Page 1 of 1

The IRS has recently issued Notice 2019-45, which increases the scope of preventive care that can be covered by a high deductible health plan (“HDHP”) without eliminating the covered person’s ability to maintain a health savings account (“HSA”).

Since 2003, eligible individuals whose sole health coverage is a HDHP have been able to contribute to HSAs. The contribution to the HSA is not taxed when it goes into the HSA or when it is used to pay health benefits. It can for example be used to pay deductibles or copays under the HDHP. But it can also be used as a kind of supplemental retirement plan to pay Medicare premiums or other health expenses in retirement, in which case it is more tax-favored than even a regular retirement plan.

As the name suggests, a HDHP must have a deductible that exceeds certain minimums ($1,350 for self-only HDHP coverage and $2,700 for family HDHP coverage for 2019, subject to cost of living changes in future years). However, certain preventive care (for example, annual physicals and many vaccinations) is covered without having to meet the deductible. In general, “preventive care” has been defined as care designed to identify or prevent illness, injury, or a medical condition, as opposed to care designed to treat an existing illness, injury, or condition.

Notice 2019-45 expands the existing definition of preventive care to cover medical expenses which, although they may treat a particular existing chronic condition, will prevent a future secondary condition. For example, untreated diabetes can cause heart disease, blindness, or a need for amputation, among other complications. Under the new guidance, a HDHP will cover insulin, treating it as a preventative for those other conditions as opposed to a treatment for diabetes.

The Notices states that in general, the intent was to permit the coverage of preventive services if:

The Notice is in general good news for those covered by HDHPs. However, it has two major limitations:

Given the expansion of the types of preventive coverage that a HDHP can cover, and the tax advantages of an HSA to employees, employers who have not previously implemented a HDHP or HSA may want to consider doing so now. However, as with any employee benefit, it is important to consider both the potential demand for the benefit and the administrative cost.

A third of millennials have health conditions that reduce their quality of life and life expectancy, according to a new study of medical claims by the Blue Cross Blue Shield Health Index (BCBS Health Index). The report found that millennials had substantially higher diagnoses for eight of the top 10 health conditions than Generation X, and based on their current health status, millennials are more likely to be less healthy when they’re older, compared to Gen Xers. These findings are based off of a study of millennials who were between the ages of 34 and 36 in 2017 and Gen Xers who were 34 to 36 in 2014.

The biggest health differences between the two generations was the higher impact of physical conditions driven by increased cardiovascular and endocrine conditions, including diabetes.

A recent Blue Cross Blue Shield Association (BCBSA) survey found that 83% of millennials consider themselves in good or excellent health, and that 68% of millennials have a primary care physician, compared to 91% of Generation X, which is an important factor in preventative care.

“Based on these findings, we’re seeing that millennials are not seeking preventative care and it’s not only having an effect on their immediate health, but will significantly impact their long-term health as well,” said Vincent Nelson, MD, vice president, Medical Affairs for BCBSA. “With millennials on track to become the largest generation in the near future, it’s critical that they’re taking their health maintenance seriously. Our plan is to address this issue now to ensure millennials, and all Americans, take a proactive role in maintaining their health and wellbeing.”

The Blue Cross Blue Shield, The Health of America Report series, “The Health of Millennials,” examined the BCBS Health Index, a database of de-identified medical claims from more than 41 million commercially insured members of Blue Cross and Blue Shield (BCBS) companies. The findings revealed overall health begins to decline at the age of 27.

Additional findings from the study are:

To identify key drivers of millennial health and how to improve it, BCBS companies will host Millennial Health Listening Sessions across the country. Through these workshops, BCBS companies will hear from millennials, leading health care experts, employers and digital leaders on how to improve the health of millennials. Independence Blue Cross will kick-start the listening sessions by hosting the first one on April 25 in Philadelphia, Pennsylvania.

A millennial is someone who was born between 1981 and 1996, and there are nearly 73 million millennials in the U.S. right now – the second largest generation among commercially insured Americans. Gen Xers were born between 1965 and 1980.

This is the 26th study of the Blue Cross Blue Shield, The Health of America Report® series. For more information, visit https://www.bcbs.com/the-health-of-america.

