Under the Affordable Care Act, (ACA) a fund for a new nonprofit corporation to assist in clinical effectiveness research was created. To aid in the financial support for this endeavor, certain health insurance carriers and health plan sponsors are required to pay fees based on the average number of lives covered by welfare benefits plans. These fees are referred to as either Patient-Centered Outcome Research Institute (PCORI) or Clinical Effectiveness Research (CER) fees.

The applicable fee was $2.26 for plan years ending on or after October 1, 2016 and before October 1, 2017. For plan years ending on or after October 1, 2017 and before October 1, 2018, the fee is $2.39. Indexed each year, the fee amount is determined by the value of national health expenditures. The fee phases out and will not apply to plan years ending after September 30, 2019.

As a reminder, fees are required for all group health plans including Health Reimbursement Arrangements (HRAs), but are not required for health flexible spending accounts (FSAs) that are considered excepted benefits. To be an excepted benefit, health FSA participants must be eligible for their employer’s group health insurance plan and may include employer contributions in addition to employee salary reductions. However, the employer contributions may only be $500 per participant or up to a dollar for dollar match of each participant’s election.

HRAs exempt from other regulations would be subject to the CER fee. For instance, an HRA that only covered retirees would be subject to this fee, but those covering dental or vision expenses only would not be, nor would employee EAPs, disease management programs and wellness programs be required to pay CER fees.

In a recent statement released by the IRS it advised that it would not accept individual 2017 tax returns that did not indicate whether the individual had health coverage, had an exemption from the individual mandate, or will make a shared responsibility payment under the individual mandate. Therefore, for the first time, an individual must complete line 61 (as shown in previous iterations) of the Form 1040 when filing his/her tax return. This article explains what the new IRS position means for the future of ACA compliance from an employer’s perspective.

First, it will be critical (more so this year than in year’s past) that an employer furnish its requisite employees the Form 1095-C by the January 31, 2018 deadline. In previous years, this deadline was extended (to March 2, 2017 last year). However, with the IRS now requiring the ACA information to be furnished by individual tax day, April 17, 2018, employers will almost certainly have to furnish the Form 1095-C to employees by the January 31, 2018 deadline. This is a tight deadline and will require employers to be on top of their data as the 2017 calendar year comes to a close.

An employee who is enrolled in a self-insured plan will need the information furnished in part III of the Form 1095-C to complete line 61 on his/her tax return. It is reasonable to assume that an employee is more likely to inquire as to the whereabouts of the Affordable Care Act information necessary to complete his/her 2017 tax return. Therefore, the possibility of word getting back to the IRS that an employer is not furnishing the Form 1095-C statements to employees is also likely greater in 2017 compared to past years. Remember, an employer can be penalized $260 if it fails to furnish a Form 1095-C that is accurate by January 31, 2018 to the requisite employees. This penalty is capped at $3,218,500. The $260 per Form penalty and the cap amount can be increased if there is intentional disregard for the filing requirements.

The IRS statement continues the IRS’ trend of being more strenuous with ACA requirements. Many employers have received correspondence from the IRS about missing Forms 1094-C and 1095-C for certain EINs. Frequently, this has been caused by the employer incorrectly filing one Form 1094-C for the aggregated ALE group as opposed to a Form 1094-C for each Applicable Large Employer member (ALE member). While the IRS’ latest statement does not ensure that enforcement of the employer mandate (the section 4980H penalties) is coming soon, one could infer that the IRS will soon be sending out penalty notices with respect to the employer mandate.

With the actions taken by the IRS in 2017, all employers need to be taking the reporting of the Forms 1094-C and 1095-C seriously. As of the date of this publication, the Form 1095-C must be furnished to an employer’s requisite employees by January 31, 2018.

The health reform law imposes a number of fees, taxes and other assessments on health insurance companies and sponsors of self-funded health plans to help subsidize a number of endeavors. One such fee funds the Patient-Centered Outcomes Research Institute (PCORI).

