The IRS has released the 2022 contribution limits for FSA and several other benefits in Revenue Procedure 2021-45. The limits are effective for plan years that begin on or after January 1, 2022.

The IRS has proposed two significant changes to electronic filing requirements for various information returns including not just the Forms 1094-C and 1095-C filings required of many employers by the Affordable Care Act (ACA), but common payee statements like Forms W-2 and 1099. If the proposed changes are finalized – we expect that to happen by this autumn – all but the very smallest employers will be required to file these forms electronically for filing due dates falling in 2022 and beyond. Employers wishing to engage an ACA reporting and/or payroll vendor to comply with electronic filings requirements will need to begin making changes to comply.

Under current e-filing rules, an employer subject to the ACA’s employer mandate is not required to file its Forms 1094-C and 1095-C electronically unless the employer is submitting at least 250 of the forms to the IRS. When determining whether the employer crosses the 250-return threshold, the employer separately counts the different returns it files, such as its Forms 1094-C and 1095-C, and even payee statements like Forms W-2, 1099, etc.

For example, an employer with 150 ACA full-time employees and 50 part-time employees over the course of the calendar year may be required to file 200 Forms W-2, 150 Forms 1095-C and one Form 1094-C, but because the employer is not filing at least 250 of the same form, the employer is not required to file any of the forms electronically.

The new IRS proposal would drop the 250-return threshold to 100 for returns due in 2022 (and to 10 for returns due in 2023 or later years), and, most significantly, would require employers to aggregate the number of different returns it files when determining whether the 250-return threshold is reached. In the example above, for returns due in 2022, the employer would aggregate the 200 Forms W-2, 150 Forms 1095-C and the one Form 1094-C, for a total of 351 returns. Because the aggregated total of returns due from the employer is at least 250, all the returns must be filed electronically.

Many employers that until now have filed their Forms 1094-C/1095-C, W-2, 1099, etc. on paper will be required – assuming the IRS shortly finalizes the newly proposed regulations – to submit those forms to the IRS electronically for filings due in 2022. Almost all employers will be required to e-file by 2023. For employers wishing to engage a vendor to conduct electronic filing – particularly those for whom the e-filing status quo will change next year – the search for an e-filing vendor should begin.

The IRS has released IRS Notice 2020-84 providing the adjusted $2.66 Patient-Centered Outcomes Research Institute (PCORI) fee per covered individual for health plan years ending on or after October 1, 2020 and before October 1, 2021, which includes 2020 calendar plan years. The fee has increased $0.12 per covered individual from last year (from $2.54).

As detailed in last year’s alert, Congress surprisingly extended the PCORI fee for another decade (until 2029). Despite the originally scheduled sunsetting of the fee in the 2019 filing (for calendar plan years), PCORI filings are now here to stay as a summer staple for the foreseeable future.

The annual PCORI fee must be reported and paid to the IRS by August 2, 2021 via the second quarter Form 720.

The fee is imposed on health insurance issuers and self-insured health plan sponsors in order to fund the Patient-Centered Outcomes Research Institute (PCORI). The mission of the institute is to improve healthcare delivery and outcomes by producing and promoting high-integrity evidence-based information that comes from research guided by patients, caregivers and the broader health community.

The institute currently maintains a robust portfolio of patient-centered outcomes research that addresses a variety of high priority conditions and topics.

PCORI research projects are also targeting certain populations of interest such as: racial and ethnic minorities, low socioeconomic status, women, older adults and individuals with multiple chronic conditions. The PCORI website lists current and completed research projects as well as outcomes.

Fully Insured Medical Plans: Health Insurers (aka insurance carriers) are responsible for paying the fee on fully insured health policies. This fee is built into the insurance premium, so there is no action required by employers.

Self-Insured Medical Plans (Including HRAs): The plan sponsor (aka the employer) is responsible for paying the PCORI fee for self-insured health plans. Self-insured plans include so-called “level funded” plans. The employer must file the Form 720 and pay the fee.

The PCORI fee generally applies only to major medical plans and health reimbursement arrangements (HRAs). (See below for an exception that applies to many HRAs.)

The PCORI fee does not apply to dental and vision coverage that are excepted benefits (whether through a stand-alone insurance policy or meeting the “not integral” test for self-insured coverage). Virtually all dental and vision plans are excepted benefits.

The PCORI fee also does not apply to health FSAs (which must be an excepted benefit to comply with the ACA) or HSAs (which are not a group health plan).

For a quick reference guide, the IRS has published a table which summarizes the applicability of the fee to common types of health and welfare benefits.

Yes, an HRA is a self-insured health plan. However, the PCORI rules provide an exception to the fee requirement for an HRA where it is offered along with a self-insured major medical plan that has the same plan year as the HRA. This avoids the need to pay the PCORI fee for both the HRA and the self-insured major medical plan (i.e., each person covered by both plans is counted only once for purposes of determining the PCORI fee).

There is no exception from the PCORI fee for an HRA offered along with fully insured major medical coverage. While the insurance carrier is responsible for paying the PCORI fee for the fully insured medical plan, the employer is responsible for paying the PCORI fee on the HRA. The IRS is essentially double-dipping in this scenario by imposing the PCORI fee on the same lives covered by both the major medical and the HRA. In recognition of this, the HRA PCORI fee paid by the employer is determined by counting only one life per employee participating in the plan (and not dependents).

Summary: The PCORI fee is required for an HRA unless it is paired with a self-insured major medical plan that has the same plan year as the HRA. Where the PCORI fee is required, the employer is responsible for filing the Form 720 and paying the PCORI fee for an HRA solely for the covered employees (not dependents).

Plan Sponsors of self-insured health plans (other than an HRA) calculate the fee based on the average number of total lives covered by the plan (both employees and dependents).

Plan Sponsors can use one of three alternative methods which are summarized by the IRS in its PCORI fee homepage and PCORI fee FAQs:

Upon reinstatement of the fee in 2020, the IRS allowed plan sponsors an alternative method of calculating the average number of covered lives. Plan sponsors were able to use any reasonable method to calculate the average number of covered lives. This guidance was not extended to the 2021 filing, and employers must use one of the above three methods.

For calendar plan years, the applicable rate for the 2020 plan year will be $2.66 per covered life.

Employers filing for a self-insured medical plan should keep in mind that the plan year is the ERISA plan year reflected in the plan document, SPD, and Form 5500 (if applicable). The PCORI fee also applies to short plan years, defined as any plan year less than 12 months.

The fee is due July 31st (August 2nd in 2021) of the year following the last day of the plan year, including short plan years.

Examples

The IRS has published a table of the applicable filing deadline and rate for each plan year ending date.

The PCORI fee is filed on the second quarter IRS Form 720, which is due by August 2, 2021 (July 31st is a Saturday in 2021). Consult the IRS Instructions for Form 720 for direction on completing the form (see pages 8-9).

In much-anticipated guidance, the Internal Revenue Service has offered its insight on the implementation of the COBRA temporary premium subsidy provisions of the American Rescue Plan Act of 2021 (ARPA) in Notice 2021-31.

Spanning more than 40 pages, the IRS-answered frequently asked questions (FAQs) finally resolve many issues relating to temporary premium assistance for COBRA continuation coverage left unanswered in the Department of Labor’s publication of model notices, election forms, and FAQs.

The practical implications of the guidance for employers are many. Significantly, employers must take action prior to May 31, 2021, to ensure compliance with some of the requirements under ARPA and related agency guidance.

Notice 2021-31 provides comprehensive guidance on the ARPA subsidy and tax credit implementation issues (although it acknowledges there are many issues that still need to be addressed). Some of the key topics addressed include:

For employers, there are some immediate takeaways:

As expected, the IRS expansively defines an “involuntary termination.” For purposes of the ARPA COBRA subsidy, involuntary terminations include employee-initiated terminations due to good reason as a result of employer action (or inaction) resulting in a material adverse change in the employment relationship.

The guidance provides helpful COVID-19-specific examples. Employees participating in severance window programs meeting specified regulatory requirements could qualify. Voluntary employee terminations due to an involuntary material reduction in hours also could qualify. Further, voluntary terminations due to daycare challenges or concerns over workplace safety may constitute an involuntary termination, but only in the narrow circumstances in which the employer’s actions or inactions materially affected the employment relationship in an adverse way, analogous to a constructive discharge.

Employer action to terminate the employment relationship due to a disability also will constitute an involuntary termination, but only if there is a reasonable expectation before the termination the employee will return to work after the end of the illness or disability. This requires a specific analysis of the surrounding facts and circumstances. The guidance notes that a disabled employee alternatively may be eligible for the subsidy based on a reduction in hours if the reduction in hours causes a loss of coverage.

