With the Republicans’ failure to pass a bill to repeal and replace the Affordable Care Act (ACA), employers should plan to remain compliant with all ACA employee health coverage and annual notification and information reporting obligations.

Even so, advocates for easing the ACA’s financial and administrative burdens on employers are hopeful that at least a few of the reforms they’ve been seeking will resurface in the future, either in narrowly tailored stand-alone legislation or added to a bipartisan measure to stabilize the ACA’s public exchanges. Relief from regulatory agencies could also make life under the ACA less burdensome for employers.

“Looking ahead, lawmakers will likely pursue targeted modifications to the ACA, including some employer provisions,” said Chatrane Birbal, senior advisor for government relations at the Society for Human Resource Management (SHRM). “Stand-alone legislative proposals have been introduced in previous Congresses, and sponsors of those proposals are gearing up to reintroduce bills in the coming weeks.”

These legislative measures, Birbal explained, are most likely to address the areas noted below.

(more…)

Repeal and replacement of the Affordable Care Act (ACA) by the American Health Care Act (AHCA) may be underway in Washington D.C., but until a final version of the AHCA is signed into law, the ACA is the law of the land. In fact, the IRS is currently issuing notices to employers that require them to disclose whether they complied with ACA large employer reporting duties, or their excuse for not doing so, where applicable.

The ACA required large employers to furnish employee statements (Forms 1095-C) and file them with the IRS under transmittal Form 1094-C, and the Internal Revenue Code (“Code”) imposes separate penalty taxes for failing to timely furnish and file the required forms. Large employer reporting was required for 2015 and 2016, even if transition relief from ACA penalty taxes applied for 2015. The potential penalties can be very large – up to $500 per each 2015 Form 1095-C statement ($250 for not furnishing the form to the employee and $250 for not filing it with IRS) – up to a total annual penalty liability of $3 million. The penalty amounts and cap are periodically adjusted for inflation.

Employers that failed to furnish Form 1095-C and file copies with Form 1094-C may receive the IRS notices, called “Request for Employer Reporting of Offers of Health Insurance Coverage (Forms 1094-C and 1095-C)” and also known as Letter 5699 forms. Forms may be received regarding reporting for 2015 or 2016. Employers that receive a Letter 5699 form will have only thirty days to complete and return the form, which contains the following check boxes:

The Letter also provides: “[i]f you are required to file information returns under IRC Section 6056, failure to comply may result in the assessment of a penalty under IRC Section 6721 for a failure to file information returns.”

Employers receiving Letter 5699 forms should contact their benefit advisors immediately and plan to respond as required within the thirty-day limit; it may be necessary to request an extension for employers that are just realizing that they have reporting duties and need to prepare statements for enclosure with their response. In this regard, the IRS offers good faith relief from filing penalties for timely filed but incomplete or incorrect returns for 2015 and 2016, but relief from penalties for failures to file entirely for those years is available only upon a showing of “reasonable cause,” which is narrowly interpreted (for instance, due to fire, flood, or major illness).

Large employers should not look to coming ACA repeal/replacement process for relief from filing duties and potential penalties. The House version of the AHCA does not change large employer reporting duties and it is unlikely the Senate or final versions of the law will do so. This is largely because procedural rules limit reform/repeal provisions to those affecting tax and revenue measures, which would not include reporting rules. Thus the reporting component of the ACA will likely remain intact (though it may be merged into Form W-2 reporting duties), regardless of the ACA’s long-term fate in Washington.

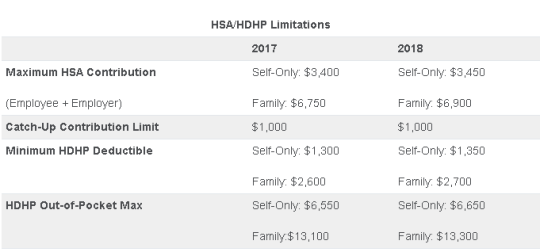

On May 4, 2017, the IRS released Revenue Procedure 2017-37 setting dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for 2018. HSAs are subject to annual aggregate contribution limits (i.e., employee and dependent contributions plus employer contributions). HSA participants age 55 or older can contribute additional catch-up contributions. Additionally, in order for an individual to contribute to an HSA, he or she must be enrolled in a HDHP meeting minimum deductible and maximum out-of-pocket thresholds. The contribution, deductible and out-of-pocket limitations for 2018 are shown in the table below (2017 limits are included for reference).