The PCORI fee for calendar year plans is $2.26 per covered life for the 2016 plan year, and must be reported on (and remitted with) IRS Form 720 by July 31, 2017. For non-calendar year plans, if the 2015-16 plan year ended on or before Sept. 30, 2016, the fee is $2.17 per covered life. If the 2015-16 plan year ended between Oct. 1 and Dec. 31, 2016, the fee is $2.26 per covered life. In either case, the filings are similarly due by July 31, 2017. (Note: The Form 720 must be filed by July 31 of the calendar year that begins after the last day of the plan year.)

For self-funded plans, the employer/plan sponsor will be responsible for submitting the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee is not permitted for self-funded plans. The process for remitting payment by sponsors of self-funded plans is described in more detail below.

The IRS will collect the fee from the insurer or, in the case of self-funded plans, the plan sponsor/employer in the same way many other excise taxes are collected. IRS regulations provide three options for determining the average number of covered lives (actual count, snapshot and Form 5500 method).

The U.S. Department of Labor believes the fee cannot be paid from plan assets. In other words, the PCORI fee must be paid by the plan sponsor; it is not a permissible expense of a self-funded plan and cannot be paid in whole or part by participant contributions. The IRS has indicated the fee is, however, a tax-deductible business expense for employers with self-funded plans.

The filing and remittance process to the IRS is straightforward and largely unchanged from last year. On page two of Form 720, under Part II, the employer needs to designate the average number of covered lives under its “applicable self-insured plan.” The number of covered lives is multiplied by the applicable amount ($2.26 or $2.17) to determine the total fee owed to the IRS. The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.” Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’s software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

With the Republicans’ failure to pass a bill to repeal and replace the Affordable Care Act (ACA), employers should plan to remain compliant with all ACA employee health coverage and annual notification and information reporting obligations.

Even so, advocates for easing the ACA’s financial and administrative burdens on employers are hopeful that at least a few of the reforms they’ve been seeking will resurface in the future, either in narrowly tailored stand-alone legislation or added to a bipartisan measure to stabilize the ACA’s public exchanges. Relief from regulatory agencies could also make life under the ACA less burdensome for employers.

“Looking ahead, lawmakers will likely pursue targeted modifications to the ACA, including some employer provisions,” said Chatrane Birbal, senior advisor for government relations at the Society for Human Resource Management (SHRM). “Stand-alone legislative proposals have been introduced in previous Congresses, and sponsors of those proposals are gearing up to reintroduce bills in the coming weeks.”

These legislative measures, Birbal explained, are most likely to address the areas noted below.

(more…)

Repeal and replacement of the Affordable Care Act (ACA) by the American Health Care Act (AHCA) may be underway in Washington D.C., but until a final version of the AHCA is signed into law, the ACA is the law of the land. In fact, the IRS is currently issuing notices to employers that require them to disclose whether they complied with ACA large employer reporting duties, or their excuse for not doing so, where applicable.

The ACA required large employers to furnish employee statements (Forms 1095-C) and file them with the IRS under transmittal Form 1094-C, and the Internal Revenue Code (“Code”) imposes separate penalty taxes for failing to timely furnish and file the required forms. Large employer reporting was required for 2015 and 2016, even if transition relief from ACA penalty taxes applied for 2015. The potential penalties can be very large – up to $500 per each 2015 Form 1095-C statement ($250 for not furnishing the form to the employee and $250 for not filing it with IRS) – up to a total annual penalty liability of $3 million. The penalty amounts and cap are periodically adjusted for inflation.

Employers that failed to furnish Form 1095-C and file copies with Form 1094-C may receive the IRS notices, called “Request for Employer Reporting of Offers of Health Insurance Coverage (Forms 1094-C and 1095-C)” and also known as Letter 5699 forms. Forms may be received regarding reporting for 2015 or 2016. Employers that receive a Letter 5699 form will have only thirty days to complete and return the form, which contains the following check boxes:

The Letter also provides: “[i]f you are required to file information returns under IRC Section 6056, failure to comply may result in the assessment of a penalty under IRC Section 6721 for a failure to file information returns.”

