The U.S. Equal Employment Opportunity Commission (EEOC) recently issued proposed new rules clarifying its stance on the interplay between the Americans with Disabilities Act (ADA) and employer wellness programs. Officially called a “notice of proposed rulemaking” or NPRM, the new rules propose changes to the text of the EEOC’s ADA regulations and to the interpretive guidance explaining them.

If adopted, the NPRM will provide employers guidance on how they can use financial incentives or penalties to encourage employees to participate in wellness programs without violating the ADA, even if the programs include disability-related inquiries or medical examinations. This should be welcome news for employers, having spent nearly the past six years in limbo as a result of the EEOC’s virtual radio silence on this question.

A Brief History: How

Did We Get Here?

In 1990, the ADA was enacted to protect individuals with ADA-qualifying

disabilities from discrimination in the workplace. Under the ADA,

employers may conduct medical examinations and obtain medical histories as part

of their wellness programs so long as employee participation in them is

voluntary. The EEOC confirmed in 2000 that it considers a wellness

program voluntary, and therefore legal, where employees are neither required to

participate in it nor penalized for non-participation.

Then, in 2006, regulations were issued that exempted wellness programs from the nondiscrimination requirements of the Health Insurance Portability and Accountability Act (HIPAA) so long as they met certain requirements. These regulations also authorized employers for the first time to offer financial incentives of up to 20% of the cost of coverage to employees to encourage them to participate in wellness programs.

But between 2006 and 2009 the EEOC waffled on the legality of these financial incentives, stating that “the HIPAA rule is appropriate because the ADA lacks specific standards on financial incentives” in one instance, and that the EEOC was “continuing to examine what level, if any, of financial inducement to participate in a wellness program would be permissible under the ADA” in another.

Shortly thereafter, the 2010 enactment of President Obama’s Patient Protection and Affordable Care Act (ACA), which regulates corporate wellness programs, appeared to put this debate to rest. The ACA authorized employers to offer certain types of financial incentives to employees so long as the incentives did not exceed 30% of the cost of coverage to employees.

But in the years following the ACA’s enactment, the EEOC restated that it had not in fact taken any position on the legality of financial incentives. In the wake of this pronouncement, employers were left understandably confused and uncertain. To alleviate these sentiments, several federal agencies banded together and jointly issued regulations that authorized employers to reward employees for participating in wellness programs, including programs that involved medical examinations or questionnaires. These regulations also confirmed the previously set 30%–of-coverage ceiling and even provided for incentives of up to 50%of coverage for programs related to preventing or reducing the use of tobacco products.

After remaining silent about employer wellness programs for nearly five years, in August 2014, the EEOC awoke from its slumber and filed its very first lawsuit targeting wellness programs, EEOC v. Orion Energy Systems, alleging that they violate the ADA. In the following months, it filed similar suits against Flambeau, Inc., and Honeywell International, Inc. In EEOC v. Honeywell International, Inc., the EEOC took probably its most alarming position on the subject to date, asserting that a wellness program violates the ADA even if it fully complies with the ACA.

What’s In The NPRM?

According to EEOC Chair Jenny Yang, the purpose of the EEOC’s NPRM is to

reconcile HIPAA’s authorization of financial incentives to encourage

participation in wellness programs with the ADA’s requirement that medical

examinations and inquiries that are part of them be voluntary. To that

end, the NPRM explains:

Each of these parts of the NPRM is briefly discussed below.

What is an employee

wellness program?

In general, the term “wellness program” refers to a program or activity offered

by an employer to encourage its employees to improve their health and to reduce

overall health care costs. For instance, one program might encourage

employees to engage in healthier lifestyles, such as exercising daily, making

healthier diet choices, or quitting smoking. Another might obtain medical

information from them by asking them to complete health risk assessments or

undergo a screening for risk factors.

The NPRM defines wellness programs as programs that are reasonably designed to promote health or prevent disease. To meet this standard, programs must have a reasonable chance of improving the health of, or preventing disease in, its participating employees. The programs also must not be overly burdensome, a pretext for violating anti-discrimination laws, or highly suspect in the method chosen to promote health or prevent disease.

