Page 1 of 1

Health Care Reform requires most self-funded and fully-insured group health plans to obtain a Health Plan Identifier (HPID). The HPID is a 10-digit number that will be used to identify the plan in covered electronic HIPAA transactions (for example,electronic communications between the plan and certain third parties regarding health care claims, health plan premium payments, or health care electronic fund transfers).

Large health plans (plans with annual receipts in excess of $5 million) must obtain an HPID by November 5, 2014. Small health plans have until November 5, 2015 to comply. “Receipts” for this purpose appear to be claims paid.

Who is Responsible? For self-funded plans, the plan sponsor is responsible for obtaining an HPID (third-party administrators cannot obtain an HPID on behalf of a self-funded plan sponsor). Although it appears that most insurers will obtain the HPID on behalf of fully-insured plans, some insurers are requiring the plan sponsor to obtain an HPID.

Application Process. To sign up for an HPID, plan sponsors must first be registered within the Centers for Medicare & Medicaid Services’ (CMS) Health Insurance Oversight System (HIOS) .

The individual responsible for applying will need to sign up as an individual and request to be linked to the relevant company. The individual will then complete the requested information (including company name, address, and EIN, authorizing official information, and the plan’s “Payer ID” number or “NAIC” number).

Some self-funded plan sponsors have reported difficulty with the registration process because self-funded plans do not have a Payer ID or NAIC number. Although CMS has not yet released any formal guidance on this issue, it is expected that self-funded plans will enter “not applicable” for the Payer ID and either leave the NAIC number blank or use the plan sponsor’s EIN in lieu of the NAIC number.

Once the required information has been submitted, an authorized individual within the company must request access to the HIOS. CMS will then grant access to the HIOS system by electronically sending an authorization code to the authorized individual.

The CMS website has step-by-step instructions via a “cheat sheet” and a YouTube video explaining the entire process.

Next Steps. The registration process can be time consuming as there are a number of different registration screens to work through, the collection of the required data may be cumbersome, and delays have been reported within the CMS registration portal. Accordingly, plan sponsors of large self-funded group health plans may wish to begin the registration process as soon as possible in order to meet the November 5, 2014 deadline. Plan sponsors for fully-insured plans should contact the plan’s insurer to see if the insurer will apply for the HPID on behalf of the plan.

The IRS has announced higher limits for 2014 contributions to health savings accounts (HSAs).The increased amounts reflect cost of living adjustments.

For 2014, the HSA contribution limit is $3300 for an individual and $6550 for a family. The HSA catch up contribution for those age 55 or older will remain at $1000. For an medical plan to be considered a qualified HDHP that can be paired with an HSA, it must have a minimum deductible of $1250 for an individual and $2500 for a family.

For those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses, they face a 20% penalty of 20% for nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

While the PPACA allows parents to add their adult children up to age 26 onto their medical plans, the IRS has not changed its definition of a dependent for HSAs. This means that an employee whose 24 year old child is covered on his HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bills. If HSA account holders can’t claim a child as a dependent on their tax returns, then they can not spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendent of these) who:

Please contact our office with questions on high deductible health plans (HDHPs) as well as Health Saving Accounts (HSAs).

As 2014 nears, small employers should begin to prepare for more and more of the Affordable Care Act (ACA) requirements they will need to comply with.

One of the important changes that will affect groups on their first renewal date in 2014 is the change of waiting periods on their insurance contracts. Effective in 2014, no benefit eligibility waiting period can exceed 90 days. This means that the large majority of employers will need to revise their current insurance contracts at their 2014 renewal to ensure they are in compliance. Most insurance carriers will not automatically update the group’s waiting period so it is in compliance without guidance from the employer, so be sure to review any carrier requirements during your renewal process.

The longest waiting period that a group can implement for insurance benefits is either one where benefits will begin on the 91st day of full time employment or the 1st of the month following 60 days of employment. Each employer needs to evaluate the pros and cons of each type of waiting period as it will affect no only how the insurance carriers bill you for the premiums due, but also how the employee is added and removed from the policy at their termination.

