Page 1 of 1

With the Republicans’ failure to pass a bill to repeal and replace the Affordable Care Act (ACA), employers should plan to remain compliant with all ACA employee health coverage and annual notification and information reporting obligations.

Even so, advocates for easing the ACA’s financial and administrative burdens on employers are hopeful that at least a few of the reforms they’ve been seeking will resurface in the future, either in narrowly tailored stand-alone legislation or added to a bipartisan measure to stabilize the ACA’s public exchanges. Relief from regulatory agencies could also make life under the ACA less burdensome for employers.

“Looking ahead, lawmakers will likely pursue targeted modifications to the ACA, including some employer provisions,” said Chatrane Birbal, senior advisor for government relations at the Society for Human Resource Management (SHRM). “Stand-alone legislative proposals have been introduced in previous Congresses, and sponsors of those proposals are gearing up to reintroduce bills in the coming weeks.”

These legislative measures, Birbal explained, are most likely to address the areas noted below.

(more…)

Beginning January 1, 2015, employers have new reporting obligations for health plan coverage, to allow the government to administer the “pay or play” penalties to be assessed against employers that do not offer compliant coverage to their full-time employees.

Even though the penalties only apply if there are 100 or more employees for 2015, employers with 50 or more full-time equivalent employees are required to report for 2015. Also, note this reporting is required even if the employer does not maintain any health plan.

Employers that provide self-funded group health coverage also have reporting obligations, to allow the government to administer the “individual mandate” which results in a tax on individuals who do not maintain health coverage.

These reporting obligations will be difficult for most employers to implement. Penalties for non-compliance are high, so employers need to begin now with developing a plan on how they will track and file the required information.

Pay or Play Reporting. Applicable large employers (ALEs) must report health coverage offered to employees for each month of 2015 in an annual information return due early in 2016. ALEs are employers with 50 or more full-time equivalent (FTE) employees. Employees who average 30 hours are counted as one, and those who average less than 30 hours are combined into an equivalent number of 30 hour employees to determine if there are 50 or more FTE employees. All employees of controlled group, or 80% commonly owned employers, are also combined to determine if the 50 FTE threshold is met.

Individual Mandate Reporting. Self-funded employers, including both ALEs and small employers that are not ALEs, must report each individual covered for each month of the calendar year. For fully-insured coverage, the insurance carrier must report individual month by month coverage. The individual mandate reporting is due early in 2016 for each month of 2015.

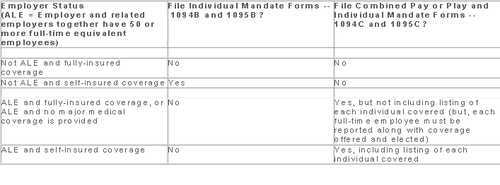

Which Form? ALE employers have one set of forms to report both the pay or play and the individual mandate information – Forms 1094C and 1095C. Insurers and self-insured employers that are not ALEs use Forms 1094B and 1095B to report the individual mandate information. Information about employee and individual coverage provided on these forms must also be reported by the employer to its employees as well as to COBRA and retiree participants. Forms 1095B and 1095C can be used to provide this information, or employers can provide the information in a different format.

The following chart summaries which returns are filed by employers:

Who Reports? While ALE status is determined on a controlled group basis, each ALE must file separate reports. Employers will need to provide insurance carriers, and third party administrators who process claims for self-funded coverage (if they will assist the employer with reporting), accurate data on the employer for whom each covered employee works. If an employee works for more than one ALE in a controlled group, the employer for whom the highest number of hours is worked does the reporting for that employee.

Due Date for Filing. The due date of the forms matches the due dates of Forms W-2, and employers may provide the required employee statements along with the W-2. Employee reporting is due January 31st and reporting to the IRS is due each February 28th, although the date is extended until March 31st if the forms are filed electronically. If the employer files 250 or more returns, the returns must be filed electronically. Reporting to employees can only be made electronically if the employee has specifically consented to receiving these reports electronically.

