In a recent statement released by the IRS it advised that it would not accept individual 2017 tax returns that did not indicate whether the individual had health coverage, had an exemption from the individual mandate, or will make a shared responsibility payment under the individual mandate. Therefore, for the first time, an individual must complete line 61 (as shown in previous iterations) of the Form 1040 when filing his/her tax return. This article explains what the new IRS position means for the future of ACA compliance from an employer’s perspective.

First, it will be critical (more so this year than in year’s past) that an employer furnish its requisite employees the Form 1095-C by the January 31, 2018 deadline. In previous years, this deadline was extended (to March 2, 2017 last year). However, with the IRS now requiring the ACA information to be furnished by individual tax day, April 17, 2018, employers will almost certainly have to furnish the Form 1095-C to employees by the January 31, 2018 deadline. This is a tight deadline and will require employers to be on top of their data as the 2017 calendar year comes to a close.

An employee who is enrolled in a self-insured plan will need the information furnished in part III of the Form 1095-C to complete line 61 on his/her tax return. It is reasonable to assume that an employee is more likely to inquire as to the whereabouts of the Affordable Care Act information necessary to complete his/her 2017 tax return. Therefore, the possibility of word getting back to the IRS that an employer is not furnishing the Form 1095-C statements to employees is also likely greater in 2017 compared to past years. Remember, an employer can be penalized $260 if it fails to furnish a Form 1095-C that is accurate by January 31, 2018 to the requisite employees. This penalty is capped at $3,218,500. The $260 per Form penalty and the cap amount can be increased if there is intentional disregard for the filing requirements.

The IRS statement continues the IRS’ trend of being more strenuous with ACA requirements. Many employers have received correspondence from the IRS about missing Forms 1094-C and 1095-C for certain EINs. Frequently, this has been caused by the employer incorrectly filing one Form 1094-C for the aggregated ALE group as opposed to a Form 1094-C for each Applicable Large Employer member (ALE member). While the IRS’ latest statement does not ensure that enforcement of the employer mandate (the section 4980H penalties) is coming soon, one could infer that the IRS will soon be sending out penalty notices with respect to the employer mandate.

With the actions taken by the IRS in 2017, all employers need to be taking the reporting of the Forms 1094-C and 1095-C seriously. As of the date of this publication, the Form 1095-C must be furnished to an employer’s requisite employees by January 31, 2018.

Until very recently, employers were at risk of receiving steep fines if they reimbursed employees for non-employer sponsored medical care – the Affordable Care Act (ACA) included fines of up to $36,500 a year per employee for such an action. Late in 2016, however, President Obama signed the 21st Century Cures Act and established Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs). As of January 1, 2017, small employers can offer these tax-free medical care reimbursements to eligible employees.

If an employee incurs a medical care expense, such as health insurance premiums or eligible medical expenses under IRC Section 213(d), the employer can reimburse the employee up to $4,950 for single coverage or $10,000 for family coverage. Employees may not make any contributions or salary deferrals to QSEHRAs.

The maximum amount must

be prorated for those not eligible for an entire year. For example, an employer

offering the maximum reimbursement amount should only reimburse up to $2,475 to

an employee who has been working for the company for six months. For a complete

list of medical expenses covered under IRC 213(d), see https://www.irs.gov/pub/irs-pdf/p502.pdf.

Employers may tailor which expenses they will reimburse to a certain extent,

and do not have to reimburse employees for all eligible medical expenses.

Much like other healthcare reimbursement arrangements, employees may have to provide substantiation before reimbursement. The IRS has discretion to establish requirements regarding this process, but has not yet done so. Although reimbursements may be provided tax-free, they must be reported on the employee’s W-2 in Box 12 using the code “FF.”

To offer QSEHRAs, an employer cannot be an applicable large employer (ALE) under the ACA. Only employers with fewer than 50 full-time equivalent employees can offer this benefit. Further, a group cannot offer group health plans to any employees to qualify.

