Beginning January 1, 2015, employers have new reporting obligations for health plan coverage, to allow the government to administer the “pay or play” penalties to be assessed against employers that do not offer compliant coverage to their full-time employees.

Even though the penalties only apply if there are 100 or more employees for 2015, employers with 50 or more full-time equivalent employees are required to report for 2015. Also, note this reporting is required even if the employer does not maintain any health plan.

Employers that provide self-funded group health coverage also have reporting obligations, to allow the government to administer the “individual mandate” which results in a tax on individuals who do not maintain health coverage.

These reporting obligations will be difficult for most employers to implement. Penalties for non-compliance are high, so employers need to begin now with developing a plan on how they will track and file the required information.

Pay or Play Reporting. Applicable large employers (ALEs) must report health coverage offered to employees for each month of 2015 in an annual information return due early in 2016. ALEs are employers with 50 or more full-time equivalent (FTE) employees. Employees who average 30 hours are counted as one, and those who average less than 30 hours are combined into an equivalent number of 30 hour employees to determine if there are 50 or more FTE employees. All employees of controlled group, or 80% commonly owned employers, are also combined to determine if the 50 FTE threshold is met.

Individual Mandate Reporting. Self-funded employers, including both ALEs and small employers that are not ALEs, must report each individual covered for each month of the calendar year. For fully-insured coverage, the insurance carrier must report individual month by month coverage. The individual mandate reporting is due early in 2016 for each month of 2015.

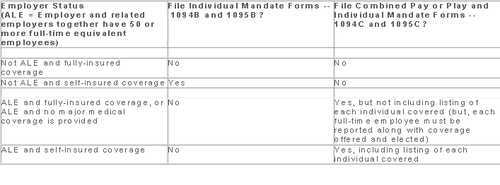

Which Form? ALE employers have one set of forms to report both the pay or play and the individual mandate information – Forms 1094C and 1095C. Insurers and self-insured employers that are not ALEs use Forms 1094B and 1095B to report the individual mandate information. Information about employee and individual coverage provided on these forms must also be reported by the employer to its employees as well as to COBRA and retiree participants. Forms 1095B and 1095C can be used to provide this information, or employers can provide the information in a different format.

The following chart summaries which returns are filed by employers:

Who Reports? While ALE status is determined on a controlled group basis, each ALE must file separate reports. Employers will need to provide insurance carriers, and third party administrators who process claims for self-funded coverage (if they will assist the employer with reporting), accurate data on the employer for whom each covered employee works. If an employee works for more than one ALE in a controlled group, the employer for whom the highest number of hours is worked does the reporting for that employee.

Due Date for Filing. The due date of the forms matches the due dates of Forms W-2, and employers may provide the required employee statements along with the W-2. Employee reporting is due January 31st and reporting to the IRS is due each February 28th, although the date is extended until March 31st if the forms are filed electronically. If the employer files 250 or more returns, the returns must be filed electronically. Reporting to employees can only be made electronically if the employee has specifically consented to receiving these reports electronically.

Penalties. Failure to file penalties can total $200 per individual for whom information must be reported, subject to a maximum of $3 million per year. Penalties will not be assessed for employers who make a good faith effort to file correct returns for 2015.

What Information is Required? For the pay or play reporting, each ALE must file a Form 1094C reporting the number of its full-time employees (averaging 30 hours) and total employees for each calendar month, whether the ALE is in a “aggregated” (controlled) group, a listing of the name and EIN of the top 30 other entities in the controlled group (ranked by number of full-time employees), and any special transition rules being used for pay or play penalties. ALE’s must also file a 1095C for each employee who was a full-time employee during any calendar month of the year. The 1095C includes the employee’s name, address and SSN, and month by month reporting of whether coverage was offered to the employee, spouse and dependents, the lowest premium for employee only coverage, and identification of the safe-harbor used to determine affordability. This information is used to determine pay or play penalty taxes and to verify the individuals’ eligibility for subsidies toward coverage costs on the Federal and state exchanges.

If the ALE provides self-funded coverage, the ALE must also report on the 1095C the name and SSN of each individual provided coverage for each calendar month. If an employer is not an ALE, but is self-funded, the name and SSN of each covered individual is reported on the 1095B and the 1094B is used to transmit the forms 1095B to the IRS.