Penalties. Failure to file penalties can total $200 per individual for whom information must be reported, subject to a maximum of $3 million per year. Penalties will not be assessed for employers who make a good faith effort to file correct returns for 2015.

What Information is Required? For the pay or play reporting, each ALE must file a Form 1094C reporting the number of its full-time employees (averaging 30 hours) and total employees for each calendar month, whether the ALE is in a “aggregated” (controlled) group, a listing of the name and EIN of the top 30 other entities in the controlled group (ranked by number of full-time employees), and any special transition rules being used for pay or play penalties. ALE’s must also file a 1095C for each employee who was a full-time employee during any calendar month of the year. The 1095C includes the employee’s name, address and SSN, and month by month reporting of whether coverage was offered to the employee, spouse and dependents, the lowest premium for employee only coverage, and identification of the safe-harbor used to determine affordability. This information is used to determine pay or play penalty taxes and to verify the individuals’ eligibility for subsidies toward coverage costs on the Federal and state exchanges.

If the ALE provides self-funded coverage, the ALE must also report on the 1095C the name and SSN of each individual provided coverage for each calendar month. If an employer is not an ALE, but is self-funded, the name and SSN of each covered individual is reported on the 1095B and the 1094B is used to transmit the forms 1095B to the IRS.

A chart is available that sets out what data must be reported on each form, to help employers determine what information they need to track. Click here to access the chart.

Next Steps. Employers will need to determine how much help their insurance carrier or TPA can provide with the reporting, and then the employer’s HR, payroll and IT functions will need to work together to be sure the necessary information is being tracked and can be produced for reporting in January 2016.

As 2015 begins, the Occupational Safety and Health Administration (OSHA) is sharpening its emphasis on inspecting and citing employers who violate its recordkeeping standard. This takes on greater importance because of the changes and new reporting requirements effective on January 1, 2015.

New OSHA Reporting Rules

Under the new rules, all employers are now required to contact OSHA within 24 hours following an occurrence of any in-patient hospitalizations, amputations, or loss of an eye, as well as the current requirement to contact OSHA within eight hours following a fatality. For reporting compliance, employers have three options when contacting OSHA: 1) call the nearest area office; 2) call OSHA’s 24-hour hotline 1-800-321-OSHA(6742); or 3) report online.

New Recordkeeping And Posting Requirements

Many new categories of employers must now maintain and post OSHA injury and illness records going forward. Employers who were already covered must complete and post their 2014 annual summary by February 1, 2015 and keep it posted until April 30, 2015. Employers must utilize the annual summary form (form 300A) to comply with the posting requirements. Even if you have no recordable injury or illness, you must still complete your 300 logs and post the 300A summary.

Below are some key details that are frequently misunderstood or overlooked which can lead to OSHA citations.

Executive Certification

OSHA’s recordkeeping standard requires a certification of the 300A summary by a company executive. Four specific management officials may be considered “company executives” for purposes of certifying the 300A summary: 1) an owner of the company; 2) an officer of the corporation; 3) the highest-ranking company official working at the location; or 4) the immediate supervisor of the highest-ranking company official working at the location. This official must certify that he or she has reviewed the OSHA 300 logs and related records, and reasonably believes, based on knowledge of the process underlying the development of the data, that the posted summary is accurate and complete.

OSHA describes this requirement as imposing “senior management accountability” for the integrity and accuracy of the reported data. Human resources managers and safety directors normally cannot sign the OSHA 300A summary unless they are officers of the company.

Number Of Employees And Hours Worked

The annual summary requires employers to include a calculation of the annual average number of employees covered by the log and the total hours worked by all covered employees. The purpose of this requirement is to help employers compare the relative frequency of significant occupational injuries and illnesses at their workplace as compared to other establishments.

Posting Process

The 300A summary must be posted in each establishment in a conspicuous place or places where notices to employees are customarily posted. You are under a duty to ensure that the posted annual summary is not altered, defaced or obscured during the entire posting period.

Those employers who maintain these records in electronic form should still retain the signed posted summary after the February 1 to April 30 posting period, to prove that it was properly signed.

