The U.S. Department of Labor (DOL) has issued guidance on the application of the Fair Labor Standards Act (FLSA) and Family and Medical Leave Act (FMLA) to employees who telework from home or from another location away from the employer’s facility.

The Field Assistance Bulletin (FAB) 2023-1, released on February 9, 2023, is directed to agency officials responsible for enforcement and provides employers a glimpse into how the DOL applies existing law and regulations to common remote-work scenarios. FAB 2023-1 addresses FLSA regulations governing “hours worked,” rules related to break time and privacy for nursing employees, and FMLA eligibility factors.

Hours Worked

In the FAB, the DOL reviews the rules governing compensability of work time, explaining that, regardless of work location, short breaks (typically, 20 minutes or less) generally are counted as compensable hours worked, whereas, longer breaks “during which an employee is completely relieved from duty, and which are long enough to enable [the employee] to use the time effectively for [their] own purposes[,] are not hours worked.” Examples of short breaks, whether at home or in the office, include when an employee takes a bathroom or coffee break or gets up to stretch their legs.

Longer rest breaks and periods of time, when employees are completely relieved from duty and able to use the time for their own purposes, are not considered work time. Just as would be the case when an employee is working in the office, if during remote work an employee’s 30-minute lunch break is interrupted by several work-related phone calls, that 30-minute period would be counted as hours worked. Conversely, if an employee working from home takes a three-hour break to pick up their child or to perform household chores, that time does not count as work time under the FLSA. In short, the FAB reiterates the telework guidance set forth by the DOL in a Q&A series published during the height of the COVID-19 pandemic.

The FAB emphasizes that, regardless of whether an employee performs duties at home, at the worksite, or at some other location, if the employer knows or has reason to believe that work is being performed, the time must be counted as hours worked. Importantly, the FAB notes that an employer may satisfy its obligation to exercise reasonable diligence to acquire knowledge regarding employees’ unscheduled hours of work by providing a reasonable reporting procedure for employees to use when they work non-scheduled time and paying employees for all hours worked. This guidance was addressed in greater detail in FAB 2020-5.

Guidelines for Nursing Employees

The FAB further clarifies that, under the FLSA, an employer’s obligation to provide employees “reasonable break time,” as well as an appropriate place to express breast milk, extends to employees who are teleworking or working at an off-site location. Just as an employer has an obligation to provide an “appropriate place” for an employee to express milk while working at a client site, the employer should ensure a teleworking employee has privacy from a “computer camera, security camera, or web conferencing platform” to express milk.

Employers are not required to pay employees for otherwise unpaid breaks simply because the employee is expressing breast milk during the break, but if an employee is working while pumping (or if the pumping occurs during an otherwise paid break), they must be paid for that time. For example, in most cases, if a remote employee attends a call or videoconference off camera while pumping, that employee would be considered on duty and must be paid for that time.

The recently enacted PUMP Act expanded existing employer obligations under the FLSA to cover exempt employees, as well as non-exempt employees. The DOL has published more guidance on breast milk pumping during work.

Eligibility Under FMLA

The DOL also addresses FMLA eligibility requirements for remote employees both in terms of hours worked (employee must work 1,250 hours in the previously 12 months) and the small worksite exception (employee must work at a worksite with at least 50 employees in a 75-mile radius).

As with the FLSA, it is important for employers to have a system to track their remote workers’ hours. With respect to hours worked, the FAB reiterates that the 1,250 hours determination for remote worker is based on compensable hours of work under FLSA principles.

With respect to the worksite size determination, the FMLA regulations explain that an employee’s personal residence is not a worksite. Instead, whether a remote employee is FMLA-eligible is based on the size of the worksite from which “they report to” or “their assignments are made.” If a remote employee reports into or receives assignments from a site with 50 or more employees working at that site (or reporting to or receiving assignments from that site) or within 75 miles, then that employee would meet that eligibility factor.

The DOL provided two examples of this rule:

Employers are reminded to review state and local wage and hour laws, paid and unpaid leave laws, and lactation accommodation laws. If you have any questions about applying the FLSA, the FMLA, or state and local laws to your remote workers or any other questions about remote work considerations, please reach out to any Jackson Lewis attorney.

The Departments of Labor, Treasury, and Health and Human Services (the Departments) issued reporting relief for health plans and issuers facing difficulty meeting the December 27th, 2022, deadline of reporting prescription drug and health care spending information.

The Consolidated Appropriations Act, 2021, (CAA) requires that health plans and issuers report, on an annual basis, certain prescription drug and health care spending information. The first reporting (for 2020 and 2021) was originally due in December 2021 but was delayed to December 27, 2022. The reporting has proved to be a challenge for many plan sponsors and issuers.