Typically, an employer that chooses to offer a QSEHRA must offer it to all employees who have completed at least 90 days of work. The few exceptions to this rule include part-time or seasonal employees, non-resident aliens, employees under the age of 25, and employees covered by a collective bargaining agreement.

Employers may offer differing reimbursement amounts based on employee age or family size. However, such variances must be based on the cost of premiums of a reference policy on the individual market. It is currently unclear which reference policy will be selected or how permitted discrepancies will be calculated.

To be eligible for a tax-free reimbursement, employees must have proof of minimum essential coverage. It is uncertain how closely employers will have to scrutinize such proof, although guidance will hopefully be available soon.

Eligible employees must disclose to health exchanges the amount of QSEHRA benefits available to them. The exchanges will account for the reported amount, even if the employee does not utilize it, and will likely reduce the amount of the subsidies available. Employers should take this into account before adopting a QSEHRA.

In order to establish a QSEHRA, employers will have to set up and administer a plan. Group health plan requirements, such as ACA reporting and COBRA requirements, do not apply to QSEHRAs. But in order to properly provide reimbursements to employees, employers will likely have to establish reimbursement procedures.

Additionally, any eligible employees must be notified of the arrangements in writing at least 90 days before the first day they will be eligible to participate. For the current year, the IRS is giving employers who implement QSEHRAs an extension until March 13, 2017 to provide a notice. The notice must provide the amount of the maximum benefit, and that eligible employees inform health insurance exchanges this benefit is available to them. It also must inform eligible employees they may be subject to the individual ACA penalties if they do not have minimum essential coverage.

The IRS has released final 1094 C and 1095 C forms for 2016 and has posted final instructions as well. The changes from the 2015 forms were minor. However, the instructions for completing the 1094 C and 1095 C forms for 2016 have changed significantly. The changes primarily were more extensive explanations on how to complete the forms.

The final forms and instruction can be found at:

As of now, a full cycle of reporting and penalty determinations has not yet been seen. The due dates for providing the forms and submitting them to the IRS were delayed for the 2015 forms. Employers may not see penalty determinations from the IRS for these forms.

The reporting requirements will affect applicable large employers (ALEs) every year. Employers should establish a process for populating the forms and submitting them to the IRS. If you are responsible for completing these forms, we recommend reviewing the final instructions to ensure understanding of the requirements for completing &submitting the forms.

The following summarizes key points from the 2016 final instructions:

The 2016 instructions are much clearer than the filing instructions from 2015.

The following summarizes key points from the final 2016 Form 1094 C:

The 1094 C has changed minimally for 2016.

The following summarizes key points from the final 2016 Form 1095 C:

A conditional coverage offer to a spouse does not include a spousal surcharge. It does include spousal force outs (spouse not offered coverage if coverage is available through spouse’s employer). Another conditional offer would be if you required spouses to enroll in their employers’ plan, before they could be eligible for your plan.

Employers should start addressing how they will handle reporting for 2016. If you are responsible for completing or checking the forms, read through the instructions. The final 2016 instructions explain more practically the reporting requirements. More examples are included as well.

If you are a self-funded plan and choose to use the B forms for specific non-employees, the B forms and instructions can be found at:

Both the 1095 B forms and the 1095 C forms have a VOID box in the upper right hand corner. Employers are instructed to never check the VOID box.

Both the 1095 B and 1095 C forms include instructions for taxpayers to retain the form with their tax records. It appears these forms will not have to be submitted with tax returns in 2017.

The good faith compliance standard will not apply in 2016 unless the IRS decides at a later date to extend it. In addition, the original deadlines will apply.

Employers should be gearing up now to complete the necessary forms for 2016.

The Affordable Care Act (ACA) established Health Insurance Marketplaces (also called Exchanges) where individuals can shop and enroll in health coverage. Individuals who meet certain criteria are eligible for premium subsidies and cost-sharing reductions for coverage on the Marketplace.