Note that the Affordable Care Act (ACA) also applies an out-of-pocket maximum on expenditures for essential health benefits. However, employers should keep in mind that the HDHP and ACA out-of-pocket maximums differ in a couple of respects. First, ACA out-of-pocket maximums are higher than the maximums for HDHPs. The ACA’s out-of-pocket maximum was identical to the HDHP maximum initially, but the Department of Health and Human Services (which sets the ACA limits) is required to use a different methodology than the IRS (which sets the HSA/HDHP limits) to determine annual inflation increases. That methodology has resulted in a higher out-of-pocket maximum under the ACA. The ACA out-of-pocket limitations for 2018 were announced are are $7350 for single and $14,700 for family.

Second, the ACA requires that the family out-of-pocket maximum include “embedded” self-only maximums on essential health benefits. For example, if an employee is enrolled in family coverage and one member of the family reaches the self-only out-of-pocket maximum on essential health benefits ($7,350 in 2018), that family member cannot incur additional cost-sharing expenses on essential health benefits, even if the family has not collectively reached the family maximum ($14,700 in 2018).

The HDHP rules do not have a similar rule, and therefore, one family member could incur expenses above the HDHP self-only out-of-pocket maximum ($6,650 in 2018). As an example, suppose that one family member incurs expenses of $10,000, $7,350 of which relate to essential health benefits, and no other family member has incurred expenses. That family member has not reached the HDHP maximum ($14,700 in 2018), which applies to all benefits, but has met the self-only embedded ACA maximum ($7,350 in 2018), which applies only to essential health benefits. Therefore, the family member cannot incur additional out-of-pocket expenses related to essential health benefits, but can incur out-of-pocket expenses on non-essential health benefits up to the HDHP family maximum (factoring in expenses incurred by other family members).

Employers should consider these limitations when planning for the 2018 benefit plan year and should review plan communications to ensure that the appropriate limits are reflected.

Until very recently, employers were at risk of receiving steep fines if they reimbursed employees for non-employer sponsored medical care – the Affordable Care Act (ACA) included fines of up to $36,500 a year per employee for such an action. Late in 2016, however, President Obama signed the 21st Century Cures Act and established Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs). As of January 1, 2017, small employers can offer these tax-free medical care reimbursements to eligible employees.

If an employee incurs a medical care expense, such as health insurance premiums or eligible medical expenses under IRC Section 213(d), the employer can reimburse the employee up to $4,950 for single coverage or $10,000 for family coverage. Employees may not make any contributions or salary deferrals to QSEHRAs.

The maximum amount must

be prorated for those not eligible for an entire year. For example, an employer

offering the maximum reimbursement amount should only reimburse up to $2,475 to

an employee who has been working for the company for six months. For a complete

list of medical expenses covered under IRC 213(d), see https://www.irs.gov/pub/irs-pdf/p502.pdf.

Employers may tailor which expenses they will reimburse to a certain extent,

and do not have to reimburse employees for all eligible medical expenses.

Much like other healthcare reimbursement arrangements, employees may have to provide substantiation before reimbursement. The IRS has discretion to establish requirements regarding this process, but has not yet done so. Although reimbursements may be provided tax-free, they must be reported on the employee’s W-2 in Box 12 using the code “FF.”

To offer QSEHRAs, an employer cannot be an applicable large employer (ALE) under the ACA. Only employers with fewer than 50 full-time equivalent employees can offer this benefit. Further, a group cannot offer group health plans to any employees to qualify.

Typically, an employer that chooses to offer a QSEHRA must offer it to all employees who have completed at least 90 days of work. The few exceptions to this rule include part-time or seasonal employees, non-resident aliens, employees under the age of 25, and employees covered by a collective bargaining agreement.

Employers may offer differing reimbursement amounts based on employee age or family size. However, such variances must be based on the cost of premiums of a reference policy on the individual market. It is currently unclear which reference policy will be selected or how permitted discrepancies will be calculated.

To be eligible for a tax-free reimbursement, employees must have proof of minimum essential coverage. It is uncertain how closely employers will have to scrutinize such proof, although guidance will hopefully be available soon.

Eligible employees must disclose to health exchanges the amount of QSEHRA benefits available to them. The exchanges will account for the reported amount, even if the employee does not utilize it, and will likely reduce the amount of the subsidies available. Employers should take this into account before adopting a QSEHRA.

