Page 3 of 3

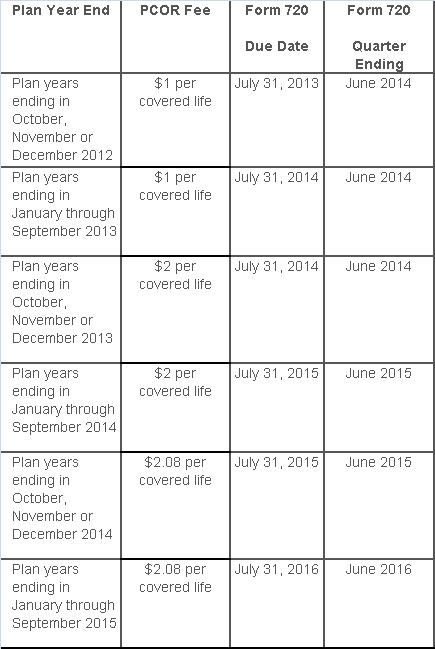

The Affordable Care Act added a patient-centered outcomes research (PCOR) fee on health plans to support clinical effectiveness research. The PCOR fee applies to plan years ending on or after Oct. 1, 2012, and before Oct. 1, 2019. The PCOR fee is due by July 31 of the calendar year following the close of the plan year. For plan years ending in 2014, the fee is due by July 31, 2015.

PCOR fees are required to be reported annually on Form 720, Quarterly Federal Excise Tax Return, for the second quarter of the calendar year. The due date of the return is July 31. Plan sponsors and insurers subject to PCOR fees but not other types of excise taxes should file Form 720 only for the second quarter, and no filings are needed for the other quarters. The PCOR fee can be paid electronically or mailed to the IRS with the Form 720 using a Form 720-V payment voucher for the second quarter. According to the IRS, the fee is tax-deductible as a business expense.

The PCOR fee is assessed based on the number of employees, spouses and dependents that are covered by the plan. The fee is $1 per covered life for plan years ending before Oct. 1, 2013, and $2 per covered life thereafter, subject to adjustment by the government. For plan years ending between Oct. 1, 2014, and Sept. 30, 2015, the fee is $2.08. The Form 720 instructions are expected to be updated soon to reflect this increased fee.

This chart summarizes the fee schedule based on the plan year end and shows the Form 720 due date. It also contains the quarter ending date that should be reported on the first page of the Form 720 (month and year only per IRS instructions). The plan year end date is not reported on the Form 720.

For insured plans, the insurance company is responsible for filing Form 720 and paying the PCOR fee. Therefore, employers with only fully- insured health plans have no filing requirement.

If an employer sponsors a self-insured health plan, the employer must file Form 720 and pay the PCOR fee. For self-insured plans with multiple employers, the named plan sponsor is generally required to file Form 720. A self-insured health plan is any plan providing accident or health coverage if any portion of such coverage is provided other than through an insurance policy.

Since the fee is a tax assessed against the plan sponsor and not the plan, most funded plans subject to ERISA must not pay the fee using plan assets since doing so would be considered a prohibited transaction by the U.S. Department of Labor (DOL). The DOL has provided some limited exceptions to this rule for plans with multiple employers if the plan sponsor exists solely for the purpose of sponsoring and administering the plan and has no source of funding independent of plan assets.

Plans sponsored by all types of employers, including tax-exempt organizations and governmental entities, are subject to the PCOR fee. Most health plans, including major medical plans, prescription drug plans and retiree-only plans, are subject to the PCOR fee, regardless of the number of plan participants. The special rules that apply to Health Reimbursement Accounts (HRAs) and Health Flexible Spending Accounts (FSAs) are discussed below.

Plans exempt from the fee include:

If a plan sponsor maintains more than one self-insured plan, the plans can be treated as a single plan if they have the same plan year. For example, if an employer has a self-insured medical plan and a separate self-insured prescription drug plan with the same plan year, each employee, spouse and dependent covered under both plans is only counted once for purposes of the PCOR fee.

The IRS has created a helpful chart showing how the PCOR fee applies to common types of health plans.

Health Reimbursement Accounts (HRAs) - Nearly all HRAs are subject to the PCOR fee because they do not meet the conditions for exemption. An HRA will be exempt from the PCOR fee if it provides benefits only for dental or vision expenses, or it meets the following three conditions:

Health Flexible Spending Accounts (FSAs) - A health FSA is exempt from the PCOR fee if it satisfies an availability condition and a maximum benefit condition.

Additional special rules for HRAs and FSAs . Once an employer determines that its HRA or FSA is subject to the PCOR fee, the employer should consider the following special rules:

The IRS provides different rules for determining the average number of covered lives (i.e., employees, spouses and dependents) under insured plans versus self-insured plans. The same method must be used consistently for the duration of any policy or plan year. However, the insurer or sponsor is not required to use the same method from one year to the next.