How is voluntary

defined?

The NPRM contains several requirements that must be met in order for

participation in wellness programs to be voluntary. Specifically,

employers may not:

Additionally, for wellness programs that are part of a group health plan, employers must provide a notice to employees clearly explaining what medical information will be obtained, how it will be used, who will receive it, restrictions on its disclosure, and the protections in place to prevent its improper disclosure.

What incentives may

you offer?

The NPRM clarifies that the offer of limited incentives is permitted and will

not render wellness programs involuntary. Under the NPRM, the maximum

allowable incentive employers can offer employees for participation in a

wellness program or for achieving certain health results is 30% of the total

cost of coverage to employees who participate in it. The total cost of

coverage is the amount that the employer and the employee pay, not just the

employee’s share of the cost. The maximum allowable penalty employers may

impose on employees who do not participate in the wellness program is the

same.

What about

confidentiality?

The NPRM does not change any of the exceptions to the confidentiality

provisions in the EEOC’s existing ADA regulations. It does, however, add

a new subsection that explains that employers may only receive information

collected by wellness programs in aggregate form that does not disclose, and is

not likely to disclose, the identity of the employees participating in it,

except as may be necessary to administer the plan.

Additionally, for a wellness program that is part of a group health plan, the health information that identifies an individual is “protected health information” and therefore subject to HIPAA. HIPAA mandates that employers maintain certain safeguards to protect the privacy of such personal health information and limits the uses and disclosure of it.

Keep in mind that the NPRM revisions discussed above only clarify the EEOC’s stance regarding how employers can use financial incentives to encourage their employees to participate in employer wellness programs without violating the ADA. It does not relieve employers of their obligation to ensure that their wellness programs comply with other anti-discrimination laws as well.

Is This The Law?

The NPRM is just a notice that alerts the public that the EEOC intends to

revise its ADA regulations and interpretive guidance as they relate to employer

wellness programs. It is also an open invitation for comments regarding

the proposed revisions. Anyone who would like to comment on the NPRM must

do so by June 19, 2015. After that, the EEOC will evaluate all of the

comments that it receives and may make revisions to the NPRM in response to

them. The EEOC then votes on a final rule, and once it is approved, it

will be published in the Federal Register.

Since the NPRM is just a proposed rule, you do not have to comply with it just yet. But our advice is that you bring your wellness program into compliance with the NPRM for a few reasons. For one, it is very unlikely that the EEOC, or a court, would fault you for complying with the NPRM until the final rule is published. Additionally, many of the requirements that are set forth in the NPRM are already required under currently existing law. Thus, while waiting for the EEOC to issue its final rule, in the very least, you should make sure that you do not:

In addition you should provide reasonable accommodations to employees with disabilities to enable them to participate in wellness programs and obtain any incentives offered (e.g., if an employer has a deaf employee and attending a diet and exercise class is part of its wellness program, then the employer should provide a sign language interpreter to enable the deaf employee to participate in the class); and ensure that any medical information is maintained in a confidential manner.

During this year, businesses will be hearing a lot about the Affordable Care Act’s (ACA’s) information reporting requirements under Code Sections 6055 and 6056. Information gathering will be critical to successful reporting, and there is one aspect of that information gathering which employers might want to take action on sooner rather than later – collecting Social Security numbers (SSNs), particularly when required to do so from the spouses and dependents of their employees. There are, of course, ACA implications for not taking this step, as well as data privacy and security risks for employer and their vendors.

Under the ACA, providers of “minimum essential coverage” (MEC) must report certain information about that coverage to the Internal Revenue Service (IRS), as well as to persons receiving that MEC. Employers that sponsor self-insured group health plans are providers of MEC for this purpose, and in the course of meeting the reporting requirements, must collect and report SSNs to the IRS. However, this reporting mandate requires those employers (or vendors acting on their behalf) to transmit to the IRS the SSNs of employee and their spouses and dependents covered under the plan, unless the employers either (i) exhaust reasonable collection efforts described below, (ii) or meet certain requirements for limited reporting overall.

Obviously, employers are familiar with collecting, using and disclosing employee SSNs for legitimate business and benefit plan purposes. Collecting SSNs from spouses and dependents will be an increased burden, creating more risk on employers given the increased amount of sensitive data they will be handling, and possibly from vendors working on their behalf. The reporting rules permit an employer to use a dependent’s date of birth, only if the employer was not able to obtain the SSN after “reasonable efforts.” For this purpose, reasonable efforts means the employer was not able to obtain the SSN after an initial attempt, and two subsequent attempts.

From an ACA standpoint, employers with self-insured plans that have not collected this information should be engaged in these efforts during the year (2015) to ensure they are ready either to report the SSNs, or the DOBs. At the same time, collecting more sensitive information about individuals raises data privacy and security risks for an organization regarding the likelihood and scope of a breach. Some of those risks, and steps employers could take to mitigate those risks, are described below.

Employers navigating through ACA compliance and reporting requirements have many issues to be considered. How personal information or protected health information is safeguarded in the course of those efforts is one more important consideration.

The IRS and the Treasury Department issued a notice on the so-called “Cadillac Tax”—a 40 percent excise tax to be imposed on high-cost employer-sponsored health plans beginning in 2018 under the Affordable Care Act (ACA).

Notice 2015-16, released on Feb. 23, 2015, discusses a number of issues concerning the tax and requests comments on the possible approaches that ultimately could be incorporated in proposed regulations. Specifically, the guidance states that the agencies anticipate that pretax salary reduction contributions made by employees to health savings accounts (HSAs) will be subject to the Cadillac tax.

Background

In 2018, the ACA provides that a nondeductible 40 percent excise tax be imposed on “applicable employer-sponsored coverage” in excess of statutory thresholds (in 2018, $10,200 for self-only, $27,500 for family). As 2018 approaches, the benefit community has long awaited guidance on this tax. While many employers have actively managed their plan offerings and costs in anticipation of the impact of the tax, those efforts have been hampered by the lack of guidance. Among other things, employers are uncertain what health coverage is subject to the tax and how the tax is calculated.

Particularly, Notice 2015-16 addresses:

The agencies are requesting comments on issues

discussed in this notice by May 15, 2015. They intend to issue another notice

that will address other areas of the excise tax and anticipates issuing

proposed regulations after considering public comments on both notices.

Applicable Coverage

Of most immediate interest to plan sponsors is the specific type of coverage (i.e., “applicable coverage”) that will be subject to the excise tax, particularly where the statute is unclear.

Employee Pretax HSA

Contributions

The ACA statute provides that employer contributions to an HSA are subject to

the excise tax, but did not specifically address the treatment of employee

pretax HSA contributions. The notice says that the agencies “anticipate that

future proposed regulations will provide that (1) employer contributions to

HSAs, including salary reduction contributions to HSAs, are included in

applicable coverage, and (2) employee after-tax contributions to HSAs are

excluded from applicable coverage.”

Note: This anticipated treatment of employee pretax contributions to HSAs will have a significant impact on HSA programs. If implemented as the agencies anticipate, it could mean many employer plans that provide for HSA contributions will be subject to the excise tax as early as 2018, unless the employer limits the amount an employee can contribute on a pretax basis.

Self-Insured Dental

and Vision Plans

The ACA statutory language specifically excludes fully insured dental and

vision plans from the excise tax. The treatment of self-insured dental and

vision plans was not clear. The notice states that the agencies will consider

exercising their “regulatory authority” to exclude self-insured plans that

qualify as excepted benefits from the excise tax.

Employee Assistance

Programs

The agencies are also considering whether to exclude excepted-benefit employee

assistance programs (EAPs) from the excise tax.