A chart is available that sets out what data must be reported on each form, to help employers determine what information they need to track. Click here to access the chart.

Next Steps. Employers will need to determine how much help their insurance carrier or TPA can provide with the reporting, and then the employer’s HR, payroll and IT functions will need to work together to be sure the necessary information is being tracked and can be produced for reporting in January 2016.

Members of the U.S. House of Representatives voted on January 8, 2015 to redefine full-time employment under the Affordable Care Act (ACA) to employees who work at least 40 hours a week rather than 30 hours a week.

The Save American Workers Act, passed the House with a vote of 252-172 with full Republican support and 12 Democratic voters. The legislation would amend the Internal Revenue Code by changing the definition of full-time employee to cover individuals who work, on average, at least 40 hours per week for purposes of the employer mandate to provide minimum essential health care coverage under the ACA.

Despite the bill’s passage in the House, the fate of the bill in the U.S. Senate remains uncertain. In addition, Republicans have not garnered enough support to override the veto promised by President Obama if the bill did pass Congress.

According to Politico, “The House has cleared more than 50 assorted measures to repeal or roll back Obamacare, but this is the first time the House can propel legislation to a GOP-controlled Senate, potentially forcing President Barack Obama to either accept changes to his signature domestic achievement or use his veto power.”

Some supporters of the change, including the U.S. Chamber of Commerce, argue that the current standard deviates from the widely accepted definition of full-time work. It is argued that it provides an incentive for employers to reduce hours, particularly for low-wage workers, to avoid offering healthcare coverage.

This month, employers with 100 or more employees will be required to offer health insurance to at least 70% of employees who works at least 30 hours a week or else pay a penalty.

The NY Times comments:

By adjusting that threshold to 40 hours, Republicans — strongly backed by a number of business groups — said that they would re-establish the traditional 40-hour workweek and prevent businesses cutting costs from radically trimming worker hours to avoid mandatory insurance coverage. They contend that the most vulnerable workers are low-skilled and underpaid, working 30 to 35 hours a week, and now facing cuts to 29 hours or less so their employers do not have to insure them. With passage of the law, those workers would not have to get employer-sponsored health care, and their workweek would remain intact.

Analysis by the Congressional Budget Office found that the bill would increase the U.S. deficit by $53 billion over the course of a decade because fewer employers would pay penalties and one million employees would not have coverage through their job. Democrats cite these reasons as evidence that the bill is simply an attempt to dismantle the ACA.

A central issue of this bill is how far employers would go to avoid mandated coverage. A majority of employees already work 40 hours a week rather than 30. That being said, few employers would cut worker hours from 40 to 29, but many would be willing to cut hours from 40 to 39, the New York Times ventures, “That means raising the definition of a full-time worker under the health care law would put far more workers at risk.”

Under the Patient Protection and Affordable Care Act (PPACA), beginning in 2015, certain large employers who do not offer affordable health insurance that provides minimum value to their full-time employees may be subject to significant penalties.

In a nutshell, in 2015, “applicable large employers” will be subject to an annualized employer “shared responsibility” penalty of $2,000 (indexed) per full-time employee (minus the first 80 full-time employees in 2015) if the employer does not offer health insurance to at least 70% of their full-time employees and their dependents. This amount will be increase from 70% to 95% after 2015. This is commonly referred to as the “Pay or Play” penalty.

Even if an applicable large employer offers insurance coverage to full-time employees, the employer still could be subject to an annualized penalty of $3,000 (indexed) per employee who receives an Exchange subsidy if the offered employer-sponsored health coverage does not meet minimum value standards or is not affordable. This $3000 penalty is capped at the amount that would apply if the $2,000 penalty described above were to apply.

What should an employer do now to prepare for these penalties?

(A) Determine if they are an “applicable large employer” -To do this, employers should count both full-time employees and part-time employee hours as follows:

1) Count the full-time employees for each month in the prior year.

2) Count the full-time equivalents for each month in the prior year.

a) Add total hours for non-full-time employees but count no more than 120 hours per month for any one non-full-time employee.

b) Divide the number obtained in (a) by 120. This is the full-time equivalent number.

3) Add the numbers obtained in (1) and (2) above (i.e., the full-time employee and full-time equivalent numbers) for each month.

4) Add the 12 sums obtained in (3) and divide by 12. This is the average number of full-time employees and full-time equivalents.

5) If this number obtained in (4) is under 50 (or under 100 for the 2015 determination for certain employers), the employer is not an applicable large employer for the year being determined.

Note: The applicable large employer is determined on a controlled group basis. For example, if there are three companies, each of which is wholly owned by the same parent company, the companies are all considered one employer for this calculation. Also note that, special transition rules apply in determining applicable large employer status for 2015 and that a special seasonal employee exception may apply even if the threshold in (5) is exceeded.

(B) If an employer will be an applicable large employer in 2015, it should determine whether it could be subject to penalties in 2015. For example, the employer should review its group health plan to determine if the insurance coverage is “offered” to full-time employees meets minimum value standards and is considered affordable to employees.

© An employer also will need to address how it will determine the full-time status of employees – will it use the “monthly measurement period” or the “look back measurement period.” This is particularly important for employers who have many variable-hour employees or seasonal employees.

(D) If the employer’s group health plan does not meet the threshold tests to avoid the penalties noted above, the employer should evaluate whether it wants to restructure its health care offerings or pay the penalties (which are non-deductible).

(E) Finally, employers should review their data collection procedures to ensure that they will be able to report the healthcare information required to be reported for 2015 (the actual reporting will occur in 2016 for the 2015 calendar year). Insurers, sponsors of self-insured plans, and other entities that provide minimum essential coverage during a calendar year will be required to report certain information to the IRS and to participants. In addition, applicable large employers will be required to report about the coverage they provide to both the IRS and to their employees. Drafts of the IRS forms to be used in reporting this information have recently been published (Form 1095-B, Form 1095-B Transmittal, Form 1095-C, Form 1095-C Transmittal). Employers should review these forms to understand the data that will need to be reported.

It is not too late for employers to take action now to avoid penalties in 2015.

In short, it depends.

Recently, several clients have received their annual premium rebate checks from their group health insurance company and are looking for guidance on the proper use of these funds. Under the Patient Protection and Affordable Care Act (“PPACA”), it requires health insurance companies now operate on specific medical loss ratios (80% for employers with less than 100 employees and 85% for employers with more than 100 lives). If an insurance company does not meet the stated medical loss ratios (MLRs), it is required to rebate part of the premium received back to groups.

Below is a summarized analysis used to determine if an employer can keep the premium rebate in whole or in part:

Plan Assets: The first step is to determine who owns the rebate. In accordance with the DOL’s guidance (Technical Release 2011-04), the portion of the rebate that is attributable to employee contributions is considered a plan asset. Therefore, if employees contributed to the cost of the group medical insurance plan, they are entitled a percentage of the rebate equal to the cost paid by the employees (i.e.- if employees paid 25% of the premiums, they would be entitled to 25% of the rebate). If the employer paid the entire cost of the premium, then no part of the rebate would be attributable to employee contributions permitting the employer to retain the full rebate.

For further guidance on premium rebates or any of the PPACA or ACA requirements for employers, please contact our office.

The Affordable Care Act (ACA) imposes significant information reporting responsibilities on employers starting with the 2015 calendar year. One reporting requirement applies to all employer-sponsored health plans, regardless of the size of the employer. A second reporting requirement applies only to large employers, even if the employer does not provide health coverage. The IRS is currently developing new systems for reporting the required information and recently released draft forms, however instructions have yet to be released.

Information returns

The new information reporting systems will be similar to the current Form W-2 reporting systems in that an information return (Form 1095-B or 1095-C) will be prepared for each applicable employee, and these returns will be filed with the IRS using a single transmittal form (Form 1094-B or 1094-C). Electronic filing is required if the employer files at least 250 returns. Employers must file these returns annually by Feb. 28 (March 31 if filed electronically). Therefore, employers will be filing these forms for the 2015 calendar year by Feb. 28 or March 31, 2016 respectively. A copy of the Form 1095, or a substitute statement, must be given to the employee by Jan. 31 and can be provided electronically with the employee’s consent. Employers will be subject to penalties of up to $200 per return for failing to timely file the returns or furnish statements to employees.

The IRS released drafts of the Form 1095-B and Form 1095-C information returns, as well as the Form 1094-B and Form 1094-C transmittal returns, in July 2014 and is expected to provide instructions for the forms in August 2014. According to the IRS, both the forms and the instructions will be finalized later this year.

Health coverage reporting requirement

The health coverage reporting requirement is designed to identify employees and their family members who are enrolled in minimum essential health coverage. Employees who are offered coverage, but decline the coverage, are not reported. The IRS will use this information to determine whether the employees are exempt from the individual mandate penalty due to having health coverage for themselves and their family members.

Insurance companies will prepare Form 1095-B (Health Coverage) and Form 1094-B (Transmittal of Health Coverage Information Returns) for individuals covered by fully-insured employer-sponsored group health plans. Small employers with self-insured health plans will use Form 1095-B and Form 1094-B to report the name, address, and Social Security number (or date of birth) of employees and their family members who have coverage under the self-insured health plan. However, large employers (as defined below) with self-insured health plans will file Forms 1095-C and 1094-C in lieu of Forms 1095-B and 1094-B.

Large employer reporting requirement

“Applicable large employer members (ALE)” are subject to the reporting requirement if they offer an insured or self-insured health plan, or do not offer any group health plan. ALE members are those employers that are either an applicable large employer on their own or are members of a controlled or affiliated service group with an ALE (regardless of the number of employees of the group member). ALEs are those that had, on average, at least 50 full-time employees (including full-time equivalent “FTE” employees) during the preceding calendar year. Full-time employees are those who work, on average, at least 30 hours per week. Employers with fewer than 50 full-time employees and equivalents are not applicable large employers and, thus, are exempt from this health coverage reporting requirement.

As referenced above, an employer’s status as an ALE is determined on a controlled or affiliated service group basis. For example, if Company A and Company B are members of the same controlled group and Company A has 100 employees and Company B has 20 employees, then A and B are both members of an ALE. Consequently, Company A and Company B must each file the information returns.

Each ALE member must file Form 1095-C (Employer-Provided Health Insurance Offer and Coverage) and Form 1094-C (Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns) with the IRS for each calendar year. The IRS will use this information to determine whether (1) the employer is subject to the employer mandate penalty, and (2) an employee is eligible for a premium tax credit on insurance purchased through the new health insurance exchange. ALEs with fewer than 100 full-time employees are generally eligible for transition relief from the employer mandate penalty for their 2015 plan year. Nonetheless, these employers are still required to file Forms 1095-C and 1094-C for the 2015 calendar year.

The employer mandate penalty can be imposed on any ALE member that does not offer affordable, minimum value health coverage to all of its full-time employees starting in 2015. Health coverage is affordable if the amount that the employer charges an employee for self-only coverage does not exceed 9.5 percent of the employee’s Form W-2 wages, rate of pay, or the federal poverty level for the year. A health plan provides minimum value if the plan is designed to pay at least 60 percent of the total cost of medical services for a standard population. In the case of a controlled or affiliated service group, the employer mandate penalties apply to each member of the group individually.

ALE members must prepare a Form 1095-C for each employee. The return will report the following information:

An ALE member will file with the IRS one Form 1094-C transmitting all of its Forms 1095-C. The Form 1094-C will report the following information:

As noted above, each ALE member is required to file Forms 1095-C and 1094-C for its own employees, even if it participates in a health plan with other employers (e.g., when the parent company sponsors a plan in which all subsidies participate). Special rules apply to multiemployer plans for collectively-bargained employees.

Action required

In light of the complexity of the new information reporting requirements, it is recommended that employers should begin taking steps now to prepare for the new reporting requirements:

Starting in 2015, the Affordable Care Act (ACA) requires applicable large employers to offer affordable, minimum value health coverage to their full time employees (and dependents) or pay a penalty. The employer penalty rules are also known as the employer mandate or the “pay or play” rules.

Effective in 2014, affordability of health coverage is used to determine whether an individual is:

On July 24, 2014, the IRS released Revenue Procedure 2014-37 to index the ACA’s affordability percentages for 2015.

For plan years beginning in 2015, an applicable large employer’s health coverage will be considered affordable under the pay or play rules if the employee’s requires contribution to the plan does not exceed 9.56 percent of the employee’s household income for the year. The current affordability percentage for 2014 is 9.5 percent.

Applicable large employers can use one of the IRS’ affordability safe harbors to determine whether their health plans will satisfy the 9.56 percent requirement for 2015 plan years, if requirements for the applicable safe harbor are met.