You should provide copies of the 300A summary to any employee who may not see the posted summary because they do not report to a fixed location on a regular basis. Even where an establishment has had no recordable injuries or illnesses, you must still post the 300A summary with zeros in the appropriate lines and certified by a company executive.

Record Review

Before the annual summary is prepared, the recordkeeping rule imposes an express duty to review the log (form 300) to verify that entries are complete and accurate. Employers must review the records as “extensively as necessary” to ensure accuracy.

OSHA scrutinizes the forms 301, 300 and 300A for even minor errors in descriptions and boxes checked. Take time to review the forms for technical errors as well as to review accident reports, first aid logs and other related materials to ensure that all recordable incidents have been included and that records are consistent. Employers have a duty to update and maintain records for five years plus the current year and provide them upon request for inspection by OSHA investigators.

Newly Covered Employers

Finally, all employers who have previously been partially exempt from OSHA recordkeeping requirements and were not required to maintain the form 300, should review the updated industry exemption list to see if they are now covered. Under the new rule, 25 industries that were previously exempt are not, and must now maintain the OSHA 300 logs and other required documentations.

The Affordable Care Act will require Applicable Large Employers (i.e. large employers subject to the employer mandate) and employers sponsoring self-insured plans to comply with new annual IRS reporting requirements. The first reporting deadline will be February 28, 2016 as to the data employers collect during the 2015 calendar year. The reporting provides the IRS with information it needs to enforce the Individual Mandate (i.e. individuals are penalized for not having health coverage) and the Employer Mandate (i.e. large employers are penalized for not offering health coverage to full-time employees). The IRS will also require employers who offer self-insured plans to report on covered individuals.

Large employers and coverage providers must also provide a written statement to each employee or responsible individual (i.e. one who enrolls one or more individuals) identifying the reported information. The written statement can be a copy of the Form.

The IRS recently released draft Forms 1094-C and 1095-C and draft Forms 1094-B and 1095-B, along with draft instructions for each form.

Which Forms Do I File?

When?

Statements to employees and responsible individuals are due annually by January 31. The first statements are due January 31, 2016.

Forms 1094-B, 1095-B, 1094-C and 1095-C are due annually by February 28 (or by March 31, if filing electronically). The first filing is due by February 28, 2016 (or March 31, 2016, if filing electronically).

Even though the forms are not due until 2016, the annual reporting will be based on data from the prior year. Employers need to plan ahead now to collect data for 2015. Many employers have adopted the Look Back Measurement Method Safe Harbor (“Safe Harbor”) to identify full-time employees under the ACA. The Safe Harbor allows employers to “look back” on the hours of service of its employees during 2014 or another measurement period. There are specific legal restrictions regarding the timing and length of the periods under the Safe Harbor, so employers cannot just pick random dates. Employers also must follow various rules to calculate hours of service under the Safe Harbor. The hours of service during the measurement period (which is likely to include most of 2014) will determine whether a particular employee is full-time under the ACA during the 2015 stability period. The stability period is the time during which the status of the employee, as full-time or non-full-time, is locked in. In 2016, employers must report their employees’ full-time status during the calendar year of 2015. Therefore, even though the IRS forms are not due until 2016, an employee’s hours of service in 2014 will determine how an employer reports that employee during each month of 2015. Employers who have not adopted the Safe Harbor should consider doing so because it allows an employer to average hours of service over a 12-month period to determine the full-time status of an employee. If an employer does not adopt the Safe Harbor, the IRS will require the employer to make a monthly determination, which is likely to increase an employer’s potential exposure to penalties.

What Must the Employer Report?

Form 1095-C

There are three parts to Form 1095-C. An applicable large employer must file one Form 1095-C for each full-time employee. If the applicable large employer sponsors self-insured health plans, it must also file Form 1095-C for any employee who enrolls in coverage regardless of the full-time status of that employee.

Form 1095-C requires the employer to identify the type of health coverage offered to a full-time employee for each calendar month, including whether that coverage offered minimum value and was affordable for that employee. Employers must use a code to identify the type of health coverage offered and applicable transition relief.