Employers should also review their Section 125 Cafeteria Plan to ensure it all reflect the most accurate benefit information as well as the updated waiting period.

Please contact our office for further guidance on the ACA requirements that will affect your business and how you can ensure you are compliant.

Florida’s minimum wage is currently $7.79 per hour. Beginning January 1, 2014, Florida’s minimum wage will increase to $7.93 per hour, which is a 1.7% (or $0.14) increase from last year.

Employers of “tipped employees” who meet eligibility requirements for the tip credit under the Fair Labor Standards Act (FLSA) may count tips actually received as wages under the FLSA. The employer, however, must pay “tipped employees” a direct wage. Effective January 1, 2014, the new minimum wage for tipped employees should become $4.91 per hour plus tips.

Florida law requires a new minimum wage calculation each year on September 30, based on the Consumer Price Index. If that calculation is higher than the federal rate (which is currently $7.25 per hour), the state’s rate would take effect the following January.

Please contact our office if you need a copy of the 2014 Florida Minimum Wage Poster. This will need to be posted in a visible place for all employees by January 1, 2014.

With the open enrollment period for the Exchange beginning October 1, 2013, many questions are beginning to surface regarding how premium subsidies will work as individuals start to evaluate all of their options available to them.

Q1: It sounds like individuals who choose to buy health insurance on the Exchange will have to pay the full monthly premium for the coverage they choose and subsidies will be paid through tax credit that are received annual as a tax refund. How can a low income person who is living paycheck to paycheck afford this?

A: When consumers apply for a plan on the Exchange (aka marketplace), you will be asked to provide income information to determine if you are eligible for a premium tax credit (aka subsidy). A subsidy will be available to people with incomes up to 400% of the federal poverty level ($45,960 for an individual in 2013 or $94,200 for a family of four).

If you qualify for the subsidy, consumers can opt to receive their tax credits in advance, and the exchange will send the money directly to the insurer every month. This subsidy will reduce the amount you owe up front on your medical premium. You can also choose, instead, to receive your credit when you file your taxes the following year.

It is important to estimate your income as accurately as possible and to contact the Exchange during the year if you find out that you are making more or less than expected. When completing your 2014 taxes, your estimate will be reconciles with what you actually earned. If you have received more than you were due, you could have to repay those amounts.

Q2: What happens if I do not pay my premium in a timely manner after I have purchased insurance on the Exchange? If I am terminated from the policy, will I be able to have it re-instated?

A:Consumers who are receiving premium tax credit for coverage on the Exchange will have a 90 day grace period to catch up on late premiums. Other consumers who do not receive a subsidy may get more or less time, depending on the Exchange rules. Once the grace period has passed, consumers will generally have to wait until the next annual open enrollment period in the fall to re-enroll in coverage. Please note though, if an individual goes uninsured for more than 3 months, they could be assess a penalty for not having insurance coverage of up to $95, or 1% of income in 2014, whichever is greater.

Please contact our office for assistance with evalutating your options and obtaining coverage through the Exchange.

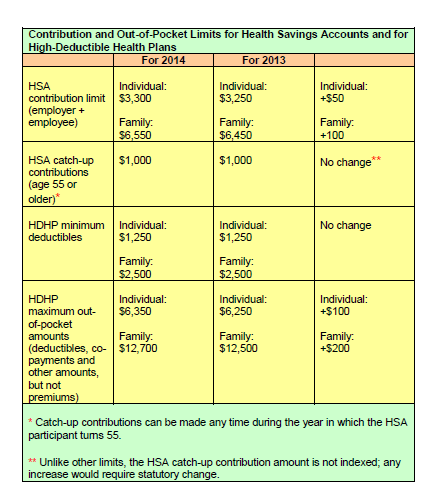

The Internal Revenue Service recently announced higher contributions limits to health savings accounts (HSAs) and for out of pocket spending under qualified high deductible health plans (HDHPs) for 2014.