For the first time, in 2016 some employers will receive a notice from a Marketplace indicating that one of their employees signed up for health coverage through the Marketplace and received advanced premium subsidies. Many employers are asking what these notices mean and what actions they should take if they receive one.

Premium subsidies and cost-sharing reductions are designed to expand healthcare coverage by making insurance, and its utilization, more affordable. Premium subsidies, more accurately referred to as a premium tax credit, are claimed on an individual’s income tax return at the end of the year. What is unique about this tax credit is that an individual can choose to have the expected premium tax credit advanced throughout the year, in which case the government makes payments directly to the health insurer on the individual’s behalf. Importantly, individuals who have access to health coverage through an employer that is affordable and meets minimum value are not eligible to receive the premium tax credit or advances of the premium tax credit for their coverage.

The ACA generally requires that applicable large employers – generally employers with 50 or more full-time employees, including full-time equivalents – offer health coverage that is affordable and of minimum value to their full-time employees (and their dependents) or face an Internal Revenue Service (IRS) tax. This is often referred to as the employer “pay or play” or employer mandate provision. Tax liability under this employer provision is triggered if one of the employer’s full-time employees receives a premium tax credit and the amount of the tax liability is determined by the number of full-time employees who received the premium tax credit.

During the Marketplace application process, individuals are asked a host of questions, including questions about access to health coverage through an employer. If the Marketplace determines that the individual does not have access through an employer to coverage that is affordable and meets the required minimum value, and assuming the individual meets other eligibility criteria, advance payments of the premium tax credit can begin.

In such an instance, the Marketplace is required to send the employer a Marketplace notice. This will be the first year the Federally Facilitated Marketplace (FFM) is sending out these notices. It is worth noting that there is not a commitment to send a notice to all employers, and the FFM has said it can send a notice only if the individual provides a complete employer address. Consequently, some employers expecting Marketplace notices may not receive them and notices may not be mailed to the preferred employer address.

The Marketplace notices will give employers advance warning that they may have potential tax liability under the employer mandate of the ACA. However, there are reasons that receiving a notice does not necessarily mean the IRS will be in hot pursuit, including:

The FFM recently posted a sample of its 2016 notice which can be found here.

Please note that the notice suggests that employers should call the IRS for more information if they have questions, however, IRS telephone assistors will be unable to provide information on the Marketplace process, including the appeals process, and will be unable to tell an employer whether they owe a tax under the employer mandate.

An employer who receives a Marketplace notice may want to appeal the decision that the individual was not offered employer coverage that was affordable and of minimum value. An employer has 90 days from the date of the notice to file an appeal, which is made directly to the Marketplace. Importantly, the IRS will independently determine whether an employer has a tax liability, and the employer will have the opportunity to dispute any proposed liability with the IRS. Similarly, an individual will have the opportunity to challenge an IRS denial of premium tax credit eligibility. Any contact by the IRS, however, will occur late in the game after the year’s tax liabilities have already been incurred. Therefore, although an appeal is not required, it may be advisable.

Regardless of whether an employer pursues an appeal, an employer, particularly one that offers affordable, minimum value health coverage, should communicate to its employees about its offering. Although an applicable large employer is required to furnish IRS Form 1095-C to full-time employees detailing the employer’s offer, a better option is providing employees with information before they enroll in Marketplace coverage.

In summary, the Marketplace notice serves as an advance warning that either the employer or the employee may have a tax liability. Given this exposure, employers should review Marketplace notices and their internal records and consider taking action.

Beginning in Spring 2016, the Affordable Care Act (ACA) Exchanges/Marketplaces will begin to send notices to employers whose employees have received government-subsidized health insurance through the Exchanges. The ACA created the “Employer Notice Program” to give employers the opportunity to contest a potential penalty for employees receiving subsidized health insurance via an Exchange.