Employers that offer self-insured health plans also must report information about each individual enrolled in the self-insured health plan, including any full-time employee, non-full-time employee, employee family members, and others.

Form 1094-C

Applicable large employers use Form 1094-C as a transmittal to report employer summary information and transmit its Forms 1095-C to the IRS. Form 1094-C requires employers to enter the name and contact information of the employer and the total number of Forms 1095-C it submits. It also requires information about whether the employer offered minimum essential coverage under an eligible employer-sponsored plan to at least 95% of its full-time employees and their dependents for the entire calendar year, the number of full-time employees for each month, and the total number of employees (full-time or non-full-time) for each month.

Form 1095-B

Employers offering self-insured coverage use Form 1095-B to report information to the IRS about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment. These employers must file a Form 1095-B for eachindividual who was covered for any part of the calendar year. The employer must make reasonable efforts to collect social security numbers for covered individuals.

Form 1094-B

Employers who file Form 1095-B will use Form 1094-B as a transmittal form. It asks for the name of the employer, the employer’s EIN, and the name, telephone number, and address of the employer’s contact person.

Failure to Report – What Happens?

The IRS will impose penalties for failure to timely provide correct written statements to employees. The IRS will also impose penalties for failure to timely file a correct return. For the 2016 reporting on 2015 data, the IRS will not impose a penalty for good faith compliance. However, the IRS specified that good faith compliance requires that employers provide the statements and file the returns.

If you employed more than 100 people in the preceding calendar year, you are required to complete and submit your EEOC Report 1 (Survey) by September 30th. You should have received a reminder letter via mail from the EEOC in August also with the link to file the report online.

Please contact our office for information about the EEOC Report 1 or for the link to the EEOC’s web based filing system.

The Affordable Care Act (ACA) imposes significant information reporting responsibilities on employers starting with the 2015 calendar year. One reporting requirement applies to all employer-sponsored health plans, regardless of the size of the employer. A second reporting requirement applies only to large employers, even if the employer does not provide health coverage. The IRS is currently developing new systems for reporting the required information and recently released draft forms, however instructions have yet to be released.

Information returns

The new information reporting systems will be similar to the current Form W-2 reporting systems in that an information return (Form 1095-B or 1095-C) will be prepared for each applicable employee, and these returns will be filed with the IRS using a single transmittal form (Form 1094-B or 1094-C). Electronic filing is required if the employer files at least 250 returns. Employers must file these returns annually by Feb. 28 (March 31 if filed electronically). Therefore, employers will be filing these forms for the 2015 calendar year by Feb. 28 or March 31, 2016 respectively. A copy of the Form 1095, or a substitute statement, must be given to the employee by Jan. 31 and can be provided electronically with the employee’s consent. Employers will be subject to penalties of up to $200 per return for failing to timely file the returns or furnish statements to employees.

The IRS released drafts of the Form 1095-B and Form 1095-C information returns, as well as the Form 1094-B and Form 1094-C transmittal returns, in July 2014 and is expected to provide instructions for the forms in August 2014. According to the IRS, both the forms and the instructions will be finalized later this year.

Health coverage reporting requirement

The health coverage reporting requirement is designed to identify employees and their family members who are enrolled in minimum essential health coverage. Employees who are offered coverage, but decline the coverage, are not reported. The IRS will use this information to determine whether the employees are exempt from the individual mandate penalty due to having health coverage for themselves and their family members.

Insurance companies will prepare Form 1095-B (Health Coverage) and Form 1094-B (Transmittal of Health Coverage Information Returns) for individuals covered by fully-insured employer-sponsored group health plans. Small employers with self-insured health plans will use Form 1095-B and Form 1094-B to report the name, address, and Social Security number (or date of birth) of employees and their family members who have coverage under the self-insured health plan. However, large employers (as defined below) with self-insured health plans will file Forms 1095-C and 1094-C in lieu of Forms 1095-B and 1094-B.

