Beginning in Spring 2016, the Affordable Care Act (ACA) Exchanges/Marketplaces will begin to send notices to employers whose employees have received government-subsidized health insurance through the Exchanges. The ACA created the “Employer Notice Program” to give employers the opportunity to contest a potential penalty for employees receiving subsidized health insurance via an Exchange.

The notices will identify any employees who received an advance premium tax credit (APTC). If a full-time employee of an applicable large employer (ALE) receives a premium tax credit for coverage through the Exchanges in 2016, the ALE will be liable for the employer shared responsibility payment. The penalty if an employer doesn’t offer full-time equivalent employees (FTEs) affordable minimum value essential coverage is $2,160 per FTE (minus the first 30) in 2016. If an employer offers coverage, but it is not considered affordable, the penalty is the lesser of $3,240 per subsidized FTE in 2016 or the above penalty. Penalties for future years will be indexed for inflation and posted on the IRS website. The Employer Notice Program does provide an opportunity for an ALE to file an appeal if employees claimed subsidies they were not entitled to.

The first batch of notices will be sent in Spring 2016 and additional notices will be sent throughout the year. For 2016, the notices are expected to be sent to employers if the employee received an APTC for at least one month in 2016 and the employee provided the Exchange with the complete employer address.

Last September, the Centers for Medicare and Medicaid Services (CMS) issued FAQs regarding the Employer Notice Program. The FAQs respond to several questions regarding how employers should respond if they receive a notice that an employee received premium tax credits and cost sharing reductions through the ACA’s Exchanges.

Employers will have an opportunity to appeal the employer notice by proving they offered the employee access to affordable minimum value employer-sponsored coverage, therefore making the employee ineligible for APTC. An employer has 90 days from the date of the notice to appeal. If the employer’s appeal is successful, the Exchange will send a notice to the employee suggesting the employee update their Exchange application to reflect that he or she has access or is enrolled in other coverage. The notice to the employee will further explain that failure to provide an update to their application may result in a tax liability.

An employer appeal request form is available on the Healthcare.gov website. For more details about the Employer Notice Program or the employer appeal request form visit www.healthcare.gov.

Although CMS has provided these guidelines to apply only to the Federal Exchange, it is likely that the state-based Exchanges will have similar notification programs.

Employers should prepare in advance by developing a process for handling the Exchange notices, including appealing any incorrect information that an employee may have provided to the Exchange. Advance preparation will enable you to respond to the notice promptly and help to avoid potential employer penalties.

You did it! Your 1095 forms are ready and going out to employees. Now what?

You guessed it: Employee confusion. You’re going to get some questions. If you’re the one in charge of providing the answers, remember a great offense is the best defense. You’ll want to answer the most common questions before they’re even asked.

We’ve put together a list of some basic things

employees will want to know, along with sample answers. Tailor these Q&As as

needed for your organization. and then send them out to employees using every channel you can (mail, e-mail, employee meetings, company

website, social media, posters). Tell employees how to get more detailed

information if they need it.

1. What is this form I’m receiving?

A 1095 form is a little bit like a W-2 form.

Your employer (and/or insurer) sends one copy to the Internal Revenue Service (IRS)

and one copy to you. A W-2 form reports your annual earnings. A 1095 form

reports your health care coverage throughout the year.

2. Who is sending it to me, when, and how?

Your employer and/or health insurance company should

send one to you either by mail or in person. They may send the form to you

electronically if you gave them permission to do so. You should receive it by

March 31, 2016. (Starting in 2017, you should receive it each year by January

31, just like your W-2.)

3. Why are you sending it to me?

The 1095 forms will show that you and your

family members either did or did not have health coverage with our organization during each month of

the past year. Because of the Affordable Care Act, every person must obtain

health insurance or pay a penalty to the IRS.

4. What am I supposed to do with this form?

Keep it for your tax records. You don’t actually

need this form in order to file your taxes, but when you do file, you’ll have to tell the IRS whether or not

you had health insurance for each month of 2015. The Form 1095-B or 1095-C

shows if you had health insurance through your employer. Since you don’t

actually need this form to file your taxes, you don’t have to wait to receive

it if you already know what months you did or didn’t have health insurance in

2015. When you do get the form, keep it with your other 2015 tax information in

case you should need it in the future to help prove you had health insurance.

5. What if I get more than one 1095 form?

Someone who had health insurance through more

than one employer during the year may receive a 1095-B or 1095-C from each

employer. Some employees may receive a Form 1095-A and/or 1095-B reporting

specific health coverage details. Just keep these—you do not need to send them

in with your 2015 taxes.

6. What if I did not get a Form 1095-B or a 1095-C?

If you believe you should have received one but

did not, contact the Benefits Department by phone or e-mail at this number or

address.

