Page 1 of 2

Plan sponsors that offer high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) will no longer be permitted to cover telehealth services before the deductible is met, as Congress failed to extend the safe harbor allowing this benefit as part of the American Relief Act of 2025, the law passed in late December to fund the federal government for the next few months. The provision may be taken up in the next Congress, but current rules expire for plan years beginning on or after January 1, 2025.

The telehealth safe harbor for HSA-qualified HDHPs was originally created by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The CARES Act permitted HDHPs to cover telehealth or other remote-care services before the plan’s deductible is met, effective on March 27, 2020 for plan years beginning on or before December 31, 2021.

Legislation enacted in March 2022 extended this flexibility from April 1, 2022 through December 31, 2022 and subsequent legislation further extended the telehealth flexibility for plan years beginning after December 31, 2022, and before January 1, 2025.

President Biden signed the American Relief Act of 2025 on December 21, 2024. The law funds the government through March 14, 2025, and provides disaster relief appropriations and economic assistance to farmers. However, the bill does not include an extension of HDHP telehealth flexibility.

Congressional leadership had originally negotiated a bipartisan bill that would have extended the HDHP telehealth flexibility rule for an additional two years.

Sponsors of HDHPs that have HSAs with plan years beginning before January 1, 2025 may continue to reimburse individuals for telehealth services before the deductible for the remainder of that plan year. However, for HDHPs with a plan year of January 1, 2025 or later, plans may not reimburse individuals for telehealth services before they meet their deductible. If a plan permits reimbursement for telehealth services before the deductible is met, the HDHP would not be HSA-qualified, and therefore participants could not contribute to an HSA for that plan year.

Consequently, plans should assure that telehealth services provided before the deductible is met in an HDHP are subject to cost-sharing, unless the service is for a preventive benefit required under the ACA (e.g., a telehealth visit to obtain a prescription for a preventive service).

Telehealth services continue to be a popular benefit. Plan sponsors should contact their health plan administrator to determine how they will implement telehealth benefits in an HDHP and whether they will be communicating changes to plan participants. In some cases, plan documents may need to be amended concerning telehealth coverage.

It is possible that the telehealth provision could be revived in the new Congress, although it is likely those efforts would take several months.

However, it is unclear when or whether there will be action on the proposed legislation. Plan sponsors should monitor developments on this issue in the next Congress.

Both the IRS and the three agencies tasked with issuing rules under the Affordable Care Act (“ACA”) have released guidance on new items considered preventive and medical care, as well as some further requirements around existing items plans are required to cover. Some of the guidance related to high deductible health plans (“HDHPs”) is effective retroactively presumably because some HDHPs may have already covered those items believing them to be preventive care.

Additional Medical and Preventive Care

In IRS Notice 2024-71, the IRS created a safe harbor stating that male condoms will be considered medical care for tax purposes. Among other results, this means that health plans, health flexible spending arrangements (“Health FSAs”), health reimbursement arrangements (“HRAs”), and health savings accounts (“HSAs”) can pay for or reimburse the cost of male condoms on a tax-free basis. The notice doesn’t specify an effective date, but presumably it is effective immediately.

However, for them to be preventive care for purposes of high deductible health plans and HSA purposes, separate guidance is required. As a reminder, for an individual to contribute to an HSA, they must be covered by a HDHP and not be covered by other non-permitted health insurance. Therefore, even though the IRS has now said that male condoms are medical care, they cannot be covered before the deductible under an HDHP without additional guidance.

Fortunately, the IRS also issued Notice 2024-75. It includes that needed guidance and some other items as well. Specifically, HDHPs can now cover the following items as preventive care before the individual satisfies the deductible:

The retroactive dates were presumably intended to address concerns that plans had already covered some of these items. However, to be clear, HDHPs are not required to cover these items pre-deductible, but this guidance allows them to do so without affecting a participant’s ability to contribute to an HSA.

FAQs part 68

In addition, the Departments of Health and Human Services, Labor, and Treasury issued guidance on some existing items plans are required to cover in their sixty-eighth edition of ACA FAQs.

For plans subject to the Women’s Health and Cancer Rights Act (“WHCRA”), the FAQs clarify that plans are required to cover chest wall reconstruction with an aesthetic flat closure, if elected by the patient in consultation with the attending physician. Under WHCRA, plans are generally required to cover reconstruction of the breast on which a mastectomy was performed, and surgery and reconstruction of the other breast to produce a symmetrical appearance. The guidance now confirms that this requirement includes providing an aesthetic flat closure, where extra tissues in the breast area are removed, and the remaining tissue is tightened and smoothed out to create a flat chest wall. Most plans are subject to WHCRA, including governmental plans, unless they are self-funded and have opted out. Church plans that have elected not to be subject to ERISA are not subject to WHCRA.

The FAQs address some common coding practices for items that are deemed to be medical care. The specifics and nuances of this guidance are more relevant to carriers or third party administrators (“TPAs”). However, in general, if an item is coded as preventive, it should be treated as such unless there’s additional information in the claim that would lead the plan or carrier to believe it should not be treated as preventive. If an item or service is not covered as preventive when it should be, participants and beneficiaries have the right to appeal under the relevant plan claims procedures.

Takeaways

Employers should work with their insurance carriers and TPAs to determine whether and how they plan to cover the additional permitted items for health FSAs, HRAs, and HDHPs. They should also address the coverage of the additional mandatory items from the FAQ guidance. Changes to plan documents, summary plan descriptions, or other communications may be required.

Employees will be able to sock away more money in their health savings accounts (HSAs) next year, thanks to rising inflation.

The annual limit on HSA contributions for self-only coverage in 2025 will be $4,300, a 3.6 percent increase from the $4,150 limit in 2024, the IRS announced May 9. For family coverage, the HSA contribution limit will jump to $8,550, up 3 percent from $8,300 in 2024.

Meanwhile, for 2025, a high-deductible health plan (HDHP) must have a deductible of at least $1,650 for self-only coverage, up from $1,600 in 2024, or $3,300 for family coverage, up from $3,200, the IRS noted. Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but not premiums) cannot exceed $8,300 for self-only coverage in 2025, up from $8,050 in 2024, or $16,600 for family coverage, up from $16,100.

The IRS also announced that the excepted-benefit HRA limit will be $2,150 in 2025, up from $2,100.

Many industry experts tout HSAs as a smart way for employees to save for medical expenses, even in retirement, citing their triple tax benefits: Contributions are made pretax, the money in the accounts grows tax free and withdrawals for qualified medical expenses are tax free.

The increased annual limits from the IRS come as HSA enrollment continues to grow, and as more employers offer contributions to employees’ accounts. HSA assets hit a record in 2023, surging to $123.3 billion last year, up nearly 19 percent from the previous record of $104 billion in 2022, according to an annual report by Devenir Group, an HSA research firm and investment consultant firm.

Jon Robb, senior vice president of research and technology at Devenir, said that growth of HSA assets “project a strong, upward trajectory for the future, indicating a steady and significant expansion of the HSA market.”

SHRM’s 2023 Employee Benefits Survey found that 64 percent of employer respondents offer a high-deductible health plan that is linked with a savings or spending account, like an HSA. That is the second most common type of health plan offered, behind a preferred provider organization plan, offered by 82 percent of employers. Among employers that do offer HSAs, 63 percent offer contributions to their employees’ accounts. The average individual-only annual contribution is $1,012, according to SHRM, while the average family annual contribution is $1,585.

Another recent report from the Employee Benefit Research Institute found that employer involvement in HSAs has a positive effect on employee’s account success. HSA holders who received employer contributions had higher balances and were more likely to invest.

HSA annual limits are released every April or May by the IRS—ahead of other limits such as flexible spending accounts and 401(k) contributions— giving employers and HSA administrators plenty of time to adjust their systems. Employers often promote HSAs and encourage employees to boost their contributions during open enrollment, though it would be a good idea for HR and benefits leaders to start that conversation now.

Thanks in part to persistent high inflation, employees will be able to sock away a lot more money in their health savings accounts (HSAs) next year.

Annual health savings account contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the IRS announced May 16: The annual limit on HSA contributions for self-only coverage will be $4,150 in 2023, a 7.8 percent increase from the $3,850 limit in 2023. For family coverage, the HSA contribution limit jumps to $8,300 in 2023, up 7.1 percent from $7,750 in 2023.

Participants 55 and older can still contribute an extra $1,000 to their HSAs.