Onsite Medical Clinics

The notice discusses the exclusion of certain onsite medical clinics that offer

only de

minimis care to employees,

citing a provision in the COBRA regulations, and anticipates excluding such

clinics from applicable coverage. Under the COBRA regulations an onsite clinic

is not considered a group health plan if:

The agencies are also asking for comment on

the treatment of clinics that provide certain services in addition to first

aid:

In Closing

With the release of this initial guidance, plan sponsors can gain some insight into the direction the government is likely to take in proposed regulations and can better address potential plan design strategie

Even small employers notsubject to the Affordable Care Act’s (ACA) coverage mandate can’t reimburse employees for nongroup health insurance coverage purchased on a public exchange, the Internal Revenue Service confirmed. But small employers providing premium reimbursement in 2014 are being offered transition relief through mid-2015.

IRS Notice 2015-17, issued on Feb. 18, 2015, is another in a series of guidance from the IRS reminding employers that they will run afoul of the ACA if they use health reimbursement arrangements (HRAs) or other employer payment plans—whether with pretax or post-tax dollars—to reimburse employees for individual policy premiums, including policies available on ACA federal or state public exchanges.

This time the warning is aimed at small employers—those with fewer than 50 full-time employees or equivalent workers. While small organizations are not subject to the ACA’s “shared responsibility” employer mandate to provide coverage or pay a penalty (aka Pay or Play), if they do provide health coverage it must meet a range of ACA coverage requirements.

“The agencies have taken the position that employer payment plans are group health plans, and thus must comply with the ACA’s market reforms,” noted Timothy Jost, J.D., a professor at the Washington and Lee University School of Law, in a Feb. 19 post on the Health Affairs Blog. “A group health plan must under these reforms cover at least preventive care and may not have annual dollar limits. A premium payment-only HRA or other payment arrangement that simply pays employee premiums does not comply with these requirements. An employer that offers such an arrangement, therefore, is subject to a fine of $100 per employee per day. (An HRA integrated into a group health plan that, for example, helps with covering cost-sharing is not a problem).”

Transition Relief

The notice provides transition relief for small employers that used premium payment arrangements for 2014. Small employers also will not be subject to penalties for providing payment arrangements for Jan. 1 through June 30, 2015. These employers must end their premium reimbursement plans by that time. This relief does not extend to stand-alone HRAs or other arrangements used to reimburse employees for medical expenses other than insurance premiums.

No similar relief was given for large employers (those with 50 or more full-time employees or equivalents) for the $100 per day per employee penalties. Large employers are required to self-report their violation on the IRS’s excise tax form 8928 with their quarterly filings.

“Notice 2015-17 recognizes that impermissible premium-reimbursement arrangements have been relatively common, particularly in the small-employer market,” states a benefits brief from law firm Spencer Fane. “And although the ACA created “SHOP Marketplaces” as a place for small employers to purchase affordable [group] health insurance, the notice concedes that the SHOPs have been slow to get off the ground. Hence, this transition relief.”

Subchapter S Corps.

The notice states that Subchapter S closely held corporations may pay for or reimburse individual plan premiums for employee-shareholders who own at least 2 percent of the corporation. “In this situation, the payment is included in income, but the 2-percent shareholder can deduct the premiums for tax purposes,” Jost explained. The 2-percent shareholder may also be eligible for premium tax credits through the marketplace SHOP Marketplace if he or she meets other eligibility requirements.

Tricare

Employers can pay for some or all of the expenses of employees covered by Tricare—a Department of Defense program that provides civilian health benefits for military personnel (including some members of the reserves), military retirees and their dependents—if the payment plan is integrated with a group health plan that meets ACA coverage requirements.

Higher Pay Is Still OK

One option that the IRS will allow employers is to simply increase an employee’s taxable wages in lieu of offering health insurance. “As long as the money is not specifically designated for premiums, this would not be a premium payment plan,” said Jost. “The employer could even give the employee general information about the marketplace and the availability of premium tax credits as long as it does not direct the employee to a specific plan.”

But if the employer pays or reimburses premiums specifically, “even if the payments are made on an after-tax basis, the arrangement is a noncompliant group health plan and the employer that offers it is subject to the $100 per day per employee penalty,” Jost warned.

“Small employers now have just over four months in which to wind down any impermissible premium-reimbursement arrangement,” the Spencer Fane brief notes. “In its place, they may wish to adopt a plan through a SHOP Marketplace. Although individuals may enroll through a Marketplace during only annual or special enrollment periods, there is no such limitation on an employer’s ability to adopt a plan through a SHOP.”