In order to establish a QSEHRA, employers will have to set up and administer a plan. Group health plan requirements, such as ACA reporting and COBRA requirements, do not apply to QSEHRAs. But in order to properly provide reimbursements to employees, employers will likely have to establish reimbursement procedures.

Additionally, any eligible employees must be notified of the arrangements in writing at least 90 days before the first day they will be eligible to participate. For the current year, the IRS is giving employers who implement QSEHRAs an extension until March 13, 2017 to provide a notice. The notice must provide the amount of the maximum benefit, and that eligible employees inform health insurance exchanges this benefit is available to them. It also must inform eligible employees they may be subject to the individual ACA penalties if they do not have minimum essential coverage.

On Feb. 15, the IRS announced on its ACA Information Center for Tax Professionals webpage that it would not reject taxpayers’ 2016 income tax returns that are missing health coverage information.

This information is supposed to be included on line 61 of the Form 1040 and line 11 of the Form 1040EZ to demonstrate compliance during the year with the Affordable Care Act’s (ACA’s) mandate that individuals have health insurance that meets ACA standards, or else pay a penalty.

Two crucial points regarding the IRS announcement should be stressed:

The IRS indicated that it will accept tax returns lacking this information in light of President Donald Trump’s executive order directing agencies to minimize the ACA’s regulatory burden. While the requirement to have ACA-compliant coverage or pay a tax penalty has been in place since 2014, starting this year the IRS was to have begun automatically flagging and rejecting tax returns missing that information.

“This action by the IRS doesn’t mean it won’t enforce the individual mandate,” said Lisa Carlson, senior Employee Retirement Income Security Act (ERISA) attorney at Lockton Compliance Services in Chicago. “This action simply means the IRS won’t reject a taxpayer’s return outright if the taxpayer doesn’t answer the health coverage question. The IRS reserves the right to follow up with a taxpayer, at a future date, regarding his or her compliance with the individual mandate, if the person’s tax return doesn’t provide information about his or her health insurance coverage during 2016.”

For those individuals who previously filed without providing health insurance information or who indicated that they did not carry coverage as was required, “whether the IRS will assess penalties depends on the retroactive nature of [a possible future] repeal of the individual mandate or its penalties,” Carlson said.

While the IRS announcement does not suggest that the agency won’t be strictly enforcing the individual mandate tax penalty, “we just don’t know” what enforcement actions the agency might take, said Garrett Fenton, an attorney with Miller & Chevalier in Washington, D.C., whose practice focuses on employee benefits, tax and executive compensation.

While it’s unclear how strenuous IRS enforcement actions might be, “the individual mandate and its related tax penalties are certainly still on the books, and it would require an act of Congress to change that,” Fenton noted. If tax filers leave unchecked the box indicating that they have ACA-compliant coverage, “the IRS may come back and ask them follow-up questions, and they still may get audited and potentially owe the tax penalty.”

The ACA is still the law of the land and prudent employers will want to continue to comply with the ACA, including the play-or-pay mandate and reporting requirements, including furnishing Forms 1095-C to employees and making all required filings with the IRS, until formal guidance relieves them of those compliance obligations.

Despite the IRS announcement, employers are still required to file their ACA reporting forms and those forms will be rejected if they do not contain the requisite information. Because the President has indicated that we may not see a repeal until 2018, employers will still be required to operate their health plans in an ACA-compliant manner until notified otherwise.

In the context of the employer mandate, waiver of penalties seems unlikely because these penalties are written into law and are a significant source of revenue for the federal government.

The bottom line: Those who are responsible for issuing and filing 1094s and 1095s on behalf of their organizations should continue to comply with all relevant laws, regulations, reporting requirements and filing specifications during the repeal-and-replace process.

The IRS issued Notice 2016-70 in November 2016, giving employers subject to the ACA’s 2016 information-reporting requirements up to an additional 30 days to deliver these forms to employees. The notice affected upcoming deadlines for ACA information reporting as follows:

The Treasury Department and the IRS determined that a substantial number of employers and other insurance providers needed additional time “to gather and analyze the information [necessary to] prepare the 2016 Forms 1095-C and 1095-B to be furnished to individuals,” Notice 2016-70 stated. This extension applies for tax year 2016 only and does not require the submission of any request or other documentation to the IRS.