A number of the circumstances that meet the involuntary termination definition in the guidance may not be coded in payroll or HRIS systems as involuntary terminations. As employers have an affirmative obligation to reach out to employees who could be AEIs, employers will need to look behind the codes to understand the circumstances of the terminations.

Further, to identify all potential AEIs, employers may need to sweep involuntary terminations or reductions in hours occurring prior to the October 1, 2019, date referenced in the Department of Labor’s FAQs. The IRS makes clear that COBRA-qualified beneficiaries who qualified for extensions of COBRA coverage due to disability (up to 29 months), a second qualifying event (up to 36 months), or an extension under state mini-COBRA potentially can qualify for the subsidy if their coverage could have covered some part of the ARPA COBRA subsidy period (April 1, 2021–September 30, 2021).

An involuntary termination is not the only event that can make an employee potentially eligible for the subsidy. Employees who lose coverage due to a reduction in hours (regardless of the reason for the reduction) can be eligible for premium assistance as well. This can include employees who have been furloughed, experienced a voluntary or involuntary reduction of hours, or took a temporary leave of absence to facilitate home schooling during the pandemic or care for a child.

The IRS explains that, if an employer subsidizes COBRA premiums for similarly situated covered employees and qualified beneficiaries who are not AEIs, the employer may not be able to claim the full ARPA tax credit. In this case, the amount of the credit the employer can receive is the premium that would have been charged to the AEI in the absence of the premium assistance and does not include any amount of subsidy the employer would otherwise have provided. For example, if a severance plan covering all regular full-time employees provides that the employer will pay 100 percent of the COBRA premium for three months following separation, this employer could not take a tax credit for the subsidy provided during this three-month period.

Notice 2021-31 does not elaborate on this issue beyond providing specific examples involving a company severance plan. Thus, ambiguity remains as to whether this guidance would prohibit an employer from claiming a tax credit where an employer has agreed to provide a COBRA subsidy in a negotiated separation or settlement agreement and not pursuant to an existing severance plan or policy. Further IRS guidance on this point may be forthcoming. In light of this guidance, employers should re-evaluate their COBRA premium subsidy strategies.

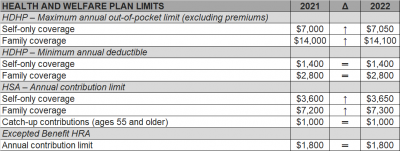

The Internal Revenue Service (IRS) recently announced (See Revenue Procedure 2021-25) cost-of-living adjustments to the applicable dollar limits for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted benefit health reimbursement arrangements (HRAs) for 2022. Many of the dollar limits currently in effect for 2021 will change for 2022. The HSA catch-up contribution for individuals ages 55 and older will not change as it is not subject to cost-of-living adjustments.

The table below compares the applicable dollar limits for HSAs, HDHPs and excepted benefit HRAs for 2021 and 2022.

The American Rescue Plan Act of 2021 (ARP) allows small and midsize employers, and certain governmental employers, to claim refundable tax credits that reimburse them for the cost of providing paid sick and family leave to their employees due to COVID-19, including leave taken by employees to receive or recover from COVID-19 vaccinations. The ARP tax credits are available to eligible employers that pay sick and family leave for leave from April 1, 2021, through September 30, 2021.

Here are some basic facts from the IRS website about the employers eligible for the tax credits and how these employers may claim the credit for leave paid to employees who take leave to receive or recover from COVID-19 vaccinations.

An eligible employer is any business, including a tax-exempt organization, with fewer than 500 employees. An eligible employer also includes a governmental employer, other than the federal government and any agency or instrumentality of the federal government that is not an organization described in section 501(c)(1) of the Internal Revenue Code. Self-employed individuals are eligible for similar tax credits.

Eligible employers are entitled to tax credits for wages paid for leave taken by employees who are not able to work or telework due to reasons related to COVID-19, including leave taken to receive COVID–19 vaccinations or to recover from any injury, disability, illness or condition related to the vaccinations. These tax credits are available for wages paid for leave from April 1, 2021, through September 30, 2021.

The paid leave credits under the ARP are tax credits against the employer’s share of the Medicare tax. The tax credits are refundable, which means that the employer is entitled to payment of the full amount of the credits if it exceeds the employer’s share of the Medicare tax.