7. I have more questions—who do I contact?

Please contact _____ at ____. You can also go to

our (company) website and find more detailed questions and answers. An IRS website called

Questions and Answers about Health Care Information Forms for

Individuals (Forms 1095-A, 1095-B, and 1095-C)

covers most of what you need to know.

Failure to thoroughly complete I-9 paperwork has left an event-planning company with a fine of $605,250 (the largest amount ever ordered) serving as a reminder that employers need to be taking I-9 compliance very seriously.

On July 8, 2015, the Office of the Chief Administrative Hearing Officer (OCAHO), which has jurisdiction to review civil penalties for I-9 violations, ordered Hartmann Studios to pay the fine for more than 800 I-9 paperwork violations.

Immigration and Customs Enforcement (ICE) audited the company in March 2011.

The bulk of the violations charged against Hartmann were due to a repeated failure to sign section 2 of the I-9 form. Employers are required to complete and sign section 2 within three business days of a hire, attesting under penalty of perjury that the appropriate verification and employment authorization documents have been reviewed.

ICE found 797 I-9s where section 2 was incomplete. About half of these incomplete forms related to individuals from the International Alliance of Theatrical Stage Employees Union Local 16A, who worked for Hartmann on a project-by-project basis during the term of a collective bargaining agreement. Even though the union workers worked on a project-by-project basis, they were not terminated upon completion of a project and remained “on-call.” The union created a “three-in-one” form that combined a portion of a W-4 form, parts of sections 1 and 2 of an I-9 form, and a withholding authorization for union dues. No separate I-9 form was completed for these workers nor did Hartmann sign section 2 of the union form.

Hartmann could have been charged with the more-substantive offense of having failed to prepare any I-9 form at all for the 399 union members, because the union’s form is not compliant, but OCAHO declined to do so.

Hartmann told OCAHO it believed that the union form was sufficient to confirm that the workers had proper employment authorization, and that nothing further needed to be done to confirm their eligibility for employment. The company also said that it did not know signing section 2 of the form was a legal requirement.

In addition to failing to sign section 2, Hartmann was also cited for:

This case demonstrates the need for employers to conduct routine self-audits of their I-9 inventories to ensure that the forms have been properly completed and retained and are ready for inspection.

Employers should also ensure that acceptable proof of audits and training is kept so that it may be used as evidence of good faith in court proceedings.

Even small employers notsubject to the Affordable Care Act’s (ACA) coverage mandate can’t reimburse employees for nongroup health insurance coverage purchased on a public exchange, the Internal Revenue Service confirmed. But small employers providing premium reimbursement in 2014 are being offered transition relief through mid-2015.

IRS Notice 2015-17, issued on Feb. 18, 2015, is another in a series of guidance from the IRS reminding employers that they will run afoul of the ACA if they use health reimbursement arrangements (HRAs) or other employer payment plans—whether with pretax or post-tax dollars—to reimburse employees for individual policy premiums, including policies available on ACA federal or state public exchanges.

This time the warning is aimed at small employers—those with fewer than 50 full-time employees or equivalent workers. While small organizations are not subject to the ACA’s “shared responsibility” employer mandate to provide coverage or pay a penalty (aka Pay or Play), if they do provide health coverage it must meet a range of ACA coverage requirements.

“The agencies have taken the position that employer payment plans are group health plans, and thus must comply with the ACA’s market reforms,” noted Timothy Jost, J.D., a professor at the Washington and Lee University School of Law, in a Feb. 19 post on the Health Affairs Blog. “A group health plan must under these reforms cover at least preventive care and may not have annual dollar limits. A premium payment-only HRA or other payment arrangement that simply pays employee premiums does not comply with these requirements. An employer that offers such an arrangement, therefore, is subject to a fine of $100 per employee per day. (An HRA integrated into a group health plan that, for example, helps with covering cost-sharing is not a problem).”

Transition Relief

The notice provides transition relief for small employers that used premium payment arrangements for 2014. Small employers also will not be subject to penalties for providing payment arrangements for Jan. 1 through June 30, 2015. These employers must end their premium reimbursement plans by that time. This relief does not extend to stand-alone HRAs or other arrangements used to reimburse employees for medical expenses other than insurance premiums.

No similar relief was given for large employers (those with 50 or more full-time employees or equivalents) for the $100 per day per employee penalties. Large employers are required to self-report their violation on the IRS’s excise tax form 8928 with their quarterly filings.

“Notice 2015-17 recognizes that impermissible premium-reimbursement arrangements have been relatively common, particularly in the small-employer market,” states a benefits brief from law firm Spencer Fane. “And although the ACA created “SHOP Marketplaces” as a place for small employers to purchase affordable [group] health insurance, the notice concedes that the SHOPs have been slow to get off the ground. Hence, this transition relief.”

Subchapter S Corps.

The notice states that Subchapter S closely held corporations may pay for or reimburse individual plan premiums for employee-shareholders who own at least 2 percent of the corporation. “In this situation, the payment is included in income, but the 2-percent shareholder can deduct the premiums for tax purposes,” Jost explained. The 2-percent shareholder may also be eligible for premium tax credits through the marketplace SHOP Marketplace if he or she meets other eligibility requirements.

Tricare

Employers can pay for some or all of the expenses of employees covered by Tricare—a Department of Defense program that provides civilian health benefits for military personnel (including some members of the reserves), military retirees and their dependents—if the payment plan is integrated with a group health plan that meets ACA coverage requirements.

Higher Pay Is Still OK

One option that the IRS will allow employers is to simply increase an employee’s taxable wages in lieu of offering health insurance. “As long as the money is not specifically designated for premiums, this would not be a premium payment plan,” said Jost. “The employer could even give the employee general information about the marketplace and the availability of premium tax credits as long as it does not direct the employee to a specific plan.”

But if the employer pays or reimburses premiums specifically, “even if the payments are made on an after-tax basis, the arrangement is a noncompliant group health plan and the employer that offers it is subject to the $100 per day per employee penalty,” Jost warned.

“Small employers now have just over four months in which to wind down any impermissible premium-reimbursement arrangement,” the Spencer Fane brief notes. “In its place, they may wish to adopt a plan through a SHOP Marketplace. Although individuals may enroll through a Marketplace during only annual or special enrollment periods, there is no such limitation on an employer’s ability to adopt a plan through a SHOP.”

The Centers for Medicare & Medicaid Services (CMS) announced on February 20,2015 a special enrollment period (SEP) for individuals and families who did not have health coverage in 2014 and are subject to the fee or “shared responsibility payment” when they file their 2014 taxes in states which use the Federally-facilitated Marketplaces (FFM). This special enrollment period will allow those individuals and families who were unaware or didn’t understand the implications of this new requirement to enroll in 2015 health insurance coverage through the FFM.

For those who were unaware or didn’t understand the implications of the fee for not enrolling in coverage, CMS will provide consumers with an opportunity to purchase health insurance coverage from March 15 to April 30. If consumers do not purchase coverage for 2015 during this special enrollment period, they may have to pay a fee when they file their 2015 income taxes.

Those eligible for this special enrollment period live in states with a Federally-facilitated Marketplace and:

The special enrollment period announced today will begin on March 15, 2015 and end at 11:59 pm E.S.T. on April 30, 2015. If a consumer enrolls in coverage before the 15th of the month, coverage will be effective on the first day of the following month.

This year’s tax season is the first time individuals and families will be asked to provide basic information regarding their health coverage on their tax returns. Individuals who could not afford coverage or met other conditions may be eligible to receive an exemption for 2014. To help consumers who did not have insurance last year determine if they qualify for an exemption, CMS also launched a health coverage tax exemption tool today on HealthCare.gov and CuidadodeSalud.gov.

“We recognize that this is the first tax filing season where consumers may have to pay a fee or claim an exemption for not having health insurance coverage,” said CMS Administrator Marilyn Tavenner. “Our priority is to make sure consumers understand the new requirement to enroll in health coverage and to provide those who were not aware or did not understand the requirement with an opportunity to enroll in affordable coverage this year.”

Most taxpayers will only need to check a box when they file their taxes to indicate that they had health coverage in 2014 through their employer, Medicare, Medicaid, veterans care or other qualified health coverage that qualifies as “minimum essential coverage.” The remaining taxpayers will take different steps. It is expected that 10 to 20 percent of taxpayers who were uninsured for all or part of 2014 will qualify for an exemption from the requirement to have coverage. A much smaller fraction of taxpayers, an estimated 2 to 4 percent, will pay a fee because they made a choice to not obtain coverage and are not eligible for an exemption.

Americans who do not qualify for an exemption and went without health coverage in 2014 will have to pay a fee – $95 per adult or 1 percent of their income, whichever is greater – when they file their taxes this year. The fee increases to $325 per adult or 2% of income for 2015. Individuals taking advantage of this special enrollment period will still owe a fee for the months they were uninsured and did not receive an exemption in 2014 and 2015. This special enrollment period is designed to allow such individuals the opportunity to get covered for the remainder of the year and avoid additional fees for 2015.

