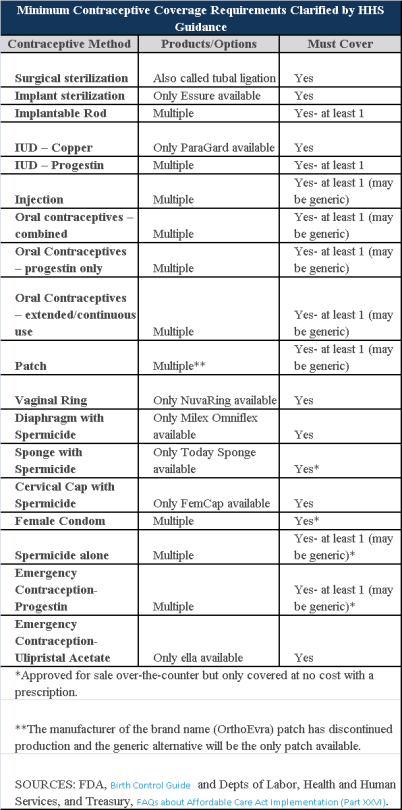

Plans and insurers must cover all 18 contraception methods approved by the U.S. Food and Drug Administration, according to a new set of questions and answers on the Affordable Care Act’s preventive care coverage requirements.

“Reasonable medical management” still may be used to steer members to specific products within those methods of contraception. A plan or insurer may impose cost-sharing on non-preferred items within a given method, as long as at least one form of contraception in each method is covered without cost-sharing.

However, an individual’s physician must be allowed to override the plan’s drug management techniques if the physician finds it medically necessary to cover without cost-sharing an item that a given plan or insurer has classified as non-preferred, according to one of the frequently asked questions from the U.S. Departments of Labor, Health and Human Services and the Treasury.

The ACA mandated all plans and insurers to cover preventive care items, as defined by the Public Health Service Act, without cost-sharing. Eighteen forms of female contraception are included under the preventive care list. The individual FAQs on contraception clarified the following requirements.

The FAQ comes just weeks after reports and news coverage detailed health plan violations of the women coverage provisions of the ACA.

Testing and Dependent Care Answers

In questions separate from contraception, plans and insurers were told they must cover breast cancer susceptibility (BRCA-1 or BRCA-2) testing without cost-sharing. The test identifies whether the woman has genetic mutations that make her more susceptible to BRCA-related breast cancer.

Another question stated that if colonoscopies are performed as preventive screening without cost-sharing, then plans could not impose cost-sharing on the anesthesia component of that service.

On December 22, 2014, the Departments of Health and Human Services (HHS) issued proposed regulations for changes to the Summary of Benefits and Coverage (SBC).

The proposed regulations clarify when and how a plan administrator or insurer must provide an SBC, shortens the SBC template, adds a third cost example, and revises the uniform glossary. The proposed regulations provide new information and also incorporate several FAQs that have been issued since the final SBC regulations were issued in 2012.

These proposed changes are effective for plan years and open enrollment period beginning on or after September 1, 2015. Comments on the proposed regulations will be accepted until March 2,2015 and are encourages on many of the provisions.

New Template

The new SBC template eliminates a significant amount of information that the Departments characterized as not being required by law and/or as having been identified by consumer testing as less useful for choosing coverage.

The sample completed SBC template for a standard group health plan has been reduced from four double-sided pages to two-and-a-half double-sided pages. Some of the other changes include:

Glossary Revisions

Revisions to the uniform glossary have also been proposed. The glossary must be available to plan participants upon request. Some definitions have been changed and new medical terms such as claim, screening, referral and specialty drug have been added. Additional terms related to health care reform such as individual responsibility requirement, minimum value and cost-sharing reductions have also been added.

Paper vs Electronic Distribution

SBCs may continue to be provided electronically to group plan participants in connection with their online enrollment or online renewal of coverage. SBCs may also be provided electronically to participants who request an SBC online. These individuals must also have the option to receive a paper copy upon request.

SBCs for self-insured non-federal government plans may continue to be provided electronically if the plan conforms to either the electronic distribution requirements that apply ERISA plan or the rules that apply to individual health insurance coverage.