The notices will identify any employees who received an advance premium tax credit (APTC). If a full-time employee of an applicable large employer (ALE) receives a premium tax credit for coverage through the Exchanges in 2016, the ALE will be liable for the employer shared responsibility payment. The penalty if an employer doesn’t offer full-time equivalent employees (FTEs) affordable minimum value essential coverage is $2,160 per FTE (minus the first 30) in 2016. If an employer offers coverage, but it is not considered affordable, the penalty is the lesser of $3,240 per subsidized FTE in 2016 or the above penalty. Penalties for future years will be indexed for inflation and posted on the IRS website. The Employer Notice Program does provide an opportunity for an ALE to file an appeal if employees claimed subsidies they were not entitled to.

The first batch of notices will be sent in Spring 2016 and additional notices will be sent throughout the year. For 2016, the notices are expected to be sent to employers if the employee received an APTC for at least one month in 2016 and the employee provided the Exchange with the complete employer address.

Last September, the Centers for Medicare and Medicaid Services (CMS) issued FAQs regarding the Employer Notice Program. The FAQs respond to several questions regarding how employers should respond if they receive a notice that an employee received premium tax credits and cost sharing reductions through the ACA’s Exchanges.

Employers will have an opportunity to appeal the employer notice by proving they offered the employee access to affordable minimum value employer-sponsored coverage, therefore making the employee ineligible for APTC. An employer has 90 days from the date of the notice to appeal. If the employer’s appeal is successful, the Exchange will send a notice to the employee suggesting the employee update their Exchange application to reflect that he or she has access or is enrolled in other coverage. The notice to the employee will further explain that failure to provide an update to their application may result in a tax liability.

An employer appeal request form is available on the Healthcare.gov website. For more details about the Employer Notice Program or the employer appeal request form visit www.healthcare.gov.

Although CMS has provided these guidelines to apply only to the Federal Exchange, it is likely that the state-based Exchanges will have similar notification programs.

Employers should prepare in advance by developing a process for handling the Exchange notices, including appealing any incorrect information that an employee may have provided to the Exchange. Advance preparation will enable you to respond to the notice promptly and help to avoid potential employer penalties.

Many employers offer affordable health coverage that meets or exceeds the minimum value requirements of the Affordable Care Act (ACA). However, if one or more of their full-time employees claims the coverage offered was not affordable, minimum value health coverage, the employee could (erroneously) get subsidized coverage on the public health exchange. This would cause problems for applicable large employers (ALEs), who potentially face employer shared responsibility penalties, and for employees, which may have to repay erroneous subsidies.

If an employee does receive subsidized coverage on the public exchange, most employers would want to know about it as soon as possible and appeal the subsidy decision if they believed they were offering affordable, minimum value coverage. There are two ways employers might be notified: (1) by the federally facilitated or state-based exchange or (2) by the Internal Revenue Service (IRS).

Employer notices from exchanges

The notices from the exchanges are intended to

be an early-warning system to employers. Ideally, the exchange would notify

employers when an employee receives an advance premium tax credit (APTC) subsidizing

coverage. The notice would occur shortly after the employee started receiving

subsidized coverage, and employers would have a chance to rectify the situation

before the tax year ends.

In a set of Frequently Asked Questions issued September 18, 2015, the Center for Consumer Information and Insurance Oversight (CCIIO) stated the federal exchanges will not notify employers about 2015 APTCs and will instead begin notifying some employers in 2016 about employees’ 2016 APTCs. The federal exchange employer notification program will not be fully implemented until sometime after 2016.

In 2016, the federal exchanges will only send APTC notices to some employers and will use the employer address given to the exchange by the employee at the time of application for insurance on the exchange. CCIIO realizes some employer notices will probably not reach their intended recipients. Going forward, the public exchanges will consider alternative ways of contacting employers.

Employers that do receive the notice have 90 days after receipt to send an appeal to the health insurance exchange.

Employers that do not receive early notice from the exchanges will not be able to address potential errors until after the tax year is over, when the IRS gets involved.