Employers receiving Letter 5699 forms should contact their benefit advisors immediately and plan to respond as required within the thirty-day limit; it may be necessary to request an extension for employers that are just realizing that they have reporting duties and need to prepare statements for enclosure with their response. In this regard, the IRS offers good faith relief from filing penalties for timely filed but incomplete or incorrect returns for 2015 and 2016, but relief from penalties for failures to file entirely for those years is available only upon a showing of “reasonable cause,” which is narrowly interpreted (for instance, due to fire, flood, or major illness).

Large employers should not look to coming ACA repeal/replacement process for relief from filing duties and potential penalties. The House version of the AHCA does not change large employer reporting duties and it is unlikely the Senate or final versions of the law will do so. This is largely because procedural rules limit reform/repeal provisions to those affecting tax and revenue measures, which would not include reporting rules. Thus the reporting component of the ACA will likely remain intact (though it may be merged into Form W-2 reporting duties), regardless of the ACA’s long-term fate in Washington.

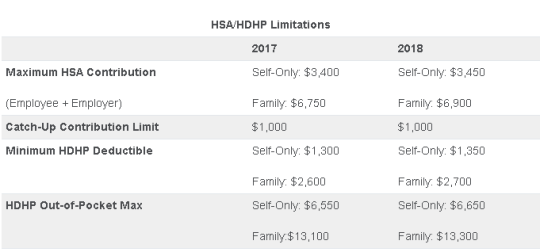

On May 4, 2017, the IRS released Revenue Procedure 2017-37 setting dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for 2018. HSAs are subject to annual aggregate contribution limits (i.e., employee and dependent contributions plus employer contributions). HSA participants age 55 or older can contribute additional catch-up contributions. Additionally, in order for an individual to contribute to an HSA, he or she must be enrolled in a HDHP meeting minimum deductible and maximum out-of-pocket thresholds. The contribution, deductible and out-of-pocket limitations for 2018 are shown in the table below (2017 limits are included for reference).

Note that the Affordable Care Act (ACA) also applies an out-of-pocket maximum on expenditures for essential health benefits. However, employers should keep in mind that the HDHP and ACA out-of-pocket maximums differ in a couple of respects. First, ACA out-of-pocket maximums are higher than the maximums for HDHPs. The ACA’s out-of-pocket maximum was identical to the HDHP maximum initially, but the Department of Health and Human Services (which sets the ACA limits) is required to use a different methodology than the IRS (which sets the HSA/HDHP limits) to determine annual inflation increases. That methodology has resulted in a higher out-of-pocket maximum under the ACA. The ACA out-of-pocket limitations for 2018 were announced are are $7350 for single and $14,700 for family.

Second, the ACA requires that the family out-of-pocket maximum include “embedded” self-only maximums on essential health benefits. For example, if an employee is enrolled in family coverage and one member of the family reaches the self-only out-of-pocket maximum on essential health benefits ($7,350 in 2018), that family member cannot incur additional cost-sharing expenses on essential health benefits, even if the family has not collectively reached the family maximum ($14,700 in 2018).

The HDHP rules do not have a similar rule, and therefore, one family member could incur expenses above the HDHP self-only out-of-pocket maximum ($6,650 in 2018). As an example, suppose that one family member incurs expenses of $10,000, $7,350 of which relate to essential health benefits, and no other family member has incurred expenses. That family member has not reached the HDHP maximum ($14,700 in 2018), which applies to all benefits, but has met the self-only embedded ACA maximum ($7,350 in 2018), which applies only to essential health benefits. Therefore, the family member cannot incur additional out-of-pocket expenses related to essential health benefits, but can incur out-of-pocket expenses on non-essential health benefits up to the HDHP family maximum (factoring in expenses incurred by other family members).