The tax credit for paid sick leave wages is equal to the sick leave wages paid for COVID-19 related reasons for up to two weeks (80 hours), limited to $511 per day and $5,110 in the aggregate, at 100 percent of the employee’s regular rate of pay. The tax credit for paid family leave wages is equal to the family leave wages paid for up to twelve weeks, limited to $200 per day and $12,000 in the aggregate, at 2/3rds of the employee’s regular rate of pay. The amount of these tax credits is increased by allocable health plan expenses and contributions for certain collectively bargained benefits, as well as the employer’s share of social security and Medicare taxes paid on the wages (up to the respective daily and total caps).

Eligible employers may claim tax credits for sick and family leave paid to employees, including leave taken to receive or recover from COVID-19 vaccinations, for leave from April 1, 2021, through September 30, 2021.

Eligible employers report their total paid sick and family leave wages (plus the eligible health plan expenses and collectively bargained contributions and the eligible employer’s share of social security and Medicare taxes on the paid leave wages) for each quarter on their federal employment tax return, usually Form 941, Employer’s Quarterly Federal Tax Return PDF. Form 941 is used by most employers to report income tax and social security and Medicare taxes withheld from employee wages, as well as the employer’s own share of social security and Medicare taxes.

In anticipation of claiming the credits on the Form 941 PDF, eligible employers can keep the federal employment taxes that they otherwise would have deposited, including federal income tax withheld from employees, the employees’ share of social security and Medicare taxes and the eligible employer’s share of social security and Medicare taxes with respect to all employees up to the amount of credit for which they are eligible. The Form 941 instructions PDF explain how to reflect the reduced liabilities for the quarter related to the deposit schedule.

If an eligible employer does not have enough federal employment taxes set aside for deposit to cover amounts provided as paid sick and family leave wages (plus the eligible health plan expenses and collectively bargained contributions and the eligible employer’s share of social security and Medicare taxes on the paid leave wages), the eligible employer may request an advance of the credits by filing Form 7200, Advance Payment of Employer Credits Due to COVID-19. The eligible employer will account for the amounts received as an advance when it files its Form 941, Employer’s Quarterly Federal Tax Return, for the relevant quarter.

Self-employed individuals may claim comparable tax credits on their individual Form 1040, U.S. Individual Income Tax Return

The COVID-19 extensions that the DOL and IRS had issued last year as part of their “Joint Notice” were set to expire at midnight on February 28th. For weeks, many have been asking the DOL and IRS for guidance on how to handle the statutorily-mandated expiration, and as a result of the lack of guidance, most plans, TPAs, insurers, and COBRA administrators had to make a judgment call as to how to proceed.

But – with 2 days to spare – DOL finally issued Disaster Relief Notice 2021-01 on February 26th.

Notice 2021-01 sets forth the DOL and IRS’ position that the COVID-19 extensions will continue past February 28th, and that all such extensions must be measured on a person-by-person basis – which was not clear from the prior guidance. Plans, TPAs, insurers, and COBRA administrators may have to reconsider their administrative practices in light of this new direction.

The original Joint Notice (85 Fed. Reg. 26351 (May 4, 2020) required that health and retirement plans toll a number of deadlines for individuals during the COVID-19 National Emergency, plus a 60-day period (the “Outbreak Period”) starting March 1, 2020.

But, as described in Footnote 4 of the Joint Notice, ERISA and the Code limit DOL and Treasury’s ability to toll deadlines to one year (“Tolling Period”).

The deadlines impacted in the Joint Notice are:

When there has been disaster relief guidance in the past, these periods have not bumped up against the statutorily-imposed one-year limit, so this COVID-19 extension is new territory – hence all the requests for the agencies to issue guidance regarding the expiration date.

In this late-breaking Notice 2021-01, DOL says it coordinated with HHS and IRS, and the agencies are interpreting the Tolling Period to be read on a person-by-person basis.

Specifically, DOL says that the Tolling Period ends the earlier of:

This means that each individual has his or her own Tolling Period!

For example, a COBRA Qualified Beneficiary (QB) has 60 days to elect COBRA, counted from the later of their loss of coverage or the date their COBRA election notice is provided. Under the Joint Notice, a QB’s 60-day deadline was tolled as of March 1, 2020, until the end of the Outbreak Period (that is, until the end of the National Emergency + 60 days).

At the end of the Outbreak Period, the deadlines would start running again, and the QB would have their normal 60-day COBRA election period (or the balance of their election period if it started before March 1, 2020).

