Page 1 of 3

Plan sponsors that offer high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) will no longer be permitted to cover telehealth services before the deductible is met, as Congress failed to extend the safe harbor allowing this benefit as part of the American Relief Act of 2025, the law passed in late December to fund the federal government for the next few months. The provision may be taken up in the next Congress, but current rules expire for plan years beginning on or after January 1, 2025.

The telehealth safe harbor for HSA-qualified HDHPs was originally created by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The CARES Act permitted HDHPs to cover telehealth or other remote-care services before the plan’s deductible is met, effective on March 27, 2020 for plan years beginning on or before December 31, 2021.

Legislation enacted in March 2022 extended this flexibility from April 1, 2022 through December 31, 2022 and subsequent legislation further extended the telehealth flexibility for plan years beginning after December 31, 2022, and before January 1, 2025.

President Biden signed the American Relief Act of 2025 on December 21, 2024. The law funds the government through March 14, 2025, and provides disaster relief appropriations and economic assistance to farmers. However, the bill does not include an extension of HDHP telehealth flexibility.

Congressional leadership had originally negotiated a bipartisan bill that would have extended the HDHP telehealth flexibility rule for an additional two years.

Sponsors of HDHPs that have HSAs with plan years beginning before January 1, 2025 may continue to reimburse individuals for telehealth services before the deductible for the remainder of that plan year. However, for HDHPs with a plan year of January 1, 2025 or later, plans may not reimburse individuals for telehealth services before they meet their deductible. If a plan permits reimbursement for telehealth services before the deductible is met, the HDHP would not be HSA-qualified, and therefore participants could not contribute to an HSA for that plan year.

Consequently, plans should assure that telehealth services provided before the deductible is met in an HDHP are subject to cost-sharing, unless the service is for a preventive benefit required under the ACA (e.g., a telehealth visit to obtain a prescription for a preventive service).

Telehealth services continue to be a popular benefit. Plan sponsors should contact their health plan administrator to determine how they will implement telehealth benefits in an HDHP and whether they will be communicating changes to plan participants. In some cases, plan documents may need to be amended concerning telehealth coverage.

It is possible that the telehealth provision could be revived in the new Congress, although it is likely those efforts would take several months.

However, it is unclear when or whether there will be action on the proposed legislation. Plan sponsors should monitor developments on this issue in the next Congress.

The IRS has announced the 2025 contribution limits for items like flexible spending accounts (FSA). Here’s a look at some of the items changing:

Employees will be able to sock away more money in their health savings accounts (HSAs) next year, thanks to rising inflation.

The annual limit on HSA contributions for self-only coverage in 2025 will be $4,300, a 3.6 percent increase from the $4,150 limit in 2024, the IRS announced May 9. For family coverage, the HSA contribution limit will jump to $8,550, up 3 percent from $8,300 in 2024.

Meanwhile, for 2025, a high-deductible health plan (HDHP) must have a deductible of at least $1,650 for self-only coverage, up from $1,600 in 2024, or $3,300 for family coverage, up from $3,200, the IRS noted. Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but not premiums) cannot exceed $8,300 for self-only coverage in 2025, up from $8,050 in 2024, or $16,600 for family coverage, up from $16,100.

The IRS also announced that the excepted-benefit HRA limit will be $2,150 in 2025, up from $2,100.

Many industry experts tout HSAs as a smart way for employees to save for medical expenses, even in retirement, citing their triple tax benefits: Contributions are made pretax, the money in the accounts grows tax free and withdrawals for qualified medical expenses are tax free.

The increased annual limits from the IRS come as HSA enrollment continues to grow, and as more employers offer contributions to employees’ accounts. HSA assets hit a record in 2023, surging to $123.3 billion last year, up nearly 19 percent from the previous record of $104 billion in 2022, according to an annual report by Devenir Group, an HSA research firm and investment consultant firm.

Jon Robb, senior vice president of research and technology at Devenir, said that growth of HSA assets “project a strong, upward trajectory for the future, indicating a steady and significant expansion of the HSA market.”

SHRM’s 2023 Employee Benefits Survey found that 64 percent of employer respondents offer a high-deductible health plan that is linked with a savings or spending account, like an HSA. That is the second most common type of health plan offered, behind a preferred provider organization plan, offered by 82 percent of employers. Among employers that do offer HSAs, 63 percent offer contributions to their employees’ accounts. The average individual-only annual contribution is $1,012, according to SHRM, while the average family annual contribution is $1,585.

Another recent report from the Employee Benefit Research Institute found that employer involvement in HSAs has a positive effect on employee’s account success. HSA holders who received employer contributions had higher balances and were more likely to invest.

HSA annual limits are released every April or May by the IRS—ahead of other limits such as flexible spending accounts and 401(k) contributions— giving employers and HSA administrators plenty of time to adjust their systems. Employers often promote HSAs and encourage employees to boost their contributions during open enrollment, though it would be a good idea for HR and benefits leaders to start that conversation now.

Thanks in part to persistent high inflation, employees will be able to sock away a lot more money in their health savings accounts (HSAs) next year.

Annual health savings account contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the IRS announced May 16: The annual limit on HSA contributions for self-only coverage will be $4,150 in 2023, a 7.8 percent increase from the $3,850 limit in 2023. For family coverage, the HSA contribution limit jumps to $8,300 in 2023, up 7.1 percent from $7,750 in 2023.

Participants 55 and older can still contribute an extra $1,000 to their HSAs.

Meanwhile, for 2024, a high-deductible health plan (HDHP) must have a deductible of at least $1,600 for self-only coverage, up from $1,500 in 2023, or $3,200 for family coverage, up from $3,000, the IRS noted. Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but not premiums) cannot exceed $8,050 for self-only coverage in 2024, up from $7,500 in 2023, or $16,100 for family coverage, up from $15,000.

The increases are detailed in IRS Revenue Procedure 2023-23 and take effect in January 2024.

While expected, the increase in 2024 HSA limits is significant for passing certain symbolic financial thresholds. For the first time, including catch-up contributions for those age 55 and older, a couple on family coverage can now contribute more than $10,000, and a single person on self-only coverage can now contribute more than $5,000.

Many industry experts tout health savings accounts as a smart way for employees to save for medical expenses, even in retirement, citing their triple tax benefits: Contributions are made pretax, the money in the accounts grows tax free and withdrawals for qualified medical expenses are tax free. This is very good news to help more Americans understand and use HSAs as a powerful tool in their healthcare spending and long-term savings.

HSA enrollment continues to grow, and more employers also are offering contributions to employees’ accounts. At the end of 2022, Americans held $104 billion in 35.5 million health savings accounts, according to HSA advisory firm Devenir.

Despite the benefits, most holders aren’t taking full advantage of their accounts and are missing out on substantial rewards, according to the Employee Benefit Research Institute. The average account holder has a modest balance, contributes far less than the maximum and does not invest their HSA, recent EBRI data found.

It has been previously discussed that President Biden announced an end to the COVID-19 Public Health Emergency (PHE) and National Emergency (NE) periods on May 11, 2023, and the practical ramifications for employer group health plan sponsors as they administer COBRA, special enrollment, and other related deadlines tied to the end of the NE. As discussed, this action generally meant that all applicable deadlines were tolled until the end of the NE plus 60 days, or July 10, 2023, with all regular (non-extended) deadlines taking effect for applicable events occurring after that.

A Change in the National Emergency End Date

A new wrinkle recently added a potential complication to calculating these deadlines. President Biden signed H.R. Res. 7 into law on April 10, 2023, after Congress jointly introduced H.R. Res. 7 as a one-line action to end the NE, effective immediately. The consequence is that the applicable end of the transition relief is now June 9, 2023 (60 days following April 10, 2023) instead of July 10, 2023, as previously anticipated. The Department of Labor (DOL), however, has informally announced that despite the statutory end of the NE being 30 days earlier than expected, to avoid potential confusion and changes to administrative processes already in progress, the deadline of July 10, 2023, will remain the relevant date for COBRA, special enrollment, and other related deadlines under previous guidance. Prophetically, updated FAQs, released March 29, 2023, by the DOL, Department of Treasury, and Department of Health and Human Services (the Agencies), provide, “the relief generally continues until 60 days after the announced end of the COVID-19 National Emergency or another date announced by DOL, the Treasury Department, and the IRS (the “Outbreak Period”). [emphasis added]” Further clarification and formal guidance are still expected.

Updated DOL FAQ Guidance

Most employers rely on third-party vendors and consultants to help administer COBRA, special enrollments, claims, appeals, etc. All should be aware of the impact the end of the NE and PHE has on all applicable deadlines. The FAQs provide at Q/A-5 specific examples to help employers, consultants, and administrators apply the end of NE and PHE deadlines and different scenarios related to COBRA elections and payments before and after the end of the Outbreak Period, special enrollment events, Medicaid election changes, etc. The FAQs also make clear that employers are encouraged to consider extending these deadlines for the current plan year. Employers should discuss the impact of this guidance with their vendors and consultants to ensure all parties comply with the upcoming transitional periods.

The FAQs also confirm (at Q/A 1-4) the impact of the end of the PHE on COVID-19-related testing and diagnostic procedures, noting that as of the end of the PHE on May 11, 2023, group health plans are no longer required to provide certain COVID-19 related coverage at 100 percent under the plan, but can revert to previous cost-sharing and deductible limitations that existed before the COVID-19 pandemic. Note that President Biden’s recent action approving the end of the NE on April 10, 2023, has no impact on the previously communicated end to the PHE on May 11, 2023. Employers should review changes in coverage of COVID-19 testing and other related treatment or procedures with their insurance carriers, consultants, and advisors, including any notices that may be required in connection with those changes. The DOL confirmed that while encouraged to do so, employers do not have to provide any separate notification of any changes in current coverage limits before the PHE end date unless the employer had previously disclosed a different level of coverage in its current Summary of Benefits and Coverage (SBC) provided during the most recent open enrollment period.