Employers should consider these limitations when planning for the 2018 benefit plan year and should review plan communications to ensure that the appropriate limits are reflected.

Yesterday (May 4, 2017) , the House of Representatives narrowly passed the American Health Care Act of 2017 (AHCA), which contains major parts that would repeal and replace the Affordable Care Act (commonly referred to as Obamacare or ACA). The next obstacle the bill faces is making it through the Senate, which proves to be a formidable challenge.

The nonpartisan Congressional Budget Office has not had time yet to analyze the current version of the bill, but this is expected next week. The bill must now pass the Senate and could get pushed back to the House if it sees changes in the upper chamber.

In the meantime, here are some highlights we know about the bill based on how it is written today and how it would work:

We will continue to keep you up to date on the bill as it progress through legislation.

Until very recently, employers were at risk of receiving steep fines if they reimbursed employees for non-employer sponsored medical care – the Affordable Care Act (ACA) included fines of up to $36,500 a year per employee for such an action. Late in 2016, however, President Obama signed the 21st Century Cures Act and established Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs). As of January 1, 2017, small employers can offer these tax-free medical care reimbursements to eligible employees.

If an employee incurs a medical care expense, such as health insurance premiums or eligible medical expenses under IRC Section 213(d), the employer can reimburse the employee up to $4,950 for single coverage or $10,000 for family coverage. Employees may not make any contributions or salary deferrals to QSEHRAs.

The maximum amount must

be prorated for those not eligible for an entire year. For example, an employer

offering the maximum reimbursement amount should only reimburse up to $2,475 to

an employee who has been working for the company for six months. For a complete

list of medical expenses covered under IRC 213(d), see https://www.irs.gov/pub/irs-pdf/p502.pdf.

Employers may tailor which expenses they will reimburse to a certain extent,

and do not have to reimburse employees for all eligible medical expenses.

Much like other healthcare reimbursement arrangements, employees may have to provide substantiation before reimbursement. The IRS has discretion to establish requirements regarding this process, but has not yet done so. Although reimbursements may be provided tax-free, they must be reported on the employee’s W-2 in Box 12 using the code “FF.”

To offer QSEHRAs, an employer cannot be an applicable large employer (ALE) under the ACA. Only employers with fewer than 50 full-time equivalent employees can offer this benefit. Further, a group cannot offer group health plans to any employees to qualify.

Typically, an employer that chooses to offer a QSEHRA must offer it to all employees who have completed at least 90 days of work. The few exceptions to this rule include part-time or seasonal employees, non-resident aliens, employees under the age of 25, and employees covered by a collective bargaining agreement.

Employers may offer differing reimbursement amounts based on employee age or family size. However, such variances must be based on the cost of premiums of a reference policy on the individual market. It is currently unclear which reference policy will be selected or how permitted discrepancies will be calculated.

To be eligible for a tax-free reimbursement, employees must have proof of minimum essential coverage. It is uncertain how closely employers will have to scrutinize such proof, although guidance will hopefully be available soon.

Eligible employees must disclose to health exchanges the amount of QSEHRA benefits available to them. The exchanges will account for the reported amount, even if the employee does not utilize it, and will likely reduce the amount of the subsidies available. Employers should take this into account before adopting a QSEHRA.

In order to establish a QSEHRA, employers will have to set up and administer a plan. Group health plan requirements, such as ACA reporting and COBRA requirements, do not apply to QSEHRAs. But in order to properly provide reimbursements to employees, employers will likely have to establish reimbursement procedures.

Additionally, any eligible employees must be notified of the arrangements in writing at least 90 days before the first day they will be eligible to participate. For the current year, the IRS is giving employers who implement QSEHRAs an extension until March 13, 2017 to provide a notice. The notice must provide the amount of the maximum benefit, and that eligible employees inform health insurance exchanges this benefit is available to them. It also must inform eligible employees they may be subject to the individual ACA penalties if they do not have minimum essential coverage.