The Administration is committed to providing the information and tools tax filers need to understand the new requirements. Part of this outreach effort involves coordinating efforts with nonprofit organizations and tax preparers who provide resources to consumers and offer on the ground support. If consumers have questions about their taxes, need to download forms, or want to learn more about the fee for not having insurance, they can find information and resources at www.HealthCare.gov/Taxes or www.IRS.gov. Consumers can also call the Marketplace Call Center at 1-800-318-2596. Consumers who need assistance filing their taxes can visit IRS.gov/VITA or IRS.gov/freefile.

Consumers seeking to take advantage of the special enrollment period can find out if they are eligible by visitinghttps://www.healthcare.gov/get-coverage. Consumers can find local help at: Localhelp.healthcare.gov or call the Federally-facilitated Marketplace Call Center at 1-800-318-2596. TTY users should call 1-855-889-4325. Assistance is available in 150 languages. The call is free.

For more information about Health Insurance Marketplaces, visit: www.healthcare.gov/marketplace

Beginning January 1, 2015, employers have new reporting obligations for health plan coverage, to allow the government to administer the “pay or play” penalties to be assessed against employers that do not offer compliant coverage to their full-time employees.

Even though the penalties only apply if there are 100 or more employees for 2015, employers with 50 or more full-time equivalent employees are required to report for 2015. Also, note this reporting is required even if the employer does not maintain any health plan.

Employers that provide self-funded group health coverage also have reporting obligations, to allow the government to administer the “individual mandate” which results in a tax on individuals who do not maintain health coverage.

These reporting obligations will be difficult for most employers to implement. Penalties for non-compliance are high, so employers need to begin now with developing a plan on how they will track and file the required information.

Pay or Play Reporting. Applicable large employers (ALEs) must report health coverage offered to employees for each month of 2015 in an annual information return due early in 2016. ALEs are employers with 50 or more full-time equivalent (FTE) employees. Employees who average 30 hours are counted as one, and those who average less than 30 hours are combined into an equivalent number of 30 hour employees to determine if there are 50 or more FTE employees. All employees of controlled group, or 80% commonly owned employers, are also combined to determine if the 50 FTE threshold is met.

Individual Mandate Reporting. Self-funded employers, including both ALEs and small employers that are not ALEs, must report each individual covered for each month of the calendar year. For fully-insured coverage, the insurance carrier must report individual month by month coverage. The individual mandate reporting is due early in 2016 for each month of 2015.

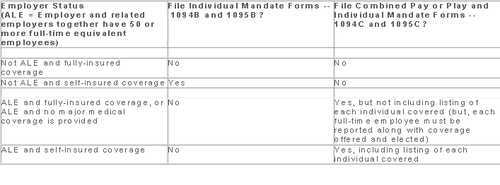

Which Form? ALE employers have one set of forms to report both the pay or play and the individual mandate information – Forms 1094C and 1095C. Insurers and self-insured employers that are not ALEs use Forms 1094B and 1095B to report the individual mandate information. Information about employee and individual coverage provided on these forms must also be reported by the employer to its employees as well as to COBRA and retiree participants. Forms 1095B and 1095C can be used to provide this information, or employers can provide the information in a different format.

The following chart summaries which returns are filed by employers:

Who Reports? While ALE status is determined on a controlled group basis, each ALE must file separate reports. Employers will need to provide insurance carriers, and third party administrators who process claims for self-funded coverage (if they will assist the employer with reporting), accurate data on the employer for whom each covered employee works. If an employee works for more than one ALE in a controlled group, the employer for whom the highest number of hours is worked does the reporting for that employee.

Due Date for Filing. The due date of the forms matches the due dates of Forms W-2, and employers may provide the required employee statements along with the W-2. Employee reporting is due January 31st and reporting to the IRS is due each February 28th, although the date is extended until March 31st if the forms are filed electronically. If the employer files 250 or more returns, the returns must be filed electronically. Reporting to employees can only be made electronically if the employee has specifically consented to receiving these reports electronically.

Penalties. Failure to file penalties can total $200 per individual for whom information must be reported, subject to a maximum of $3 million per year. Penalties will not be assessed for employers who make a good faith effort to file correct returns for 2015.

What Information is Required? For the pay or play reporting, each ALE must file a Form 1094C reporting the number of its full-time employees (averaging 30 hours) and total employees for each calendar month, whether the ALE is in a “aggregated” (controlled) group, a listing of the name and EIN of the top 30 other entities in the controlled group (ranked by number of full-time employees), and any special transition rules being used for pay or play penalties. ALE’s must also file a 1095C for each employee who was a full-time employee during any calendar month of the year. The 1095C includes the employee’s name, address and SSN, and month by month reporting of whether coverage was offered to the employee, spouse and dependents, the lowest premium for employee only coverage, and identification of the safe-harbor used to determine affordability. This information is used to determine pay or play penalty taxes and to verify the individuals’ eligibility for subsidies toward coverage costs on the Federal and state exchanges.