Types of Plans to Which SBCs Apply

The regulations confirm that SBCs are not required for expatriate health plans, Medicare Advantage plans or plans that qualify as excepted benefits. Excepted benefits include:

SBCs are required for:

The rush for group health plan administrators to navigate the Centers for Medicare & Medicaid Services (CMS) website and obtain a Health Plan Identifier (HPID) ahead of the November 5th deadline is over. On October 31, 2014, the CMS Office of e-Health Standards and Services (OESS), the division of the Department of Health & Human Services (HHS) that is responsible for enforcement of the HIPAA standard transaction requirements, announced a “delay, until further notice,” of the HPID requirements. The regulatory obligations of plan administrators delayed by this notice are the: (i) obtaining of a HPID, and (ii) the use of the HPID in HIPAA transactions.

This delay comes on the heels of a recommendation by the National Committee on Vital and Health Statistics (NCVHS), an advisory body to HHS. The NCVHS asked HHS to review the HPID requirement and recommended that HPIDs not be used in HIPAA transactions. NCVHS’s primary opposing argument to implementation of the HPID standard was that the healthcare industry has already adopted a “standardized national payer identifier based on the National Association of Insurance Commissioners (NAIC) identifier.”

Whether HHS will adopt the recommendations of the NCVHS on a permanent basis remains to be seen, but for the time being, plan administrators may discontinue the HPID application process and should stay tuned for further announcements from HHS.

The Department of Health and Human Services (HHS) recently updated the Code Set Rules. The Code Set rules are part of the Health Insurance Portability and Accountability Act’s (HIPPA’s) Administrative Simplification Provisions. These rules create uniform electronic standards for common health plan administrative processes. Requiring health care providers and other stakeholders to use the same data formats for common transactions simplifies certain administrative aspects of providing and paying for health care.

Under the latest rules, self funded employers will need to apply for a Health Plan Identifier (HPID). Most employers will have to apply by November 5, 2014. This number will be used to ensure employers comply with certain Code Set rules requirements.

The Code Set Rules have affected covered entities for a number of years. However, certain aspects of these rules were not enforced in the past. In order to promote efficient health coverage, health care reform includes provisions to ensure health care stakeholders are complying with specific transaction and code set requirements.

Review of the HIPAA Code Set Rules

The final HIPAA Transaction and Code regulations published in August 2000 applied to most health plans as of October 16, 2003. They require covered entities conducting certain transactions electronically to use specific standards and code sets. Covered entities include:

Most of the applicable transactions occur between the health plan and health care providers covering areas like claims submission and payment, eligibility, and authorizations/referrals, however the enrollment and disenrollment transaction process generally involves the employer and the health plan.

New Requirements for a HPID for Self Funded Plans

The Code Set rules require all parties involved in the health care system to use an identifying number. Large group health plans (plans with an annual cost of $5 million or more) need to register for their Health Plan Identifier (HPID) number by November 5, 2014. Small group health plans (plans with an annual cost of less than $5 million) will have an extra year to obtain an HPID. Annual cost is based on paid claims before stop loss recoveries and excluding administrative costs and stop loss premiums.

Insurance carriers will likely apply for the 10-digit HPID number for all of their fully- insured group health plans. Employers will have to apply for their 10-digit HPID for self-funded medical plans. The health plan needs to use the HPID number for any of the standard transactions the Code Set rules cover.

Every health plan considered a covered entity must obtain an HPID. The regulations include delineations of group health plans including Controlling Health Plans (a health plan that controls its own business activities, actions and policies) and Subhealth Plan (a health plan whose business activities, actions or policies are directed by a Controlling Health Plan).

Employers are not really sure how the relationship between controlling health plans and subhealth plans would apply to employer-sponsored health plans and are awaiting further clarification from HHS on this issue.

All health plans, regardless of size, must use their HPIDs in standard transactions by November 7, 2016. A “standard transaction” is a CMS menu of transactions, like a claim payment, that must be coded with an HPID.

Employer must provide information about their organizations and health plans when they register for the HPID electronically. More information on applying for an HPID is available here.

Certification Requirements for Compliance with Standard Transaction Rules

Health plans must also verify with HHS that they comply with the Code Set rules. Health plans have been subject to these rules for almost a decade, however there has been little to no oversight on compliance with the common formats. HHS is now requiring a certification showing that the plan is using the standard formats. Initially, the certification will only be done on a few of the required transactions.

The health plan must first certify that they meet the Code Set requirements for eligibility, claim status and EFT and remittance advice transactions. Plans have two different options to certify they are complying. Both involve having specific vendors certify the plan uses the proper transaction formats. The two options are as follows:

The HIPAA Credential option involves testing the required transactions with at least three trading partners. Those three partners have to represent at least 30% of transactions conducted with providers. If it does not constitute 30%, then the plan must confirm it has successfully traded with at least 25%.

