The DOL’s Employee Benefits Security Administration (EBSA) has made available Spanish language versions of model notices to employees of health coverage options. The Affordable Care Act (ACA) requires employers to provide employees with a notice of their health insurance coverage options available through the future health insurance exchanges no later than October 1, 2013. The English version of these model notices were released in May 2013.

Please contact our office for copies of the model notice(s) in English and/or Spanish.

On June 26, 2013, the US Supreme Court declared the Defense of Marriage Act (DOMA) as unconstitutional. DOMA had previously established the federal definition of marriage as a legal union only between one man and one woman. The extinction of DOMA already has HR departments thinking how this will impact the future of the Family and Medical Leave Act (FMLA) as well as other benefits.

How FMLA is Impacted

As we know, the FMLA allows otherwise eligible employees to take leave to care for a family member with a serious health condition. “Family member” includes the employee’s spouse, which, under the FMLA regulations, is defined as:

a husband or wife as defined or recognized under State law for purposes of marriage in the State where the employee resides, including common law marriage in States where it is recognized. 29 C.F.R. 825.102

Initially, this seems to suggest that the DOL would look to state law to define “spouse”…but not so fast. According to a 1998 Department of Labor opinion letter, the DOL acknowledged that the FMLA was bound by DOMA’s definition that “spouse” could only be a person of the opposite sex who is a husband or wife. Thus, the DOL has taken the position that only DOMA’s definitions could be recognized for FMLA leave purposes. As a result, FMLA leave has not been made available to same-sex spouses.

That changes yesterday, at least in part.

What’s Clear about FMLA After the Ruling

In striking down a significant part of DOMA, the Supreme Court cleared the way for each state to decide its own definition of “spouse”. Thus, if an employee is married to a same-sex partner and lives in a state that recognizes same-sex marriage, the employee will be entitled to take FMLA leave to care for his/her spouse who is suffering from a serious health condition, for military caregiver leave, or to take leave for a qualifying exigency when a same-sex spouse is called to active duty in a foreign country while in the military.

What’s Unclear about FMLA After the Ruling

But what about employees who live in a state that does not recognize same-sex marriage? Are they entitled to FMLA leave to care for their spouses?

As an initial matter, the regulations look to the employee’s “place of domicile” (aka state of primary residence) to determine whether a person is a spouse for purposes of FMLA. Therefore, even if the employee formerly lived or was married in a state that recognized the same-sex marriage, he/she is unlikely to be considered a spouse in the “new” state for purposes of FMLA if the state does not recognize the marriage. This is no small issue, since 30+ states currently do not recognize same-sex marriage and some don’t go all the way (e.g. Illinois, which recognizes same-sex unions, not marriages).

Surely, some might argue that the U.S. Constitution requires other states to recognize the marriage; however, this issue is far from settled. Clearly employers need some help from the DOL. It is speculated that the DOL may draft regulations on how employers can administer FMLA in situations where the employee’s spouse is not recognized under state law. This would give life to concepts such as a “State of Celebration” rule, in which a spousal status is determined based on the law of the State where the employee was married and not where they reside. However, without more guidance, it is still too early to tell how the DOL will handle this.

Other Key Benefits Affected by the DOMA Decision

FMLA is not the only federal law impacted by the fall of DOMA. If federal regulations follow through, some of the notable federal laws and benefits impacted may include:

Fisher & Phillips LLP announced that it has developed a Smartphone and Tablet app to help employers calculate certain Family & Medical Leave Act (FMLA) leaves of absence. The best news is that the app is free!

The leave calculator app allows human resource and benefit managers the ability to calculate basic leave requests and determine how much FMLA leave an employee has available. This new Beta version of the iPhone and Android app will be introduced during the SHRM Annual Conference in mid-June.

The Beta version will cover requests for leave for employees working a standard 40 hour work week and the next version of the app will cover more complicated situations such as employees working reduced work weeks.

The app is able to report the number of FMLA leave days still available for that employee, when the employee should return to work based on the new leave request, and how much leave the employee will have remaining after the current leave request is completed. The app even has a feature where you can then email the information directly to the employee who requested the leave.

This app is available for download at the Apple App Store or Google Play. Use “Fisher & Phillips” to search for the app for download or visit www.laborlawyers.com/FMLALeaveApp to get the app.

On May 31st, the US Department of Health and Human Services (HHS) issued a final rule delaying the implementation of a significant portion of the Federal Small Business Health Options Program (SHOP) Exchanges until 2015.

The Patient Protection and Affordable Care Act (PPACA) calls for the creation and implementation of health Exchanges for both individuals and small businesses. These marketplaces were to be operational by October 1, 2013 in time for the open enrollment period for a January 1, 2014 effective date.