A plan sponsor of a self-insured plan may use any of the following three

methods to determine the number of covered lives for a plan year:

1. Actual count method. Count the covered lives on each day of the plan year and divide by the number of days in the plan year.

Example: An employer has 900 covered lives on Jan. 1, 901 on Jan. 2, 890 on

Jan. 3, etc., and the sum of the lives covered under the plan on each day of

the plan year is 328,500. The average number of covered lives is 900 (328,500 ÷

365 days).

2. Snapshot method. Count the covered lives on a single day in each quarter (or more than one day) and divide the total by the number of dates on which a count was made. The date or dates must be consistent for each quarter. For example, if the last day of the first quarter is chosen, then the last day of the second, third and fourth quarters should be used as well.

Example: An employer has 900 covered lives on Jan. 15, 910 on April 15, 890 on

July 15, and 880 on Oct. 15. The average number of covered lives is 895 [(900 +

910+ 890+ 880) ÷ 4 days].

As an alternative to counting actual lives, an employer can count the number of

employees with self-only coverage on the designated dates, plus the number of

employees with other than self-only coverage multiplied by 2.35.

3. Form 5500 method. If a Form 5500 for a plan is filed before the due date of the Form 720 for that year, the plan sponsor can determine the number of covered lives based on the Form 5500. If the plan offers just self-only coverage, the plan sponsor adds the participant counts at the beginning and end of the year (lines 5 and 6d on Form 5500) and divides by 2. If the plan also offers family or dependent coverage, the plan sponsor adds the participant counts at the beginning and end of the year (lines 5 and 6d on Form 5500) without dividing by 2.

Example: An employer offers single and family coverage with a plan year ending

on Dec. 31. The 2013 Form 5500 is filed on June 5, 2014, and reports 132

participants on line 5 and 148 participants on line 6d. The number of covered

lives is 280 (132 + 148).

To evaluate liability for PCOR fees, plan sponsors should identify all of their plans that provide medical benefits and determine if each plan is insured or self-insured. If any plan is self-insured, the plan sponsor should take the following actions:

The IRS released the 2016 cost-of-living adjustment amounts for health savings accounts (HSAs). Adjustments have been made to the HSA contribution limit for individuals with family high deductible health plan (HDHP) coverage and to some of the deductible and out-of-pocket limitations for HSA-compatible HDHPs.

The HSA contribution limit for an individual with self-only HDHP coverage remains at $3,350 for 2016. The 2016 contribution limit for an individual with family coverage is increased to $6,750. These limits do not include the additional annual $1,000 catch-up contribution amount for individuals age 55 and older, which is not subject to cost-of-living adjustments.

HSA-compatible HDHPs are defined by certain minimum deductible amounts and maximum out-of-pocket expense amounts. For HDHP self-only coverage, the minimum deductible amount is unchanged for 2016 and cannot be less than $1,300. The 2016 maximum out-of-pocket expense amount for self-only coverage is increased to $6,550. For 2016 family coverage, the minimum deductible amount is unchanged at $2,600 and the out-of-expense amount increases to $13,100.

The IRS and the Treasury Department issued a notice on the so-called “Cadillac Tax”—a 40 percent excise tax to be imposed on high-cost employer-sponsored health plans beginning in 2018 under the Affordable Care Act (ACA).

Notice 2015-16, released on Feb. 23, 2015, discusses a number of issues concerning the tax and requests comments on the possible approaches that ultimately could be incorporated in proposed regulations. Specifically, the guidance states that the agencies anticipate that pretax salary reduction contributions made by employees to health savings accounts (HSAs) will be subject to the Cadillac tax.

Background

In 2018, the ACA provides that a nondeductible 40 percent excise tax be imposed on “applicable employer-sponsored coverage” in excess of statutory thresholds (in 2018, $10,200 for self-only, $27,500 for family). As 2018 approaches, the benefit community has long awaited guidance on this tax. While many employers have actively managed their plan offerings and costs in anticipation of the impact of the tax, those efforts have been hampered by the lack of guidance. Among other things, employers are uncertain what health coverage is subject to the tax and how the tax is calculated.

Particularly, Notice 2015-16 addresses:

The agencies are requesting comments on issues

discussed in this notice by May 15, 2015. They intend to issue another notice

that will address other areas of the excise tax and anticipates issuing

proposed regulations after considering public comments on both notices.

Applicable Coverage

Of most immediate interest to plan sponsors is the specific type of coverage (i.e., “applicable coverage”) that will be subject to the excise tax, particularly where the statute is unclear.

Employee Pretax HSA

Contributions

The ACA statute provides that employer contributions to an HSA are subject to

the excise tax, but did not specifically address the treatment of employee

pretax HSA contributions. The notice says that the agencies “anticipate that

future proposed regulations will provide that (1) employer contributions to

HSAs, including salary reduction contributions to HSAs, are included in

applicable coverage, and (2) employee after-tax contributions to HSAs are

excluded from applicable coverage.”

