The IRS has released the 2014 Form 720 that plan sponsors of self-insured group health plans will use to report and pay the Patient Centered Outcomes Research Institute (PCORI) fee. The fee is due by July 31, 2014 for plan years ending in 2013.

The Affordable Care Act (ACA) imposes a fee on health insurers and plan sponsors of self-insured group health plans to help fund the Patient Centered Outcomes Research Institute. PCORI is responsible for conducting research to evaluate and compare the health outcomes and clinical effectiveness, risks, and benefits of medical treatments, services, procedures, and drugs.

The PCORI fee is assessed for plan years ending after September 30, 2012. The initial fee is $1 times the average number of covered lives for the first plan year ending before October 1, 2013 and $2 per covered life for the plan year ending after October 1, 2013 and before October 1, 2014. Fees for subsequent years are subject to indexing. The PCORI fee will not be assessed for plan years ending after September 30, 2019, which means that for a calendar year plan, the last plan year for assessment is the 2018 calendar year.

Plan sponsors must pay the PCORI fee by July 31 of the calendar year immediately following the last day of that plan year. All plan sponsors of self-insured group health plans will pay the fee in 2014, but the amount of the fee varies depending on the plan year.

The IRS has released the 2014 Form 720 with instructions for plan sponsors to use to report and pay the PCORI fee. Although the Form 720 is a quarterly federal excise tax return, if the Form 720 is filled only to report the PCORI fee, no filing is required in other quarters unless other fees or taxes have to be reported.

Please contact our office for information on the Affordable Care Act (ACA) and how it affects your business.

Many employers originally thought they could shift health costs to the government by sending their employees to a health insurance Exchange/Marketplace with a tax-free contribution of cash to help pay premiums, but the Obama administration has squashed this idea in a new ruling. Such arrangements do not satisfy requirements under the Affordable Care Act (ACA), the Obama administration said, and employers could now be subject to a tax penalty of $100 a day — or $36,500 a year — for each employee who goes into the individual Marketplace/Exchange for health coverage.

The ruling this month, by the Internal Revenue Service, prevents any “dumping” of employees into the exchanges by employers.

Under a main provision in the health care law, employers with 50 or more employees are required to offer health coverage to full-time workers, or else the employer may be subject to penalties.

Many employers had concluded that it would be cheaper to provide each employee with a lump sum of money to buy insurance on an exchange, instead of providing employer-sponsored health coverage directly to employees as they had in the past.

But the Obama administration has now raised objections in an authoritative Q&A document recently released by the IRS, in consultation with other agencies.

The health law, known as the Affordable Care Act (ACA), was intended to build on the current system of employer-based health insurance. The administration wants employers to continue to provide coverage to workers and their families and do not see the introduction of ACA as an eventual erosion of employer provided coverage.

Employer contributions to sponsored health coverage, which averages more than $5,000 a year per employee, are not counted as taxable income to workers. But the IRS has said employers could not meet their obligations under ACA by simply reimbursing employees for some or all of their premium costs from the marketplace/exchange.

Christopher E. Condeluci, a former tax and benefits counsel to the Senate Finance Committee, said the recent IRS ruling was significant because it made clear that “an employee cannot use tax-free contributions from an employer to purchase an insurance policy sold in the individual health insurance market, inside or outside an exchange.”

If an employer wants to help employees buy insurance on their own, Condeluci said, they can give the employee higher pay, in the form of taxable wages. But in such cases, he said, the employer and the employee would owe payroll taxes on those wages, and the change could be viewed by workers as reducing a valuable benefit.

A tax partner from a large accounting firm has also said the ruling could disrupt reimbursement arrangements used in many industries.

For decades, many employers have been assisting employees by reimbursing them for health insurance premiums and out-of-pocket costs associated with their health coverage. The new federal ruling eliminates many of those arrangements, commonly known as Health Reimbursement Arrangements (HRAs) or employer payment plans, by imposing an unusually punitive penalty. The IRS has said that these employer payment plans are considered to be group health plans, but they do not satisfy requirements of the Affordable Care Act for health coverage.

Under the law, insurers may not impose annual limits on the dollar amount of benefits for any individual, and they must provide certain preventive services, like mammograms and colon cancer screenings, without co-payments or other charges.

But the administration has said that employer payment plans or HRAs do not meet these requirements.

This ruling was released as the Obama administration rushed to provide guidance to employers and insurers who are beginning to review coverage options for 2015.