Meanwhile, for 2024, a high-deductible health plan (HDHP) must have a deductible of at least $1,600 for self-only coverage, up from $1,500 in 2023, or $3,200 for family coverage, up from $3,000, the IRS noted. Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but not premiums) cannot exceed $8,050 for self-only coverage in 2024, up from $7,500 in 2023, or $16,100 for family coverage, up from $15,000.

The increases are detailed in IRS Revenue Procedure 2023-23 and take effect in January 2024.

While expected, the increase in 2024 HSA limits is significant for passing certain symbolic financial thresholds. For the first time, including catch-up contributions for those age 55 and older, a couple on family coverage can now contribute more than $10,000, and a single person on self-only coverage can now contribute more than $5,000.

Many industry experts tout health savings accounts as a smart way for employees to save for medical expenses, even in retirement, citing their triple tax benefits: Contributions are made pretax, the money in the accounts grows tax free and withdrawals for qualified medical expenses are tax free. This is very good news to help more Americans understand and use HSAs as a powerful tool in their healthcare spending and long-term savings.

HSA enrollment continues to grow, and more employers also are offering contributions to employees’ accounts. At the end of 2022, Americans held $104 billion in 35.5 million health savings accounts, according to HSA advisory firm Devenir.

Despite the benefits, most holders aren’t taking full advantage of their accounts and are missing out on substantial rewards, according to the Employee Benefit Research Institute. The average account holder has a modest balance, contributes far less than the maximum and does not invest their HSA, recent EBRI data found.

It has been previously discussed that President Biden announced an end to the COVID-19 Public Health Emergency (PHE) and National Emergency (NE) periods on May 11, 2023, and the practical ramifications for employer group health plan sponsors as they administer COBRA, special enrollment, and other related deadlines tied to the end of the NE. As discussed, this action generally meant that all applicable deadlines were tolled until the end of the NE plus 60 days, or July 10, 2023, with all regular (non-extended) deadlines taking effect for applicable events occurring after that.

A Change in the National Emergency End Date

A new wrinkle recently added a potential complication to calculating these deadlines. President Biden signed H.R. Res. 7 into law on April 10, 2023, after Congress jointly introduced H.R. Res. 7 as a one-line action to end the NE, effective immediately. The consequence is that the applicable end of the transition relief is now June 9, 2023 (60 days following April 10, 2023) instead of July 10, 2023, as previously anticipated. The Department of Labor (DOL), however, has informally announced that despite the statutory end of the NE being 30 days earlier than expected, to avoid potential confusion and changes to administrative processes already in progress, the deadline of July 10, 2023, will remain the relevant date for COBRA, special enrollment, and other related deadlines under previous guidance. Prophetically, updated FAQs, released March 29, 2023, by the DOL, Department of Treasury, and Department of Health and Human Services (the Agencies), provide, “the relief generally continues until 60 days after the announced end of the COVID-19 National Emergency or another date announced by DOL, the Treasury Department, and the IRS (the “Outbreak Period”). [emphasis added]” Further clarification and formal guidance are still expected.

Updated DOL FAQ Guidance

Most employers rely on third-party vendors and consultants to help administer COBRA, special enrollments, claims, appeals, etc. All should be aware of the impact the end of the NE and PHE has on all applicable deadlines. The FAQs provide at Q/A-5 specific examples to help employers, consultants, and administrators apply the end of NE and PHE deadlines and different scenarios related to COBRA elections and payments before and after the end of the Outbreak Period, special enrollment events, Medicaid election changes, etc. The FAQs also make clear that employers are encouraged to consider extending these deadlines for the current plan year. Employers should discuss the impact of this guidance with their vendors and consultants to ensure all parties comply with the upcoming transitional periods.

The FAQs also confirm (at Q/A 1-4) the impact of the end of the PHE on COVID-19-related testing and diagnostic procedures, noting that as of the end of the PHE on May 11, 2023, group health plans are no longer required to provide certain COVID-19 related coverage at 100 percent under the plan, but can revert to previous cost-sharing and deductible limitations that existed before the COVID-19 pandemic. Note that President Biden’s recent action approving the end of the NE on April 10, 2023, has no impact on the previously communicated end to the PHE on May 11, 2023. Employers should review changes in coverage of COVID-19 testing and other related treatment or procedures with their insurance carriers, consultants, and advisors, including any notices that may be required in connection with those changes. The DOL confirmed that while encouraged to do so, employers do not have to provide any separate notification of any changes in current coverage limits before the PHE end date unless the employer had previously disclosed a different level of coverage in its current Summary of Benefits and Coverage (SBC) provided during the most recent open enrollment period.