The Phase III Core Seal will require the Controlling Health Plan to test transactions with an authorized testing vendor.

All certifications will be filed with HHS. The first one will be due by December 31, 2015. Health insurance carriers and Third Party Administrators will most likely provide the certifications for employer-sponsored health plans, but employers will still need more details on the filing.

The second certification applies to other transactions the Code Set rules cover. Specifically, the second certification applies to claims information, enrollment, premium payments, claims attachments, and authorizations or referrals. HHS has not issued any guidance on these certifications yet. These second certifications are also due by December 31, 2015. However, because of the lack of specific guidance, it is very likely this due date may be delayed.

Action Plan

To register for an HPID, employers need to take the following steps:

1. Determine when the plan must obtain an HPID

2. If your plan if fully insured, contact your insurance carrier. It appears most insurance carriers will apply for the HPID for fully insured plans.

3. If your plan is self-funded, schedule time over the next several months to register for an HPID for your health plan. The registration is a CMS-managed online application process. The regulations estimate that it will take 20 -30 minutes to complete the application. Sponsors will be directed to an online enumeration system titled: Health Plan and Other Entity Enumeration System (HPOES).

Following the recent Supreme Court ruling regarding contraceptives in the Hobby Lobby Stores case, a new circuit decision now sets the stage for another possible Supreme Court decision on the ACA. On Tuesday (July 22, 2014), the U.S. Court of Appeals for the District of Columbia (in Halbig v. Burwell) and the U.S. Court of Appeals for the Fourth Circuit (in King v. Burwell) issued conflicting opinions regarding the IRS’ authority to administer subsidies in federally facilitated exchanges.

In general, the employer mandate requires that “applicable large employers” offer their full-time employees minimum essential coverage or potentially pay a tax penalty in 2015. However, according to the statutory text of the ACA, the penalties under the employer mandate are triggered only if an employee receives a subsidy to purchase coverage “through an Exchange established by the State under section 1311…” of the ACA. If a state elected not to establish an exchange or was unable to establish an operational exchange by January 1, 2014, the Secretary of HHS was required to establish a federal-run exchange under section 1321 of the ACA.

The appellants in each of these cases are residents of states that did not establish state run exchanges. Consequently, the appellants argue that the IRS does not have the authority to administer subsidies in their states because the exchanges were set up by HHS under section 1321 of the ACA and not under section 1311 as is the clear prerequisite for IRS authority to administer the subsidies.

In regulations implementing the subsidies, the IRS recognized this discrepancy and noted that “[c]ommentators disagreed on whether the language [of the ACA] limits the availability of the premium tax credit only to taxpayers who enroll in qualified health plans [QHPs] on State Exchanges."

The IRS, however, rejected these comments and stated that, “[t]he statutory language of section 36B and other provisions of the Affordable Care Act support the interpretation that credits are available to taxpayers who obtain coverage through a State Exchange, regional Exchange, subsidiary Exchange, and the Federally-facilitated Exchange. Moreover, the relevant legislative history does not demonstrate that Congress intended to limit the premium tax credit to State Exchanges. Accordingly, the final regulations maintain the rule in the proposed regulations because it is consistent with the language, purpose, and structure of section 36B and the Affordable Care Act as a whole.”

In Halbig v. Burwell, the D.C. Circuit disagreed with the IRS’ interpretation and, in a 2-1 decision, held that the IRS regulation authorizing tax credits in federal exchanges was invalid. The court focused heavily on the text itself and concluded, “that the ACA unambiguously restricts the …subsidy to insurance purchased on Exchanges established by the state.”

In an opinion issued only hours following the D.C. Circuit decision, the 4th Circuit, in King v. Burwell, agreed with the IRS’ interpretation and upheld the subsidies by permitting the IRS to decide whether the premium tax credits should be available over the federal exchange. The justices argued that the text did not intend to create two unequal exchanges. Additionally, they argue that the ambiguous text of the act intended that the exchanges be operated as appendages of the Bureaucracy, and so under the directives of the IRS.

Currently, 36 states are using federally facilitated exchanges, including Florida. Further, roughly 85% of enrollees who signed up for health insurance receive subsidies allowing them to purchase coverage that would be otherwise unaffordable. If the subsidies allocated over the federal exchange were declared invalid, those individuals’ ability to receive subsidies to purchase coverage could be jeopardized. As a result, the average price of a health plan is projected to rise from $82 per month to $346 per month, making it more difficult to afford for approximately 5.4 M enrollees.