The Obama administration announced that SHOPs will only offer one health plan now in 2014, instead of offering small employer groups a choice of several health plans. As reported in the Wall Street Journal, “For transitional purposes we have proposed that in 2014, a state may elect to have businesses choose one plan to offer employees, and in 2015 employees will be able to choose from the full range of plans in the marketplace,” said Fabien Levy, an HHS official.

This delay will apply to states in which the federal government will administer the Exchanges, and makes the requirement optional for state-run Exchanges. The administration cited operational challenges as the reason for the delay.

This announcement has been met with disappointment by many small businesses as it will limit the attractiveness of exchanges to small businesses. The vast majority of small employers want their employees to be able to choose among multiple insurance carriers so employees can pick the plan to best meet their personal needs.

Whether a similar delay will be announced for the individual Exchanges remains to be seen.

Employers should make sure that any background check they perform is job related and consistent with business necessity. As advised during the recent 2013 Workplace Strategies seminar, the Equal Employment Opportunity Commission (EEOC), worker advocacy groups and plaintiff attorneys are not giving employee and applicant credit and criminal background checks intense scrutiny.

To avoid EEOC charges of disparate treatment or disparate impact based on a background check, an employer should follow four essential steps:

These steps involve the interplay of federal law including Title VII and the federal Fair Credit Reporting Act (FCRA) as well as state mini FCRAs.

When an Employer May Request a Background Check

According to the EEOC, employers must ensure that there is a direct connection between the type of background check performed and the individual applicant’s or employee’s job duties and that a particular type of background check is done for all applicants and employees in certain positions (not just certain applicants or employees) if there is not an individualized, specific reason for the background check.

The starting place is the job title. For example, while there would be a strong business justification to run a credit check on a CFO, there would not be a justification for a credit check for a janitor. The next step is to consider the nature of the job –whether it involves activities like data entry or just lifting boxes- and the circumstances in which the job is performed. Consider the level of supervision involved and whether there is interaction with vulnerable adults. Finally, take into account the location where the position is performed.

Requesting a background check requires the employee or applicant to sign a disclosure and authorization form that is separate from other documents, such as the employment application. Be sure to list and describe the background check information being requested and reviewed but don’t include a release from liability as that would invalidate the consent.

If the employer receives negative information about the applicant or employee, the FCRA requires that a pre-adverse- action letter be sent to the individual if there is potential for an adverse employment action. Title VII requires the employer to conduct an individualized assessment and send an action letter.

The individualized- assessment process must give the applicant or employee an opportunity to provide additional facts or context to explain why the background check’s finding should not be applied in his or her case. It is advised to ask for the response from the employee in writing as it exhibits the seriousness of your position and establishes a record. If the individual does not respond, the employer may make the employment decision without the extra information.

Criminal Checks

It is cautioned that employers generally should not use arrest information in making employment decisions, but rather consider if you would exclude the applicant if there was a conviction.

With regard to convictions, EEOC’s 2012 guidance on Title VII and background checks strongly recommends that employers use a targeted screening process that takes into consideration the nature and gravity of the offense or conduct; the time that has passed since the offense, conduct and/or completion of the sentence; and the nature of the job held or sought.

The EEOC does not provide guidance on the time period to cover when looking into criminal records. Many employers use a seven year period, but it is best to consider a longer time frame if it is deemed appropriate for your business activities.

State Law

Several states have mini-FCRAs that restrict employers from requesting certain types of background checks. Currently, 11 states (California, Connecticut, Hawaii, Illinois, Maryland, New Jersey, Ohio, Oregon, Pennsylvania, Vermont, and Washington) limit an employer’s ability to run a credit background check. Similar legislation is pending in 13 other states as of 2013.

In addition, 12 states have state-specific disclosures that must be included on the disclosure and authorization form and some states require an employer to customize its form by position or type of check being run. In California, for example, employers must identify the specific state statutory basis authorizing them to request and use a credit report.

There are no state law restrictions on requesting criminal check however.

After months of negotiations, landmark legislation was unveiled that proposed substantial changes to the U.S. immigration laws.

The Border Security, Economic Opportunity, and Immigration Modernization Act of 2013 (filed April 16, 2013) lays out a 13-year path to citizenship for most of the 11 million people living in the U.S. illegally, allocates billions of dollars to be spent on border security, creates new legal guest worker programs for low-income jobs and farm labor, mandates the use of E-Verify for most companies hiring new workers and expands overall immigration to the U.S. by 50% in the next 10 years.