Although the date for filing with the IRS was not extended, employers can obtain a 30-day extension by submitting Form 8809 (Application for Extension of Time to File Information Returns) by the due date for the ACA information returns.

Note: For small businesses with fewer than 50 full-time equivalent employees that provide employees with an ACA-compliant group plan, the rules are a bit different. If fully insured, the insurance company that provides coverage is required to send enrollees a copy of Form 1095-B and to submit Forms 1995-B (along with transmittal Form 1094-B) to the IRS in order to report minimum essential coverage.

If a small company is self-insured and provides group coverage, it must also provide employees and the IRS with Form 1095-B. But small business that offer insurance are not required to send Form 1095-Cs to employees or to the IRS.

Small business that do not provide group coverage are not subject to ACA reporting.

While Congress considers options to repeal and replace the ACA, businesses should prepare to comply with the current employer mandate through 2018. Businesses should pay close attention to decisions over the next few weeks, but be prepared to stay patient because significant details on employer obligations are unlikely to take shape for some time.

Earlier this week, President Obama signed the 21st Century Cures Act (“Act”). This Act contains provisions for “Qualified Small Business Health Reimbursement Arrangements” (“HRA”). This new HRA would allow eligible small employers to offer a health reimbursement arrangement funded solely by the employer that would reimburse employees for qualified medical expenses including health insurance premiums.

The maximum reimbursement that can be provided under the plan is $4,950 or $10,000 if the HRA provided for family members of the employee. An employer is eligible to establish a small employer health reimbursement arrangement if that employer (i) is not subject to the employer mandate under the Affordable Care Act (i.e., less than 50 full-time employees) and (ii) does not offer a group health plan to any employees.

To be a qualified small employer HRA, the arrangement must be provided on the same terms to all eligible employees, although the Act allows benefits under the HRA to vary based on age and family-size variations in the price of an insurance policy in the relevant individual health insurance market.

Employers must report contributions to a reimbursement arrangement on their employees’ W-2 each year and notify each participant of the amount of benefit provided under the HRA each year at least 90 days before the beginning of each year.

This new provision also provides that employees that are covered by this HRA will not be eligible for subsidies for health insurance purchased under an exchange during the months that they are covered by the employer’s HRA.

Such HRAs are not considered “group health plans” for most purposes under the Code, ERISA and the Public Health Service Act and are not subject to COBRA.

This new provision also overturns guidance issued by the Internal Revenue Service and the Department of Labor that stated that these arrangements violated the Affordable Care Act insurance market reforms and were subject to a penalty for providing such arrangements.

The previous IRS and DOL guidance would still prohibit these arrangements for larger employers. The provision is effective for plan years beginning after December 31, 2016. (There was transition relief for plans offering these benefits that ends December 31, 2016 and extends the relief given in IRS Notice 2015-17.)

In IRS Notice 2016-70, the IRS announced a 30-day automatic extension for the furnishing of 2016 IRS Forms 1095-B (Health Coverage) and 1095-C (Employer-Provided Health Insurance Offer and Coverage), from January 31, 2017 to March 2, 2017. This extension was made in response to requests by employers, insurers, and other providers of health insurance coverage that additional time be provided to gather and analyze the information required to complete the Forms. Notwithstanding the extension, the IRS encourages employers and other coverage providers to furnish the Forms as soon as possible.

Notice 2016-70 does not extend the due date for employers, insurers, and other providers of minimum essential coverage to file 2016 Forms 1094-B, 1095-B, 1094-C and 1095-C with the IRS. The filing due date for these forms remains February 28, 2017 (March 31, 2017, if filing electronically), unless the due dates are extended pursuant to other available relief.

The IRS also indicates that, while failure to furnish and file the Forms on a timely basis may subject employers and other coverage providers to penalties, such entities should still attempt to furnish and file even after the applicable due date as the IRS will take such action into consideration when determining penalties.

Additionally, guidance provides that good faith reporting standards will apply for 2016 reporting. This means that reporting entities will not be subject to reporting penalties for incorrect or incomplete information if they can show that they have made good faith efforts to comply with the 2016 Form 1094 and 1095 information-reporting requirements. This relief applies to missing and incorrect taxpayer identification numbers and dates of birth, and other required return information. However, no relief is provided where there has not been a good faith effort to comply with the reporting requirements or where there has been a failure to file an information return or furnish a statement by the applicable due date (as extended).

