If you accepted expired forms of identification from new employees who completed their I-9 forms during the pandemic, your deadline for updating them with current proofs of identification is fast approaching. The Department of Homeland Security recently announced that it was winding down its temporary policy that had allowed for expired List B (proof of identification) documents to be used when completing I-9s because of COVID-related difficulties in renewing such I.D. documents. You have until July 31 to update your I-9 forms to get into compliance with the law. What do you need to know about this fast-approaching deadline?

How We Ended Up Where We Are

In response to the COVID-19 pandemic, the Department of Homeland Security issued a number of temporary policies easing Form I-9 compliance. One of them was the COVID-19 Temporary Policy for List B Identity Documents.

Under this policy, employers were allowed to accept expired List B (proof of identification) documents. Many state and local agencies were under lockdown, so it was difficult – if not impossible – for individuals to renew expired documents such as drivers’ licenses, school I.D. cards, Native American tribal documents, and others.

What’s Changed?

The Department rescinded this temporary policy on May 1 and began again to require employers to accept only unexpired List B documents. USICS recently announced that employers who accepted expired List B documents prior to May 1, 2022, will have until July 31,2022 to update their Forms I-9.

What Should You Do?

Specifically, for employees hired between May 1, 2020 and April 30, 2022 who presented an expired List B document, you need to have them to present to you:

Important Notes

You do not need to update documents for affected employees who are no longer employed.

When updating List B documentation, you should enter the document’s:

Your representative should initial and date the change.

If the List B document was auto-extended by the issuing authority, making it unexpired when it was presented, no update is needed. For example, many states automatically extended the expiration date of certain drivers’ licenses due to COVID. Those documents would not need updating.

Remote I-9 Verification Remains in Place – For Now

This move by DHS does not affect its decision to extend its remote I-9 verification flexibility policy, which has been extended once again to October 31, 2022.

Under that temporary policy, if employees hired on or after April 1, 2021, work exclusively in a remote setting due to COVID-19-related precautions, they are temporarily exempt from the I-9’s physical inspection requirements until they undertake non-remote employment on a regular, consistent, or predictable basis, or the extension of the flexibilities related to such requirements is terminated by DHS, whichever is earlier.

Conclusion

With these constantly evolving rules, employers who have adjusted their document inspection protocols during the pandemic may be at a higher risk for expensive monetary fines, potentially running in the thousands of dollars. Now is a good time to review your I-9 files and process to ensure continued compliance.

Transparency in Coverage mandates and COVID-19 considerations continue to dominate the discussion in the employee benefits compliance space this summer, but an “old faithful” reporting requirement looms soon: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The typical due date for the PCORI fee is July 31, but because that date falls on a Sunday in 2022, the effective due date is pushed to the next business day, which is Aug. 1.

The filing and payment due by Aug. 1, 2022, is required for policy and plan years that ended during the 2021 calendar year. For plan years that ended Jan. 1, 2021 – Sept. 30, 2021, the fee is $2.66 per covered life. For plan years that ended Oct. 1, 2021 – Dec. 31, 2021 (including calendar year plans that ended Dec. 31, 2021), the fee is calculated at $2.79 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is typically due by July 31 of the year following the last day of the plan year to which the payment relates, but this year the due date pushes to Aug. 1.

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2021 the plan year ended) to determine the total fee owed to the IRS.

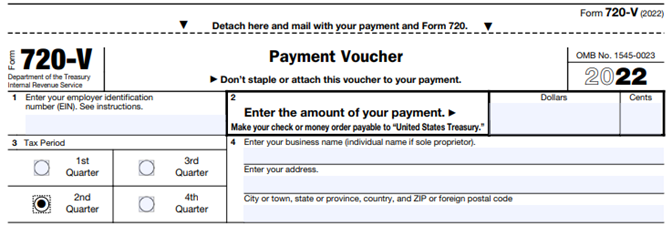

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.

On April 19, 2022, the Departments of Labor, Health and Human Services, and the Treasury issued additional guidance under the Transparency in Coverage Final Rules issued in 2020. The guidance, FAQs About Affordable Care Act Implementation Part 53, provides a safe harbor for disclosing in-network healthcare costs that cannot be expressed as a dollar amount. They also serve as a timely reminder of the pending July 1, 2022, deadline to begin enforcing the Final Rules.

Background

The Final Rules require non-grandfathered health plans and health insurance issuers to post information about the cost to participants, beneficiaries, and enrollees for in-network and out-of-network healthcare services through machine-readable files posted on a public website. The Final Rules for this requirement are effective for plan years beginning on or after January 1, 2022 (an additional requirement for disclosing information about pharmacy benefits and drug costs is delayed pending further guidance). The Final Rules require that all costs be expressed as a dollar amount. After the Final Rules were published, plans and issuers pointed out that under some alternative reimbursement arrangements in-network costs are calculated as a percentage of billed charges. In those cases, dollar amounts cannot be determined in advance.

FAQ Safe Harbor

The FAQs provide a safe harbor for disclosing costs under a contractual arrangement where the plan or issuer agrees to pay an in-network provider a percentage of billed charges and cannot assign a dollar amount before delivering services. Under this kind of arrangement, they may report the percentage number instead of a dollar amount. The FAQs also provide that where the nature of the contractual arrangement requires the submission of additional information to describe the nature of the negotiated rate, plans and issuers may describe the formula, variables, methodology, or other information necessary to understand the arrangement in an open text field. This is only permitted if the current technical specifications do not support the disclosure via the machine-readable files.

Public Website Requirement

This guidance is pretty narrow and of most interest to plans, issuers, and third-party administrators responsible for the technical aspects of the disclosure. Still, it is a helpful reminder to plan sponsors that the July 1st enforcement deadline for these requirements is rapidly approaching. As a reminder, for fully insured plans the plan sponsor is considered the insurance carrier. However, for self or level funded medical plans the plan sponsor is the employer so they will be the one responsible making sure they are meeting the transparency disclosure requirements. Plans sponsors should remember that these machine-readable files must be posted on a public website. The Final Rules clearly state that the files must be accessible for free, without having to establish a user account, password, or other credentials and without submitting any personal identifying information such as a name, email address, or telephone number. If a third-party website hosts the files, the plan or issuer must post a link to the file’s location on its own public website. Simply posting the files on an individual plan website or the Plan Sponsor’s company intranet falls short of these requirements. Regardless of how a plan opts to comply, The July 1st deadline is right around the corner.

More than 3,300 workers at 70 British companies, ranging from small consultancies to large financial firms, have started working a four-day week with no loss of pay in what organizers of the program call the world’s biggest trial of a shorter workweek.

The pilot program, which launched on June 6 and will run for six months, is organized by the nonprofit 4 Day Week Global, with offices in London and New York City, in partnership with the London-based thinktank Autonomy, the UK’s 4 Day Week Campaign, and researchers at Cambridge University, Oxford University and Boston College.

The researchers will analyze how employees respond to having an extra day off, studying areas such as stress and burnout, job and life satisfaction, health, sleep, energy use and travel.

Joe O’Connor, chief executive of 4 Day Week Global, said the pilot programs puts the UK at the forefront of the four-day week movement. “As we emerge from the pandemic, more and more companies are recognizing that the new frontier for competition is quality of life, and that reduced-hour, output-focused working is the vehicle to give them a competitive edge,” he told The Guardian.

On June 6, O’Connor tweeted, “This is a historic day, as the lives of over 3,000 workers and their families are transformed by the pioneering, forward-thinking approach of their firms to embrace a new approach to how we organize work.”

Shorter Workweek Options

Participating employers in the pilot program agreed to adjust working hours to accord with one of the following options:

4 Day Week Global said it advocates for a “100-80-100” model: 100 percent of pay for workers, who put in 80 percent of their traditional working time, in exchange for maintaining 100 percent of their productivity, according to the group’s website.

Weighing Pros and Cons

The British pilot program follows several other shorter workweek trials in different countries. “Trials by big companies such as Microsoft in Japan and Buffer in the U.S. have shown that a four-day week boosts productivity,” the UK’s 4 Day Week Campaign posted on its website.