Large employer reporting requirement

“Applicable large employer members (ALE)” are subject to the reporting requirement if they offer an insured or self-insured health plan, or do not offer any group health plan. ALE members are those employers that are either an applicable large employer on their own or are members of a controlled or affiliated service group with an ALE (regardless of the number of employees of the group member). ALEs are those that had, on average, at least 50 full-time employees (including full-time equivalent “FTE” employees) during the preceding calendar year. Full-time employees are those who work, on average, at least 30 hours per week. Employers with fewer than 50 full-time employees and equivalents are not applicable large employers and, thus, are exempt from this health coverage reporting requirement.

As referenced above, an employer’s status as an ALE is determined on a controlled or affiliated service group basis. For example, if Company A and Company B are members of the same controlled group and Company A has 100 employees and Company B has 20 employees, then A and B are both members of an ALE. Consequently, Company A and Company B must each file the information returns.

Each ALE member must file Form 1095-C (Employer-Provided Health Insurance Offer and Coverage) and Form 1094-C (Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns) with the IRS for each calendar year. The IRS will use this information to determine whether (1) the employer is subject to the employer mandate penalty, and (2) an employee is eligible for a premium tax credit on insurance purchased through the new health insurance exchange. ALEs with fewer than 100 full-time employees are generally eligible for transition relief from the employer mandate penalty for their 2015 plan year. Nonetheless, these employers are still required to file Forms 1095-C and 1094-C for the 2015 calendar year.

The employer mandate penalty can be imposed on any ALE member that does not offer affordable, minimum value health coverage to all of its full-time employees starting in 2015. Health coverage is affordable if the amount that the employer charges an employee for self-only coverage does not exceed 9.5 percent of the employee’s Form W-2 wages, rate of pay, or the federal poverty level for the year. A health plan provides minimum value if the plan is designed to pay at least 60 percent of the total cost of medical services for a standard population. In the case of a controlled or affiliated service group, the employer mandate penalties apply to each member of the group individually.

ALE members must prepare a Form 1095-C for each employee. The return will report the following information:

An ALE member will file with the IRS one Form 1094-C transmitting all of its Forms 1095-C. The Form 1094-C will report the following information:

As noted above, each ALE member is required to file Forms 1095-C and 1094-C for its own employees, even if it participates in a health plan with other employers (e.g., when the parent company sponsors a plan in which all subsidies participate). Special rules apply to multiemployer plans for collectively-bargained employees.

Action required

In light of the complexity of the new information reporting requirements, it is recommended that employers should begin taking steps now to prepare for the new reporting requirements:

Keeping up with changes under the Affordable Care Act (ACA) is a challenge for all employers. Here are the top five issues you should specifically pay attention to as healthcare reform rolls out.

The Employer Mandate

Under the ACA, large employers will be required to provide affordable healthcare insurance that meets minimum value to all full-time employees beginning in 2015. Final regulations issued in February clarify most aspects of how the mandate will be implemented.

The Individual Mandate

Beginning January 1, 2014, all individuals are required to carry qualified health insurance known as “minimum essential coverage” or face penalties when they file taxes in the spring of 2015. In 2014, the penalty for noncompliance will be the greater of $95 per uninsured person or 1% of household income over the filing threshold. This penalty will rise in 2015 and again in 2016.

Wellness Programs

As health insurance costs rise, wellness programs are gaining popularity, however be cautious when designing and maintaining a wellness program because they must conform to new ACA requirements and existing HIPAA nondiscrimination requirements.

Reporting Requirements

Beginning in the spring of 2016, large employers will face a new reporting requirement for the 2015 calendar year. The Form 6056 will ask for information including:

Automatic Enrollment And Nondiscrimination Regulations

Though enforcement of the automatic enrollment and nondiscrimination provisions of the ACA has not started, keep an eye out for regulations that will trigger compliance obligations. Employers with over 100 employees should anticipate that in the next few years, they will be required to automatically enroll all full-time employees for health insurance coverage.

In addition, employers who offer varying levels of coverage or employer-provided subsidies based on classes of employees need to watch for nondiscrimination regulations.

Please contact our office if you have any questions on how Healthcare Reform will affect you or your business.