The Centers for Medicare & Medicaid Services (CMS) announced on February 20,2015 a special enrollment period (SEP) for individuals and families who did not have health coverage in 2014 and are subject to the fee or “shared responsibility payment” when they file their 2014 taxes in states which use the Federally-facilitated Marketplaces (FFM). This special enrollment period will allow those individuals and families who were unaware or didn’t understand the implications of this new requirement to enroll in 2015 health insurance coverage through the FFM.

For those who were unaware or didn’t understand the implications of the fee for not enrolling in coverage, CMS will provide consumers with an opportunity to purchase health insurance coverage from March 15 to April 30. If consumers do not purchase coverage for 2015 during this special enrollment period, they may have to pay a fee when they file their 2015 income taxes.

Those eligible for this special enrollment period live in states with a Federally-facilitated Marketplace and:

The special enrollment period announced today will begin on March 15, 2015 and end at 11:59 pm E.S.T. on April 30, 2015. If a consumer enrolls in coverage before the 15th of the month, coverage will be effective on the first day of the following month.

This year’s tax season is the first time individuals and families will be asked to provide basic information regarding their health coverage on their tax returns. Individuals who could not afford coverage or met other conditions may be eligible to receive an exemption for 2014. To help consumers who did not have insurance last year determine if they qualify for an exemption, CMS also launched a health coverage tax exemption tool today on HealthCare.gov and CuidadodeSalud.gov.

“We recognize that this is the first tax filing season where consumers may have to pay a fee or claim an exemption for not having health insurance coverage,” said CMS Administrator Marilyn Tavenner. “Our priority is to make sure consumers understand the new requirement to enroll in health coverage and to provide those who were not aware or did not understand the requirement with an opportunity to enroll in affordable coverage this year.”

Most taxpayers will only need to check a box when they file their taxes to indicate that they had health coverage in 2014 through their employer, Medicare, Medicaid, veterans care or other qualified health coverage that qualifies as “minimum essential coverage.” The remaining taxpayers will take different steps. It is expected that 10 to 20 percent of taxpayers who were uninsured for all or part of 2014 will qualify for an exemption from the requirement to have coverage. A much smaller fraction of taxpayers, an estimated 2 to 4 percent, will pay a fee because they made a choice to not obtain coverage and are not eligible for an exemption.

Americans who do not qualify for an exemption and went without health coverage in 2014 will have to pay a fee – $95 per adult or 1 percent of their income, whichever is greater – when they file their taxes this year. The fee increases to $325 per adult or 2% of income for 2015. Individuals taking advantage of this special enrollment period will still owe a fee for the months they were uninsured and did not receive an exemption in 2014 and 2015. This special enrollment period is designed to allow such individuals the opportunity to get covered for the remainder of the year and avoid additional fees for 2015.

The Administration is committed to providing the information and tools tax filers need to understand the new requirements. Part of this outreach effort involves coordinating efforts with nonprofit organizations and tax preparers who provide resources to consumers and offer on the ground support. If consumers have questions about their taxes, need to download forms, or want to learn more about the fee for not having insurance, they can find information and resources at www.HealthCare.gov/Taxes or www.IRS.gov. Consumers can also call the Marketplace Call Center at 1-800-318-2596. Consumers who need assistance filing their taxes can visit IRS.gov/VITA or IRS.gov/freefile.

Consumers seeking to take advantage of the special enrollment period can find out if they are eligible by visitinghttps://www.healthcare.gov/get-coverage. Consumers can find local help at: Localhelp.healthcare.gov or call the Federally-facilitated Marketplace Call Center at 1-800-318-2596. TTY users should call 1-855-889-4325. Assistance is available in 150 languages. The call is free.

