.

The IRS described the scam as follows:

The IRS gave these examples of what appear to be e-mails from top executives at the organization:

The scam affected all types of employers last year, from small and large businesses to public schools and universities, hospitals, tribal governments and charities, the IRS said.

(more…)

Earlier this week, President Obama signed the 21st Century Cures Act (“Act”). This Act contains provisions for “Qualified Small Business Health Reimbursement Arrangements” (“HRA”). This new HRA would allow eligible small employers to offer a health reimbursement arrangement funded solely by the employer that would reimburse employees for qualified medical expenses including health insurance premiums.

The maximum reimbursement that can be provided under the plan is $4,950 or $10,000 if the HRA provided for family members of the employee. An employer is eligible to establish a small employer health reimbursement arrangement if that employer (i) is not subject to the employer mandate under the Affordable Care Act (i.e., less than 50 full-time employees) and (ii) does not offer a group health plan to any employees.

To be a qualified small employer HRA, the arrangement must be provided on the same terms to all eligible employees, although the Act allows benefits under the HRA to vary based on age and family-size variations in the price of an insurance policy in the relevant individual health insurance market.

Employers must report contributions to a reimbursement arrangement on their employees’ W-2 each year and notify each participant of the amount of benefit provided under the HRA each year at least 90 days before the beginning of each year.

This new provision also provides that employees that are covered by this HRA will not be eligible for subsidies for health insurance purchased under an exchange during the months that they are covered by the employer’s HRA.

Such HRAs are not considered “group health plans” for most purposes under the Code, ERISA and the Public Health Service Act and are not subject to COBRA.

This new provision also overturns guidance issued by the Internal Revenue Service and the Department of Labor that stated that these arrangements violated the Affordable Care Act insurance market reforms and were subject to a penalty for providing such arrangements.

The previous IRS and DOL guidance would still prohibit these arrangements for larger employers. The provision is effective for plan years beginning after December 31, 2016. (There was transition relief for plans offering these benefits that ends December 31, 2016 and extends the relief given in IRS Notice 2015-17.)

In July 2015, President Obama signed into law the Trade Preferences Extension Act of 2015. Included in the bill was an important provision that affects welfare and retirement benefit plans. The Act sizably increases filing penalties for information return and statement failures under the Internal Revenue Code, effective for filings after December 31,2015. Employers now face significantly larger penalties for failing to correctly file and furnish the ACA forms 1094 and 1095 (shared responsibility reporting requirements) as well as Forms W-2 and 1099-R.

Background

Sections 6721 and 6722 of the IRC impose penalties associated with failures to file- or to file correct- information returns and statements. Section 6721 applies to the returns required to be filed with the IRS, and Section 6722 applies to statements required to be provided generally to employees.These penalty provisions apply to the ACA shared responsibility reporting Forms 1094-B, 1094-C, 1095-B, and 1095-C (Sections 6055 & 6056) failures as well as other information returns and statement failures, like those on Forms W-2 and 1099.

For ACA:

The Sections 6055 & 6056 reporting requirements are effective for medical coverage provided on or after January 1, 2015, with the first information returns to be filed with the IRS by February 29, 2016 (or March 31,2016 if filing electronically) and provided to individuals by February 1, 2016.

Increase in Penalties

The Trade Preferences Extension Act of 2015 (Act) contains several tax provisions in addition to the trade measures that were the focus of the bill. Provided as a revenue offset provision, the law significantly increases the penalty amounts under Sections 6721 and 6722. A failure includes failing to file or furnish information returns or statements by the due date, failing to provide all required information, as well as failing to provide correct information.

The law increases the penalty for:

Other penalty increase also apply, including those associated with timely filing a corrected return. Penalties could also provide a one-two punch under the ACA for employers and other responsible entities. For example, under Sec 6056, applicable large employers (ALE) must file information returns to the IRS (the 1094-B and 1094-C) as well as furnish statements to employees (the 1095-B and 1095-C). So incorrect information shared on those forms could result in a double penalty- one associated with the information return to the IRS and the other associated with individual statements to employees.

Final regulations on the ACA reporting requirements provide short-term relief from these penalties. For reports files in 2016 (for 2015 calendar year info), the IRS will not impose penalties on ALE members that can show they made a “good-faith effort” to comply with the information reporting requirements. Specifically, relief is provided for incorrect or incomplete info reported on the return or statement, including Social Security numbers, but not for failing to file timely.

Form 1095-A is a tax form that will be sent to consumers who have been enrolled in health insurance through the Marketplace in the past year. Just like employees receive a W-2 from their employer, consumer who had a plans on the Marketplace will also receive form 1095-A from the Marketplace, which they will need for taxes. Similar to how households receive multiple W-2s if individuals have multiple jobs, some households will get multiple Form 1095-As if they were covered under different plans or changed plans during the year. The 1095-A forms will be mailed direct to consumer’s last known home address provided to the Marketplace and will be postmarked by February 2, 2015.