This adjusted affordability percentage will also be used to determine whether an individual is eligible for a premium tax credit for 2015. Individuals who are eligible for employer-sponsored coverage that is affordable and provides minimum value are not eligible for a premium tax credit in the Exchange.

Also, Revenue Procedure 2014-37 adjusts the affordability percentage for the exemption from the individual mandate for individuals who lack access to affordable minimum essential coverage. For plan years beginning in 2015, coverage is unaffordable for purposes of the individual mandate if it exceeds 8.05 percent of household income.

Employer Mandate

The pay or play rules apply only to applicable large employers. An “applicable large employer” is an employer with, on average, at least 50 full-time employees (including full-time equivalents) during the preceding calendar year. Many applicable large employers will be subject to the pay or play rules starting in 2015. However, applicable large employers with fewer than 100 full-time employees may qualify for an additional year, until 2016, to comply with the employer mandate.

Affordability Determination

The affordability of health coverage is a key point in determining whether an applicable large employers will be subject to a penalty.

For 2014, the ACA provides that an employer’s health coverage is considered affordable if the employee’s required contribution to the plan does not exceed 9.5 percent of the employee’s household income for the taxable year. The ACA provides that, for plan year beginning after 2014, the IRS must adjust the affordability percentage to reflect the excess of the rate of premium growth over the rate of income growth for the preceding calendar year.

As noted above, the IRS has adjusted the affordability percentage for plan years beginning in 2015 to 9.56 percent. The affordability text applies only to the portion of the annual premiums for self-only coverage and does not include any additional cost for family coverage. Also, if an employer offers multiple health coverage options, the affordability test applies to the lowest-cost option that also satisfies the minimum value requirement.

Affordability Safe Harbors

Because an employer generally will not know an employee’s household income, the IRS created three affordability safe harbors that employers may use to determine affordability based on information that is available to them.

The affordability safe harbors are all optional. An employer may choose to use one or more of the affordability safe harbors for all its employees or for any reasonable category of employees, provided it does so on a uniform and consistent basis for all employees in a category.

The affordability safe harbors are:

Individual Mandate

Beginning in 2014, the ACA requires most individuals to obtain acceptable health insurance coverage for themselves and their family members or pay a penalty. This rule is often referred to as the “individual mandate”. Individual may be eligible for an exemption from the penalty in certain circumstances.

Under the ACA, individuals who lack access to affordable minimum essential coverage are exempt from the individual mandate. For purposes of this exemption, coverage is considered affordable for an employee in 2014 if the required contribution for the lowest-cost, self-only coverage does not exceed 8 percent of household income. For family members, coverage is considered affordable in 2014 if the required contribution for the lowest-cost family coverage does not exceed 8 percent of household income. This percentage will be adjusted annually after 2014.

For plan years beginning in 2015, the IRS has increased this percentage from 8 percent to 8.05 percent.

Following the recent Supreme Court ruling regarding contraceptives in the Hobby Lobby Stores case, a new circuit decision now sets the stage for another possible Supreme Court decision on the ACA. On Tuesday (July 22, 2014), the U.S. Court of Appeals for the District of Columbia (in Halbig v. Burwell) and the U.S. Court of Appeals for the Fourth Circuit (in King v. Burwell) issued conflicting opinions regarding the IRS’ authority to administer subsidies in federally facilitated exchanges.

In general, the employer mandate requires that “applicable large employers” offer their full-time employees minimum essential coverage or potentially pay a tax penalty in 2015. However, according to the statutory text of the ACA, the penalties under the employer mandate are triggered only if an employee receives a subsidy to purchase coverage “through an Exchange established by the State under section 1311…” of the ACA. If a state elected not to establish an exchange or was unable to establish an operational exchange by January 1, 2014, the Secretary of HHS was required to establish a federal-run exchange under section 1321 of the ACA.

The appellants in each of these cases are residents of states that did not establish state run exchanges. Consequently, the appellants argue that the IRS does not have the authority to administer subsidies in their states because the exchanges were set up by HHS under section 1321 of the ACA and not under section 1311 as is the clear prerequisite for IRS authority to administer the subsidies.

In regulations implementing the subsidies, the IRS recognized this discrepancy and noted that “[c]ommentators disagreed on whether the language [of the ACA] limits the availability of the premium tax credit only to taxpayers who enroll in qualified health plans [QHPs] on State Exchanges."