If the ALE provides self-funded coverage, the ALE must also report on the 1095C the name and SSN of each individual provided coverage for each calendar month. If an employer is not an ALE, but is self-funded, the name and SSN of each covered individual is reported on the 1095B and the 1094B is used to transmit the forms 1095B to the IRS.

A chart is available that sets out what data must be reported on each form, to help employers determine what information they need to track. Click here to access the chart.

Next Steps. Employers will need to determine how much help their insurance carrier or TPA can provide with the reporting, and then the employer’s HR, payroll and IT functions will need to work together to be sure the necessary information is being tracked and can be produced for reporting in January 2016.

The Affordable Care Act will require Applicable Large Employers (i.e. large employers subject to the employer mandate) and employers sponsoring self-insured plans to comply with new annual IRS reporting requirements. The first reporting deadline will be February 28, 2016 as to the data employers collect during the 2015 calendar year. The reporting provides the IRS with information it needs to enforce the Individual Mandate (i.e. individuals are penalized for not having health coverage) and the Employer Mandate (i.e. large employers are penalized for not offering health coverage to full-time employees). The IRS will also require employers who offer self-insured plans to report on covered individuals.

Large employers and coverage providers must also provide a written statement to each employee or responsible individual (i.e. one who enrolls one or more individuals) identifying the reported information. The written statement can be a copy of the Form.

The IRS recently released draft Forms 1094-C and 1095-C and draft Forms 1094-B and 1095-B, along with draft instructions for each form.

Which Forms Do I File?

When?

Statements to employees and responsible individuals are due annually by January 31. The first statements are due January 31, 2016.

Forms 1094-B, 1095-B, 1094-C and 1095-C are due annually by February 28 (or by March 31, if filing electronically). The first filing is due by February 28, 2016 (or March 31, 2016, if filing electronically).

Even though the forms are not due until 2016, the annual reporting will be based on data from the prior year. Employers need to plan ahead now to collect data for 2015. Many employers have adopted the Look Back Measurement Method Safe Harbor (“Safe Harbor”) to identify full-time employees under the ACA. The Safe Harbor allows employers to “look back” on the hours of service of its employees during 2014 or another measurement period. There are specific legal restrictions regarding the timing and length of the periods under the Safe Harbor, so employers cannot just pick random dates. Employers also must follow various rules to calculate hours of service under the Safe Harbor. The hours of service during the measurement period (which is likely to include most of 2014) will determine whether a particular employee is full-time under the ACA during the 2015 stability period. The stability period is the time during which the status of the employee, as full-time or non-full-time, is locked in. In 2016, employers must report their employees’ full-time status during the calendar year of 2015. Therefore, even though the IRS forms are not due until 2016, an employee’s hours of service in 2014 will determine how an employer reports that employee during each month of 2015. Employers who have not adopted the Safe Harbor should consider doing so because it allows an employer to average hours of service over a 12-month period to determine the full-time status of an employee. If an employer does not adopt the Safe Harbor, the IRS will require the employer to make a monthly determination, which is likely to increase an employer’s potential exposure to penalties.

What Must the Employer Report?

Form 1095-C

There are three parts to Form 1095-C. An applicable large employer must file one Form 1095-C for each full-time employee. If the applicable large employer sponsors self-insured health plans, it must also file Form 1095-C for any employee who enrolls in coverage regardless of the full-time status of that employee.

Form 1095-C requires the employer to identify the type of health coverage offered to a full-time employee for each calendar month, including whether that coverage offered minimum value and was affordable for that employee. Employers must use a code to identify the type of health coverage offered and applicable transition relief.

Employers that offer self-insured health plans also must report information about each individual enrolled in the self-insured health plan, including any full-time employee, non-full-time employee, employee family members, and others.

Form 1094-C

Applicable large employers use Form 1094-C as a transmittal to report employer summary information and transmit its Forms 1095-C to the IRS. Form 1094-C requires employers to enter the name and contact information of the employer and the total number of Forms 1095-C it submits. It also requires information about whether the employer offered minimum essential coverage under an eligible employer-sponsored plan to at least 95% of its full-time employees and their dependents for the entire calendar year, the number of full-time employees for each month, and the total number of employees (full-time or non-full-time) for each month.

Form 1095-B

Employers offering self-insured coverage use Form 1095-B to report information to the IRS about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment. These employers must file a Form 1095-B for eachindividual who was covered for any part of the calendar year. The employer must make reasonable efforts to collect social security numbers for covered individuals.

Form 1094-B

Employers who file Form 1095-B will use Form 1094-B as a transmittal form. It asks for the name of the employer, the employer’s EIN, and the name, telephone number, and address of the employer’s contact person.

Failure to Report – What Happens?