The Department of Health and Human Services said it would provide financial assistance to certain insurers that experience unexpected financial losses this year. Administration officials hope the payments will stabilize medical premiums and prevent rate increases that are associated with the required policy changes as a result of ACA.

Republicans want to block these payments, however, as they see them as a bailout for insurance companies who originally supported the president’s health care law.

Stay tuned for more updates on ACA as they are released. Should you have any questions, please do not hesitate to contact our office.

The IRS has released the 2013 version of Form 8941, which eligible small employers will need to use to calculate their small business health care tax credit.

Employers may qualify for a tax credit of up to 35% (or up to 25% for eligible tax exempt organizations) of nonelective employer contributions under a qualifying health insurance arrangement, if they have fewer than 25 employees AND pay average annual wages of less than $50,000 per employee. A qualifying health insurance plan generally requires the employer to pay a uniform percentage of the premium (not less than 50%) for each enrolled employee’s health coverage. Once calculated, the tax credit is claimed as a general business credit on Form 3800 (or for tax exempt small employers as a refundable credit on Form 990-T).

There are important changes to the tax credit that become effective beginning with 2014 taxable years that are important to note:

1. the maximum credit amount increases from 35% to 50% of employer paid premiums

2. coverage under a qualifying arrangement must be offered through a SHOP Exchange

3. the credit can be claimed for only 2 consecutive years beginning in or after 2014, and

4. due to the cost-of-living adjustment, the tax credit will be reduced if an employer’s average annual wages exceed $25,400 and will be eliminated if average annual wages exceed $50,800

Employers who plan on claiming the small business tax credit for 2014 will need to make sure they are familiar with these new requirements.

All 2013 W2’s that will be distributed in January 2014 are required to report the aggregate cost of insurance coverage. Currently, if you filed lessthan 250 W2’s in 2012 you are exempt from this W2 reporting requirement this year.

The value of health care coverage will be reported in Box 12 of the W2 with code “DD” to identify the amount. You are required to report the total cost of both employer and employee contributions for major medical and any other nontaxable “group health plan” coverage for which COBRA is offered, except if dental or vision coverage is offered on a stand alone basis.

Please contact our office for a copy of the full chart from the IRS outlining the types of coverage that employers must report on the W2.

For tax years 2010 – 2013, eligible small employers are entitled to a 35% tax credit for health insurance premiums they pay for employees. Tax-exempt entities are eligible for a 25% credit.

To qualify for the credit, an employer must:

Employers with less than 10 FTEs and average annual wages of $25,000 or less are eligible for the full credit. There is a phase-out of the credit for employers that have between 10 and 25 FTEs or average annual wages between $25,000 and $50,000.

All employers calculate the credit using IRS Form 8941, Credit for Small Employer Health Insurance Premiums. Taxable employers claim the credit on their federal tax return and can apply the credit to both regular and alternative minimum tax. Tax-exempt employers claim the credit by filing Form 990-T, Exempt Organization Business Income Tax Return, and can receive a refundable credit up to the amount of the employer’s payroll taxes.

In 2014, the credit will continue to be available, but with significant modifications. Employers will only be eligible for the credit if they purchase health insurance through the new Small Business Health Options Program (SHOP). The SHOP is one component of the internet-based health insurance marketplace, also known as an exchange, which launches on Oct. 1, 2013.

Other upcoming changes include:

The following is a frequently asked question recently released by CMS regarding the Marketplace and Income Verification for the purpose of advance payment of the premium tax credit and cost sharing reductions.

Q: Will Marketplaces verify the income of consumers as part of the eligibility process for advance payments of the premium tax credit and cost sharing reductions?

A: Yes. The Marketplaces will use data from tax filings and Social Security data to verify household income provided on an application, and in many cases, will also use current wage information that is available electronically. The multi-step process will begin when an applicant applies for insurance affordability programs (such as the advance payments of the premium tax credit and cost sharing reductions) through the Marketplace and affirms or inputs their projected annual household income. The applicant’s inputted projected annual household income is then compared with information available from the IRS and Social Security Administration (SSA). If the data submitted as part of the application process cannot be verified using IRS and SSA data, then the information is compared with wage information from employers provided by Equifax. If Equifax data does not substantiate the inputted information, the Marketplace will request an explanation or additional documentation to substantiate the applicant’s household income.