The IRS provided the inflation adjusted HSA contribution and HDHP minimum deductible and out of pocket limits effective for calendar year 2014. The higher rates reflect a cost of living adjustment (COLA) as well as rounding rules under the IRS Code Sec 223.

A comparison of the 2014 and 2013 limits are below:

The increases in contribution limits and out of pocket maximums from 2013 to 2014 were somewhat lower than increases in years prior.

Those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses face a penalty of 20% of the funds used for those nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

Adult Children Coverage

While the Patient Protection and Affordable Care Act allows parents to add their adult children (up to age 26) to their health plans (and some state laws allow up to age 30 if certain requirements are met), the IRS has not changed its definition of a dependent for health savings accounts. This means that an employee whose 24 year old child is covered on their HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bill.

If account holders can’t claim a child as a dependent on their tax returns, then they can’t spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendant of these) who:

If you currently have an individual health insurance plan, you will be in for a big change when you sign up for your coverage in 2014.

Approximately 50% of the individual health plans that are currently being sold in the marketplace do not meet the standards of Obamacare to be sold in 2014. The reason for this is because the Affordable Care Act (ACA) sets new minimums for the basic coverage every individual health care plan must provide effective on renewals on or after January 1, 2014.

About 15 million Americans (or about 6% of non-elderly adults) currently have coverage in the individual health market. Beginning in the fall of 2013, they will be able to shop for and enroll in health insurance through state-based exchanges (aka SHOP or The Exchange) with coverage taking effect in January. By 2016, it is projected that around 24 million people will get their insurance through the exchanges, while another 12 million will continue to obtain individual coverage outside of the exchange.

Beginning in 2014, nearly all plans, both group and individual, will be required to cover an array of “essential” services regardless of if they are purchased within the exchange or not. These “essential” services will include medication, maternity, and mental health care. Many individual plans do not currently offer these benefits.

What will happen to the plans that do not meet the new minimum standards? They will more than likely disappear and you will not be allowed to renew your existing coverage on the plan you currently have. A handful of existing plans will be grandfathered in, but the qualifying criteria for a grandfathered plan is hard to meet. In order for your existing individual plan to be considered “grandfathered”, (1) you have to have been enrolled on this plan before the ACA was passed in 2010 and (2) the plan has to have maintained fairly steady co-pay, deductible and coverage rates until now.

Many insurers in the individual marketplace have already acknowledged that the majority of their existing individual plans do not meet Obamacare standards for 2014 and they are currently working to ready new product lineups for 2014.

In the future, consumers buying individual plans will be able to choose between four levels of coverage: platinum, gold, silver, and bronze.

Platinum plans will carry the highest premiums but will offer the lowest out of pocket expenses, with enrollees paying no more than 10%, on average. At the other end of the spectrum are the bronze plans, which will have the lowest monthly premiums but will have higher deductibles and copayments totaling up to 40% of the out of pocket costs on average.

Starting also in 2014, all Americans will be required to carry health care coverage or face fines. Those penalties will start at $95 per adult or 1% of the adjusted family income, whichever is greater, and will escalate in later years.

Individuals will annual incomes of up to 400% of the poverty line (or roughly $45,000 for an individual and about $92,000 for a family of four) will get federal subsidies to help defray the premium costs.

Most individual plans sold next year, even the lowest level bronze plans, are likely to charge higher premiums than today’s most “bare-bones” individual insurance plans. Many consumers feel the costs will be offset by having lower out of pocket costs and more comprehensive coverage than their current “bare-bones” plan offers.

In today’s marketplace, with deductibles of $10,000, an individual can buy a policy and then when they get sick, they may go broke because the policy leaves them with such a high level of out of pocket expenses to pay. Many insurance industry experts feel, however, that consumers may now wind up with more coverage–and higher monthly costs– than they want. As a result, some individuals may just choose to simply pay the fine instead of obtaining health insurance coverage they will not use or can not afford.

Our topic this month covers the new I-9 form that was recently released as well as various considerations for 2014.

Areas discussed include:

Contact us today for more information on this topic.