For more information about Health Insurance Marketplaces, visit: www.healthcare.gov/marketplace

Last week, the IRS issued its “final” versions of the forms 1094-B,1094-C, 1095-B and 1095-C along with instructions for the “B” forms and instructions for the “C” forms. The good news is that the forms are pretty much the same from the drafts released in mid 2014. What has changed is that the revised instructions have filled in some gaps about reporting, some of which are highlighted below:

1. Employers with 50-99 FTEs who were exempt from compliance in 2015 must still file these forms for the 2015 tax year.

2. For employers that cover non-employees (COBRA beneficiaries or retirees being most common), they can use forms 1094-B and 1095-B instead of filing out 1095-C Part III to report for those individuals.

3. With respect to reporting for employees who work for more than one employer member of a controlled group aggregated “ALE”, the employee may receive a report from each separate employer. However, the employer for whom he or she works the most hours in a given month should report for that month.

4. Under the final instructions, a full-time employee of a self-insured employer that accepts a qualifying offer and enrolls in coverage, the employer must provide that employee a 1095-C. The previous draft indicated that it would be enough to simply provide an employee a statement about the offer rather than an actual form

5. For plans that exclude spouses covered or offered health coverage through their own employers, the definition of “offer of health coverage” now provides that an offer to a spouse subject to a reasonable, objective condition is treated as an offer of coverage for reporting purposes.

6. There are some changes with respect to what days can be used to measure the “count” for reporting purposes. Employers are allowed to use the first day of the first payroll period of each month or the last day of the first payroll period of each month, as long as the last day is in the same month as when the payroll period starts. Also, an employer can report offering coverage for a month only if the employer offers coverage for every day of that month. Mid-month eligibilities would presumably be counted as being covered on the first day of the next month. However, in the case of terminations of employment mid-month, the coverage can be treated as offered for the entire month if, but for the termination, the coverage would have continued for the full month.

Now as a refresher about what needs to be filed:

Bear in mind that there is a considerable amount of time between now and the final filing obligation so there may be additional revisions to these instructions, or at least some further clarification. But in the meantime, read the instructions and familiarize yourself with the reporting obligations as well as beginning the steps to collecting the necessary data to make completing the forms next year easier.

Healthcare Reform continues to roll on despite all of its opponents. While 2014 brought the implementation of the health insurance exchanges, the Individual Mandate, and a host of new rules relating to employer-provided health coverage, 2015 marks the start of yet another major component of the Affordable Care Act (ACA): the Employer Mandate.

In the a recent article written by Fisher & Phillips LLP attorney Steven Witt, he discusses the potential risks employers can face if they are not careful in how they implement (and document) their compliance strategies with regards to the Employer Mandate.

The Employer Mandate requires large employers to offer compliant group health coverage to their “full-time employees” and their dependents or face excise tax penalties. Say you are a large employer who has never offered health insurance (or perhaps only to a small subset of your employees). You do not want to bankrupt the company and offer health insurance to your entire workforce, nor do you want to face tax penalties. Instead, you opt for what the Employer Mandate calls for: you offer health insurance coverage to only your full-time employees.

If you decide to only offer coverage to your “full-time” employees, simply setting measurement period dates with your human resources department and running payroll reports to determine who is “full-time” will not sufficiently limit the risk of controversy and potential legal liability. You will be much better off to clearly define these eligibility rules in writing and make sure any old, conflicting eligibility rules are updated.

Leaving existing plan documents and other materials (e.g., employee handbooks) to define health insurance eligibility with something vague like “full-time employees: employees who regularly work 30 or more hours per week,” is only inviting trouble. You will no doubt have employees (with attorneys) who could make plausible arguments that they “regularly” work 30 or more hours a week and can point to your existing written documents as evidence they should have been offered health insurance. Without clearly setting out new eligibility rules, it will be a much steeper uphill battle for the employer to defend itself.

On the other hand, if such employees attempt to claim that they were unfairly denied health insurance coverage, an employer should be on much stronger footing to defend its position that those employees are not “full-time” if it can point to written documentation outlining items such as (a) date ranges used for measurement periods and stability periods; (b) waiting periods for newly-eligible employees; and © how to treat employees in special circumstances, such as those who are promoted from a part-time position to a full-time position, those on a leave of absence, or rehired employees.