Note: This anticipated treatment of employee pretax contributions to HSAs will have a significant impact on HSA programs. If implemented as the agencies anticipate, it could mean many employer plans that provide for HSA contributions will be subject to the excise tax as early as 2018, unless the employer limits the amount an employee can contribute on a pretax basis.

Self-Insured Dental

and Vision Plans

The ACA statutory language specifically excludes fully insured dental and

vision plans from the excise tax. The treatment of self-insured dental and

vision plans was not clear. The notice states that the agencies will consider

exercising their “regulatory authority” to exclude self-insured plans that

qualify as excepted benefits from the excise tax.

Employee Assistance

Programs

The agencies are also considering whether to exclude excepted-benefit employee

assistance programs (EAPs) from the excise tax.

Onsite Medical Clinics

The notice discusses the exclusion of certain onsite medical clinics that offer

only de

minimis care to employees,

citing a provision in the COBRA regulations, and anticipates excluding such

clinics from applicable coverage. Under the COBRA regulations an onsite clinic

is not considered a group health plan if:

The agencies are also asking for comment on

the treatment of clinics that provide certain services in addition to first

aid:

In Closing

With the release of this initial guidance, plan sponsors can gain some insight into the direction the government is likely to take in proposed regulations and can better address potential plan design strategie

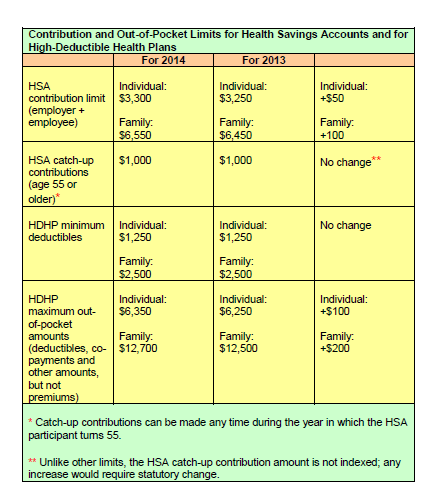

The IRS has announced higher limits for 2014 contributions to health savings accounts (HSAs).The increased amounts reflect cost of living adjustments.

For 2014, the HSA contribution limit is $3300 for an individual and $6550 for a family. The HSA catch up contribution for those age 55 or older will remain at $1000. For an medical plan to be considered a qualified HDHP that can be paired with an HSA, it must have a minimum deductible of $1250 for an individual and $2500 for a family.

For those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses, they face a 20% penalty of 20% for nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

While the PPACA allows parents to add their adult children up to age 26 onto their medical plans, the IRS has not changed its definition of a dependent for HSAs. This means that an employee whose 24 year old child is covered on his HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bills. If HSA account holders can’t claim a child as a dependent on their tax returns, then they can not spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendent of these) who:

Please contact our office with questions on high deductible health plans (HDHPs) as well as Health Saving Accounts (HSAs).

The Internal Revenue Service recently announced higher contributions limits to health savings accounts (HSAs) and for out of pocket spending under qualified high deductible health plans (HDHPs) for 2014.

The IRS provided the inflation adjusted HSA contribution and HDHP minimum deductible and out of pocket limits effective for calendar year 2014. The higher rates reflect a cost of living adjustment (COLA) as well as rounding rules under the IRS Code Sec 223.

A comparison of the 2014 and 2013 limits are below:

The increases in contribution limits and out of pocket maximums from 2013 to 2014 were somewhat lower than increases in years prior.

Those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses face a penalty of 20% of the funds used for those nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

Adult Children Coverage

While the Patient Protection and Affordable Care Act allows parents to add their adult children (up to age 26) to their health plans (and some state laws allow up to age 30 if certain requirements are met), the IRS has not changed its definition of a dependent for health savings accounts. This means that an employee whose 24 year old child is covered on their HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bill.

If account holders can’t claim a child as a dependent on their tax returns, then they can’t spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendant of these) who:

According to a recent employer survey by the nonprofit National Business Group on Health and Fidelity Investments, corporate employers plan on spending an average of $521 per employee on wellness-based incentives in 2013. This marks a 13% increase from the average of $460 per employee in 2011 and almost doubles the per employee average from 2009.

The survey also found that the overall use of these incentives among corporate employers continues to increase. 86% of employers surveyed indicated that they offered wellness-based incentives.

The most populate wellness-based incentives continue to be:

A large majority of employers (54%) have also expanded their wellness-based incentives to include dependents as well. As part of the wellness incentives, employer are requiring employees to complete a health activity- like an employer sponsored biometric screening or health risk assessment- in order to determine their eligibility for the company’s health plans in 2013. Some employers are even taking steps as far informing employees that their failure to complete a health risk assessment may result in the employee being moved automatically into a less attractive medical plan offered by the company or even completely being removing them from the health coverage.

Forty-one percent of employers include, or plan to include, an outcomes based metrics as part of their incentive program. This will give both the employer and employees a measurable goal that can be used to reward behavior or results in certain health categories, such as lowering cholesterol or blood pressure or their waist line.