As such, the Departments announced two important pieces of relief:

As group health plan sponsors, employers are responsible for ensuring compliance with the prescription drug data collection (RxDC) reporting requirements added to ERISA by the Consolidated Appropriations Act of 2021 (CAA). Under ERISA section 725, enforced by the US Department of Labor (DOL), group health plans (not account-based plans, e.g., health reimbursement arrangements and health savings accounts, or excepted benefit arrangements) must report details regarding the plan’s prescription drug benefit utilization, including the drugs most frequently dispensed, the most expensive drugs, and the drugs with the highest cost increase for a given calendar year. Reporting is to be made annually to the US Department of Health and Human Services’ (HHS) CMS enterprise portal’s Health Insurance Oversight System (HIOS) module, starting with the report due by December 27, 2022, for the 2020 and 2021 calendar years. After that, annual reporting is due by June 1st following the calendar year (so, the 2022 calendar year report is due by June 1, 2023). The DOL must thereafter post aggregated information on its website so that the public can see trends in prescription drug utilization and pricing.

What’s required. Under regulations issued jointly by HHS, DOL, and the US Treasury Department, plans must submit RxDC reports which include –

How to comply. HIOS issued specific reporting instructions which explain the reporting requirements in detail and assure plan sponsors that submission for a plan “is considered complete if CMS receives all required files, regardless of who submits the files.” Many group health plan vendors (insurers, third-party administrators, pharmacy benefit managers, etc.) have proactively contacted plan sponsors to assure them that the vendor will report at least some of the information on the plan’s behalf. However, not all vendors are willing to accept responsibility for the RxDC reporting requirements. Employers need to know which reporting obligations will be fulfilled by the group health insurer or other vendor and which reporting obligations must be satisfied by the plan sponsor. Most plan sponsors are wise to be prepared to upload at least some of the data to the HIOS module themselves, which means first setting up a HIOS account on the CMS portal. HIOS accounts can take a couple of weeks to set up, so it’s important for plan sponsors to act on this now if they’ve not already done so. CMS has provided detailed instructions for setting up the HIOS account.

Compliance issues. The statute and regulations impose the RxDC reporting requirements on group health plans, which, by default, usually means that requirements and liability for noncompliance are imposed on plan sponsors (generally, employers). Thus, each group health plan sponsor should ensure that all of the RxDC reporting requirements are satisfied for each group health plan subject to the reporting requirements. Employers should obtain written agreements from plan vendors identifying what data each vendor will upload. Note that the employer remains liable for noncompliance (and subject to excise tax and potential civil penalties), even if it has an enforceable agreement with its vendor to ensure compliance unless the plan is fully-insured and the agreement is with the insurer. Unfortunately, only the reporting entity can view the files it uploads to HIOS, so there is no way for an employer to confirm on the HIOS module that a vendor uploaded the file(s) it agreed to upload on behalf of the employer’s group health plan. Instead, the employer should obtain written assurance from the plan’s vendor(s) and rely on contractual provisions for recourse if a vendor fails to fulfill its RxDC reporting service as agreed.

Transparency in Coverage mandates and COVID-19 considerations continue to dominate the discussion in the employee benefits compliance space this summer, but an “old faithful” reporting requirement looms soon: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The typical due date for the PCORI fee is July 31, but because that date falls on a Sunday in 2022, the effective due date is pushed to the next business day, which is Aug. 1.

The filing and payment due by Aug. 1, 2022, is required for policy and plan years that ended during the 2021 calendar year. For plan years that ended Jan. 1, 2021 – Sept. 30, 2021, the fee is $2.66 per covered life. For plan years that ended Oct. 1, 2021 – Dec. 31, 2021 (including calendar year plans that ended Dec. 31, 2021), the fee is calculated at $2.79 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is typically due by July 31 of the year following the last day of the plan year to which the payment relates, but this year the due date pushes to Aug. 1.

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2021 the plan year ended) to determine the total fee owed to the IRS.

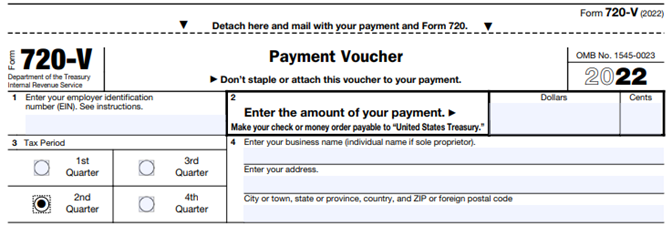

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.