“For the next 6 months more than 3,000 UK workers will enjoy the equivalent of a standard bank holiday every single week,” the group tweeted. “And the best thing about it? This could be the future of work for everyone.”

But maybe not. An article in the Harvard Business Review recently pointed out that a study of New Zealand’s move to the four-day workweek found that “not only was work intensified following the change, but so too were managerial pressures around performance measurement, monitoring and productivity,” according to the article’s authors, researchers Emma Russell at the University of Sussex, Caroline Murphy at the University of Limerick and Esme Terry at Leeds University.

“The New Zealand four-day workweek trial rings some alarm bells in that reductions in working days did not necessarily create well-being benefits as workers struggled to meet the demands of their job roles,” the researchers noted. “It is perhaps telling that much of the publicity around the success of Microsoft Japan’s four-day workweek trial rested on how productivity increased substantially during the study period. Employers may need to be careful about promoting outputs over well-being if they want to be seen as investing in their workforce’s work-life balance.”

Still, there is ample evidence that many employees and job candidates would favor the move to a four-day workweek.

Employees Want Flexibility

Ladders, a San Francisco based recruitment firm for executives and professionals, recently surveyed more than 400 job candidates who are active on its search service platform and found that 79 percent said they have already left or would leave a five-day workweek job for a four-day workweek job, provided there is no drop in salary.

“While this strongly indicates an edge in hiring for employers that offer four-day workweeks, nothing is set in stone,” said Ladders CEO Dave Fisch.

The decision to try a shorter workweek should be made after “a careful weighing of the pros and cons for their businesses,” he advised.

However, employers that don’t pursue a shorter workweek may want to “consider other flexible options, or they may find themselves struggling to keep and replace talented people going forward,” Fisch said.

Flexible Schedules as an Alternative Alicia Garcia, chief culture officer at MasterControl, a global technical support company based in Salt Lake City, favors greater flexibility around scheduled hours as an alternative to shorter workweeks. “The biggest issue with a four-day workweek is that it is still rigid,” she said. Whether it is a four- or five-day workweek, “the exact days and times employees are required to work are fixed.” When approached by employees, she said, “the most common request is for ‘flexibility.’ They ask if they can pick up children from school every day and log back in, take an afternoon exercise class, or take a break when the day is feeling stressful. Rarely does the number of hours an employee works surface in these discussions.” She added, “doctor appointments, dentist visits and school performances don’t always fall on the same day of the week.” Garcia advised companies to trust employees to schedule flexibility into their workweek. “Supervisors and managers know if work is getting done and getting done well. They should be empowered to allow flexibility in their teams,” she said. “By developing a culture where managers are trusted to make the best decisions and, in turn, trust their teams to ensure work is covered, companies can develop future senior leaders and recruit the best talent in the market.” |

Citing soaring gas prices, the Internal Revenue Service (IRS) on June 9 announced an increase in the optional standard mileage rate for the final six months of 2022.

Effective July 1 through Dec. 31, 2022, the standard mileage rate for the business use of employees’ vehicles will be 62.5 cents per mile—the highest rate the IRS has ever published—up 4 cents from the 58.5 cents per mile rate effective for the first six months of the year.

The rate is used to compute the deductible costs of operating an automobile for business use, as an alternative to tracking actual costs. Beyond the individual tax deduction, employers often use the standard mileage rate—also called the safe harbor rate—to pay tax-free reimbursements to employees who use their own cars, vans or trucks to conduct business for their employers.

Organizations are typically required to reimburse their workforce for the business use of their mixed-use assets, or personally owned assets such as vehicles that are required for their jobs.

Employers have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

The IRS normally updates standard mileage rates once a year in the fall for the next calendar year. For vehicle use from Jan. 1 through June 30, 2022, employers and employees should use the rates set forth in IRS Notice 2022-03.

While fuel costs are a significant factor in the mileage figure, other items enter into the calculation of mileage rates, such as depreciation and insurance and other fixed and variable costs, the IRS noted. For cars employees use for business, the portion of the standard mileage rate treated as depreciation will stay at 26 cents per mile for 2022.

Midyear increases in the optional mileage rates are rare. The last time the IRS made such an increase was in 2011.