Employer notices from IRS

The IRS, which is responsible for assessing and

collecting shared responsibility payments from employers, will start notifying

employers in 2016 if they are potentially subject to shared responsibility

penalties for 2015. Likewise, the IRS will notify employers in 2017 of

potential penalties for 2016, after their employees’ individual tax returns

have been processed. Employers will have an opportunity to respond to the IRS

before the IRS actually assesses any ACA shared responsibility penalties.

Regarding assessment and collection of the employer shared responsibility payment, the IRS states on its website:

An employer will not be contacted by the IRS regarding an employer shared responsibility payment until after their employees’ individual income tax returns are due for that year—which would show any claims for the premium tax credit.

If, after the employer has had an opportunity to respond to the initial IRS contact, the IRS determines that an employer is liable for a payment, the IRS will send a notice and demand for payment to the employer. That notice will instruct the employer how to make the payment.

Bottom line

For 2015, and quite possibly for 2016 and future years, the

soonest an employer will hear it has an employee who received a subsidy on the

federal exchange will be when the IRS notifies the employer that the employer

is potentially liable for a shared responsibility payment for the prior year.

The employer will have an opportunity to respond to the IRS before any

assessment or notice and demand for payment is made. The “early-warning system”

of public exchanges notifying employers of employees’ APTCs in the year in

which they receive them is not yet fully operational.

Last week, the IRS issued its “final” versions of the forms 1094-B,1094-C, 1095-B and 1095-C along with instructions for the “B” forms and instructions for the “C” forms. The good news is that the forms are pretty much the same from the drafts released in mid 2014. What has changed is that the revised instructions have filled in some gaps about reporting, some of which are highlighted below:

1. Employers with 50-99 FTEs who were exempt from compliance in 2015 must still file these forms for the 2015 tax year.

2. For employers that cover non-employees (COBRA beneficiaries or retirees being most common), they can use forms 1094-B and 1095-B instead of filing out 1095-C Part III to report for those individuals.

3. With respect to reporting for employees who work for more than one employer member of a controlled group aggregated “ALE”, the employee may receive a report from each separate employer. However, the employer for whom he or she works the most hours in a given month should report for that month.

4. Under the final instructions, a full-time employee of a self-insured employer that accepts a qualifying offer and enrolls in coverage, the employer must provide that employee a 1095-C. The previous draft indicated that it would be enough to simply provide an employee a statement about the offer rather than an actual form

5. For plans that exclude spouses covered or offered health coverage through their own employers, the definition of “offer of health coverage” now provides that an offer to a spouse subject to a reasonable, objective condition is treated as an offer of coverage for reporting purposes.

6. There are some changes with respect to what days can be used to measure the “count” for reporting purposes. Employers are allowed to use the first day of the first payroll period of each month or the last day of the first payroll period of each month, as long as the last day is in the same month as when the payroll period starts. Also, an employer can report offering coverage for a month only if the employer offers coverage for every day of that month. Mid-month eligibilities would presumably be counted as being covered on the first day of the next month. However, in the case of terminations of employment mid-month, the coverage can be treated as offered for the entire month if, but for the termination, the coverage would have continued for the full month.

Now as a refresher about what needs to be filed:

Bear in mind that there is a considerable amount of time between now and the final filing obligation so there may be additional revisions to these instructions, or at least some further clarification. But in the meantime, read the instructions and familiarize yourself with the reporting obligations as well as beginning the steps to collecting the necessary data to make completing the forms next year easier.

Beginning January 1, 2015, employers have new reporting obligations for health plan coverage, to allow the government to administer the “pay or play” penalties to be assessed against employers that do not offer compliant coverage to their full-time employees.

Even though the penalties only apply if there are 100 or more employees for 2015, employers with 50 or more full-time equivalent employees are required to report for 2015. Also, note this reporting is required even if the employer does not maintain any health plan.

Employers that provide self-funded group health coverage also have reporting obligations, to allow the government to administer the “individual mandate” which results in a tax on individuals who do not maintain health coverage.