While the Halbig decision is a major setback to the ACA, it is almost certainly not the final word on this issue. Given the fact that two courts have reached different outcomes, the Supreme Court is more likely to weigh in on the decision. However, the Halbig decision is likely to be reviewed by the entire D.C. Circuit prior to any potential review by the Supreme Court.

As fall approaches, both state and federal Exchanges created by the Affordable Care Act (ACA) are preparing for potential opportunities and challenges they may face during the 2015 open enrollment period. The start date for the Exchange open enrollment has been delayed by a month, beginning on November 15, 2014, and will run through February 15, 2015. Those desiring coverage beginning January 1, 2015 must enroll by December 15, 2014.

This delay will help to ease some enrollment pressure points, but does not address some of the challenges associated with a new automatic renewal policy. Specifically, the Obama Administration and the Department of Health and Human Services (HHS) just announced a proposed rule to automatically renew existing Exchange health plans and premium subsidies for 2015 that individuals obtained in 2014.

Automatic Renewal Concerns

A key feature of the 2015 open enrollment period is implementation of the automatic renewal system. Consumers who do not return to the www.healthcare.gov website and change their plan or eligibility information will be automatically re-enrolled in their current plan from the previous enrollment period for the 2015 plan year. The overall goal is to relieve pressure on the Exchange website while allowing for roughly 95% of consumers to re-enroll in health plans. However, automatic re-enrollment raises issues with the subsidy programs operated by the Exchanges.

Beginning in 2015, the automatic re-enrollment function is likely to cause issues with consumers that have a different income levels than the previous year. With the automatic re-enrollment feature, most consumers may not report changes in their income, thus creating discrepancies in subsidy distributions. For instance, if someone experiences a decrease in income from the previous year, but the change is not reported due to the automatic re-enrollment, the consumer may not receive subsidies that he/she is eligible for, and vice versa if the consumer’s income increases. With roughly 87% of consumers enrolled in an Exchange plan receiving subsidy tax credits, resolving this issue will be key to the success of the upcoming enrollment period.

In addition, reports continue to surface that the IRS has not been able to document the reported income for several million Americans who enrolled an Exchange plan for the 2014 plan year. Therefore, hundreds of thousands of individuals may end up receiving subsidies for two different plan years, which they might not qualify for resulting in an unexpected tax burden, interest and penalties.

Open Enrollment Period Delayed

Despite the issues plaguing the Exchanges, a recent change in the date of the 2015 open-enrollment period may help alleviate some of the future website and enrollment strains. This spring, the Obama Administration announced a month-long extension of the 2015 open enrollment period until February 15, 2015. An initial delay was announced last fall that pushed back the start date from October 15 to November 15, 2014. As a result of these changes, insurance companies will benefit from the delay, consumers will have more time to enroll in an Exchange plan, and websites hope to have fewer technical and administrative hiccups. However, some have expressed concerns that the White House continues to make up the rules as they go along which violates normal regulatory protocols associated with a statutory-based initiatives like the ACA.

While the Exchanges prepare for the new open enrollment season, some problems from the previous open enrollment likely remain unresolved. As widely reported earlier, both www.healthcare.gov and its state-level Exchanges experienced a slew of technical issues and glitches in the 2014 open enrollment that hampered enrollment and significantly increased the wait time for enrollment activation for many.

Verifying Income Levels

Other technical issues have hampered enrollment, such as the lack of oversight in filling out applications on the Exchange websites. The delay in www.healthcare.gov’s verification requirement has led to chaos in the federal Exchange, as well as in states that use the federal Exchange, by implementing an “honor system” where individuals self-report their income without having to provide proof. As a result, HHS and the IRS must verify the incomes of a backlog of roughly 2 million individuals for federal subsidy eligibility.

AAG will continue tracking and reporting on key health care reform changes that will affect employers and individuals alike.

In the recent U.S. Supreme Court’s ruling in Burwell vs. Hobby Lobby, it was ruled that closely held for-profit companies have the right to refuse to offer insurance coverage for specific birth control methods if they conflict with the owner’s religious beliefs. Many benefits attorneys expect the impact of this ruling to limited for employers—despite what some political reps might suggest.

The June 30, 2014 ruling pertains to the Affordable Care Act (ACA) mandate that employers who provide medical coverage to employees must provide contraceptive coverage to female full-time employees with no cost-sharing. The U.S. Department of Health and Human Services (HHS) regulations had set forth an expansive interpretation of contraceptive coverage, including so-called “morning-after pills” and intrauterine devices (IUDs).

The ruling was limited to closely held companies (those with a limited number of shareholders) whose owners hold sincere religious beliefs, such as the firms that sued HHS in this case: Hobby Lobby, an arts and crafts chain that says it is run on biblical principles, and Conestoga Wood Specialties, a Pennsylvania cabinet-making company owned by a Mennonite family.

Few Employers Affected

“The Hobby Lobby ruling has a direct impact on a relatively small number of employers—as a percentage of total employers across the country there are very few that can be considered faith-based employers,” advised a recent alert from a law firm.

“Employers who do not have objections to the mandate are most likely able to continue with their plans without any changes merely because of this decision,” concurred another benefits attorney. “Employers who wish to take advantage of the ruling may want to amend their plans in order to make them clear about what is and is not covered.”

Why have there been apparently overwrought reactions to the ruling? Supreme Court decisions implicating any of the Affordable Care Act’s provisions are routinely used both by proponents and opponents of the act as evidence of the correctness of their position. Their positions are then picked up by and amplified in media coverage, often resulting in confusion on the part of the public.

Contraceptives Only

The opinion “seemed to limit itself to the contraceptive mandate only, likely quelling the concerns of many who argued a broader decision may put in jeopardy other items typically covered under group plans, such as vaccinations and blood transfusions,” according to a post by attorneys at Fisher & Phillips. In addition, the court warned that its decision should not be interpreted to provide a shield to employers to cover up illegal discrimination under the appearance of claimed religious beliefs (for example, companies claiming to object, on religious grounds, to same-sex marriage).

This decision on contraceptives likely will not seem to extend to larger corporations with diverse ownership interests. The court noted the difficulty of determining the religious beliefs of, for example, a large publicly traded corporation, and pointed out that the corporations in this case were all closely held corporations, each owned and controlled by a single family, with undisputed sincere religious beliefs.

Attorneys expect that “there may be relatively few employers that fit the exemption created by the court’s decision,” and that “HHS will likely draft new regulations to comply with [the] decision, and it remains to be seen whether new plaintiffs will challenge the contraception requirements or other requirements under the ACA on similar grounds.”

The Administration’s Options

The Supreme Court decision cited the federal Religious Freedom Restoration Act (RFRA) requirement that any laws that substantially burden a person’s exercise of religion must be justified by a compelling governmental interest and be the least restrictive approach to furthering the governmental interest. The majority opinion, written by Justice Samuel Alito and signed by three other justices, suggested that one “least restrictive” approach would be for the government to directly pay for contraceptives when an employer has religious objections to providing them.

A concurring opinion by Justice Anthony Kennedy suggested that the administration extend an accommodation already made available to religiously affiliated nonprofit organizations more broadly to private employers who claim that purchasing insurance that covers contraception, or certain types of contraception, would violate their religious beliefs.

The Hobby Lobby decision should stand as a reminder that while there may be differences of opinion about specific rules and requirements under the ACA, and some of those differences may be decided against the government, the law itself is not going away. Employers need to continue to monitor new developments and implement strategies for complying with the ACA.

The Obama administration recently kicked off the Health Insurance Marketplace education effort with a new, consumer focused HealthCare.gov website paired with a 24-hours a day consumer call center to help Americans prepare for open enrollment and sign up for private health insurance. The new tools will help Americans understand their choices and select the coverage that best suits their needs when open enrollment for the Exchange begins October 1, with coverage beginning January 1, 2014.

The website will continue to add functionality over the summer months so that, by October, consumers will be able to create accounts, complete an online application, and shop for qualified health plans. For Spanish speaking consumers, CuidadoDeSalud.gov, will also be updated to match HealthCare.gov’s new consumer focus.

Key features of the website include integration of social media, sharable content, and engagement destinations for consumers to get more information. The site will also launch with web chat functionality to support additional consumer inquiries.

Between now and the start of open enrollment, the Marketplace call center will provide educational information and, beginning October 1, 2013, will assist consumers will application completion and plan selection. In addition to English and Spanish, the call center provides assistance in more than 150 languages through an interpretation and translation service. Customer service representatives are available for assistance via a toll-free number at 1-800-318-2596 and hearing impaired callers using TTY/TDD technology can dial 1-855-889-4325 for assistance.

On May 31st, the US Department of Health and Human Services (HHS) issued a final rule delaying the implementation of a significant portion of the Federal Small Business Health Options Program (SHOP) Exchanges until 2015.

The Patient Protection and Affordable Care Act (PPACA) calls for the creation and implementation of health Exchanges for both individuals and small businesses. These marketplaces were to be operational by October 1, 2013 in time for the open enrollment period for a January 1, 2014 effective date.

The Obama administration announced that SHOPs will only offer one health plan now in 2014, instead of offering small employer groups a choice of several health plans. As reported in the Wall Street Journal, “For transitional purposes we have proposed that in 2014, a state may elect to have businesses choose one plan to offer employees, and in 2015 employees will be able to choose from the full range of plans in the marketplace,” said Fabien Levy, an HHS official.

This delay will apply to states in which the federal government will administer the Exchanges, and makes the requirement optional for state-run Exchanges. The administration cited operational challenges as the reason for the delay.

This announcement has been met with disappointment by many small businesses as it will limit the attractiveness of exchanges to small businesses. The vast majority of small employers want their employees to be able to choose among multiple insurance carriers so employees can pick the plan to best meet their personal needs.

Whether a similar delay will be announced for the individual Exchanges remains to be seen.

Under the 2013 Health Insurance Portability and Accountability Act (HIPAA) privacy and security rules provisions, employers must update their health information disclosure policies and retrain employees to ensure compliance.

The Department of Health and Human Services (HHS) issued the new HIPAA regulations on January 25, 2013, to execute major changes that were mandated by the Health Information Technology for Economic and Clinical Health Act (HITECH) as well as the Genetic Information Nondiscrimination Act (GINA).

New Requirements for Business Associates

HIPAA regulations previously generally covered any business associate who performed or assisted in any activity involving the use or disclosure of individually identifiable health information, such as third-party administrators, pharmacy benefit managers and benefit consultants. Under the new regulations, business associate status is triggered when a vendor “creates, receives, maintains, or transmits” personal health information (PHI).

The key addition in this part of the regulation is found in the word ‘maintains’ because any entity that ‘maintains’ PHI on behalf of a covered entity- even if no access to that information is required or expected- will now be considered a business associate.

This change has some important consequences for group health plans that rely on cloud storage as a repository for their PHI or that outsource information-technology support and other functions and do not have business associate agreements (BAAs) with such vendors.

If you give PHI to a vendor before a BAA is in place, you will be in violation of HIPAA, and if you are a vendor, you can’t receive PHI without a compliant BAA in place. There must be a compliant BAA in place first.

Another change is that plan sponsors must enter into a sub-BAA with agents or subcontractors who are retained to help a business associate with covered functions for an employer-sponsored health plan. Plan sponsors should include BAA language that states that a business associate can’t subcontract work without prior permission, and then to monitor compliance with those agreements.

Presumption of PHI Breach Introduced

Under the previous rules, an impermissible use or disclosure of PHI- including electronic PHI- was a breach only if it posed a significant risk of harm to the individual. The HHS included in the new rules a presumption that any impermissible use or disclosure of PHI is a breach, subject to breach-notification rules.

Under the new rules, the only way now to get out of this presumption is by a demonstration that there is a low probability that the PHI was compromised.

To demonstrate low probability, the health plan or business associate must perform a risk assessment of four factors- at a minimum:

The HHS has indicated that it expects these risk assessments to be thorough and completed in good faith and to reach reasonable conclusions. If the risk assessment does not find a low probability that PHI has been compromised, then breach notification is required.

Action Advised for 2013

While the new regulations bring certainty to employer-sponsored health plans and their business associates on HIPAA compliance issues, they also emphasize the department’s intention to subject business associates and their subcontractors to heightened scrutiny.

Employers should review and revise their BAAs to ensure compliance with the security rule, paying special attention to the inclusion of subcontractors. Employers should also review and revise (or create) breach-notification procedures that detail how a risk assessment will be conducted. It is also important to train employees who have access to PHI on these updated policies and procedures.

The final regulations take effect September 23, 2013 and the HHS has provided another one-year transition period for some covered entities and their business associates that had a BAA in place on January 1, 2013. HHS also published an updated version of a template BAA, but it does not address all the unique situations that may arise between a covered entity and a business associate. Employers should ultimately ensure that their business associate agreements are appropriately tailored to their individual circumstances and business needs.