COVID-19 Testing and Treatment Under High Deductible Health Plan/Health Savings Accounts

Q/A-8 of the FAQs provides interim clarification regarding the impact of the end of the PHE on high-deductible health plans (HDHPs) that are tied to health savings accounts (HSAs) and the ability to provide medical coverage for COVID-19 testing or treatment without requiring an employee to satisfy applicable HDHP deductibles for HSA contribution purposes. Even though IRS Notice 2020-15 provided relief from general deductible limitations under Code Section 223(c)(1) through the end of the PHE, the Agencies have determined this relief will remain in effect after the end of the PHE and until the IRS issues further guidance.

Employees can put an extra $200 into their health care flexible spending accounts (health FSAs) next year, the IRS announced on Oct. 18, as the annual contribution limit rises to $3,050, up from $2,850 in 2022. The increase is double the $100 rise from 2021 to 2022 and reflects recent inflation.

If the employer’s plan permits the carryover of unused health FSA amounts, the maximum carryover amount rises to $610, up from $570. Employers may set lower limits for their workers.

The limit also applies to limited-purpose FSAs that are restricted to dental and vision care services, which can be used in tandem with health savings accounts (HSAs).

The IRS released 2023 HSA contribution limits in April, giving employers and HSA administrators plenty of time to adjust their systems for the new year. The individual HSA contribution limit will be $3,850 (up from $3,650) and the family contribution limit will be $7,750 (up from $7,300).

CARRYOVER AMOUNTS OR GRACE PERIOD

Health or dependent care FSA funds that are not spent by the employee within the plan year can include a two-and-a-half-month grace period to spend down remaining FSA funds, if employees are enrolled in FSAs that have adopted the grace period option.

Health FSAs have an additional option of allowing participants to carry over unused funds at the end of the plan year, up to an inflation-adjusted limit set by the IRS, and still contribute up to the maximum in the next plan year. Health FSA plans can elect either the carryover or grace period option but not both.

Dependent Care FSAs

A dependent care FSA (DC-FSA) is a pretax benefit account used to pay for dependent care services such as day care, preschool, summer camps and non-employer-sponsored before or after school programs. Funds may be used for expenses relating to children under the age of 13 or incapable of self-care who live with the account holder more than half the year.

These plans may also be referred to as dependent care assistance plans (DCAPs) or dependent care reimbursement accounts (DCRAs).

In general, an FSA carryover only applies to health FSAs, although COVID-19 legislation permitted a carryover of unused balances for DC-FSAs into the next plan year for plan years 2020 and 2021 only.

The dependent care FSA maximum annual contribution limit is not indexed and did not change for 2022 or for 2023. It remains $5,000 per household for single taxpayers and married couples filing jointly, or $2,500 for married people filing separately. Married couples have a combined $5,000 limit, even if each has access to a separate DC-FSA through his or her employer.

Maximum contributions to a DC-FSA may not exceed these earned income limits:

Employers can also choose to contribute to employees’ DC-FSAs. However, unlike with a health FSA, the combined employer and employee contributions to a DC-FSA cannot exceed the IRS limits noted above.

A separate tax code child and dependent care tax credit cannot be claimed for expenses paid through a DC-FSA, as “double dipping” is not permitted.

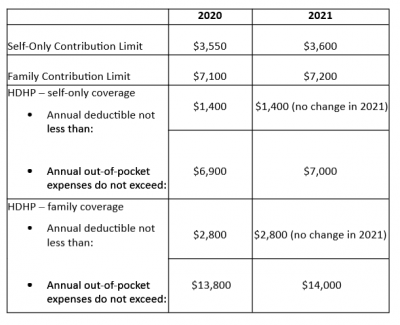

The new 2023 limits are:

HSA – Single $3,850 / Family $7,750 per year

HDHP (self-only coverage) – $1,500 minimum deductible / $7,500 out-of-pocket limit

HDHP (family coverage) – $3,000 minimum deductible / $15,000 out-of-pocket limit

The IRS has released the 2022 contribution limits for FSA and several other benefits in Revenue Procedure 2021-45. The limits are effective for plan years that begin on or after January 1, 2022.

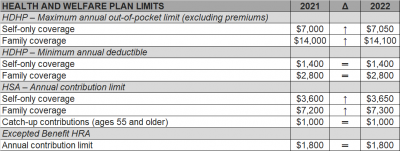

The Internal Revenue Service (IRS) recently announced (See Revenue Procedure 2021-25) cost-of-living adjustments to the applicable dollar limits for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted benefit health reimbursement arrangements (HRAs) for 2022. Many of the dollar limits currently in effect for 2021 will change for 2022. The HSA catch-up contribution for individuals ages 55 and older will not change as it is not subject to cost-of-living adjustments.

The table below compares the applicable dollar limits for HSAs, HDHPs and excepted benefit HRAs for 2021 and 2022.