On April 19, 2022, the Departments of Labor, Health and Human Services, and the Treasury issued additional guidance under the Transparency in Coverage Final Rules issued in 2020. The guidance, FAQs About Affordable Care Act Implementation Part 53, provides a safe harbor for disclosing in-network healthcare costs that cannot be expressed as a dollar amount. They also serve as a timely reminder of the pending July 1, 2022, deadline to begin enforcing the Final Rules.

Background

The Final Rules require non-grandfathered health plans and health insurance issuers to post information about the cost to participants, beneficiaries, and enrollees for in-network and out-of-network healthcare services through machine-readable files posted on a public website. The Final Rules for this requirement are effective for plan years beginning on or after January 1, 2022 (an additional requirement for disclosing information about pharmacy benefits and drug costs is delayed pending further guidance). The Final Rules require that all costs be expressed as a dollar amount. After the Final Rules were published, plans and issuers pointed out that under some alternative reimbursement arrangements in-network costs are calculated as a percentage of billed charges. In those cases, dollar amounts cannot be determined in advance.

FAQ Safe Harbor

The FAQs provide a safe harbor for disclosing costs under a contractual arrangement where the plan or issuer agrees to pay an in-network provider a percentage of billed charges and cannot assign a dollar amount before delivering services. Under this kind of arrangement, they may report the percentage number instead of a dollar amount. The FAQs also provide that where the nature of the contractual arrangement requires the submission of additional information to describe the nature of the negotiated rate, plans and issuers may describe the formula, variables, methodology, or other information necessary to understand the arrangement in an open text field. This is only permitted if the current technical specifications do not support the disclosure via the machine-readable files.

Public Website Requirement

This guidance is pretty narrow and of most interest to plans, issuers, and third-party administrators responsible for the technical aspects of the disclosure. Still, it is a helpful reminder to plan sponsors that the July 1st enforcement deadline for these requirements is rapidly approaching. As a reminder, for fully insured plans the plan sponsor is considered the insurance carrier. However, for self or level funded medical plans the plan sponsor is the employer so they will be the one responsible making sure they are meeting the transparency disclosure requirements. Plans sponsors should remember that these machine-readable files must be posted on a public website. The Final Rules clearly state that the files must be accessible for free, without having to establish a user account, password, or other credentials and without submitting any personal identifying information such as a name, email address, or telephone number. If a third-party website hosts the files, the plan or issuer must post a link to the file’s location on its own public website. Simply posting the files on an individual plan website or the Plan Sponsor’s company intranet falls short of these requirements. Regardless of how a plan opts to comply, The July 1st deadline is right around the corner.

The recorded presentation of AAG’s 2022 Education Seminar held on April 7, 2022 is now available for viewing.

Guest Speaker and Attorney Keith Hammond, of Hammond Law Center, focuses on changes in employment law that have occurred over the past year. Some of the topics addressed include new regulations under the Biden administration, as well as how the new DOL Secretary Marty Walsh and Democratic controlled NLRB could impact your business.

This seminar is also approved for 2 Professional Development Credits (PDCs) with SHRM for all attendees.

In fulfillment of President Biden’s promise to make at-home COVID tests more available for all of us, two significant action steps have now occurred:

Key Points:

All group health plans and insurance carriers must now cover the cost of at-home COVID-19 test kits, passing none of that cost to employees or individuals covered under the plan, and without requiring a medical diagnosis or prescription from a health care provider.

On September 9, 2021, the White House issued Path Out of the Pandemic: President Biden’s COVID-19 Action Plan (the Plan). The Plan outlines a six-pronged approach, portions of which will impose new obligations on employers across the country.

Most notably for employers, the first prong of the Plan, “Vaccinating the Unvaccinated,” includes:

The Plan also calls on states to adopt vaccination requirements for all school employees as part of the effort to “keep schools safely open.”

The Plan indicates that the administration will increase the amount of COVID-19 testing by ramping up production of testing products, offering at-home rapid COVID-19 tests at cost through certain retailers, and expanding free testing at retail pharmacy sites, among other things.

While the Plan is far-reaching, there are still many unknowns. Employer obligations arising from OSHA’s ETS will be dictated by the timing and the specific ETS provisions and corresponding requirements. The only thing we know for certain about the forthcoming ETS is that employers will need to continue to adapt and be prepared to pivot if necessary. It is also unclear how the new ETS will fit in with OSHA’s current COVID-19 Healthcare ETS, in 29 C.F.R. 1910 Subpart U, or impact OSHA’s current guidance for non-healthcare employers. Further, the 27 states with OSHA-approved State Plans, such as California, Washington, Oregon, and Virginia, will need to determine how to respond to the ETS, once it is issued, and if certain provisions require implementation alongside the state’s standards and regulations.

CMS also issued a press release urging Medicare and Medicaid-certified facilities to “make efforts now to get health care staff vaccinated.” However, the agency noted that it is still developing an Interim Final Rule with Comment Period that will be issued in October.

Employers who are impacted by the Plan, and who may be impacted by an ETS once issued, are advised to start thinking through how they will navigate many legal issues and operational challenges related to required vaccination and testing. These issues include policy requirements, workplace testing strategies, vaccination tracking and management, medical record collection and retention, and accommodations for religion, disability and pregnancy, as well as wage and hour implications, bargaining obligations for unionized workplaces, employee confidentiality and privacy issues. Further, employers should consider the logistical impact on federal contracts and how these obligations will interplay with other state or local mandates or restrictions on vaccinations.

Stay tuned as we dive into the Plan and corresponding guidance documents, as well as await further information from federal agencies responsible for complying with the Plan and its directives.

New regulatory guidance from three federal agencies that enforce private-sector benefits laws will make employers’ daunting 2021 health benefit to-do lists slightly—but only slightly—more manageable heading into 2022.

Most importantly, the frequently asked questions (FAQ) guidance delays several of the most challenging 2021 and 2022 compliance requirements under the Consolidated Appropriations Act, 2021 (CAA) and the Patient Protection and Affordable Care Act (ACA): so-called “advanced explanations of benefits” (EOBs) providing good-faith estimates of the out-of-pocket costs for scheduled medical services; a “price comparison tool” to enable participants to compare cost-sharing amounts for specific network providers; extensive drug cost information that was to have been reported to the federal regulators in December 2021; and public pricing disclosures related to in-network rates, out-of-network allowed costs, and prescription drug prices.

The FAQ guidance, issued August 20, 2021, by the U.S. Department of Labor, U.S. Department of Health and Human Services, and U.S. Department of the Treasury, also provides some relief or useful clarifications related to other key 2021 health benefit compliance items for employers, including gag clauses, identification cards, continuity-of-care requirements, and provider directories.

The FAQ guidance neither delays nor provides other relief related to the new surprise medical billing requirements under the No Surprises Act, which was enacted as part of the CAA and is set to take effect January 1, 2022, or the Mental Health Parity and Addiction Equity Act “comparative analysis” required by the CAA, which is already in effect.

Here is a summary of the key employer takeaways in the new FAQ guidance.

Advanced EOBs

Under the No Surprises Act, plans are required to provide good-faith estimates of expected provider charges for a specific scheduled service, along with good-faith estimates of the cost sharing that would apply to a participant, and the amount already incurred toward any financial responsibility limits. This was initially set to take effect January 1, 2022, but the guidance indicates that the agencies will defer enforcement until regulations are issued on these plan disclosures and the disclosures required by medical providers. (Question 6)

Price Comparison Tool and Public Price Disclosures

Under the No Surprises Act, plans are required to offer online tools and phone support to enable participants to compare cost-sharing amounts for specific network providers in a specific region. Separately, under the ACA, plans are required to offer three “machine-readable files” on a public website covering in-network rates, out-of-network allowable amounts, and prescription drug prices. Both the No Surprises Act and ACA requirements were set to take effect on January 1, 2022. The guidance delays the effective date of the No Surprises Act requirements to January 1, 2023, and the ACA in-network and out-of-network requirements to July 1, 2022. The ACA prescription drug requirement is delayed until the agencies issue regulations on the matter. (Questions 1-3)

Drug Cost Reporting

The CAA requires employer plans to report very detailed prescription drug cost information to the agencies, including the 50 most commonly covered drugs per plan, the 50 most expensive drugs per plan, and the total health spending for each plan broken out into specific categories. The initial reports were to be provided to the agencies by December 27, 2021, and then by June 1, 2022. The agencies will defer enforcement related to the 2021 and 2022 reports until they issue further guidance, though the agencies “strongly encourage plans” to get ready to report 2020 and 2021 plan year data no later than December 27, 2022. (Question 12)

Gag Clauses

Under the CAA, plans cannot enter into network or other agreements that would prevent them from making available provider-specific cost or quality-of-care information to providers or participants, electronically accessing de-identified claims and encounter information for each participant (consistent with privacy laws), or sharing either of those types of information with business associates. Plans have to attest to the agencies each year that they have no such clauses in their agreements. This requirement took effect on enactment of the CAA on December 27, 2020, and is not changed by the FAQ guidance. The agencies have indicated that additional guidance is forthcoming on how plans will attest to their compliance. (Question 7)

Insurance Cards

Under the No Surprises Act, plans have to update physical or electronic insurance cards to include network and out-of-network deductibles and out-of-pocket limits and consumer assistance contact information. This is set to take effect on January 1, 2022, a date unchanged by the FAQ guidance. The guidance does clarify, though, that the agencies will consider both data actually on the cards and data “made available through information that is provided on the ID card.” (Question 4)

Continuity of Care

Under the No Surprises Act, when a provider or network contract is terminated, plans have to take steps to protect hospitalized or other continuing care patients. This requirement will take effect on January 1, 2022. The guidance clarifies that the agencies intend to issue formal regulations on this requirement, but will not do so before the effective date. Until such regulations take effect, plans will be held to a good-faith compliance standard. (Question 10)

Provider Directories

Under the No Surprises Act, plans are required to take several steps to improve provider directories, such as updating them at least every 90 days, and more promptly notifying participants about whether a particular provider is in the network. These requirements will take effect on January 1, 2022, and the guidance does not change that. The agencies do indicate that they intend to issue formal regulations in the future, and may also have specific additional guidance on required disclosure of balance billing information. (Questions 8 and 9)

I understand that your first thought may be that this article has nothing to do with your business and you can skip it.

Please read before you disregard. Your employees will soon receive a union message! You have a short amount of time to decide if that message comes from your organization or if you will wait and your employees will learn all they need to know about unions from the Federal Task Force, whose very existence is to encourage unionizing.

I understand the desire to avoid the topic of unions as in my thirty years of working as an Employer Advocate, I’ve skimmed over union articles, and barely skimmed at that. Unions have never been a real issue for most Florida employers, unless you are Disney or a public service entity/municipality. Yes, we must work within the regulations and rules around Section 7 rights (protected concerted activity) of the National Labor Relations Act, but unions have never been a concern. Nationally, there has been a steady decline in union activity as the rights of employees have continued to expand. What is the threat now? Why does it matter to you?

Biden vowed to be “the most pro-union president you’ve ever seen” and he appears to be living up to that promise. His first order of business, day one in office, was to fire (and replace) the sitting General Counsel of the NLRB, even though his term was set to expire November 2021. This is the first time in history a President has fired the sitting General Counsel!

Biden nominated Marty Walsh to be our Secretary of Labor. Mr. Walsh has been confirmed by the Senate and is now the first union member in nearly 50 years to run the Department of Labor.

Biden’s most recent act to abide by the union promise was an Executive Order to create a task force to encourage worker organizing and collective bargaining.

VP Harris has been tapped to chair the Federal Task Force. The task force has no more than 180 days from the Executive Order to submit recommendations for actions to promote worker organizing and to increase union density.

Most business owners and HR professionals have no history in dealing with a partial workforce rebellion. This could happen in individual companies or it could be a wider industry movement in a city or region. Again, most of us have no history in dealing with unions or collective bargaining, so where do you start? What are you supposed to do and how?

You may wish to start with training your managers. They typically have the pulse of your employees and will be the first to know if organizing starts and will likely be the ones your employees go to with questions. Mostly importantly, they need to know how to report, monitor and legally respond to employees. A manager saying “They will shut this company down, before allowing a union in” is not an appropriate response and could cause you much bigger legal problems.

Next, you will want to talk with your employees. In our current environment, they need to be communicated with regularly, regardless of union activity. It seems, we have spent most of the past year with social media, news outlets and the government focused on dividing the country and our citizens. We’ve been divided by our race, gender, religion, political party, mask and/or COVID vaccine status, views on Second Amendment rights, sexual preference, or how you identify. The media has provided you with a multitude of options to cause division in your community. Wouldn’t it be nice if employees didn’t have to endure division at their place of employment?

Communicating with employees to remind them that they do not need an intermediary to speak with their manager or the company owner is a must! You want to stress that you have good open communication between managers and employees. Remind employees that you offer competitive wages and benefits. If any of this is not true, now is the time to fix it as it will be good for your company as a whole, even if the taskforce doesn’t target your industry. Union organizers will use any real (or imagined) crack in your company’s framework to convince employees of how much better they would be with a union on their side.

You may also consider modernizing your policies in regard to your position on unions, while stressing your company’s open door policy as well as a no solicitation policy.

Remember your people are the reason your company exists, and they need to be reminded and shown that they are valued and appreciated.

Being proactive now is one of the keys to your success when it comes to preventing a union from walking through your front door.

Let us know if you would like any help with implementing a Union Avoidance management training program. With AAG on your side, we will help to ensure your team is prepared to answer employee questions.