Form 1095-A provides information to consumers that is needed to complete Form 8962, Premium Tax Credit (PTC). The Marketplace has also reporting this information to the IRS. Consumers will file Form 8962 with their tax returns if they want to claim the premium tax credit or if they received premium assistance through advance credit payments made to their insurance provider.

Beginning January 1, 2015, employers have new reporting obligations for health plan coverage, to allow the government to administer the “pay or play” penalties to be assessed against employers that do not offer compliant coverage to their full-time employees.

Even though the penalties only apply if there are 100 or more employees for 2015, employers with 50 or more full-time equivalent employees are required to report for 2015. Also, note this reporting is required even if the employer does not maintain any health plan.

Employers that provide self-funded group health coverage also have reporting obligations, to allow the government to administer the “individual mandate” which results in a tax on individuals who do not maintain health coverage.

These reporting obligations will be difficult for most employers to implement. Penalties for non-compliance are high, so employers need to begin now with developing a plan on how they will track and file the required information.

Pay or Play Reporting. Applicable large employers (ALEs) must report health coverage offered to employees for each month of 2015 in an annual information return due early in 2016. ALEs are employers with 50 or more full-time equivalent (FTE) employees. Employees who average 30 hours are counted as one, and those who average less than 30 hours are combined into an equivalent number of 30 hour employees to determine if there are 50 or more FTE employees. All employees of controlled group, or 80% commonly owned employers, are also combined to determine if the 50 FTE threshold is met.

Individual Mandate Reporting. Self-funded employers, including both ALEs and small employers that are not ALEs, must report each individual covered for each month of the calendar year. For fully-insured coverage, the insurance carrier must report individual month by month coverage. The individual mandate reporting is due early in 2016 for each month of 2015.

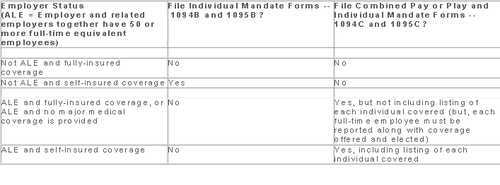

Which Form? ALE employers have one set of forms to report both the pay or play and the individual mandate information – Forms 1094C and 1095C. Insurers and self-insured employers that are not ALEs use Forms 1094B and 1095B to report the individual mandate information. Information about employee and individual coverage provided on these forms must also be reported by the employer to its employees as well as to COBRA and retiree participants. Forms 1095B and 1095C can be used to provide this information, or employers can provide the information in a different format.

The following chart summaries which returns are filed by employers:

Who Reports? While ALE status is determined on a controlled group basis, each ALE must file separate reports. Employers will need to provide insurance carriers, and third party administrators who process claims for self-funded coverage (if they will assist the employer with reporting), accurate data on the employer for whom each covered employee works. If an employee works for more than one ALE in a controlled group, the employer for whom the highest number of hours is worked does the reporting for that employee.

Due Date for Filing. The due date of the forms matches the due dates of Forms W-2, and employers may provide the required employee statements along with the W-2. Employee reporting is due January 31st and reporting to the IRS is due each February 28th, although the date is extended until March 31st if the forms are filed electronically. If the employer files 250 or more returns, the returns must be filed electronically. Reporting to employees can only be made electronically if the employee has specifically consented to receiving these reports electronically.

Penalties. Failure to file penalties can total $200 per individual for whom information must be reported, subject to a maximum of $3 million per year. Penalties will not be assessed for employers who make a good faith effort to file correct returns for 2015.

What Information is Required? For the pay or play reporting, each ALE must file a Form 1094C reporting the number of its full-time employees (averaging 30 hours) and total employees for each calendar month, whether the ALE is in a “aggregated” (controlled) group, a listing of the name and EIN of the top 30 other entities in the controlled group (ranked by number of full-time employees), and any special transition rules being used for pay or play penalties. ALE’s must also file a 1095C for each employee who was a full-time employee during any calendar month of the year. The 1095C includes the employee’s name, address and SSN, and month by month reporting of whether coverage was offered to the employee, spouse and dependents, the lowest premium for employee only coverage, and identification of the safe-harbor used to determine affordability. This information is used to determine pay or play penalty taxes and to verify the individuals’ eligibility for subsidies toward coverage costs on the Federal and state exchanges.

If the ALE provides self-funded coverage, the ALE must also report on the 1095C the name and SSN of each individual provided coverage for each calendar month. If an employer is not an ALE, but is self-funded, the name and SSN of each covered individual is reported on the 1095B and the 1094B is used to transmit the forms 1095B to the IRS.

A chart is available that sets out what data must be reported on each form, to help employers determine what information they need to track. Click here to access the chart.

Next Steps. Employers will need to determine how much help their insurance carrier or TPA can provide with the reporting, and then the employer’s HR, payroll and IT functions will need to work together to be sure the necessary information is being tracked and can be produced for reporting in January 2016.