The IRS will impose penalties for failure to timely provide correct written statements to employees. The IRS will also impose penalties for failure to timely file a correct return. For the 2016 reporting on 2015 data, the IRS will not impose a penalty for good faith compliance. However, the IRS specified that good faith compliance requires that employers provide the statements and file the returns.

With Congress in its summer recess, now is a good time to reflect on the top ACA issues worth monitoring as 2015 quickly approaches. Here are a handful of key issues to watch:

Dueling Court Cases on Federal Subsidies

One issue grabbing national headlines is the dueling decisions coming out of the U.S. Court of Appeals for the District of Columbia (Halbig v. Burwell) and the U.S. Court of Appeals for the Fourth Circuit (King v. Burwell) on missing language in the ACA that would have authorized the federal government to provide premium subsidies to individuals who sign up for health plans through the federal Exchanges. The legal issue in these court cases is whether the ACA premium tax credit (aka subsidy) is available to those individuals who enroll in qualified health plans (QHP) through state operated Exchanges or if it is available only to those to enroll in a QHP through a federally funded Exchange.

A primary concern is that a significant number of people in about two-thirds of the states (who did not set up a state-run Exchange) rely on the subsidy to purchase a plan in the federal Exchange. Specifically, the ACA’s employer mandate penalty of $3000 is based upon an employer having an employee seek coverage through an Exchange and receive the federal premium subsidy. In general, the employer mandate requires that “applicable large employers” offer their full-time employees minimum essential coverage or potentially pay a tax penalty. However, according to the statutory text of the ACA, the penalties under the employer mandate are triggered only if an employee receives a subsidy to purchase coverage through an Exchange established by the states. Both cases are being appealed to higher courts and will likely be consolidated into one case to be heard by the U.S. Supreme Court in the not so distant future.

In an interesting development, a video surfaced last week featuring one of the ACA’s chief architects (John Gruber) saying that health insurance subsidies should only be available in those states who opt to build and implement state-based Exchanges to gain participation. The idea was to create an incentive to have states actively involved in the hosting of an Exchange, rather than relying on the federal government to operate the Exchanges in each state. Whether this video will be used as evidence to uphold the argument that subsidies can only be offered by state-based Exchanges remains to be seen.

Lack of Back End Software for Federal Exchange

Of course, one of the big news stories in 2013 and early 2014 was the substandard launch of the federal Exchange, which led to many Americans having to wait to be enrolled in an ACA-compliant health plan. Although some technical snafus have been addressed, there are many that still remain. For example, a top White House official recently told Congress that the automated system that is supposed to send premium payments to insurance companies is still under development, and they did not have a completion date for it yet. The lack of an electronic verification process is only one part of the “backend” software that is still problematic five years after PPACA was passed.

Future of Navigators in Comparison with the Value of Brokers

Several recent studies have touted the benefits of using third parties, such as Brokers, to help consumers find coverage under the ACA. Some of these studies have focused on the usefulness of using Brokers/Agents over the benefits of using Navigators. A recent Urban Institute study found that health insurance Brokers were the most helpful in providing health insurance Exchange information when compared to other types of resources, including Navigators and website content. However, there are other published studies showcasing how Navigators have been useful to consumers. That being said, Brokers have assumed an integral role supporting millions of Americans in securing and maintaining coverage for many decades, and continue to be knowledgeable resources, as they are licensed in the states they operate in, whereas Navigators are not required to meet the same licensing standards as Brokers/Agents. It will be interesting to see what the future holds for Navigators, who are not as experienced and who are, in the end, dependent upon federal grants to provide their services.

Provider Access Issues & Emergency Room Over-Usage

A number of public policymakers have raised concerns recently about the fact that there are shortages of key physicians and other providers and as a result is causing a increase in non-emergent patient visits to expensive ER departments. A recent story in the New York Times highlighted similar concerns, saying the ACA cannot change the fact that visiting an emergency room may be easier than seeing a primary care physician in some instances or locations. Other stories and studies highlight how the ACA and health care reform initiatives can affect access to providers in many different ways, such as changing reimbursement levels, improving the availability of certain types of specialists, or re-educating the patient to move from visiting the ER department to either making an appointment ahead-of-time or visiting a less expensive Urgent Care center for care.

Premium Rate Increases

Another critical issue to monitor are premium increases that might be occurring in spite of the initial promises that the ACA would lower health care costs. Health plans have begun publishing proposed rates for 2015, resulting in a recent flurry of news articles and reports addressing the impact of the ACA on insurance premiums.

The Wall Street Journal published a front page report discussing the ACA’s impact on premium increases earlier this summer, saying, “Hundreds of thousands of consumers nationwide, who bought insurance plans under the Affordable Care Act, will face a choice this fall: swallow higher premiums to stay in their plans or save money by switching.”