If you have not already done this, it is not too late. Even employers subject to the Employer Mandate in 2015 can still timely revise their SPDs or perhaps draft stand-alone benefits eligibility documents or other “wrap” documents to fully outline new eligibility rules. Steven advises employers to pay close attention as additional regulations and agency guidance continues to roll out to ensure they stay in compliance with ERISA, the ACA, and other related federal and state health insurance-related laws.

Form 1095-A is a tax form that will be sent to consumers who have been enrolled in health insurance through the Marketplace in the past year. Just like employees receive a W-2 from their employer, consumer who had a plans on the Marketplace will also receive form 1095-A from the Marketplace, which they will need for taxes. Similar to how households receive multiple W-2s if individuals have multiple jobs, some households will get multiple Form 1095-As if they were covered under different plans or changed plans during the year. The 1095-A forms will be mailed direct to consumer’s last known home address provided to the Marketplace and will be postmarked by February 2, 2015.

Form 1095-A provides information to consumers that is needed to complete Form 8962, Premium Tax Credit (PTC). The Marketplace has also reporting this information to the IRS. Consumers will file Form 8962 with their tax returns if they want to claim the premium tax credit or if they received premium assistance through advance credit payments made to their insurance provider.

Beginning January 1, 2015, employers have new reporting obligations for health plan coverage, to allow the government to administer the “pay or play” penalties to be assessed against employers that do not offer compliant coverage to their full-time employees.

Even though the penalties only apply if there are 100 or more employees for 2015, employers with 50 or more full-time equivalent employees are required to report for 2015. Also, note this reporting is required even if the employer does not maintain any health plan.

Employers that provide self-funded group health coverage also have reporting obligations, to allow the government to administer the “individual mandate” which results in a tax on individuals who do not maintain health coverage.

These reporting obligations will be difficult for most employers to implement. Penalties for non-compliance are high, so employers need to begin now with developing a plan on how they will track and file the required information.

Pay or Play Reporting. Applicable large employers (ALEs) must report health coverage offered to employees for each month of 2015 in an annual information return due early in 2016. ALEs are employers with 50 or more full-time equivalent (FTE) employees. Employees who average 30 hours are counted as one, and those who average less than 30 hours are combined into an equivalent number of 30 hour employees to determine if there are 50 or more FTE employees. All employees of controlled group, or 80% commonly owned employers, are also combined to determine if the 50 FTE threshold is met.

Individual Mandate Reporting. Self-funded employers, including both ALEs and small employers that are not ALEs, must report each individual covered for each month of the calendar year. For fully-insured coverage, the insurance carrier must report individual month by month coverage. The individual mandate reporting is due early in 2016 for each month of 2015.

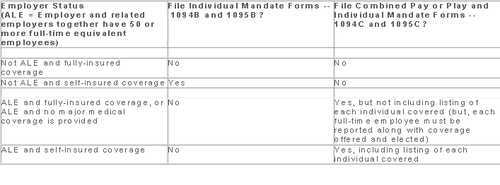

Which Form? ALE employers have one set of forms to report both the pay or play and the individual mandate information – Forms 1094C and 1095C. Insurers and self-insured employers that are not ALEs use Forms 1094B and 1095B to report the individual mandate information. Information about employee and individual coverage provided on these forms must also be reported by the employer to its employees as well as to COBRA and retiree participants. Forms 1095B and 1095C can be used to provide this information, or employers can provide the information in a different format.

The following chart summaries which returns are filed by employers:

Who Reports? While ALE status is determined on a controlled group basis, each ALE must file separate reports. Employers will need to provide insurance carriers, and third party administrators who process claims for self-funded coverage (if they will assist the employer with reporting), accurate data on the employer for whom each covered employee works. If an employee works for more than one ALE in a controlled group, the employer for whom the highest number of hours is worked does the reporting for that employee.

Due Date for Filing. The due date of the forms matches the due dates of Forms W-2, and employers may provide the required employee statements along with the W-2. Employee reporting is due January 31st and reporting to the IRS is due each February 28th, although the date is extended until March 31st if the forms are filed electronically. If the employer files 250 or more returns, the returns must be filed electronically. Reporting to employees can only be made electronically if the employee has specifically consented to receiving these reports electronically.