These reporting obligations will be difficult for most employers to implement. Penalties for non-compliance are high, so employers need to begin now with developing a plan on how they will track and file the required information.

Pay or Play Reporting. Applicable large employers (ALEs) must report health coverage offered to employees for each month of 2015 in an annual information return due early in 2016. ALEs are employers with 50 or more full-time equivalent (FTE) employees. Employees who average 30 hours are counted as one, and those who average less than 30 hours are combined into an equivalent number of 30 hour employees to determine if there are 50 or more FTE employees. All employees of controlled group, or 80% commonly owned employers, are also combined to determine if the 50 FTE threshold is met.

Individual Mandate Reporting. Self-funded employers, including both ALEs and small employers that are not ALEs, must report each individual covered for each month of the calendar year. For fully-insured coverage, the insurance carrier must report individual month by month coverage. The individual mandate reporting is due early in 2016 for each month of 2015.

Which Form? ALE employers have one set of forms to report both the pay or play and the individual mandate information – Forms 1094C and 1095C. Insurers and self-insured employers that are not ALEs use Forms 1094B and 1095B to report the individual mandate information. Information about employee and individual coverage provided on these forms must also be reported by the employer to its employees as well as to COBRA and retiree participants. Forms 1095B and 1095C can be used to provide this information, or employers can provide the information in a different format.

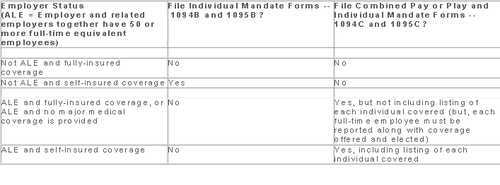

The following chart summaries which returns are filed by employers:

Who Reports? While ALE status is determined on a controlled group basis, each ALE must file separate reports. Employers will need to provide insurance carriers, and third party administrators who process claims for self-funded coverage (if they will assist the employer with reporting), accurate data on the employer for whom each covered employee works. If an employee works for more than one ALE in a controlled group, the employer for whom the highest number of hours is worked does the reporting for that employee.

Due Date for Filing. The due date of the forms matches the due dates of Forms W-2, and employers may provide the required employee statements along with the W-2. Employee reporting is due January 31st and reporting to the IRS is due each February 28th, although the date is extended until March 31st if the forms are filed electronically. If the employer files 250 or more returns, the returns must be filed electronically. Reporting to employees can only be made electronically if the employee has specifically consented to receiving these reports electronically.

Penalties. Failure to file penalties can total $200 per individual for whom information must be reported, subject to a maximum of $3 million per year. Penalties will not be assessed for employers who make a good faith effort to file correct returns for 2015.

What Information is Required? For the pay or play reporting, each ALE must file a Form 1094C reporting the number of its full-time employees (averaging 30 hours) and total employees for each calendar month, whether the ALE is in a “aggregated” (controlled) group, a listing of the name and EIN of the top 30 other entities in the controlled group (ranked by number of full-time employees), and any special transition rules being used for pay or play penalties. ALE’s must also file a 1095C for each employee who was a full-time employee during any calendar month of the year. The 1095C includes the employee’s name, address and SSN, and month by month reporting of whether coverage was offered to the employee, spouse and dependents, the lowest premium for employee only coverage, and identification of the safe-harbor used to determine affordability. This information is used to determine pay or play penalty taxes and to verify the individuals’ eligibility for subsidies toward coverage costs on the Federal and state exchanges.

If the ALE provides self-funded coverage, the ALE must also report on the 1095C the name and SSN of each individual provided coverage for each calendar month. If an employer is not an ALE, but is self-funded, the name and SSN of each covered individual is reported on the 1095B and the 1094B is used to transmit the forms 1095B to the IRS.

A chart is available that sets out what data must be reported on each form, to help employers determine what information they need to track. Click here to access the chart.

