Employees can put an extra $200 into their health care flexible spending accounts (health FSAs) next year, the IRS announced on Oct. 18, as the annual contribution limit rises to $3,050, up from $2,850 in 2022. The increase is double the $100 rise from 2021 to 2022 and reflects recent inflation.

If the employer’s plan permits the carryover of unused health FSA amounts, the maximum carryover amount rises to $610, up from $570. Employers may set lower limits for their workers.

The limit also applies to limited-purpose FSAs that are restricted to dental and vision care services, which can be used in tandem with health savings accounts (HSAs).

The IRS released 2023 HSA contribution limits in April, giving employers and HSA administrators plenty of time to adjust their systems for the new year. The individual HSA contribution limit will be $3,850 (up from $3,650) and the family contribution limit will be $7,750 (up from $7,300).

CARRYOVER AMOUNTS OR GRACE PERIOD

Health or dependent care FSA funds that are not spent by the employee within the plan year can include a two-and-a-half-month grace period to spend down remaining FSA funds, if employees are enrolled in FSAs that have adopted the grace period option.

Health FSAs have an additional option of allowing participants to carry over unused funds at the end of the plan year, up to an inflation-adjusted limit set by the IRS, and still contribute up to the maximum in the next plan year. Health FSA plans can elect either the carryover or grace period option but not both.

Dependent Care FSAs

A dependent care FSA (DC-FSA) is a pretax benefit account used to pay for dependent care services such as day care, preschool, summer camps and non-employer-sponsored before or after school programs. Funds may be used for expenses relating to children under the age of 13 or incapable of self-care who live with the account holder more than half the year.

These plans may also be referred to as dependent care assistance plans (DCAPs) or dependent care reimbursement accounts (DCRAs).

In general, an FSA carryover only applies to health FSAs, although COVID-19 legislation permitted a carryover of unused balances for DC-FSAs into the next plan year for plan years 2020 and 2021 only.

The dependent care FSA maximum annual contribution limit is not indexed and did not change for 2022 or for 2023. It remains $5,000 per household for single taxpayers and married couples filing jointly, or $2,500 for married people filing separately. Married couples have a combined $5,000 limit, even if each has access to a separate DC-FSA through his or her employer.

Maximum contributions to a DC-FSA may not exceed these earned income limits:

Employers can also choose to contribute to employees’ DC-FSAs. However, unlike with a health FSA, the combined employer and employee contributions to a DC-FSA cannot exceed the IRS limits noted above.

A separate tax code child and dependent care tax credit cannot be claimed for expenses paid through a DC-FSA, as “double dipping” is not permitted.

On October 11, 2022, the IRS released a final rule that changes the way health insurance affordability is determined for members of an employee’s family, beginning with Plan Year (PY) 2023 coverage. Beginning in 2023, if a employee has an offer of employer-sponsored coverage that extends to the employee’s family members, the affordability of that offer of coverage for the family members will be based on the family premium amount, not the amount the employee must pay for self-only coverage, when purchasing coverage in the marketplace.

To view the final rule, visit: https://www.federalregister.gov/public-inspection/2022-22184/affordability-of-employer-coverage-for-family-members-of-employees

There are two potential ACA employer mandate penalties that can impact ALEs:

a) IRC §4980H(a)—The “A Penalty”

The first is the §4980H(a) penalty—frequently referred to as the “A Penalty” or the “Sledge Hammer Penalty.” This penalty applies where the ALE fails to offer minimum essential coverage to at least 95% of its full-time employees in any given calendar month.

The 2022 A Penalty is $229.17/month ($2,750 annualized) multiplied by all full-time employees (reduced by the first 30). It is triggered by at least one full-time employee who was not offered minimum essential coverage enrolling in subsidized coverage on the Exchange. Note: The IRS has not yet released the 2023 A Penalty increase.

The “A Penalty” liability is focused on whether the employer offered a major medical plan to a sufficient percentage of full-time employees—not whether that offer was affordable (or provided minimum value).

b) IRC §4980H(b)—The “B Penalty”

The second is the §4980H(b) penalty—frequently referred to as the “B Penalty or the “Tack Hammer Penalty.” This penalty applies where the ALE is not subject to the A Penalty (i.e., the ALE offers coverage to at least 95% of full-time employees).

The B Penalty applies for each full-time employee who was:

Only those full-time employees who enroll in subsidized coverage on the Exchange will trigger the B Penalty. Unlike the A Penalty, the B Penalty is not multiplied by all full-time employees.

In other words, an ALE who offers minimum essential coverage to a full-time employee will be subject to the B Penalty if:

The 2022 B Penalty is $343.33/month ($4,120 annualized) per full-time employee receiving subsidized coverage on the Exchange. Note: The IRS has not yet released the 2023 B Penalty increase.

Transparency in Coverage mandates and COVID-19 considerations continue to dominate the discussion in the employee benefits compliance space this summer, but an “old faithful” reporting requirement looms soon: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The typical due date for the PCORI fee is July 31, but because that date falls on a Sunday in 2022, the effective due date is pushed to the next business day, which is Aug. 1.

The filing and payment due by Aug. 1, 2022, is required for policy and plan years that ended during the 2021 calendar year. For plan years that ended Jan. 1, 2021 – Sept. 30, 2021, the fee is $2.66 per covered life. For plan years that ended Oct. 1, 2021 – Dec. 31, 2021 (including calendar year plans that ended Dec. 31, 2021), the fee is calculated at $2.79 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is typically due by July 31 of the year following the last day of the plan year to which the payment relates, but this year the due date pushes to Aug. 1.

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2021 the plan year ended) to determine the total fee owed to the IRS.

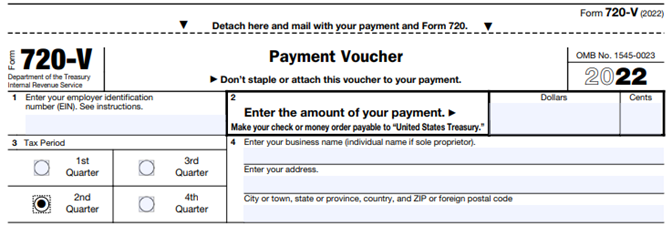

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.

Citing soaring gas prices, the Internal Revenue Service (IRS) on June 9 announced an increase in the optional standard mileage rate for the final six months of 2022.

Effective July 1 through Dec. 31, 2022, the standard mileage rate for the business use of employees’ vehicles will be 62.5 cents per mile—the highest rate the IRS has ever published—up 4 cents from the 58.5 cents per mile rate effective for the first six months of the year.

The rate is used to compute the deductible costs of operating an automobile for business use, as an alternative to tracking actual costs. Beyond the individual tax deduction, employers often use the standard mileage rate—also called the safe harbor rate—to pay tax-free reimbursements to employees who use their own cars, vans or trucks to conduct business for their employers.

Organizations are typically required to reimburse their workforce for the business use of their mixed-use assets, or personally owned assets such as vehicles that are required for their jobs.

Employers have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

The IRS normally updates standard mileage rates once a year in the fall for the next calendar year. For vehicle use from Jan. 1 through June 30, 2022, employers and employees should use the rates set forth in IRS Notice 2022-03.

While fuel costs are a significant factor in the mileage figure, other items enter into the calculation of mileage rates, such as depreciation and insurance and other fixed and variable costs, the IRS noted. For cars employees use for business, the portion of the standard mileage rate treated as depreciation will stay at 26 cents per mile for 2022.

Midyear increases in the optional mileage rates are rare. The last time the IRS made such an increase was in 2011.

The new 2023 limits are:

HSA – Single $3,850 / Family $7,750 per year

HDHP (self-only coverage) – $1,500 minimum deductible / $7,500 out-of-pocket limit

HDHP (family coverage) – $3,000 minimum deductible / $15,000 out-of-pocket limit

The IRS just released IRS Notice 2022-04 that provides the updated fee for Patient-Centered Outcomes Research Institute (PCORI) paid by fully insured and self-funded health plans for the upcoming tax reporting period.

Even though the original PCORI fee assessments under the Affordable Care Act were scheduled to end after September 30, 2019, Congress extended these fees to be assessed by the IRS under the Further Consolidated Appropriations Act of 2020 for another ten years, until at least September 30, 2029.

The updated PCORI fee is now $2.79 per covered life for all plan years ending on or after October 1, 2021, and before October 1, 2022, up from $2.66 for the prior period. As a reminder, fully insured plans are to be assessed the applicable PCORI fee amount through their monthly premium payments made to their health insurance carrier. Self-insured plans pay this fee as part of the annual IRS Form 720 filing due by July 31 of each year.

The draft instructions for the Forms 1094-C and 1095-C for the 2021 reporting season were released in late September 2021 with subtle, but important changes. To an untrained eye, these changes may fly under the radar. However, for the first time since the Affordable Care Act’s (ACA’s) inception, employers who file incorrect or incomplete Forms 1095-C with the IRS may suffer costly penalties. The remainder of this article will explore the changes made in the draft instructions for the Forms 1094-C and 1095-C in 2021.

The 2020 instructions to the Forms 1094-C and 1095-C included language that asserted no penalty would be imposed under IRC sections 6721 or 6722 for incorrect or incomplete Forms 1095-C so long as the employer showed that it made good-faith efforts to comply with the information reporting requirements. Similar language has been included in Notices released by the IRS that correspond to all the ACA reporting seasons to date. However, Notice 2020-76, the Notice that extended the good-faith efforts relief for the 2020 reporting season and was incorporated into the final instructions for the Forms 1094-C and 1095-C in 2020, stated that the good-faith efforts relief would not continue for tax reporting seasons past 2020.

As a result of the good-faith efforts relief no longer applying, if an employer submits a Form 1095-C to the IRS or furnishes a Form 1095-C to an employee that is incorrect or incomplete, the employer could be penalized $280 per return. It should be noted that this penalty would apply twice to the same Form 1095-C, once for the Form 1095-C that is furnished to the employee and once for the Form 1095-C that is submitted to the IRS for a total of $560.

The chart below details the cost an employer could incur depending on the percentage of its Forms 1095-C that are filed incorrectly or incompletely. While the chart only discusses the penalty under IRC section 6721, if the IRS were to aggressively penalize an employer, the penalty could be doubled by the IRS by utilizing the penalty under IRC section 6722. The column labeled “# of Forms 1095-C” states the number of Forms 1095-C filed by the employer. The columns labeled with a “x%” state the presumed number of Forms 1095-C that are hypothetically filed incorrectly or incompletely. The dollar figure in the chart states the hypothetical penalty.

| # of Forms 1095-C | 1% | 3% | 5% | 10% | 15% | 20% | 25% |

|---|---|---|---|---|---|---|---|

| 100 | $280 | $840 | $1,400 | $2,800 | $4,200 | $5,600 | $7,000 |

| 1,000 | $2,800 | $8,400 | $14,000 | $28,000 | $42,000 | $56,000 | $70,000 |

| 2,500 | $7,000 | $21,000 | $35,000 | $70,000 | $105,000 | $140,000 | $175,000 |

| 5,000 | $14,000 | $42,000 | $70,000 | $140,000 | $210,000 | $280,000 | $350,000 |

| 10,000 | $28,000 | $84,000 | $140,000 | $280,000 | $420,000 | $560,000 | $700,000 |

| 25,000 | $70,000 | $210,000 | $350,000 | $700,000 | $1,050,000 | $1,400,000 | $1,750,000 |

| 50,000 | $140,000 | $420,000 | $700,000 | $1,400,000 | $2,100,000 | $2,800,000 | $3,500,000 |

As the chart above displays, an employer who submits 1,000 Forms 1095-C to the IRS with 10 percent of the Forms 1095-C being incorrect could be subject to a penalty of $28,000 under IRC section 6721. Additionally, that employer could be subject to a separate $28,000 penalty for furnishing incorrect Forms 1095-C to employees under IRC section 6722. Many employers and service providers in the ACA space have submitted Forms 1095-C to the IRS that have a much higher error rate than 10 percent in previous years. Consequently, it is easy to envision staggering penalties under IRC sections 6721 and 6722 if the IRS stringently enforces these penalties. As a result, employers must be confident that the information reported to the IRS on the Forms 1094-C and 1095-C is complete, meticulous and error free in order to avoid IRS penalties.

Additionally, for the first time in ACA reporting history the IRS appears set on keeping the deadline of January 31, 2022 to furnish the Forms 1095-C to employees. The 2021 draft instructions provide guidance on how an employer can request a 30 day extension. This extension is not automatically granted and therefore should not be relied upon by employers.

Two other small changes were made in the draft instructions to the Forms 1094-C and 1095-C. First, the maximum penalty under IRC sections 6721 and 6722 increased from $3,392,000 in 2020 to $3,426,000 in 2021. Second, two new codes were added for individual coverage health reimbursement arrangements (ICHRAs). Each new code involves employers who offered ICHRAs to the employee and the employee’s spouse.

Code 1T – Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee’s primary residence location ZIP code.

Code 1U – Individual Coverage HRA offered to employee and spouse (not dependents) using employee’s primary employment site ZIP code affordability safe harbor.

Since both new codes deal with ICHRAs and both should never be used, as the new codes do not offer coverage to dependent children, these new codes will have little impact on employers. Any employer who is using an ICHRA as part of their ACA strategy should be utilizing codes 1M, 1N, 1P, or 1Q depending on who in the employee’s family is eligible to utilize the ICHRA.

We anticipate the final instructions will be released any week with minimal, if any, changes compared to the draft instructions. While it is still possible the IRS may release a Notice extending the good-faith efforts relief to 2021 reporting and extend the due date to furnish the Forms 1095-C to full-time employees, employers should not rely on such a Notice this year. As a result, it is essential that employers make sure that every line 14 and 16 code combination submitted to the IRS is error free.