Page 2 of 2

The health reform law imposes a number of fees, taxes and other assessments on health insurance companies and sponsors of self-funded health plans to help subsidize a number of endeavors. One such fee funds the Patient-Centered Outcomes Research Institute (PCORI).

The PCORI fee is $2.17 per covered life for plan years ending on or after Oct. 1, 2015, and must be reported on (and remitted with) IRS Form 720 by Aug. 1, 2016 (the deadline is July 31, but since July 31 falls on a weekend, the form is due by the next business day, Aug. 1). For self-funded plans, the employer/plan sponsor will be responsible for submitting the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee is not permitted for self-funded plans.

The process for remitting payment by sponsors of self-funded plans is described in more detail below.

The IRS will collect the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. The fees are reported and paid annually on IRS Form 720 by July 31 of the year following the last day of the plan year. This year the fee is due by Aug. 1.

The fee due on Aug. 1, 2016 is $2.17 per covered life for plan years ending before Oct. 1, 2016, and on or after Oct. 1, 2015. For plan years ending before Oct. 1, 2015, the fee due on Aug. 1, 2016, is $2.08 per covered life under the plan. IRS regulations provide three options for determining the average number of covered lives (actual count, snapshot and Form 5500 method).

The Form 720 must be filed by July 31 (Aug. 1 in 2016) of the calendar year immediately following the last day of the plan year. For example, calendar year plans will owe a fee of $2.17 per covered life by Aug. 1, 2016. Plans that operate on years that begin the first day of any month from February through October will be paying a $2.08 per covered life fee with the Aug. 1, 2016, filing.

The U.S. Department of Labor believes the fee cannot be paid from plan assets. In other words, the PCORI fee must be paid by the plan sponsor; it is not a permissible expense of a self-funded plan and cannot be paid in whole or part by participant contributions. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for employers with self-funded plans.

The filing and remittance process to the IRS is straightforward and is largely unchanged from last year. On page two of Form 720, under Part II, the employer needs to designate the average number of covered lives under its “applicable self-insured plan.” The number of covered lives is multiplied by $2.17 (for plan years ending on or after Oct. 1, 2015) to determine the total fee owed to the IRS.

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.” Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’s software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

The Affordable Care Act added a patient-centered outcomes research (PCOR) fee on health plans to support clinical effectiveness research. The PCOR fee applies to plan years ending on or after Oct. 1, 2012, and before Oct. 1, 2019. The PCOR fee is due by July 31 of the calendar year following the close of the plan year. For plan years ending in 2014, the fee is due by July 31, 2015.

PCOR fees are required to be reported annually on Form 720, Quarterly Federal Excise Tax Return, for the second quarter of the calendar year. The due date of the return is July 31. Plan sponsors and insurers subject to PCOR fees but not other types of excise taxes should file Form 720 only for the second quarter, and no filings are needed for the other quarters. The PCOR fee can be paid electronically or mailed to the IRS with the Form 720 using a Form 720-V payment voucher for the second quarter. According to the IRS, the fee is tax-deductible as a business expense.

The PCOR fee is assessed based on the number of employees, spouses and dependents that are covered by the plan. The fee is $1 per covered life for plan years ending before Oct. 1, 2013, and $2 per covered life thereafter, subject to adjustment by the government. For plan years ending between Oct. 1, 2014, and Sept. 30, 2015, the fee is $2.08. The Form 720 instructions are expected to be updated soon to reflect this increased fee.

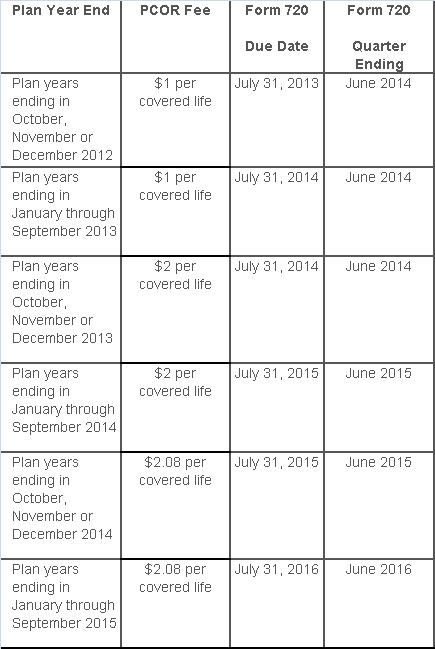

This chart summarizes the fee schedule based on the plan year end and shows the Form 720 due date. It also contains the quarter ending date that should be reported on the first page of the Form 720 (month and year only per IRS instructions). The plan year end date is not reported on the Form 720.

For insured plans, the insurance company is responsible for filing Form 720 and paying the PCOR fee. Therefore, employers with only fully- insured health plans have no filing requirement.

If an employer sponsors a self-insured health plan, the employer must file Form 720 and pay the PCOR fee. For self-insured plans with multiple employers, the named plan sponsor is generally required to file Form 720. A self-insured health plan is any plan providing accident or health coverage if any portion of such coverage is provided other than through an insurance policy.

Since the fee is a tax assessed against the plan sponsor and not the plan, most funded plans subject to ERISA must not pay the fee using plan assets since doing so would be considered a prohibited transaction by the U.S. Department of Labor (DOL). The DOL has provided some limited exceptions to this rule for plans with multiple employers if the plan sponsor exists solely for the purpose of sponsoring and administering the plan and has no source of funding independent of plan assets.

Plans sponsored by all types of employers, including tax-exempt organizations and governmental entities, are subject to the PCOR fee. Most health plans, including major medical plans, prescription drug plans and retiree-only plans, are subject to the PCOR fee, regardless of the number of plan participants. The special rules that apply to Health Reimbursement Accounts (HRAs) and Health Flexible Spending Accounts (FSAs) are discussed below.

Plans exempt from the fee include:

If a plan sponsor maintains more than one self-insured plan, the plans can be treated as a single plan if they have the same plan year. For example, if an employer has a self-insured medical plan and a separate self-insured prescription drug plan with the same plan year, each employee, spouse and dependent covered under both plans is only counted once for purposes of the PCOR fee.

The IRS has created a helpful chart showing how the PCOR fee applies to common types of health plans.

Health Reimbursement Accounts (HRAs) - Nearly all HRAs are subject to the PCOR fee because they do not meet the conditions for exemption. An HRA will be exempt from the PCOR fee if it provides benefits only for dental or vision expenses, or it meets the following three conditions:

Health Flexible Spending Accounts (FSAs) - A health FSA is exempt from the PCOR fee if it satisfies an availability condition and a maximum benefit condition.

Additional special rules for HRAs and FSAs . Once an employer determines that its HRA or FSA is subject to the PCOR fee, the employer should consider the following special rules:

The IRS provides different rules for determining the average number of covered lives (i.e., employees, spouses and dependents) under insured plans versus self-insured plans. The same method must be used consistently for the duration of any policy or plan year. However, the insurer or sponsor is not required to use the same method from one year to the next.

A plan sponsor of a self-insured plan may use any of the following three

methods to determine the number of covered lives for a plan year:

1. Actual count method. Count the covered lives on each day of the plan year and divide by the number of days in the plan year.

Example: An employer has 900 covered lives on Jan. 1, 901 on Jan. 2, 890 on

Jan. 3, etc., and the sum of the lives covered under the plan on each day of

the plan year is 328,500. The average number of covered lives is 900 (328,500 ÷

365 days).

2. Snapshot method. Count the covered lives on a single day in each quarter (or more than one day) and divide the total by the number of dates on which a count was made. The date or dates must be consistent for each quarter. For example, if the last day of the first quarter is chosen, then the last day of the second, third and fourth quarters should be used as well.

Example: An employer has 900 covered lives on Jan. 15, 910 on April 15, 890 on

July 15, and 880 on Oct. 15. The average number of covered lives is 895 [(900 +

910+ 890+ 880) ÷ 4 days].

As an alternative to counting actual lives, an employer can count the number of

employees with self-only coverage on the designated dates, plus the number of

employees with other than self-only coverage multiplied by 2.35.

3. Form 5500 method. If a Form 5500 for a plan is filed before the due date of the Form 720 for that year, the plan sponsor can determine the number of covered lives based on the Form 5500. If the plan offers just self-only coverage, the plan sponsor adds the participant counts at the beginning and end of the year (lines 5 and 6d on Form 5500) and divides by 2. If the plan also offers family or dependent coverage, the plan sponsor adds the participant counts at the beginning and end of the year (lines 5 and 6d on Form 5500) without dividing by 2.

Example: An employer offers single and family coverage with a plan year ending

on Dec. 31. The 2013 Form 5500 is filed on June 5, 2014, and reports 132

participants on line 5 and 148 participants on line 6d. The number of covered

lives is 280 (132 + 148).

To evaluate liability for PCOR fees, plan sponsors should identify all of their plans that provide medical benefits and determine if each plan is insured or self-insured. If any plan is self-insured, the plan sponsor should take the following actions:

The IRS has released the 2014 Form 720 that plan sponsors of self-insured group health plans will use to report and pay the Patient Centered Outcomes Research Institute (PCORI) fee. The fee is due by July 31, 2014 for plan years ending in 2013.

The Affordable Care Act (ACA) imposes a fee on health insurers and plan sponsors of self-insured group health plans to help fund the Patient Centered Outcomes Research Institute. PCORI is responsible for conducting research to evaluate and compare the health outcomes and clinical effectiveness, risks, and benefits of medical treatments, services, procedures, and drugs.

The PCORI fee is assessed for plan years ending after September 30, 2012. The initial fee is $1 times the average number of covered lives for the first plan year ending before October 1, 2013 and $2 per covered life for the plan year ending after October 1, 2013 and before October 1, 2014. Fees for subsequent years are subject to indexing. The PCORI fee will not be assessed for plan years ending after September 30, 2019, which means that for a calendar year plan, the last plan year for assessment is the 2018 calendar year.

Plan sponsors must pay the PCORI fee by July 31 of the calendar year immediately following the last day of that plan year. All plan sponsors of self-insured group health plans will pay the fee in 2014, but the amount of the fee varies depending on the plan year.

The IRS has released the 2014 Form 720 with instructions for plan sponsors to use to report and pay the PCORI fee. Although the Form 720 is a quarterly federal excise tax return, if the Form 720 is filled only to report the PCORI fee, no filing is required in other quarters unless other fees or taxes have to be reported.

Please contact our office for information on the Affordable Care Act (ACA) and how it affects your business.

If your company offered either a Health Reimbursement Account (HRA) or Medical Expense Reimbursement Plan (MERP) as part of your employee benefits package in 2012, you must report and pay the PCORI fee for your 2012 plan year no later than July 31, 2013. Please note that the penalty for not filing can be as high as $10,000 per month.

You must use the IRS Form 720 to report and pay the PCORI fee.

If you used a third party administrator to handle the administration of your HRA or MERP plan, they should have provided you with the necessary information to complete Form 720 as they are not permitted to file this with the IRS on your behalf.

Please let us know if you have any questions.