Next Steps. Employers will need to determine how much help their insurance carrier or TPA can provide with the reporting, and then the employer’s HR, payroll and IT functions will need to work together to be sure the necessary information is being tracked and can be produced for reporting in January 2016.

The Affordable Care Act will require Applicable Large Employers (i.e. large employers subject to the employer mandate) and employers sponsoring self-insured plans to comply with new annual IRS reporting requirements. The first reporting deadline will be February 28, 2016 as to the data employers collect during the 2015 calendar year. The reporting provides the IRS with information it needs to enforce the Individual Mandate (i.e. individuals are penalized for not having health coverage) and the Employer Mandate (i.e. large employers are penalized for not offering health coverage to full-time employees). The IRS will also require employers who offer self-insured plans to report on covered individuals.

Large employers and coverage providers must also provide a written statement to each employee or responsible individual (i.e. one who enrolls one or more individuals) identifying the reported information. The written statement can be a copy of the Form.

The IRS recently released draft Forms 1094-C and 1095-C and draft Forms 1094-B and 1095-B, along with draft instructions for each form.

Which Forms Do I File?

When?

Statements to employees and responsible individuals are due annually by January 31. The first statements are due January 31, 2016.

Forms 1094-B, 1095-B, 1094-C and 1095-C are due annually by February 28 (or by March 31, if filing electronically). The first filing is due by February 28, 2016 (or March 31, 2016, if filing electronically).

Even though the forms are not due until 2016, the annual reporting will be based on data from the prior year. Employers need to plan ahead now to collect data for 2015. Many employers have adopted the Look Back Measurement Method Safe Harbor (“Safe Harbor”) to identify full-time employees under the ACA. The Safe Harbor allows employers to “look back” on the hours of service of its employees during 2014 or another measurement period. There are specific legal restrictions regarding the timing and length of the periods under the Safe Harbor, so employers cannot just pick random dates. Employers also must follow various rules to calculate hours of service under the Safe Harbor. The hours of service during the measurement period (which is likely to include most of 2014) will determine whether a particular employee is full-time under the ACA during the 2015 stability period. The stability period is the time during which the status of the employee, as full-time or non-full-time, is locked in. In 2016, employers must report their employees’ full-time status during the calendar year of 2015. Therefore, even though the IRS forms are not due until 2016, an employee’s hours of service in 2014 will determine how an employer reports that employee during each month of 2015. Employers who have not adopted the Safe Harbor should consider doing so because it allows an employer to average hours of service over a 12-month period to determine the full-time status of an employee. If an employer does not adopt the Safe Harbor, the IRS will require the employer to make a monthly determination, which is likely to increase an employer’s potential exposure to penalties.

What Must the Employer Report?

Form 1095-C

There are three parts to Form 1095-C. An applicable large employer must file one Form 1095-C for each full-time employee. If the applicable large employer sponsors self-insured health plans, it must also file Form 1095-C for any employee who enrolls in coverage regardless of the full-time status of that employee.

Form 1095-C requires the employer to identify the type of health coverage offered to a full-time employee for each calendar month, including whether that coverage offered minimum value and was affordable for that employee. Employers must use a code to identify the type of health coverage offered and applicable transition relief.

Employers that offer self-insured health plans also must report information about each individual enrolled in the self-insured health plan, including any full-time employee, non-full-time employee, employee family members, and others.

Form 1094-C

Applicable large employers use Form 1094-C as a transmittal to report employer summary information and transmit its Forms 1095-C to the IRS. Form 1094-C requires employers to enter the name and contact information of the employer and the total number of Forms 1095-C it submits. It also requires information about whether the employer offered minimum essential coverage under an eligible employer-sponsored plan to at least 95% of its full-time employees and their dependents for the entire calendar year, the number of full-time employees for each month, and the total number of employees (full-time or non-full-time) for each month.

Form 1095-B

Employers offering self-insured coverage use Form 1095-B to report information to the IRS about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment. These employers must file a Form 1095-B for eachindividual who was covered for any part of the calendar year. The employer must make reasonable efforts to collect social security numbers for covered individuals.