The Journal goes on to say that a new picture is emerging in 10 states where 2015 premium insurance rates for individual plans have been filed, “In all but one (state), the largest health insurer is proposing to increase premiums between 8.5% to 22.8% next year.” Ironically, smaller health plans are reducing their 2015 rates in the same market in an attempt to gain market share.

The significance of this trend is underscored in a statement released earlier this summer by Karen Ignagni, president & CEO of America’s Health Insurance Plans (AHIP), in which she expressed concerns about keeping health insurance affordable for patients. “Affordability remains a top priority for consumers when it comes to their health care,” she said.

Bonus: Be Sure To Watch The Political Races

With the ACA’s continued challenges, the ups and downs of the U.S. economy, key world events in the Middle East, and other confounding variables, one has to wonder what will happen during the mid-year elections this fall. As reported by CNN and other news outlets, the ACA became an key issue in Obama’s 2012 re-election victory as well as Democrats picking up seats in the Senate and House in that election.

As November 3, 2015 approaches, many different messages could be sent back to the White House and Congress. If Republicans take over the Senate and retain control of the House, how will this impact the ACA over the next several years? If the congressional houses remain split, we may have less going on by either political party. How will the state-level elections impact the ACA and state-run Exchanges? Only time will tell.

Under the Patient Protection and Affordable Care Act (PPACA), beginning in 2015, certain large employers who do not offer affordable health insurance that provides minimum value to their full-time employees may be subject to significant penalties.

In a nutshell, in 2015, “applicable large employers” will be subject to an annualized employer “shared responsibility” penalty of $2,000 (indexed) per full-time employee (minus the first 80 full-time employees in 2015) if the employer does not offer health insurance to at least 70% of their full-time employees and their dependents. This amount will be increase from 70% to 95% after 2015. This is commonly referred to as the “Pay or Play” penalty.

Even if an applicable large employer offers insurance coverage to full-time employees, the employer still could be subject to an annualized penalty of $3,000 (indexed) per employee who receives an Exchange subsidy if the offered employer-sponsored health coverage does not meet minimum value standards or is not affordable. This $3000 penalty is capped at the amount that would apply if the $2,000 penalty described above were to apply.

What should an employer do now to prepare for these penalties?

(A) Determine if they are an “applicable large employer” -To do this, employers should count both full-time employees and part-time employee hours as follows:

1) Count the full-time employees for each month in the prior year.

2) Count the full-time equivalents for each month in the prior year.

a) Add total hours for non-full-time employees but count no more than 120 hours per month for any one non-full-time employee.

b) Divide the number obtained in (a) by 120. This is the full-time equivalent number.

3) Add the numbers obtained in (1) and (2) above (i.e., the full-time employee and full-time equivalent numbers) for each month.

4) Add the 12 sums obtained in (3) and divide by 12. This is the average number of full-time employees and full-time equivalents.

5) If this number obtained in (4) is under 50 (or under 100 for the 2015 determination for certain employers), the employer is not an applicable large employer for the year being determined.

Note: The applicable large employer is determined on a controlled group basis. For example, if there are three companies, each of which is wholly owned by the same parent company, the companies are all considered one employer for this calculation. Also note that, special transition rules apply in determining applicable large employer status for 2015 and that a special seasonal employee exception may apply even if the threshold in (5) is exceeded.

(B) If an employer will be an applicable large employer in 2015, it should determine whether it could be subject to penalties in 2015. For example, the employer should review its group health plan to determine if the insurance coverage is “offered” to full-time employees meets minimum value standards and is considered affordable to employees.

© An employer also will need to address how it will determine the full-time status of employees – will it use the “monthly measurement period” or the “look back measurement period.” This is particularly important for employers who have many variable-hour employees or seasonal employees.

(D) If the employer’s group health plan does not meet the threshold tests to avoid the penalties noted above, the employer should evaluate whether it wants to restructure its health care offerings or pay the penalties (which are non-deductible).

(E) Finally, employers should review their data collection procedures to ensure that they will be able to report the healthcare information required to be reported for 2015 (the actual reporting will occur in 2016 for the 2015 calendar year). Insurers, sponsors of self-insured plans, and other entities that provide minimum essential coverage during a calendar year will be required to report certain information to the IRS and to participants. In addition, applicable large employers will be required to report about the coverage they provide to both the IRS and to their employees. Drafts of the IRS forms to be used in reporting this information have recently been published (Form 1095-B, Form 1095-B Transmittal, Form 1095-C, Form 1095-C Transmittal). Employers should review these forms to understand the data that will need to be reported.

It is not too late for employers to take action now to avoid penalties in 2015.