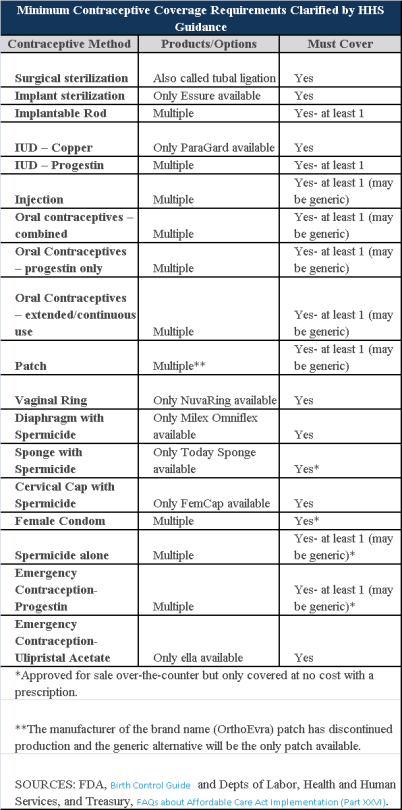

Plans and insurers must cover all 18 contraception methods approved by the U.S. Food and Drug Administration, according to a new set of questions and answers on the Affordable Care Act’s preventive care coverage requirements.

“Reasonable medical management” still may be used to steer members to specific products within those methods of contraception. A plan or insurer may impose cost-sharing on non-preferred items within a given method, as long as at least one form of contraception in each method is covered without cost-sharing.

However, an individual’s physician must be allowed to override the plan’s drug management techniques if the physician finds it medically necessary to cover without cost-sharing an item that a given plan or insurer has classified as non-preferred, according to one of the frequently asked questions from the U.S. Departments of Labor, Health and Human Services and the Treasury.

The ACA mandated all plans and insurers to cover preventive care items, as defined by the Public Health Service Act, without cost-sharing. Eighteen forms of female contraception are included under the preventive care list. The individual FAQs on contraception clarified the following requirements.

The FAQ comes just weeks after reports and news coverage detailed health plan violations of the women coverage provisions of the ACA.

Testing and Dependent Care Answers

In questions separate from contraception, plans and insurers were told they must cover breast cancer susceptibility (BRCA-1 or BRCA-2) testing without cost-sharing. The test identifies whether the woman has genetic mutations that make her more susceptible to BRCA-related breast cancer.

Another question stated that if colonoscopies are performed as preventive screening without cost-sharing, then plans could not impose cost-sharing on the anesthesia component of that service.

You may have heard a lot about how the Affordable Care Act (ACA) is going to change health insurance in the next year, but does it all apply to you? If you get your insurance from your employer, there may be a chance that you may be enrolled in a “grandfathered plan” and some of these changes may not affect you – yet.

Some health plans were allowed to be exempt from some of the ACA’s rules and protections in the interest of a smooth transition and to allow employers and individuals to keep their current policies in force without having to make substantial changes. Almost half of all Americans who get insurance through their jobs are enrolled in such plans, however that number is expected to continue to decline every year.

Consumers should know the status of their plans since that may determine whether they are eligible for certain protections and benefits created by ACA. For example, an employee at a large company may wonder why his employer provided coverage does not included the free preventative services that he has heard about on the news. In order to understand this, you must understand the status of your current medical plan and how grandfathering works.

What is a grandfathered plan?

Most health insurance plans that existed on March 23, 2013 are eligible for grandfathered status and therefore do not have to meet all of the requirements of the health care law. But if an insurer or employer makes significant changes to a plan’s benefits or how much members pay through premiums, copays, or deductibles, then the plan loses that status.

Both individual and group plans can be grandfathered. If you get coverage through an employer and they currently offer employees a grandfathered plan as part of their benefits package, you can enroll in this plan even if you were not enrolled on March 23, 2010.

What Rules Does a Grandfathered Plan Have to Follow?

A grandfathered plan has to follow some of the same rules other plans so under the ACA. For example, the plans can not impose lifetime limits on how much health care coverage an individual can receive, and they must offer dependent coverage for young adults until age 26.

There are many rules, however, that grandfather plans do not have to follow. For example, they are not required to provide preventative care without cost-sharing. In addition, they do not have to offer a package of “essential health benefits” that individual and small group plans must offer beginning 2014. Grandfathered individual plans can still impose annual dollar limits (such as capping key benefits at $750,000 in a given year) and they can deny coverage for children under age 19 if they have pre-existing conditions.

How Many People Are Enrolled in Grandfathered Plans?

In 2013, 36% of those who get coverage through their employer are enrolled in a grandfathered health plan. This number is down from 48% in 2012 and 56% in 2011, according to the Kaiser Family Foundation Employer Health Benefits Survey. Most plans are expected to lose grandfather status over time though.

How Do I Find Out If I’m Enrolled in a Grandfathered Plan?

If you want to know more about your coverage, it is best ask your insurance company or your employer’s human resource department about the status of your plan. If your employer is currently offering a grandfather plan, they are required to release a notice to you annually if they are offering benefits through a grandfathered medical plan.

Please contact our office for more information regarding if your current plan is considered “grandfathered” or for more information on ACA.