BUT – with the 1-year expiration, DOL’s new Notice 2021-01 says that the one-year period does not end on February 28, 2021 for all individuals, but rather each individual has his/her own one-year Tolling Period.

Examples:

For all of these examples, the tolling would end earlier if the National Emergency ends. In that case, the election period would end 60 days after the end of the National Emergency.

Notice 2021-01 also says that DOL recognizes that enrollees may continue to encounter COVID issues, even after the one-year Tolling Period expiration. DOL says that the “guiding principle” is for plans to act reasonably, prudently, and in the interest of the workers and their families. DOL says that plan fiduciaries should make “reasonable accommodations to prevent the loss of or undue delay in payment of benefits . . . and should take steps to minimize the possibility of individuals losing benefits because of a failure to comply with pre-established time frames.”

Notice 2021-01 does not provide any direction regarding what would constitute a “reasonable accommodation.” It sounds like plans may need a process to consider whether to continue to waive deadlines on a case-by-case basis, but without any guidance as to what parameters to apply. And DOL suggests that failure to do so could be a fiduciary issue.

Regarding communicating these changes to enrollees, DOL says:

DOL seems to be saying that plans may need to notify each individual when his or her one-year extension is about to be up and should include information about the Health Insurance Marketplace. In addition, plans may need to update prior communications that did not anticipate this new DOL interpretation.

DOL says it acknowledges that there may be instances when plans or service providers themselves may not be able to fully and timely comply with pre-established timeframes and disclosure requirements. DOL says that where fiduciaries have acted in “good faith and with reasonable diligence under the circumstances,” DOL’s approach to enforcement will be “marked by an emphasis on compliance assistance,” including grace periods or other relief.

Every year Applicable Large Employers (ALEs) must file and furnish their ACA information to the IRS and their employees, respectively. Failing to do so can result in significant IRS penalty assessments.

To recap, only groups with 50 or more full time or equivalent employees or those groups under 50 with self funded medical coverage are required to furnish their employees with copies of either the 1095-B or 1095-C forms (based on group size)

Employers will need to be sure you meet the following IRS deadlines for complying with the ACA’s Employer Mandate for 2020:

Failing to meet these deadlines can result in penalties under IRC 6721/6722, which the IRS is issuing through Letter 972CG. If you receive one of these notices, you only have 45 days from the issue date to respond to the penalty notice.

For the 2020 tax year, the penalties associated with failing to comply with IRC 6721/6722 for employers with average gross receipts of more than $5 million in the last three years are as follows:

Failure to timely file and furnish correct information returns

If employers file ACA information returns with the IRS no more than 30 days after the deadline they could be subject to a $50 penalty per return not filed, not to exceed an annual maximum of $556,500. If the ACA information returns are 31 or more days late, up to August 1, 2021, the penalty per return jumps up to $110, not to exceed an annual maximum of $1,669,500. After August 1, the penalty amount steepens to $270 per return, not to exceed an annual maximum of $3,339,000. For intentional disregard, meaning the deadline was missed willfully, the penalty more than doubles to $550 per return with no annual maximum limit.

The penalty amounts for employers with gross receipts of $5 million or less in the last three years will have the same penalty amounts per return with lower annual maximums, except in the case of intentional disregard. For more information on the penalty schedules for failing to meet the IRS deadlines click here.

As if the penalties for failing to meet the filing and furnishing deadlines weren’t enough, the IRS is also issuing penalties to employers that fail to comply with the ACA’s Employer Mandate. As a reminder to employers in conjunction with the Employer Shared Responsibility Payment (ESRP), the ACA’s Employer Mandate, Applicable Large Employers (ALEs), organizations with 50 or more full-time employees and full-time equivalent employees, are required to offer Minimum Essential Coverage (MEC) to at least 95% of their full-time workforce (and their dependents) whereby such coverage meets Minimum Value (MV) and is affordable for the employee, or be subject to Internal Revenue Code (IRC) 4980H penalties. These penalties are being issued through IRS Letter 226J.

The IRS has issued relief from certain Form 1094-C and 1095-C reporting requirements under the Affordable Care Act relating to employee health plans, as well as relief from certain reporting-related penalties.

As a refresher, the ACA generally requires four forms to be produced each year, and the names are anything but intuitive:

Which form your plan would be required to file or furnish depends on whether you are an ALE, and how you fill out the form and whether you offer fully insured or self-insured coverage.