Penalties. Failure to file penalties can total $200 per individual for whom information must be reported, subject to a maximum of $3 million per year. Penalties will not be assessed for employers who make a good faith effort to file correct returns for 2015.

What Information is Required? For the pay or play reporting, each ALE must file a Form 1094C reporting the number of its full-time employees (averaging 30 hours) and total employees for each calendar month, whether the ALE is in a “aggregated” (controlled) group, a listing of the name and EIN of the top 30 other entities in the controlled group (ranked by number of full-time employees), and any special transition rules being used for pay or play penalties. ALE’s must also file a 1095C for each employee who was a full-time employee during any calendar month of the year. The 1095C includes the employee’s name, address and SSN, and month by month reporting of whether coverage was offered to the employee, spouse and dependents, the lowest premium for employee only coverage, and identification of the safe-harbor used to determine affordability. This information is used to determine pay or play penalty taxes and to verify the individuals’ eligibility for subsidies toward coverage costs on the Federal and state exchanges.

If the ALE provides self-funded coverage, the ALE must also report on the 1095C the name and SSN of each individual provided coverage for each calendar month. If an employer is not an ALE, but is self-funded, the name and SSN of each covered individual is reported on the 1095B and the 1094B is used to transmit the forms 1095B to the IRS.

A chart is available that sets out what data must be reported on each form, to help employers determine what information they need to track. Click here to access the chart.

Next Steps. Employers will need to determine how much help their insurance carrier or TPA can provide with the reporting, and then the employer’s HR, payroll and IT functions will need to work together to be sure the necessary information is being tracked and can be produced for reporting in January 2016.

Members of the U.S. House of Representatives voted on January 8, 2015 to redefine full-time employment under the Affordable Care Act (ACA) to employees who work at least 40 hours a week rather than 30 hours a week.

The Save American Workers Act, passed the House with a vote of 252-172 with full Republican support and 12 Democratic voters. The legislation would amend the Internal Revenue Code by changing the definition of full-time employee to cover individuals who work, on average, at least 40 hours per week for purposes of the employer mandate to provide minimum essential health care coverage under the ACA.

Despite the bill’s passage in the House, the fate of the bill in the U.S. Senate remains uncertain. In addition, Republicans have not garnered enough support to override the veto promised by President Obama if the bill did pass Congress.

According to Politico, “The House has cleared more than 50 assorted measures to repeal or roll back Obamacare, but this is the first time the House can propel legislation to a GOP-controlled Senate, potentially forcing President Barack Obama to either accept changes to his signature domestic achievement or use his veto power.”

Some supporters of the change, including the U.S. Chamber of Commerce, argue that the current standard deviates from the widely accepted definition of full-time work. It is argued that it provides an incentive for employers to reduce hours, particularly for low-wage workers, to avoid offering healthcare coverage.

This month, employers with 100 or more employees will be required to offer health insurance to at least 70% of employees who works at least 30 hours a week or else pay a penalty.

The NY Times comments:

By adjusting that threshold to 40 hours, Republicans — strongly backed by a number of business groups — said that they would re-establish the traditional 40-hour workweek and prevent businesses cutting costs from radically trimming worker hours to avoid mandatory insurance coverage. They contend that the most vulnerable workers are low-skilled and underpaid, working 30 to 35 hours a week, and now facing cuts to 29 hours or less so their employers do not have to insure them. With passage of the law, those workers would not have to get employer-sponsored health care, and their workweek would remain intact.

Analysis by the Congressional Budget Office found that the bill would increase the U.S. deficit by $53 billion over the course of a decade because fewer employers would pay penalties and one million employees would not have coverage through their job. Democrats cite these reasons as evidence that the bill is simply an attempt to dismantle the ACA.

A central issue of this bill is how far employers would go to avoid mandated coverage. A majority of employees already work 40 hours a week rather than 30. That being said, few employers would cut worker hours from 40 to 29, but many would be willing to cut hours from 40 to 39, the New York Times ventures, “That means raising the definition of a full-time worker under the health care law would put far more workers at risk.”