The IRS, however, rejected these comments and stated that, “[t]he statutory language of section 36B and other provisions of the Affordable Care Act support the interpretation that credits are available to taxpayers who obtain coverage through a State Exchange, regional Exchange, subsidiary Exchange, and the Federally-facilitated Exchange. Moreover, the relevant legislative history does not demonstrate that Congress intended to limit the premium tax credit to State Exchanges. Accordingly, the final regulations maintain the rule in the proposed regulations because it is consistent with the language, purpose, and structure of section 36B and the Affordable Care Act as a whole.”

In Halbig v. Burwell, the D.C. Circuit disagreed with the IRS’ interpretation and, in a 2-1 decision, held that the IRS regulation authorizing tax credits in federal exchanges was invalid. The court focused heavily on the text itself and concluded, “that the ACA unambiguously restricts the …subsidy to insurance purchased on Exchanges established by the state.”

In an opinion issued only hours following the D.C. Circuit decision, the 4th Circuit, in King v. Burwell, agreed with the IRS’ interpretation and upheld the subsidies by permitting the IRS to decide whether the premium tax credits should be available over the federal exchange. The justices argued that the text did not intend to create two unequal exchanges. Additionally, they argue that the ambiguous text of the act intended that the exchanges be operated as appendages of the Bureaucracy, and so under the directives of the IRS.

Currently, 36 states are using federally facilitated exchanges, including Florida. Further, roughly 85% of enrollees who signed up for health insurance receive subsidies allowing them to purchase coverage that would be otherwise unaffordable. If the subsidies allocated over the federal exchange were declared invalid, those individuals’ ability to receive subsidies to purchase coverage could be jeopardized. As a result, the average price of a health plan is projected to rise from $82 per month to $346 per month, making it more difficult to afford for approximately 5.4 M enrollees.

While the Halbig decision is a major setback to the ACA, it is almost certainly not the final word on this issue. Given the fact that two courts have reached different outcomes, the Supreme Court is more likely to weigh in on the decision. However, the Halbig decision is likely to be reviewed by the entire D.C. Circuit prior to any potential review by the Supreme Court.

Many employers originally thought they could shift health costs to the government by sending their employees to a health insurance Exchange/Marketplace with a tax-free contribution of cash to help pay premiums, but the Obama administration has squashed this idea in a new ruling. Such arrangements do not satisfy requirements under the Affordable Care Act (ACA), the Obama administration said, and employers could now be subject to a tax penalty of $100 a day — or $36,500 a year — for each employee who goes into the individual Marketplace/Exchange for health coverage.

The ruling this month, by the Internal Revenue Service, prevents any “dumping” of employees into the exchanges by employers.

Under a main provision in the health care law, employers with 50 or more employees are required to offer health coverage to full-time workers, or else the employer may be subject to penalties.

Many employers had concluded that it would be cheaper to provide each employee with a lump sum of money to buy insurance on an exchange, instead of providing employer-sponsored health coverage directly to employees as they had in the past.

But the Obama administration has now raised objections in an authoritative Q&A document recently released by the IRS, in consultation with other agencies.

The health law, known as the Affordable Care Act (ACA), was intended to build on the current system of employer-based health insurance. The administration wants employers to continue to provide coverage to workers and their families and do not see the introduction of ACA as an eventual erosion of employer provided coverage.

Employer contributions to sponsored health coverage, which averages more than $5,000 a year per employee, are not counted as taxable income to workers. But the IRS has said employers could not meet their obligations under ACA by simply reimbursing employees for some or all of their premium costs from the marketplace/exchange.

Christopher E. Condeluci, a former tax and benefits counsel to the Senate Finance Committee, said the recent IRS ruling was significant because it made clear that “an employee cannot use tax-free contributions from an employer to purchase an insurance policy sold in the individual health insurance market, inside or outside an exchange.”

If an employer wants to help employees buy insurance on their own, Condeluci said, they can give the employee higher pay, in the form of taxable wages. But in such cases, he said, the employer and the employee would owe payroll taxes on those wages, and the change could be viewed by workers as reducing a valuable benefit.

A tax partner from a large accounting firm has also said the ruling could disrupt reimbursement arrangements used in many industries.

For decades, many employers have been assisting employees by reimbursing them for health insurance premiums and out-of-pocket costs associated with their health coverage. The new federal ruling eliminates many of those arrangements, commonly known as Health Reimbursement Arrangements (HRAs) or employer payment plans, by imposing an unusually punitive penalty. The IRS has said that these employer payment plans are considered to be group health plans, but they do not satisfy requirements of the Affordable Care Act for health coverage.

Under the law, insurers may not impose annual limits on the dollar amount of benefits for any individual, and they must provide certain preventive services, like mammograms and colon cancer screenings, without co-payments or other charges.

But the administration has said that employer payment plans or HRAs do not meet these requirements.

This ruling was released as the Obama administration rushed to provide guidance to employers and insurers who are beginning to review coverage options for 2015.

The Department of Health and Human Services said it would provide financial assistance to certain insurers that experience unexpected financial losses this year. Administration officials hope the payments will stabilize medical premiums and prevent rate increases that are associated with the required policy changes as a result of ACA.

Republicans want to block these payments, however, as they see them as a bailout for insurance companies who originally supported the president’s health care law.

Stay tuned for more updates on ACA as they are released. Should you have any questions, please do not hesitate to contact our office.

It was announced on Wednesday, March 5th, by the Obama Administration that it would allow some health plans that do not currently meet all Affordable Care Act (ACA) requirements to continue offering non-compliant insurance for another two years. The Centers for Medicare and Medicaid Services (CMS) released the announcement, clarifying the new policy.

In November 2013, the Obama administration decided that some non-grandfathered health plans in the small group and individual markets would not be considered out of compliance if they failed to meet certain coverage provisions of the ACA. The transition relief was originally scheduled to last for one year, and was viewed as a response to the numerous health insurance policy cancellations that would result from the new requirements.

This recent announcement extends this relief for two additional years. CMS released the following:

“At the option of the States, health insurance issuers that have issued or will issue a policy under the transitional policy anytime in 2014 may renew such policies at any time through October 1, 2016, and affected individuals and small businesses may choose to re-enroll in such coverage through October 1, 2016.”

Who Will This Impact?

This decision, which will likely prevent another wave of cancellations that were scheduled to begin November 1, 2014 and will impact some insurance offerings, but is unlikely to have a significant impact, since only about half of the states have opted to grant extensions to health plans within their jurisdictions. Further, the number of people currently on these non-compliant plans has been dropping, and is expected to continue to decline. Under the new policy, these plans (which typically offer fewer benefits at lower costs since they do not have to abide by the ACA’s minimum essential coverage) will still be available until plans expire in 2017.

Please note that it will be up to each individual state, as well as each individual insurance carrier, as to if they will decide to adopt this additional two year extension. Under the original one year transitional relief, even though it was allowed in the State of Florida, there are currently some health insurance carriers who have decided to not allow groups to renew their existing non-compliant medical plans.

We will continue to keep you up to date of new developments in ACA implementation as they arise. Please contact our office for additional information regarding your group’s medical policy and the impact of this recent change on it.

The Obama administration is giving certain employers extra time before they must offer health insurance to almost all of their full time workers.

Under new rules announced Monday by Treasury Department officials, employers with 50 to 99 workers will be given until 2016 (two years longer than originally envisioned under the Affordable Care Act) before they risk a federal penalty for not complying.

Companies with 100+ workers or more are getting a different kind of one-year grace period. Instead of being required in 2015 to offer coverage to 95% of full time workers, these bigger employers can now avoid a fine by offering insurance to at least 70% of workers next year.

Administration officials had already announced in July 2013 that the employer requirements would be postponed until 2015 and this recent announcement has caught officials by surprise.

Obama administration officials said the Treasury Department decided to allow medium-size businesses more latitude because “they need a little more time to adjust to providing coverage”.

The Affordable Care Act (ACA) states that anyone who works 30 hours or more is a full time employee, and it compels many employers to offer affordable insurance to those workers and their dependents. (Please note that Florida law currently defines a full time worker as anyone who works 25 or more hours). It also defines affordable as premiums of no more than 9.5% of an employee’s income, and employers must pay for the equivalent of 60% of the actuarial value of a worker’s coverage. Businesses that fail to do so will eventually face a fine of up to $2000 for each employee not offered coverage, though workers are not required to sign up for the benefits.

For questions on how these recent changes will affect your business or for help complying with the ever-changing ACA requirements, please contact our office.