Finally, an individual taxpayer who files his or her tax return before receiving a 2016 Form 1095-B or 1095-C, as applicable, may rely on other information received from his or her employer or coverage provider for purposes of filing his or her return. Thus, if employers take advantage of the extension in Notice 2016-70 and receive employee requests for 2016 Forms 1095-C before the extended due date, they should refer their employees to the guidance in Notice 2016-70.

Today the IRS released Revenue Procedure 2016-55 confirming a $50 increase in the health FSA contribution limit to $2,600.

With the passing of the ACA, employee contributions to an FSA were initially limited to $2500 per plan year. This has increased since 2014 to adjust for inflation with the limit being bumped up slightly to $2550 for 2015 & 2016 plan years.

Now, for health FSA plan years beginning on or after January 1, 2017, we have a new increase in the salary reduction contribution limit to $2,600. Be sure to double-check your Section 125 cafeteria plan document to confirm that it automatically incorporates these health FSA cost-of-living increases or to see if you need to specifically request to have the cap increased.

Earlier this year, the IRS also announced the inflation adjusted amounts for 2017 HSA contributions in Revenue Procedure 2016-28. For individuals in self-only coverage, the 2017 contribution limit will increase to $3,400 (up from $3,350). The family coverage contribution limit remains at $6,750 again in 2017.

The next ACA compliance hurdle employers are set to face is managing subsidy notifications and appeals. Many exchanges recently began mailing out notifications this summer and it’s important for employers to make sure they’re prepared to manage the process. Why? Well, subsidies—also referred to as Advanced Premium Tax Credits, are a trigger for employer penalties. If you fail to offer coverage to an eligible employee and the employee receives a subsidy, you may be liable for a fine.

If an employee receives a subsidy, you’ll receive a notice. This is where things can get complicated. You need to ensure that the notifications go directly to the correct person or department as soon as possible, because you (the employer) only have 90 days from the date on the notification to respond. And rounding up these notices may not be so easy. For example, your employee may not have put the right employer address on their exchange / marketplace application. Most often, employees will list the address of the location where they work, not necessarily the address where the notification should go, like your headquarters or HR department. If the employee is receiving a subsidy but put a wrong address or did not put any address for their employer, you will not even receive a notice about that employee.

Once you receive the notification, you must decide whether or not you want to appeal the subsidy. If you offered minimum essential coverage (MEC) to the employee who received a subsidy and it met both the affordability and minimum value requirements, you should consider appealing.

You may think that appealing a subsidy and potentially getting in the way of your employee receiving a tax credit could create complications. Believe it or not, you may actually be doing your employee a favor. If an employee receives a subsidy when they weren’t supposed to, they’ll likely have to repay some (or all) of the subsidy amount back when they file their taxes. Your appeal can help minimize the chance of this happening since they will learn sooner rather than later that they didn’t qualify for the subsidy. Plus, the appeal can help prevent unnecessary fines impacting your organization by showing that qualifying coverage was in fact offered.

If you have grounds to appeal, you can complete an Employer Appeal Request Form and submit it to the appropriate exchange / marketplace (Note: this particular form is intended to appeal subsidies through the Federal exchange). The form will ask for information about your organization, the employee whose subsidy you’re appealing, and why you’re appealing it. Once sent, the exchange will notify both you and the employee when the appeal was received.

Next, the exchange will review the case and make a decision. In some cases, the exchange may choose to hold a hearing. Once a decision is made, you and your employee will be notified. But it doesn’t necessarily end there. Your employee will have an opportunity to appeal the exchange’s decision with the Department of Health and Human Services (HHS). If HHS decides to hold a hearing, you may be called to testify. In this situation, HHS will review the case and make a final decision. If HHS decides that the employee isn’t eligible for the subsidy, then the employee may have to repay the subsidy amount for the last few months. On the other hand, if the HHS decides the employee is eligible for the subsidy, it will be important for you to keep your appeal on file since this can potentially result in a fine from the IRS later in the year.

Sound complicated? It certainly can be. Managing subsidies and appeals could quickly add up to a substantial time investment, and if handled improperly you could see additional impacts to your bottom line in the form of fines. Handling subsidy notifications and appeals properly up front can lead to fewer fines down the road, benefiting both you and your employees.