Form 1094-B

Employers who file Form 1095-B will use Form 1094-B as a transmittal form. It asks for the name of the employer, the employer’s EIN, and the name, telephone number, and address of the employer’s contact person.

Failure to Report – What Happens?

The IRS will impose penalties for failure to timely provide correct written statements to employees. The IRS will also impose penalties for failure to timely file a correct return. For the 2016 reporting on 2015 data, the IRS will not impose a penalty for good faith compliance. However, the IRS specified that good faith compliance requires that employers provide the statements and file the returns.

Under the Patient Protection and Affordable Care Act (PPACA), beginning in 2015, certain large employers who do not offer affordable health insurance that provides minimum value to their full-time employees may be subject to significant penalties.

In a nutshell, in 2015, “applicable large employers” will be subject to an annualized employer “shared responsibility” penalty of $2,000 (indexed) per full-time employee (minus the first 80 full-time employees in 2015) if the employer does not offer health insurance to at least 70% of their full-time employees and their dependents. This amount will be increase from 70% to 95% after 2015. This is commonly referred to as the “Pay or Play” penalty.

Even if an applicable large employer offers insurance coverage to full-time employees, the employer still could be subject to an annualized penalty of $3,000 (indexed) per employee who receives an Exchange subsidy if the offered employer-sponsored health coverage does not meet minimum value standards or is not affordable. This $3000 penalty is capped at the amount that would apply if the $2,000 penalty described above were to apply.

What should an employer do now to prepare for these penalties?

(A) Determine if they are an “applicable large employer” -To do this, employers should count both full-time employees and part-time employee hours as follows:

1) Count the full-time employees for each month in the prior year.

2) Count the full-time equivalents for each month in the prior year.

a) Add total hours for non-full-time employees but count no more than 120 hours per month for any one non-full-time employee.

b) Divide the number obtained in (a) by 120. This is the full-time equivalent number.

3) Add the numbers obtained in (1) and (2) above (i.e., the full-time employee and full-time equivalent numbers) for each month.

4) Add the 12 sums obtained in (3) and divide by 12. This is the average number of full-time employees and full-time equivalents.

5) If this number obtained in (4) is under 50 (or under 100 for the 2015 determination for certain employers), the employer is not an applicable large employer for the year being determined.

Note: The applicable large employer is determined on a controlled group basis. For example, if there are three companies, each of which is wholly owned by the same parent company, the companies are all considered one employer for this calculation. Also note that, special transition rules apply in determining applicable large employer status for 2015 and that a special seasonal employee exception may apply even if the threshold in (5) is exceeded.

(B) If an employer will be an applicable large employer in 2015, it should determine whether it could be subject to penalties in 2015. For example, the employer should review its group health plan to determine if the insurance coverage is “offered” to full-time employees meets minimum value standards and is considered affordable to employees.

© An employer also will need to address how it will determine the full-time status of employees – will it use the “monthly measurement period” or the “look back measurement period.” This is particularly important for employers who have many variable-hour employees or seasonal employees.

(D) If the employer’s group health plan does not meet the threshold tests to avoid the penalties noted above, the employer should evaluate whether it wants to restructure its health care offerings or pay the penalties (which are non-deductible).

(E) Finally, employers should review their data collection procedures to ensure that they will be able to report the healthcare information required to be reported for 2015 (the actual reporting will occur in 2016 for the 2015 calendar year). Insurers, sponsors of self-insured plans, and other entities that provide minimum essential coverage during a calendar year will be required to report certain information to the IRS and to participants. In addition, applicable large employers will be required to report about the coverage they provide to both the IRS and to their employees. Drafts of the IRS forms to be used in reporting this information have recently been published (Form 1095-B, Form 1095-B Transmittal, Form 1095-C, Form 1095-C Transmittal). Employers should review these forms to understand the data that will need to be reported.

It is not too late for employers to take action now to avoid penalties in 2015.