In a surprise move, federal immigration officials recently announced that they will permit remote review of new hires’ I-9 documentation for those who work exclusively in a remote setting due to COVID-19 related precautions through October 31, 2022. According to the April 25th announcement, U.S. Immigration and Customs Enforcement (ICE) has said that the requirement that employers inspect employees’ Form I-9 identity and employment eligibility documentation in-person applies only to those employees who physically report to work at a company location on any regular, consistent, or predictable basis for at least the next six months. Could this continued flexibility be a welcome sign of things to come?

(more…)

Have you received a text from a random number in the last few days? Perhaps the text looks quite obviously suspicious, but it could pass as legitimate – especially if you are distracted or multitasking while scrolling through your device. The text contains a link asking you to confirm the delivery or receipt of a package. Or it tells you that you have just paid a bill. Or need to pay an outstanding bill. Or it could just be advertising a random product. These texts are actually scams that have been dubbed “smishing” – combining “SMS” and “phishing” – and your employees are no doubt receiving them, too. In a remote-work era where a multitude of attackers are attempting to gain access to your company network through digital vulnerabilities, the time is now for employers to guard yourself against this latest weapon in the cyberwar raging all around us. What are the five steps your organization can take today to best prepare?

What is Smishing?

“Smishing” is a version of phishing carried out over SMS (short message service, commonly known as texting) channels. The senders of these malicious texts are trying to get hold of personal information, passwords, and money.

Smishers start by sending a text impersonating a reputable company. Typical smishing attempts specifically involve using the name of common parcel carriers informing you that your package has been delivered, or fake texts seemingly coming from a bank, company vendor, or other common company name. The messages almost always have a link. Unfortunate recipients who click that link will often end up having unsuspecting malware downloaded to their devices, or will be lead to a legitimate-looking form to “log in” and voluntarily provide a trove of valuable data.

Smishing is the New Cyberattack

There is ample evidence indicating a rapid increase in smishing attempts. Smishing attacks increased 24% in the U.S. alone and 69% globally last year. According to data from the Federal Trade Commission, 21% of fraud reports that were filed in 2021 involved smishing. That’s 377,840 out of the total 1,813,832 reports that identify a contact method. Of those hundreds of thousands of claims, a total of $131 million was lost, with an average of $900 per report.

Work-from-home and hybrid work arrangements have led your employees to use their mobile phones and company devices at an increasing rate. This has led many of these smishing attacks to have a workplace component.

What Can Employers Do? A 5-Step Plan to Combat Smishing

So what can you do to address this latest cyber-concern? Here are five steps your organization can take to put yourself in the best position.

The new 2023 limits are:

HSA – Single $3,850 / Family $7,750 per year

HDHP (self-only coverage) – $1,500 minimum deductible / $7,500 out-of-pocket limit

HDHP (family coverage) – $3,000 minimum deductible / $15,000 out-of-pocket limit

You may recall the Seinfeld episode where Elaine Benes consumes a $29,000 piece of cake from the 1937 wedding of the Duke and Duchess of Windsor. A birthday cake from an office party in Kentucky may have that pricey wedding slice beat. If you haven’t heard already, a Kentucky jury just served an employer with a $450,000 bill associated with a surprise office birthday party gone awry. Does this massive legal loss spell the end of office birthday parties as we know them? Thankfully, no. Despite the media attention the April 15th verdict has garnered, it had less to do with the fact that the employer threw a surprise party than with how it handled the situation – and particularly the fallout. All kidding aside, this case has important reminders for employers about how you should handle disabilities in the workplace – and you can easily avoid a similar fate by following some commonsense steps.

The Worst Birthday Party Ever?

This case stemmed from a surprise birthday party thrown by Gravity Diagnostics LLC for lab worker Kevin Berling. According to his lawsuit, Berling suffered from an anxiety disorder and specifically asked his office manager not to celebrate his birthday party in the office. Coincidentally, the office manager was out of the office on Berling’s big day and his co-workers decided to plan him a surprise birthday celebration. When Berling caught wind of it, he alleged that he suffered a panic attack and spent his lunch period hiding out in his car.

But it’s what happened next that was particularly damning for the employer. According to Berling, his managers subsequently called him into a meeting and scolded and belittled him for his reaction. In fact, according to media reports, Berling said he was accused of “stealing his co-workers’ joy.

This in turn led him to suffer another panic attack where he used methods such as clenching his fists to deescalate the situation. According to the lawsuit, his behavior alarmed the employer, who feared Berling might respond violently. He says they asked him to immediately leave the property. He alleged that the company terminated him several days later.

Berling sued his ex-employer for disability discrimination and by the time the case went to the jury the only claim to decide was whether Gravity Diagnostics reasonably failed to reasonably accommodate his disability. After deliberating for merely one and one-half hours, the jury awarded Berling $450,000 – which consisted of $120,000 in lost wages and benefits, $30,000 in future lost earnings, and $300,000 for pain and suffering, mental anguish, embarrassment, humiliation, mortification, and loss of self-esteem. At some point in the near future, the court will tack on reasonable attorneys’ fees and costs, which could considerably increase the final tally that Gravity has to pony up to Berling.

All in all, that’s a costly payout for a birthday cake and some decorations.

What Can You Do to Avoid a Similar Fate?

What went so wrong with this seemingly joyous occasion? The alleged facts of the case offer some simple steps for employers to take to avoid a similar fate:

There was some dispute in this case about whether Berling had explicitly informed his employer about his anxiety order. Regardless of what happened here, it’s a good reminder to be attuned to your employees that may have disabilities and are seeking reasonable accommodations – even if not specifically couched in those terms.

If an employee is expressing significant unease with an office social function, they may very well be signaling that they suffer from some form of disability such as an anxiety disorder. A request not to throw a party or to not participate in a similar workplace function could be construed by a court as a request for a reasonable accommodation if the employee ties such request to something that is health related. At a minimum, you should be aware that issues such as this could trigger your obligation to engage in an interactive process to discuss this issue further with your employees.

While many employees are excited about returning to the office, seeing co-workers again, and getting back into the swing of social interactions at work, you should be aware that this may not be the universal sentiment for all employees. In the post-pandemic world, many employees may still be cautious or even fearful about such social interactions – especially those who may be immunocompromised or live with vulnerable family members.

As much as you may want to promote employee engagement and interaction, you should realize we are in a new era. Some employees may simply choose to be more cautious while interacting with others. After the trauma of the last two years, in fact, some employees may find that this discomfort rises to the level of an anxiety disorder or similar disability.

You should train your employees – especially HR folks and front-line supervisors and managers – to be attentive to such issues. They should know the specific steps to take in response to requests for reasonable accommodations and handling potential disabilities. The outcome in this case may very well have been avoided had the employer provided good training to the office manager and other employees about how to respond in such situations. Leaving employees to navigate these issues on their own and figure things out “on the fly” is almost always a recipe for disaster.

Before taking any adverse action against a worker, you should consider working with appropriate staff to look into whether there have been performance issues, disabilities, or any mitigating circumstances before making a final decision to discipline an employee. This process should be well-documented and consistent across the board.

In this case, the company alleged that it was concerned about violent behavior by Berling and acted on its “zero tolerance” policy towards workplace violence in making the decision to discharge him.

Depending on the circumstances, removing an employee from the workplace may be the right call from a workplace violence prevention standpoint. If an employee makes a threat or commits an act of violence, termination may simply be the best course of action. When an employee has not made a direct threat but you have witnessed behavior that may suggest the employee could be violent, you may want to remove the employee from the workplace until you can more carefully evaluate what you observed and make an informed decision concerning continued employment. This would include following up by asking the right questions, investigating, and figuring out what was happening with the employee in the specific situation. In some cases, a “cooling off” period of paid leave might be worth considering to assess the situation further and determine the appropriate course of action – rather than immediately making the decision to terminate without having all the facts.

Conclusion

Cases such as this generate a lot of attention and buzz due to their novelty. The facts of this case may certainly be unique. But cases like this are a good reminder for all employers to take a step back and contemplate how you would have handled a similar situation, and what you would have done differently. Keeping the points above in mind may help you avoid a similar outcome and ending up with egg (or birthday cake) on your face.