COVID-19 Testing and Treatment Under High Deductible Health Plan/Health Savings Accounts

Q/A-8 of the FAQs provides interim clarification regarding the impact of the end of the PHE on high-deductible health plans (HDHPs) that are tied to health savings accounts (HSAs) and the ability to provide medical coverage for COVID-19 testing or treatment without requiring an employee to satisfy applicable HDHP deductibles for HSA contribution purposes. Even though IRS Notice 2020-15 provided relief from general deductible limitations under Code Section 223(c)(1) through the end of the PHE, the Agencies have determined this relief will remain in effect after the end of the PHE and until the IRS issues further guidance.

Need medical treatment this year and want to nail down your out-of-pocket costs before you walk into the doctor’s office? There’s a new tool for that, at least for insured patients.

As of Jan. 1, 2023, health insurers and employers that offer health plans must provide online calculators for patients to get detailed estimates of what they will owe — taking into account deductibles and copayments — for a range of services and drugs.

It’s the latest effort in an ongoing movement to make prices and upfront cost comparisons possible in a business known for its opaqueness.

Insurers must make the cost information available for 500 nonemergency services considered “shoppable,” meaning patients generally have time to consider their options. The federal requirement stems from the Transparency in Coverage rule finalized in 2020.

So how will it work?

Patients, knowing they need a specific treatment, drug, or medical service, first log on to the cost estimator on a website offered through their insurer or, for some, their employer. Next, they can search for the care they need by billing code, which many patients may not have; or by a general description, like “repair of knee joint,” or “MRI of abdomen.” They can also enter a hospital’s or physician’s name or the dosage amount of a drug for which they are seeking price information.

Not all drugs or services will be available in the first year of the tools’ rollout, but the required 500-item list covers a wide swath of medical services, from acne surgery to X-rays.

Once the information is entered, the calculators are supposed to produce real-time estimates of a patient’s out-of-pocket cost.

Starting in 2024, the requirement on insurers expands to include all drugs and services.

These estimator-tool requirements come on top of other price information disclosures that became effective during the past two years, which require hospitals and insurers to publicly post their prices, including those negotiated between them, along with the cost for cash-paying or uninsured patients.

Still, some hospitals have not fully complied with this 2021 disclosure directive and the insurer data released in July is so voluminous that even researchers are finding it cumbersome to download and analyze.

The price estimator tools may help fill that gap.

The new estimates are personalized, computing how much of an annual deductible patients still owe and the out-of-pocket limit that applies to their coverage. The amount the insurer would pay if the service were out of network must also be shown. Patients can request to have the information delivered on paper, if they prefer that to online.

Insurers or employers who fail to provide the tool can face penalty fines of at least $100 a day for each person affected, a significant incentive to comply — if enforced.

And there are caveats: Consumers using the tools must be enrolled in the respective health plan, and there’s no guarantee the final cost will be exactly as shown.

That’s because “unforeseen factors during the course of treatment, which may involve additional services or providers, can result in higher actual cost sharing liability,” federal regulators wrote in outlining the rules.

Insurers will not be held liable for incorrect estimates.

Because the cost estimates may well vary from the final price, either because the procedure was more complex than initially expected, or was handled by a different provider at the last minute, one risk is that a consumer might get a bill for $4,000 and they will be upset because the estimator told them $3,000.

Many insurers have offered versions of cost-estimator tools before, but small percentages of enrollees actually use them, studies have shown.

Federal regulators defended the requirement for estimator tools, writing that even though many insurers had provided them, the new rule sets specific parameters, which may be more detailed than earlier versions.

In outlining the final rule, the Centers for Medicare & Medicaid Services pointed out that some previous calculators “on the market only offer wide-range estimates or average estimates of pricing that use historical claims data” and did not always include information about how much the patient had accumulated toward an annual deductible or out-of-pocket limit.

The agency says such price disclosure will help people comparison-shop and may ultimately help slow rising medical costs.

But that isn’t a given.

“CMS has a lot of people who believe this will make a significant impact, but they also have a long time frame,” said David Brueggeman, director of commercial health at the consulting firm Guidehouse.

In the short term, results may be harder to see.

“Most patients are not moving en masse to use these tools,” said Dr. Ateev Mehrotra, a professor of health care policy at Harvard Medical School.

There are many reasons, he said, including little financial incentive if they face the same dollar copayment whether they go to a very expensive facility or a less expensive one. A better way to get patients to switch to lower-cost providers, he said, is to create pricing tiers, rewarding patients who seek the most cost-effective providers with lower copayments.

Mehrotra is skeptical that the cost estimator tools alone will do much to dent rising medical prices. He’s more hopeful that, in time, the requirement that hospitals and insurers post all their negotiated prices will go further to slow costs by showcasing which are the most expensive providers, along with which insurers negotiate the best rates.

Still, the cost-estimator tools could be useful for the increasing number of people with high-deductible health plans who pay directly out-of-pocket for much of their health care before they hit that deductible. During that period, some may save substantially by shopping around.

Those deductibles add “pressure on consumers to shop on price,” said Brueggeman, at Guidehouse. “Whether they are actually doing that is up for debate.”

Employers will have the option to provide pre-deductible coverage of telehealth services for people with high-deductible health plans for another two years.

The $1.7 trillion omnibus spending bill signed into law by President Joe Biden Dec. 29—which contains a number of other important provisions affecting employers, including the Secure 2.0 retirement overhaul and pregnancy accommodations—includes a provision extending the telehealth relief in the 2020 Coronavirus Aid, Relief and Economic Security (CARES) Act.

Significantly for employers, the provision allows health savings account (HSA)-qualifying high-deductible health plans (HDHPs) to cover telehealth and other remote-care services on a pre-deductible basis. Additionally, an otherwise HSA-eligible individual can receive pre-deductible coverage for telehealth and other remote-care services from a stand-alone vendor outside of the HDHP. In both cases, the pre-deductible telehealth coverage won’t hinder an individual’s eligibility to make or receive HSA contributions. Many employer groups and stakeholders have said that the waiver improves health access, notably for some employees who may have avoided telehealth because of out-of-pocket expenses.

SHRM has been advocating for the continuation of pre-deductible telehealth coverage, arguing that improved access to telehealth allows employees to access more health care options—including mental health services—at their convenience.

“Pre-deductible coverage helps employees because it allows insurance providers to cover telehealth services without requiring a co-pay or deductible upfront,” said Emily Dickens, SHRM chief of staff, head of public affairs and corporate secretary. “Employers need the flexibility to design benefit plans that improve employees’ well-being and help retain top talent. I am grateful to our members for engaging with lawmakers from across the nation to secure this extension.”

The CARES Act allowed HSA-eligible health plans to provide pre-deductible coverage for telehealth services, but only through 2021. Normal cost-sharing was still allowed for telehealth visits, such as through co-pays that the plan may require after the deductible is paid. It was then renewed in the 2022 Consolidated Appropriations Act for April 1 through Dec. 31, 2022.

The omnibus bill also extends Medicare telehealth provisions for another two years, including delaying in-person screening requirements for Medicare telehealth mental health services and allowing providers to provide acute hospital-level care at home.

Still, the extensions don’t permanently extend telehealth relief—something many health and policy experts advocate for. Without a further extension, the telehealth relief will expire Dec. 31, 2024, for calendar-year plans. Some groups expect Congress might make these changes permanent, although some lawmakers are concerned with telehealth’s potential for higher costs and increased fraud.

The new 2023 limits are:

HSA – Single $3,850 / Family $7,750 per year

HDHP (self-only coverage) – $1,500 minimum deductible / $7,500 out-of-pocket limit

HDHP (family coverage) – $3,000 minimum deductible / $15,000 out-of-pocket limit

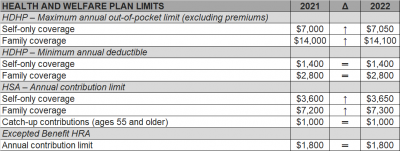

The Internal Revenue Service (IRS) recently announced (See Revenue Procedure 2021-25) cost-of-living adjustments to the applicable dollar limits for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted benefit health reimbursement arrangements (HRAs) for 2022. Many of the dollar limits currently in effect for 2021 will change for 2022. The HSA catch-up contribution for individuals ages 55 and older will not change as it is not subject to cost-of-living adjustments.

The table below compares the applicable dollar limits for HSAs, HDHPs and excepted benefit HRAs for 2021 and 2022.

This week the IRS released two new sets of rules impacting Section 125 Cafeteria Plans. Notice 2020-33 provides permanent rule changes that include an increase in the amount of unused benefits that Health FSA plans may allow plan participants to rollover from one plan year to the next. Notice 2020-29 provides temporary rules designed to improve employer sponsored group health benefits for eligible employees in response to the coronavirus pandemic. The relief provided under each notice is optional for employers. Employers who choose to take advantage of any of the offered plan options will be required to notify eligible employees and will eventually be required to execute written plan amendments.

Notice 2020-33 modifies the amount of annual rollover of unused benefits that Health FSA plans may offer to Plan participants. Up until now, rollovers have been limited to $500 per Plan Year. The new rule sets the annual rollover limit to 20% of the statutory maximum annual employee Health FSA contribution for the applicable Plan Year. Because the statutory maximum is indexed for inflation, most years it increases (in mandated increments of $50).

The notice provides that the increased rollover amount may apply to Plan Years beginning on or after January 1, 2020. Because the corresponding annual Health FSA employee contribution limit for those Plan Years is $2,750, the annual rollover limit may be increased up to $550.

The relief provided under Notice 2020-29 falls into two major categories, both of which apply only for calendar year 2020. First, the IRS introduces several significant exceptions to the mid-year change of election rules generally applicable to Section 125 Cafeteria Plans. Second, the notice contains a special grace period which offers Health Flexible Spending Arrangement (FSA) and Dependent Care Assistance Program (DCAP) Participants additional time to incur eligible expenses during 2020.

The temporary exceptions to mid-year participant election change rules for 2020 authorize employers to allow employees who are eligible to participate in a Section 125 Cafeteria Plan to:

None of the above described election changes require compliance with the consistency rules which typically apply for mid-year Section 125 Cafeteria Plan election changes. They also do not require a specific impact from the coronavirus pandemic for the employee.

Employers have the ability to limit election changes that would otherwise be permissible under the exceptions permitted by Notice 2020-29 so long as the limitations comply with the Section 125 non-discrimination rules. For allowable Health FSA or DCAP election changes, employers may limit the amount of any election reduction to the amount previously reimbursed by the plan. Interestingly, even though new elections to make Health FSA and DCAP contributions may not be retroactive, Notice 2020-29 provides that amounts contributed to a Health FSA after a revised mid-year election may be used for any medical expense incurred during the first Plan Year that begins on or after January 1, 2020.

For the election change described in item 3 above, the enrolled employee must make a written attestation that any coverage being dropped is being immediately replaced for the applicable individual. Employers are allowed to rely on the employee’s written attestation without further documentation unless the employer has actual knowledge that the attestation is false.

The special grace period introduced in Notice 2020-29 allows all Health FSAs and DCAPs with a grace period or Plan Year ending during calendar year 2020 to allow otherwise eligible expenses to be incurred by Plan Participants until as late as December 31, 2020. This temporary change will provide relief to non-calendar year based plans. Calendar year Health FSA plans that offer rollovers of unused benefits will not benefit from this change.

The notice does clarify that this special grace period is permitted for non-calendar year Health FSA plans even if the plan provides rollover of unused benefits. Previous guidance had prohibited Health FSA plans from offering both grace periods and rollovers but Notice 2020-29 provides a limited exception to that rule.

The notice raises one issue for employers to consider before amending their plan to offer the special grace period. The special grace period will adversely affect the HSA contribution eligibility of individuals with unused Health FSA benefits at the end of the standard grace period or Plan Year for which a special grace period is offered. This will be of particular importance for employers with employees who may be transitioning into a HDHP group health plan for the first time at open enrollment.

As mentioned above, employers wishing to incorporate any of the allowable changes offered under Notices 2020-29 and 2020-33 will be required to execute written amendments to their Plan Documents and the changes should be reflected in the Plan’s Summary Plan Description and/or a Summary of Material Modification. Notice 2020-29 requires that any such Plan Amendment must be executed by the Plan Sponsor no later than December 31, 2021.