The Affordable Care Act (ACA) imposes significant information reporting responsibilities on employers starting with the 2015 calendar year. One reporting requirement applies to all employer-sponsored health plans, regardless of the size of the employer. A second reporting requirement applies only to large employers, even if the employer does not provide health coverage. The IRS is currently developing new systems for reporting the required information and recently released draft forms, however instructions have yet to be released.

Information returns

The new information reporting systems will be similar to the current Form W-2 reporting systems in that an information return (Form 1095-B or 1095-C) will be prepared for each applicable employee, and these returns will be filed with the IRS using a single transmittal form (Form 1094-B or 1094-C). Electronic filing is required if the employer files at least 250 returns. Employers must file these returns annually by Feb. 28 (March 31 if filed electronically). Therefore, employers will be filing these forms for the 2015 calendar year by Feb. 28 or March 31, 2016 respectively. A copy of the Form 1095, or a substitute statement, must be given to the employee by Jan. 31 and can be provided electronically with the employee’s consent. Employers will be subject to penalties of up to $200 per return for failing to timely file the returns or furnish statements to employees.

The IRS released drafts of the Form 1095-B and Form 1095-C information returns, as well as the Form 1094-B and Form 1094-C transmittal returns, in July 2014 and is expected to provide instructions for the forms in August 2014. According to the IRS, both the forms and the instructions will be finalized later this year.

Health coverage reporting requirement

The health coverage reporting requirement is designed to identify employees and their family members who are enrolled in minimum essential health coverage. Employees who are offered coverage, but decline the coverage, are not reported. The IRS will use this information to determine whether the employees are exempt from the individual mandate penalty due to having health coverage for themselves and their family members.

Insurance companies will prepare Form 1095-B (Health Coverage) and Form 1094-B (Transmittal of Health Coverage Information Returns) for individuals covered by fully-insured employer-sponsored group health plans. Small employers with self-insured health plans will use Form 1095-B and Form 1094-B to report the name, address, and Social Security number (or date of birth) of employees and their family members who have coverage under the self-insured health plan. However, large employers (as defined below) with self-insured health plans will file Forms 1095-C and 1094-C in lieu of Forms 1095-B and 1094-B.

Large employer reporting requirement

“Applicable large employer members (ALE)” are subject to the reporting requirement if they offer an insured or self-insured health plan, or do not offer any group health plan. ALE members are those employers that are either an applicable large employer on their own or are members of a controlled or affiliated service group with an ALE (regardless of the number of employees of the group member). ALEs are those that had, on average, at least 50 full-time employees (including full-time equivalent “FTE” employees) during the preceding calendar year. Full-time employees are those who work, on average, at least 30 hours per week. Employers with fewer than 50 full-time employees and equivalents are not applicable large employers and, thus, are exempt from this health coverage reporting requirement.

As referenced above, an employer’s status as an ALE is determined on a controlled or affiliated service group basis. For example, if Company A and Company B are members of the same controlled group and Company A has 100 employees and Company B has 20 employees, then A and B are both members of an ALE. Consequently, Company A and Company B must each file the information returns.

Each ALE member must file Form 1095-C (Employer-Provided Health Insurance Offer and Coverage) and Form 1094-C (Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns) with the IRS for each calendar year. The IRS will use this information to determine whether (1) the employer is subject to the employer mandate penalty, and (2) an employee is eligible for a premium tax credit on insurance purchased through the new health insurance exchange. ALEs with fewer than 100 full-time employees are generally eligible for transition relief from the employer mandate penalty for their 2015 plan year. Nonetheless, these employers are still required to file Forms 1095-C and 1094-C for the 2015 calendar year.

The employer mandate penalty can be imposed on any ALE member that does not offer affordable, minimum value health coverage to all of its full-time employees starting in 2015. Health coverage is affordable if the amount that the employer charges an employee for self-only coverage does not exceed 9.5 percent of the employee’s Form W-2 wages, rate of pay, or the federal poverty level for the year. A health plan provides minimum value if the plan is designed to pay at least 60 percent of the total cost of medical services for a standard population. In the case of a controlled or affiliated service group, the employer mandate penalties apply to each member of the group individually.

ALE members must prepare a Form 1095-C for each employee. The return will report the following information:

An ALE member will file with the IRS one Form 1094-C transmitting all of its Forms 1095-C. The Form 1094-C will report the following information:

As noted above, each ALE member is required to file Forms 1095-C and 1094-C for its own employees, even if it participates in a health plan with other employers (e.g., when the parent company sponsors a plan in which all subsidies participate). Special rules apply to multiemployer plans for collectively-bargained employees.

Action required

In light of the complexity of the new information reporting requirements, it is recommended that employers should begin taking steps now to prepare for the new reporting requirements: