Page 1 of 1

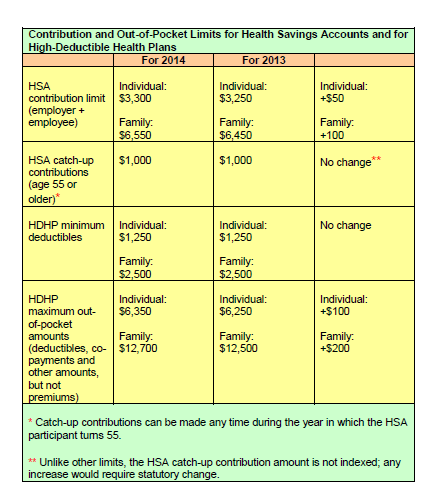

The Internal Revenue Service recently announced higher contributions limits to health savings accounts (HSAs) and for out of pocket spending under qualified high deductible health plans (HDHPs) for 2014.

The IRS provided the inflation adjusted HSA contribution and HDHP minimum deductible and out of pocket limits effective for calendar year 2014. The higher rates reflect a cost of living adjustment (COLA) as well as rounding rules under the IRS Code Sec 223.

A comparison of the 2014 and 2013 limits are below:

The increases in contribution limits and out of pocket maximums from 2013 to 2014 were somewhat lower than increases in years prior.

Those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses face a penalty of 20% of the funds used for those nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

Adult Children Coverage

While the Patient Protection and Affordable Care Act allows parents to add their adult children (up to age 26) to their health plans (and some state laws allow up to age 30 if certain requirements are met), the IRS has not changed its definition of a dependent for health savings accounts. This means that an employee whose 24 year old child is covered on their HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bill.

If account holders can’t claim a child as a dependent on their tax returns, then they can’t spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendant of these) who:

The Patient Protection and Affordable Care Act (the “ACA”) adds a new Section 4980H to the Internal Revenue Code of 1986 which requires employers to offer health coverage to their employees (aka the “Employer Mandate”). The following Q&As are designed to deal with commonly asked questions. These Q&As are based on proposed regulations and final regulations, when issued, may change the requirements.

Question 3: When Is the Employer Mandate Effective and What Transition Rules Apply?

Large employers are subject to the Employer Mandate beginning on January 1, 2014. However, the effective date for employers that have fiscal year health plans is deferred if certain requirements are met. There are also special transition rules for offering coverage to dependents, offering coverage through multi-employer plans, change in status events under cafeteria plans, determining large employer status, and determining who is a full-time employee.

Fiscal Year Health Plans

An employer with a health plan on a fiscal year faces unique challenges concerning the Employer Mandate. Because terms and conditions of coverage may be difficult to change mid-year, a January 1, 2014 effective date would force fiscal year plans to be compliant for the entire fiscal 2013 plan year. Recognizing the potential burdens, the IRS has granted special transition relief for employers that maintained fiscal year health plans as of December 27, 2012. Both transition relief rules apply separately to each employer in a group of related employers under common control.

Coverage of Dependents

Large employers must offer coverage not just to their full-time employees but also to their dependents to avoid the Employer Mandate penalty. A “dependent” for this purpose is defined as a full-time employee’s child who is under age 26. Because this requirement may result in substantial changes to eligibility for some employer-sponsored plans, the IRS is providing transition relief for 2014. As long as employers “take steps” during the 2014 plan year to comply and offer coverage that meets this requirement no later than the beginning of the 2015 plan year, no penalty will be imposed during the 2014 plan year solely due to the failure of the employer to offer coverage to dependents.

Multiemployer Plans

Multiemployer plans represent another special circumstance because their unique structure complicates application of the Employer Mandate rules. These plans generally are operated under collective bargaining agreements and include multiple participating employers. Typically, an employee’s is determined by considering the employee’s hours of service for all participating employers, even though those employers generally are unrelated. Furthermore, contributions may be made on a basis other than hours worked, such as days worked, projects completed, or a percentage of earnings. Thus, it may be difficult to determine how many hours a particular employee has worked over any given period of time.

To ease the administrative burden faced by employers participating in multiemployer plans, a special transition rule applies through 2014. Under this transition rule, an employer whose full-time employees participate in a multiemployer plan will not be subject to any Employer Mandate penalties with respect to such full-time employees, provided that:

(i) the employer contributes to a multiemployer plan for those employees under a collective bargaining agreement or participation agreement

(ii) full-time employees and their dependents are offered coverage under the multiemployer plan, and

(iii) such coverage is affordable and provides minimum value.

This rule applies only to employees who are eligible for coverage under the multiemployer plan. Employers must still comply with the Employer Mandate under the normal rules with respect to its other full-time employees.

Change in Status Events under Fiscal Year Cafeteria Plans

The IRS has also issued transition rules that apply specifically to fiscal year cafeteria plans. Under tax rules applicable to cafeteria plans, an employee’s elections must be made prior to the beginning of the plan year and may not be changed during the plan year, unless the employee experiences a “qualifying event”. An employee’s mid-year enrollment in health coverage through an Exchange or in an employer’s health plan to meet the obligation under the ACA’s individual mandate to obtain health coverage is not a “qualifying event” under the current cafeteria plan rules.

The IRS addresses this by providing that a large employer that operates a fiscal year cafeteria plan may amend the plan to allow for mid-year changes to employee elections for the 2013 fiscal plan year if they are consistent with an employee’s election of health coverage under the employer’s plan or through an Exchange. Specifically, the plan may provide that an employee who did not make a Sec. 125 election to purchase health coverage before the deadline for the 2013 fiscal plan year is permitted to make such an election during the 2013 fiscal plan year, and/or that an employee who made a Section 125 election to purchase health coverage is permitted to revoke/change such election once during the 2013 fiscal plan year, regardless of whether a qualifying event occurs with respect to the employee.

This transition rule applies only to elections related to health coverage and not to any other benefits offered under a cafeteria plan. Any amendment to implement this transition rule must be adopted no later than December 31, 2014 and can be retroactively effective if adopted by such date.

Determining Large Employer Status and Who is a Full-Time Employee

The IRS has also issued transition rules for determining large employer status and determining who is a full-time employee. In general, large employer status is based on the number of employees employed during the immediately preceding year. In order to allow employers to have sufficient time to prepare for the Employer Mandate before the beginning of 2014, for purposes of determining large employer status for 2014 only, employers may use a period of no less than 6 calendar months in 2013 to determine their status for 2014 (rather than using the entire 2013 calendar year).