When documentation is requested, the Affordable Care Act and implementing regulations specify that if an applicant meets all other eligibility requirements, he/she will be provided with eligibility for advance payments of premium tax credit and cost sharing reductions based on the inputted projected annual household income for 90 days (which may be extended based on good faith), provided that the tax filer attests to the Marketplace that he/she understands that any advance payments of the premium tax credit paid on his/her behalf are subject to reconciliation. If documentation is requested and is not provided within the specified timeframe, regulations specify that the Marketplace will base its eligibility determination on IRS and SSA data, unless IRS data is unavailable. In this case, the Marketplace will discontinue any advance payments of the premium tax credit and cost sharing reductions.

Please note that applicants for advance payment of the premium tax credit and cost sharing reductions must attest, under penalty of perjury, that they are not providing false or fraudulent information. In addition to the existing penalties for perjury, the Affordable Care Act applies penalties when an individual fails to provide correct information based on negligence or disregard of program rules, or knowingly and willfully provides false or fraudulent info. Moreover, the IRS has said they will reconcile advance payments of the premium tax credit when consumers file their annual tax returns at the end of the year, and it will recoup overpayments and provide refunds when appropriate, subject to statutory limits.

The Internal Revenue Service (IRS) launched a new website aimed at clarifying many of the tax provision of the Patient Protection and Affordable Care Act (PPACA). The site (www.irs.gov/aca) aims to provide a tool to more clearly explain responsibilities and potential benefits to individuals, employers, and other organizations including insurers and others affects by the law’s tax changes.

Please contact our office for more information on how you can prepare for the many changes coming with Health Care Reform in 2014.

The U.S Department of Treasury and the Internal Revenue Service (IRS) ruled on August 29, 2013 that same sex couples who are legally married in jurisdictions that recognize their same sex marriage, will be treated as married for federal tax purposes. The ruling applies regardless of whether the couple lives in a jurisdiction that recognizes same-sex marriage or not.

Under the ruling, same-sex couples will be treated as married for all federal tax purposes, including income as well as gift and estate taxes. The ruling applies to all federal tax provisions where marriage is a factor, including filing status, claiming personal and dependency exemptions, taking deductions, employee benefits, contributing to an IRA and claiming the earned income tax credit or child tax credit.

Any same-sex marriage legally entered into in one of the 50 states, the District of Columbia, a U.S. territory or a foreign country will be covered by the ruling. However, the ruling does not apply to registered domestic partnerships, civil unions or similar formal relationships recognized under state law.

If your company offered either a Health Reimbursement Account (HRA) or Medical Expense Reimbursement Plan (MERP) as part of your employee benefits package in 2012, you must report and pay the PCORI fee for your 2012 plan year no later than July 31, 2013. Please note that the penalty for not filing can be as high as $10,000 per month.

You must use the IRS Form 720 to report and pay the PCORI fee.

If you used a third party administrator to handle the administration of your HRA or MERP plan, they should have provided you with the necessary information to complete Form 720 as they are not permitted to file this with the IRS on your behalf.

Please let us know if you have any questions.

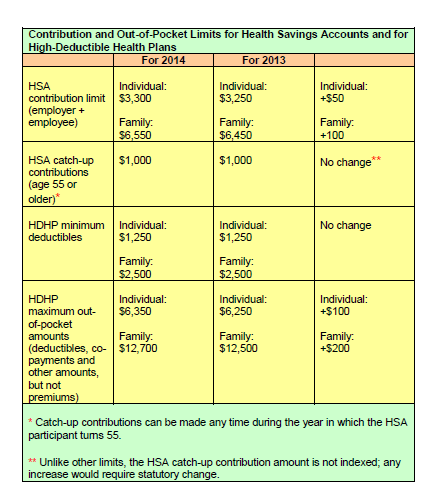

The Internal Revenue Service recently announced higher contributions limits to health savings accounts (HSAs) and for out of pocket spending under qualified high deductible health plans (HDHPs) for 2014.

The IRS provided the inflation adjusted HSA contribution and HDHP minimum deductible and out of pocket limits effective for calendar year 2014. The higher rates reflect a cost of living adjustment (COLA) as well as rounding rules under the IRS Code Sec 223.

A comparison of the 2014 and 2013 limits are below:

The increases in contribution limits and out of pocket maximums from 2013 to 2014 were somewhat lower than increases in years prior.

Those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses face a penalty of 20% of the funds used for those nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

Adult Children Coverage

While the Patient Protection and Affordable Care Act allows parents to add their adult children (up to age 26) to their health plans (and some state laws allow up to age 30 if certain requirements are met), the IRS has not changed its definition of a dependent for health savings accounts. This means that an employee whose 24 year old child is covered on their HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bill.

If account holders can’t claim a child as a dependent on their tax returns, then they can’t spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendant of these) who: