Page 1 of 1

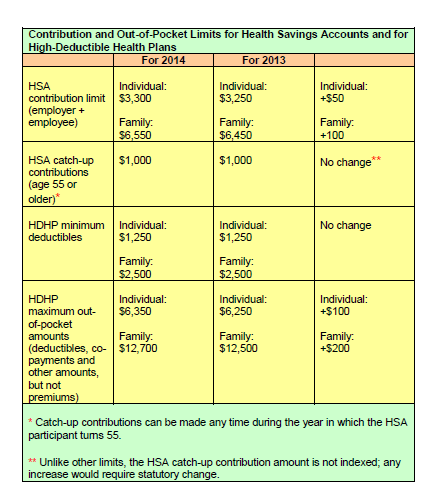

The Internal Revenue Service recently announced higher contributions limits to health savings accounts (HSAs) and for out of pocket spending under qualified high deductible health plans (HDHPs) for 2014.

The IRS provided the inflation adjusted HSA contribution and HDHP minimum deductible and out of pocket limits effective for calendar year 2014. The higher rates reflect a cost of living adjustment (COLA) as well as rounding rules under the IRS Code Sec 223.

A comparison of the 2014 and 2013 limits are below:

The increases in contribution limits and out of pocket maximums from 2013 to 2014 were somewhat lower than increases in years prior.

Those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses face a penalty of 20% of the funds used for those nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

Adult Children Coverage

While the Patient Protection and Affordable Care Act allows parents to add their adult children (up to age 26) to their health plans (and some state laws allow up to age 30 if certain requirements are met), the IRS has not changed its definition of a dependent for health savings accounts. This means that an employee whose 24 year old child is covered on their HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bill.

If account holders can’t claim a child as a dependent on their tax returns, then they can’t spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendant of these) who: