Now that most states, the CDC, and OSHA have (or may soon) lift mask mandates for vaccinated workers, what is an employer to do about revealing an employee’s vaccination status? Under any relaxed masking guidance applicable to those who are fully vaccinated, customers, visitors, and co-workers are likely to draw their own conclusions about the vaccination status of everyone else in the workplace based upon whether or not they are wearing a mask. This addresses some of the legal and practical considerations for employers dealing with a partially vaccinated workforce and provides seven options for you to consider as you navigate this rapidly evolving area.

The Push to Unmask

Anxious to get back to normal after more than a year of mask mandates and social distancing, employers and employees are ready to do away with COVID-19 restrictions. Employees in certain industries (such as health care workers and educators) will likely continue to be required to mask up and social distance for the foreseeable future. However, other employers are developing various approaches and policies to lift masking requirements for employees (and others) who are fully vaccinated following new CDC and OSHA guidance.

Unmasking Employees Based On “Proof” of Vaccination

“Proof” of vaccination status is and will continue to be a significant consideration for employers when lifting mask mandates. Indeed, many employees are under the mistaken belief that an employer cannot ask vaccine status. However, per the guidance of the EEOC and other state agencies, you are permitted to request vaccination status. In California, local health authorities such as in Santa Clara County, have already mandated that businesses and government entities ascertain the vaccination status of all employees, independent contractors, and volunteers who are or will be working at a facility or worksite in the county.

Indeed, the inquiry may be required to determine which employees can and which employees cannot unmask. As an example, the Oregon Occupational Safety and Health Administration has already issued guidance that requires employers to “verify the vaccination status” of workers before permitting them to unmask. The CDC, OSHA, and many state authorities agree that only those employees who are fully vaccinated can follow relaxed COVID-19 protocols, while those who are not fully vaccinated must continue to observe safety protocols such as mask wearing and social distancing. During COVID-19 inspections, OSHA will likely require employers to show how they have documented or “verified” vaccination status where employees are permitted to work under the relaxed COVID-19 safety protocols.

In determining an employee’s vaccine status, however, you must carefully limit any vaccine-related inquiry only to vaccination status and not inquire further, as such follow-up could improperly elicit information about an employee’s medical disability or other family medical information. Given that this is likely considered medical information, such information should be kept separate and confidential. Additionally, employers subject to the CCPA in states such as California need to understand that collecting vaccine-related information triggers the CCPA notice obligation.

Navigating State Limitations on Requiring Proof of Vaccination Status

Even though some federal, state, or local agencies may require or request that employers track employee vaccine status, there is a growing move in some states to protect vaccine status as confidential, private information. States are literally all over the map when it comes to vaccine disclosure or use of so called “vaccine passports.” Some states have adopted or are considering laws that promote vaccine passports. New York, for example, launched a COVID-19 vaccine passport initiative known as the Excelsior Pass that allows users to provide proof of vaccination where required. Other states, like Hawaii, have or are considering similar passport systems that promote vaccine disclosure to assist in safe reopening of business and public access.

However, many other states have gone in the opposite direction to protect individual privacy rights. These states have acted to restrict vaccine passports, with government entities and businesses barred from requiring proof of vaccinations. For example, Florida Governor Ron DeSantis recently signed into law a statute that prohibits the use of vaccine passports by government entities or businesses, stating that “in Florida, your personal choice regarding vaccinations will be protected and no business or government entity will be able to deny you services based on your decision.” Other states such as Alabama, Arizona, Idaho, Indiana, Iowa, Georgia, South Carolina, South Dakota, Texas, and Wyoming have also restricted vaccine passports or requirements.

Arkansas and Montana have taken a more aggressive approach to address individuals’ privacy concerns and limit disclosure of vaccination status. Governor Hutchinson signed into law a statute that prevents state and local government entities from requiring proof of vaccinations as a condition of employment or to access goods and services. The law provides some exceptions for state-owned medical facilities. Montana Governor Gianforte has signed into law a statute that provides even greater protections for the unvaccinated, generally prohibiting employers from requiring any of the current vaccinations.

Given the fluidity in this area, you should remain mindful of the need to monitor these developments and check with counsel before implementing any vaccine-tracking policies.

Additional Landmines if Fully Vaccinated Employees Unmask

Aside from the spate of state and local government restrictions and mandates, employers face other potential legal landmines and practical problems when tracking and/or disclosing an employee’s vaccination status. As mentioned above, you should consider the legal privacy considerations in requesting and maintaining the vaccination status of employees.

As employers move to allow fully vaccinated workers to unmask employees, there will likely be legal, privacy, and employee morale issues related to any express or perceived disclosure of employee vaccination status. Indeed, even without an explicit disclosure, others will likely be able to decipher the vaccination status of employees. While employees are choosing to voluntarily disclose their vaccination status to their co-workers, you should not adopt such a casual attitude. You should consider the ramifications of disclosure of vaccine status without employee consent or as a result of a “company policy” or practice. Such practices could potentially give rise to exposure in areas of breach of confidentiality, privacy, discrimination, retaliation, and more.

Company disclosure of vaccine status may also inadvertently expose employees with legitimate disability issues or religious objections related to the vaccine. Employee morale could be compromised if employees believe they are being pitted against each other due to their vaccine status, especially if the company is somehow involved in the disclosures. Additionally, a policy of company-wide disclosure might even boomerang, potentially discouraging employees who do not want to be ridiculed or harassed by co-workers who are opposed to the vaccination.

What Should Employers Do? 7 Options to Address a Partially Vaccinated Workforce

How to relax restrictions for those who are fully vaccinated while maintaining confidentiality and a safe workplace for all? How to balance the possible exposure and potential federal and state safety agency fines if you don’t get it right? While there are rarely clear answers, and legal liabilities remain unclear, below are some options employers have been adopting to deal with the dilemma of the partially vaccinated workforce.

Conclusion

Each of these options come with some level of risk. You should explore the various paths available to you with your legal counsel before adopting any of them, especially in light of rapidly changing state and local laws in this area. Also, note that every option in which some employees are masked and some are unmasked includes the risk of employee conflict or harassment issues. This risk should be evaluated and addressed up front through training, ongoing communications emphasizing the importance of mutual respect in the workplace, adoption of written policies and procedures, and effective management oversight.

The EEOC kicked off the unofficial start of summer with a bang by clearing the way for employers to offer their employees incentives to get the COVID-19 vaccine in new guidance released on the eve of the Memorial Day weekend. The May 28 updates to the agency’s COVID-19 Technical Assistance guidance now provides employers with two clear options, drawing a key distinction based on who administers the shot:

Regardless of which path you travel, there are still hoops to jump through if you want to provide vaccine incentives – providing accommodations, ensuring confidentiality, etc. – but you now have a clear direction to take to encourage your workers towards vaccination. What do you need to know about this critical update?

Why Was This Guidance Necessary?

Before we take a deeper dive into discussing the options and other considerations, some employers may be wondering why this guidance was even necessary. Couldn’t you just offer some cash or PTO or some other reward to induce employee behavior without concern about the legal ramifications?

The main sticking point troubling employers for months concerned wellness program rules. Historically, the EEOC has indicated it didn’t want employers to force employees to make medical-related decisions through the use of incentives. Until this latest guidance, the EEOC believed that too significant of an incentive could coerce employees to participate, thus leading to legal violations if employees are “forced” to disclose protected medical information to gain the incentive. Through rules, guidance, and federal litigation, the EEOC has taken steps to ensure that any employment decisions in this regard were genuinely voluntary.

Earlier this year, the EEOC issued a proposed rule expressly permitting only de minimis incentives as passing muster under participatory wellness programs. The proposed rule contained language referring to a permissible incentive as a “water bottle” or something of equivalent value. However, the Biden administration withdrew the proposed rule under a regulatory freeze typically seen when new leadership takes charge at the White House. The proposed rule is still pending review and it is unclear when or what form it may re-emerge. Against the backdrop of this uncertainty, employers have been attempting to navigate the thorny path of vaccine incentives, concerned that offering robust incentives could bring about a higher legal risk. At the urging of business groups seeking clarity on the matter, the EEOC finally heeded the call and provided the certainty that employers have been craving.

Option 1: Unlimited Incentives

Under the first option, you are seemingly permitted to provide unlimited incentives to your workforce so long as your employees voluntarily provide you with documentation or other confirmation they received the COVID-19 vaccine, and they received the vaccination on their own from a third-party provider that is not an “agent” of your organization. The EEOC describes such third parties as pharmacies, public health departments, or other health care providers in the community.

Option 2: Restricted Incentives

On the other hand, if employees are voluntarily vaccinated by you or your “agent,” you can offer only incentives that are “not so substantial as to be coercive.” Which leads to two questions: what is an “agent,” and how substantial is “substantial”?

Definition of “Agent” and How to Avoid This Designation

Definition of “Substantial” and How to Avoid Violations

Other Considerations

Whichever path you take, there are several other considerations to keep in mind when offering vaccine incentives based on voluntary inoculations.

Accommodations

Some employees may have legitimate medical or religious reasons not to get vaccinated, and failure to provide them with the same types of incentives could lead to claims under the Americans with Disabilities Act (ADA) or Title VII. You will need to consider offering alternative means by which an employee can earn an incentive if they cannot be vaccinated due to a disability or sincerely held religious belief. Alternative ways to earn the incentive might be watching a workplace COVID-19 safety video or reviewing CDC literature on mitigating the spread of COVID-19 in the workforce.

Confidentiality

Once you gather information from employees about whether they have been vaccinated or not, you must maintain confidentiality. You should maintain the records as you would any other medical-related documentation (in a separate file, accessible to only those who need to know, etc.) and comply with all other state-specific privacy rules (such as in California).

Family Members

While you can offer an incentive to employees to provide documentation or other confirmation from a third party not acting on your behalf that their family members have been vaccinated, the EEOC confirmed that you may not offer incentives to your employees in return for their family members getting vaccinated by your organization or your agent. This would be considered a violation of the Genetic Information Nondiscrimination Act (GINA) Title II health and genetic services provision. Asking pre-screening medical questions would lead to you receiving genetic information in the form of family medical history of the employee, and GINA regulations prohibit employers from providing incentives in exchange for genetic information. However, you can still offer an employee’s family member the opportunity to be vaccinated by your organization or your agent if you take certain steps to ensure GINA compliance.

Possible Incentives to Consider

If you are now considering what kind of incentives to offer your workforce in light of this new guidance, you might find comfort knowing that employers’ two most common incentive options include cash/gifts (38%) and paid time off (30%). This is according to an FP Flash Survey conducted earlier this year, which found that more than one in five employers were providing vaccine incentives. That number is bound to rise given that close to half of all respondents (43%) said they were unsure about whether to offer some form of incentive, many commenting that the then-current legal uncertainty fueled their hesitancy.

In much-anticipated guidance, the Internal Revenue Service has offered its insight on the implementation of the COBRA temporary premium subsidy provisions of the American Rescue Plan Act of 2021 (ARPA) in Notice 2021-31.

Spanning more than 40 pages, the IRS-answered frequently asked questions (FAQs) finally resolve many issues relating to temporary premium assistance for COBRA continuation coverage left unanswered in the Department of Labor’s publication of model notices, election forms, and FAQs.

The practical implications of the guidance for employers are many. Significantly, employers must take action prior to May 31, 2021, to ensure compliance with some of the requirements under ARPA and related agency guidance.

Notice 2021-31 provides comprehensive guidance on the ARPA subsidy and tax credit implementation issues (although it acknowledges there are many issues that still need to be addressed). Some of the key topics addressed include:

For employers, there are some immediate takeaways:

As expected, the IRS expansively defines an “involuntary termination.” For purposes of the ARPA COBRA subsidy, involuntary terminations include employee-initiated terminations due to good reason as a result of employer action (or inaction) resulting in a material adverse change in the employment relationship.

The guidance provides helpful COVID-19-specific examples. Employees participating in severance window programs meeting specified regulatory requirements could qualify. Voluntary employee terminations due to an involuntary material reduction in hours also could qualify. Further, voluntary terminations due to daycare challenges or concerns over workplace safety may constitute an involuntary termination, but only in the narrow circumstances in which the employer’s actions or inactions materially affected the employment relationship in an adverse way, analogous to a constructive discharge.

Employer action to terminate the employment relationship due to a disability also will constitute an involuntary termination, but only if there is a reasonable expectation before the termination the employee will return to work after the end of the illness or disability. This requires a specific analysis of the surrounding facts and circumstances. The guidance notes that a disabled employee alternatively may be eligible for the subsidy based on a reduction in hours if the reduction in hours causes a loss of coverage.

A number of the circumstances that meet the involuntary termination definition in the guidance may not be coded in payroll or HRIS systems as involuntary terminations. As employers have an affirmative obligation to reach out to employees who could be AEIs, employers will need to look behind the codes to understand the circumstances of the terminations.

Further, to identify all potential AEIs, employers may need to sweep involuntary terminations or reductions in hours occurring prior to the October 1, 2019, date referenced in the Department of Labor’s FAQs. The IRS makes clear that COBRA-qualified beneficiaries who qualified for extensions of COBRA coverage due to disability (up to 29 months), a second qualifying event (up to 36 months), or an extension under state mini-COBRA potentially can qualify for the subsidy if their coverage could have covered some part of the ARPA COBRA subsidy period (April 1, 2021–September 30, 2021).

An involuntary termination is not the only event that can make an employee potentially eligible for the subsidy. Employees who lose coverage due to a reduction in hours (regardless of the reason for the reduction) can be eligible for premium assistance as well. This can include employees who have been furloughed, experienced a voluntary or involuntary reduction of hours, or took a temporary leave of absence to facilitate home schooling during the pandemic or care for a child.

The IRS explains that, if an employer subsidizes COBRA premiums for similarly situated covered employees and qualified beneficiaries who are not AEIs, the employer may not be able to claim the full ARPA tax credit. In this case, the amount of the credit the employer can receive is the premium that would have been charged to the AEI in the absence of the premium assistance and does not include any amount of subsidy the employer would otherwise have provided. For example, if a severance plan covering all regular full-time employees provides that the employer will pay 100 percent of the COBRA premium for three months following separation, this employer could not take a tax credit for the subsidy provided during this three-month period.

Notice 2021-31 does not elaborate on this issue beyond providing specific examples involving a company severance plan. Thus, ambiguity remains as to whether this guidance would prohibit an employer from claiming a tax credit where an employer has agreed to provide a COBRA subsidy in a negotiated separation or settlement agreement and not pursuant to an existing severance plan or policy. Further IRS guidance on this point may be forthcoming. In light of this guidance, employers should re-evaluate their COBRA premium subsidy strategies.

In a surprise move today, CDC followed the lead of the various states that have lifted their masking and physical distancing recommendations. However, CDC’s new recommendations come with a twist. The CDC’s recommendations only apply to fully vaccinated people in non-healthcare settings. Here’s what your business should consider as it decides whether to “unmask.”

The May 13, 2021 CDC Interim Public Health Recommendations for Fully Vaccinated People states that fully vaccinated people no longer need to wear a mask or physically distance in any non-health care setting (except prisons and homeless shelters and public transportation), except where required by federal, state, local, tribal, or territorial laws, rules, and regulations, including local business and workplace guidance. According to the CDC, prevention measures (including masks and physical distancing) are still recommended for unvaccinated people.

Employers who are interested in relaxing mask requirements in the workplace should first consider the following.

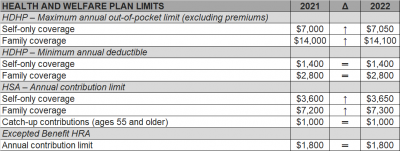

The Internal Revenue Service (IRS) recently announced (See Revenue Procedure 2021-25) cost-of-living adjustments to the applicable dollar limits for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted benefit health reimbursement arrangements (HRAs) for 2022. Many of the dollar limits currently in effect for 2021 will change for 2022. The HSA catch-up contribution for individuals ages 55 and older will not change as it is not subject to cost-of-living adjustments.

The table below compares the applicable dollar limits for HSAs, HDHPs and excepted benefit HRAs for 2021 and 2022.

Declaring that the state is “no longer in a state of emergency,” Florida Governor Ron DeSantis signed a bill on Monday, May 3rd, banning vaccine passports while issuing two executive orders immediately suspending and invalidating local government COVID-19 restrictions, including mask mandates. But the news doesn’t necessarily mean you should rush to ease up on your facemask requirements for workers or visitors, nor impact your decision to mandate vaccines for your workers. Below is a summary of the implications for Florida businesses.

Vaccine Passports Banned

As the vaccine rollout progresses, businesses and employers nationwide have been wondering if a “vaccine passport” – an official document certifying that an individual has been vaccinated against COVID-19 – can lead to a path back to normalcy. A Florida law now prohibits businesses operating in Florida from implementing those measures with respect to customers. The new law does not come as a surprise to most Floridians. On April 2, Governor DeSantis signed Executive Order 21-81 prohibiting vaccine passports. This new law, however, solidifies the ban and provides more guidance for businesses.

Specifically, the new law says that “business entities,” including for-profit and not-for-profit entities, cannot require that patrons or customers provide documentation certifying that they received the COVID-19 vaccine or certifying that they have recovered from the virus to enter or receive a service from the business. Licensed health care providers are exempt from this provision.

The law also provides that educational institutions, including both public and private schools, cannot require students or residents to provide documentation certifying that they received the COVID-19 vaccine or have recovered from the virus.

Importantly, the law does not prohibit private businesses from requiring that their own employees show proof of vaccination or certification that they recovered from the virus. Of note, recent guidance from the Equal Employment Opportunity Commission clarifies that it is generally permissible for employers to ask employees about whether they have been vaccinated, but employers should avoid further inquiries.

Further, the new law permits covered entities to continue to use screening protocols (such as temperature checks) in accordance with state or federal law to protect public health.

Governor Eliminates Current Local Restrictions After Florida Surgeon General Discourages Masks

On April 29, Florida State Surgeon General Dr. Scott Rivkees issued a Public Health Advisory rescinding prior public health advisories. Notably, the advisory states that fully vaccinated people should no longer be advised to wear face coverings or avoid social and recreational gatherings except in “limited circumstances.” Those limited circumstances are not defined, but the advisory appears to cover masking both indoors and outdoors.

Noticeably, the Surgeon General’s advisory is less restrictive than CDC guidance. Although the CDC recently announced that fully vaccinated people can forego masks in certain situations (for example, if they are indoors with other vaccinated people, indoors with unvaccinated people from the same household, or outdoors in spaces that are not crowded), the CDC generally recommends that fully vaccinated people continue to wear masks or face coverings in other scenarios.

To follow the Surgeon General’s advisory, Governor DeSantis issued a pair of executive orders on May 3 suspending and invalidating local government COVID-19 restrictions, including mask mandates. These orders effectively eliminate all existing coronavirus-related restrictions imposed by local governments. This means that local orders requiring, among other things, masks, sanitizing, and capacity limits are no longer effective. The orders do not affect restrictions issued by school districts.

Noticeably, the governor’s orders only prohibit local governments from issuing and enforcing COVID-19 restrictions using their emergency procedures. They specifically allow local governments to enact ordinances under regular enactment procedures. Thus, it is possible that local governments will counter the governor’s orders by enacting ordinances continuing to require such measures as masking and distancing.

However, the state’s guidance does not mean that private businesses cannot – or should not – enforce their own policies. The orders only prohibit local governments from issuing and enforcing restrictions on individuals or businesses using emergency powers. Local governments may still enact such procedures using regular procedures. Businesses can still generally enforce their own measures, including mask mandates, if they choose to.

What Should Employers Do Now?

Pushing forward to a new normal, Florida employers should be aware of how to proceed. Despite the state’s guidance, you should continue to enforce safety measures.

Florida recently passed a new COVID-19 liability protection law for businesses. Although very favorable to businesses, the law requires that businesses make a “good faith effort to substantially comply with authoritative or controlling government-issued health standards” to gain its protection. If there are different sources of guidance in effect, a business may follow any of them. This means that although they are different, a business can likely be protected from liability by following either Florida or CDC guidance. However, an employer may have stronger defenses and be able to undercut possible claims earlier by following CDC guidance, which takes a more conservative approach than current Florida guidance.

Further, OSHA requires that employers maintain a workplace free of recognized hazards. COVID-19 is such a recognized hazard. By not following CDC guidance, a Florida employer may open themselves to exposure under OSHA’s General Duty Clause, even in the absence of a state mandate.

Employers should also consider the business realities of having unmasked employees. Among other things, customers and vendors may not feel comfortable entering your business if they see employees unmasked, even if they are vaccinated.

Finally, because the Surgeon General’s recommendations only apply to fully vaccinated people, your business may have an inconsistent patchwork of some employees wearing masks while others are not. This may result in a situation where different standards apply to different employees depending on their vaccination status. Employers should avoid this, as OSHA has issued guidance stating that businesses should not treat unvaccinated employees differently than vaccinated employees. Additionally, inconsistency among employees wearing masks may inadvertently reveal who is and is not vaccinated, which may be disruptive and may unintentionally single out employees who do not get the vaccine, including for medical or religious reasons.

The sudden and prolonged isolation brought on by COVID-19 has greatly impacted the normal routines and activities of the entire workforce. While the ongoing vaccine rollout inspires hope for a COVID-free future, the emerging virus variants and the harsh winter weather experienced across the United States after over a year of social distancing have raised further concerns about employee mental health issues and engagement in 2021.

As many employers continue to manage a partially or entirely remote workforce – some of which may shift to a permanent off-site or hybrid workplace model – they’re faced with the challenge of keeping employees connected. Since social health plays an important role in determining an overall sense of wellbeing and a large number of individuals aren’t socializing with coworkers, peers and friends like they used to, it’s important for workplace leaders to provide their people with opportunities to make meaningful connections. The wellbeing of your workforce depends on it.

The mental wellbeing of your workforce is best supported by positive social interactions. Remote workers who have struggled with feelings of loneliness and social isolation are more likely to feel lonely, anxious and depressed, which is why it’s important for organizations to provide plenty of opportunities to engage with their co-workers. Encouraging employees to work together on collaborative tasks, scheduling weekly team meetings (they don’t have to focus on work!) and empowering employees to create and interact with interest-based groups within their digital wellbeing platforms are just a few easy ways to help your people feel connected.

Providing employees with mental health resources is a must. Beyond offering up mental health benefits like mindfulness tools and live health coaching, remote workers can also engage through activities like guided team meditation or virtual yoga sessions. According to MetLife, 79% of employees who report good mental health are less likely to feel detached from their organization. Additionally, 86% of workers who feel that they are mentally healthy are more likely to be productive at work. Rather than simply considering workplace mental health resources as an addition to an employee benefits package, putting an emphasis on mental health as a main component of a company’s culture is an essential business move in 2021.

Countless employees are missing the bustling workplace environment. The constant Zoom meetings and digital interactions lack the sense of social connectedness once accustomed to. Finding unique ways to make regular meetings and virtual communication more engaging is critical for maximizing employee performance. Casual video chats and remote social happy hours are a great way to use technology as an advantage and initiate a stronger connection among employees while working remotely. Additional ways to promote more social interactions among employees include scheduling group exercise breaks or starting a workplace wellbeing challenge. To ensure everyone is able to participate, consider designating employees who really know their way around the virtual world as leaders for a multigenerational workforce. By opening more channels of communication, the remote work environment will improve for everyone and increase employee engagement as well as productivity.

Around 66% of workers are struggling to stay socially connected, which is negatively affecting their wellbeing. Fortunately, by encouraging your remote workforce to prioritize their mental health and social wellbeing, organizations are likely to see a significant increase employee engagement and productivity as employee wellbeing improves.

The American Rescue Plan Act of 2021 (ARP) allows small and midsize employers, and certain governmental employers, to claim refundable tax credits that reimburse them for the cost of providing paid sick and family leave to their employees due to COVID-19, including leave taken by employees to receive or recover from COVID-19 vaccinations. The ARP tax credits are available to eligible employers that pay sick and family leave for leave from April 1, 2021, through September 30, 2021.

Here are some basic facts from the IRS website about the employers eligible for the tax credits and how these employers may claim the credit for leave paid to employees who take leave to receive or recover from COVID-19 vaccinations.

An eligible employer is any business, including a tax-exempt organization, with fewer than 500 employees. An eligible employer also includes a governmental employer, other than the federal government and any agency or instrumentality of the federal government that is not an organization described in section 501(c)(1) of the Internal Revenue Code. Self-employed individuals are eligible for similar tax credits.

Eligible employers are entitled to tax credits for wages paid for leave taken by employees who are not able to work or telework due to reasons related to COVID-19, including leave taken to receive COVID–19 vaccinations or to recover from any injury, disability, illness or condition related to the vaccinations. These tax credits are available for wages paid for leave from April 1, 2021, through September 30, 2021.

The paid leave credits under the ARP are tax credits against the employer’s share of the Medicare tax. The tax credits are refundable, which means that the employer is entitled to payment of the full amount of the credits if it exceeds the employer’s share of the Medicare tax.

The tax credit for paid sick leave wages is equal to the sick leave wages paid for COVID-19 related reasons for up to two weeks (80 hours), limited to $511 per day and $5,110 in the aggregate, at 100 percent of the employee’s regular rate of pay. The tax credit for paid family leave wages is equal to the family leave wages paid for up to twelve weeks, limited to $200 per day and $12,000 in the aggregate, at 2/3rds of the employee’s regular rate of pay. The amount of these tax credits is increased by allocable health plan expenses and contributions for certain collectively bargained benefits, as well as the employer’s share of social security and Medicare taxes paid on the wages (up to the respective daily and total caps).

Eligible employers may claim tax credits for sick and family leave paid to employees, including leave taken to receive or recover from COVID-19 vaccinations, for leave from April 1, 2021, through September 30, 2021.

Eligible employers report their total paid sick and family leave wages (plus the eligible health plan expenses and collectively bargained contributions and the eligible employer’s share of social security and Medicare taxes on the paid leave wages) for each quarter on their federal employment tax return, usually Form 941, Employer’s Quarterly Federal Tax Return PDF. Form 941 is used by most employers to report income tax and social security and Medicare taxes withheld from employee wages, as well as the employer’s own share of social security and Medicare taxes.

In anticipation of claiming the credits on the Form 941 PDF, eligible employers can keep the federal employment taxes that they otherwise would have deposited, including federal income tax withheld from employees, the employees’ share of social security and Medicare taxes and the eligible employer’s share of social security and Medicare taxes with respect to all employees up to the amount of credit for which they are eligible. The Form 941 instructions PDF explain how to reflect the reduced liabilities for the quarter related to the deposit schedule.

If an eligible employer does not have enough federal employment taxes set aside for deposit to cover amounts provided as paid sick and family leave wages (plus the eligible health plan expenses and collectively bargained contributions and the eligible employer’s share of social security and Medicare taxes on the paid leave wages), the eligible employer may request an advance of the credits by filing Form 7200, Advance Payment of Employer Credits Due to COVID-19. The eligible employer will account for the amounts received as an advance when it files its Form 941, Employer’s Quarterly Federal Tax Return, for the relevant quarter.

Self-employed individuals may claim comparable tax credits on their individual Form 1040, U.S. Individual Income Tax Return