The IRS has extended the deadline for furnishing Forms 1095-B and 1095-C to individuals. The typical deadline to report 2020 plan information is January 31, 2021. However, the new relief extends the deadline to March 2, 2021. The extension is automatic, and the IRS has indicated that no further extensions will be granted, and it will not respond to such requests.

Be aware that this extension does not apply to the 1094-B and 1094-C filings with the IRS. The deadline for submitting these filings to the IRS will remain March 1, 2021 (since the original due date of February 28 falls on a Sunday), for paper filings and March 31, 2021, for those filing electronically. However, while the automatic extension does not apply to these deadlines, filers may still request an extension from the IRS.

Recognizing that the main purpose of Forms 1095-B and 1095-C was to allow an individual to compute his or her tax liability relating to the individual mandate, and because the individual mandate has been reduced to zero, the IRS has granted relief from furnishing certain documents to individuals.

The IRS indicated that it will not assess penalties for failure to furnish a Form 1095-B if two conditions are met. First, the reporting entity must post a prominent notice on its website stating that individuals may receive a copy of their 2020 Form 1095-B upon request, along with an email address, physical address, and phone number. Second, the reporting entity must furnish the 2020 Form 1095-B to the responsible individual within 30 days of receipt of the request. The statements may be furnished electronically if certain additional requirements are met.

The same reporting relief does not extend to ALEs that are required to furnish Form 1095-C. This form must continue to be furnished to full-time employees, and penalties will continue to be assessed for a failure to furnish Form 1095-C. However, the relief does generally apply to furnishing the Form 1095-C to participants who were not full-time employees for any month of 2019 if the requirements above are met. This would typically include part-time employees, COBRA continuees, or retirees.

Note that while these requirements for furnishing the 1095-B and 1095-C to individuals has been modified, these forms must still be transmitted to the IRS along with their Form 1094 counterparts.

In the final piece of good news from the IRS, it announced relief from penalties for incorrect or incomplete information on any of these forms. This relief applies to both missing and inaccurate taxpayer identification numbers and birthdays, as well as other required information.

The reporting entity must be able to show that it made a good faith effort to comply with the reporting requirements. A successful showing of good faith will show that an employer made reasonable efforts to prepare for the reporting requirements and the furnishing to employees, such as gathering and transmitting the necessary information to the person preparing the forms.

However, the relief does not apply to reporting entities that completely fail to file or furnish the forms at all.

Finally, and importantly, the IRS has indicated that this will be the last year that it will provide this good faith reporting relief.

IRS Notice 2020-44 was issued last week as a reminder that Patient-Centered Outcomes Research Institute (PCORI) fees were extended under the Further Consolidated Appropriations Act of 2020 and are now not scheduled to expire until plan years ending after September 30, 2029. Annual PCORI fees will still need to be paid by insurers for employers with fully insured group health plans (and will remain to be included in annual premiums). Groups that offer self-insured plans are responsible for filing and paying the fee on IRS Forms 720, which must be filed by July 31 each year.

The IRS Notice also clarifies there is still a filing obligation owed for all such group health plan filings for plan years ending on or after October 1, 2019, and before October 1, 2020, with the PCORI Fee amount being $2.54 (up from $2.45 for the previous PCORI fee period). However, the guidance recognizes that insurers and self-funded plan sponsors may not have been accurately tracking the number of covered lives to be reported and paid for the plan year periods from October 1, 2019, through October 1, 2020, because the previous PCORI fee assessments under the Affordable Care Act were scheduled to end after September 30, 2019. To allow for ease in current reporting of covered lives information, the Notice clarifies that in addition to the other statutory methods of reporting covered lives, for the PCORI reporting periods for plan years ending from October 1, 2019, through October 1, 2020, the IRS will allow insurers and plan sponsors to use a “reasonable” method to calculate the average number of covered lives for this period.

Impact on Employers

Employers with fully insured health plan coverage provided by an insurance carrier may see a slight increase in future insurance premiums to account for this recent update from the IRS. Self-funded health plan sponsors need to ensure they timely file their annual Form 720 by July 31, 2020, using the appropriate PCORI fee amount (i.e., $2.45 per covered life for plan years ending on or before September 30, 2019, or $2.54 per covered life for plan years ending on or after October 1, 2019), based on the calculated covered lives formula alternatives (e.g., actual count method, snapshot method, Form 5500 method, or for the October 1, 2019, through October 1, 2020, periods, a “reasonable” method for average covered lives).