The bill proposes ways to clear up green card backlogs, raises the cap for H-1B workers and creates a new “W-visa” program for lower skilled workers.

Aspects of the bill that would impact the workplace include the following:

Mandatory E-Verify

All employers would be required to use the E-Verify electronic employment verification system, phased in over a 5 year period. Large employers with more than 5000 employees would be phased in within two years.

Every non-citizen would be required to carry a “biometric work authorization card”.

Enhancements to the E-Verify system would include a photo-matching tool and the capability for employees to “lock” their Social Security numbers in the system to prevent others from using them. In order for the non-citizen to be cleared for a job, the picture on the card presented by the employee to the employer will have to match the identical picture the employer has in the E-Verify system. Employers would be required to certify that the photograph presented in person matches the photograph in the system.

Legal Immigration

The bill addresses what’s been one of the biggest programs with the current system. Beyond employment- based visas, the bill would create an entirely new category of “merit-based” visas. A merit-based visa, created in the fifth year after the bill becomes law, would award points to individuals based on their education, employment, length of residence in the U.S., and other considerations. Individuals with the most points would earn one of the 120,000 visas that will be available per year. The number would increase by 5% annually if demand exceeds supply in any year where unemployment is less than 8.5%.A maximum cap of 250,000 merit-based visas is proposed.

Under this system, the DHS would allocate merit-based immigrant visas beginning Oct. 1, 2014, for employment-based visas that have been pending for 3 years, family based petitions that were filed prior to enactment and have been pending for 5 years, and to long term immigrant workers who have been lawfully present in the country for more than 10 years. It is this category that those who are in the country illegally now would be funneled into after a decade as legalized residents.

Currently, only about 14% of green cards granted are employment based. That percentage could increase to as high as 50% under this proposal. The bill also emphasizes the need to shift immigration resources toward high-skilled immigrants. It creates a start up visa for foreign entrepreneurs who seek to emigrate to the U.S. to launch their own companies.

The bill exempts the following categories from the annual numerical limits on employment-based immigrants: derivative beneficiaries of employment-based immigrants; aliens of extraordinary ability in the sciences, arts, education, business or athletics; outstanding professors and researchers; multinational executives and managers; doctoral degree holders in science, technology, engineering, and mathematics (STEM) fields; and physicians who have completed the foreign residency requirements or have received a waiver.

The bill also redistributes 40% of the worldwide level of employment-based visas to high skilled workers and those who have earned a master’s degree or higher in STEM fields from an accredited U.S. institution. The bill increases the percentage of employment visas for skilled workers and other professionals to 40%, maintains the percentage of employment visas for certain special immigrants to 10% and maintains visas for those who foster employment creation to 10%.

Married children over 30 years of age and siblings of U.S. citizens would no longer be eligible for a family preference in the visa application process and the bill would eliminate the 55,000 Diversity Visa Program recipients awarded by lottery each year that go largely to immigrants from Africa and Eastern Europe.

Those who were or are selected for diversity immigrant visas for fiscal years 2013 or 2014 would still receive their visas.

H-1B Reforms

The plan calls for a sizable increase in high-skilled visas, fees for employers that hire large numbers of foreign workers, and institutes a ban on those companies applying for additional H-1B visas in the future.

The legislation would increase the current number of H-1B visas from 65,000 to 110,000. The current 20,000 visa exemption for U.S. advanced degree holders would be amended to a 25,000 visa exemption for advance degree graduates in science, technology, engineering, and mathematics from U.S. schools.

Provisions designed to keep high-skilled hiring from hurting U.S. tech workers include “H-1B dependent employers” paying significantly higher wages and fees than normal users of the program and prohibiting companies whose U.S. workforce largely consists of foreign guest workers from obtaining additional H-1B and L visas. In 2014, companies will be banned from bringing in any additional workers if more than 75% of their workers are H-1B or L-1 employees.

New Visa on the Block

The bill creates a new visa for lower-skilled workers in the service sector, construction and agriculture. The program begins April 1, 2015 and would be initially capped at 20,000 and would rise to 75,000 by 2019.

The spouse and minor children of the W visa holder will be allowed to accompany or follow to join and will be given work authorization for the same period of admission as the principle visa holder.

Immigrants would apply at the U.S. embassies and consulates in their home countries and the visa would be valid for 3 years. If visa holders are unemployed for 60 days or more, they would be required to leave the United States. The workers must be paid the prevailing wage and cannot be employed in areas where unemployment is above 8.5%. Employers cannot fire American workers 90 days before or after the hiring of guest workers.

Agriculture Program Revised

A new agricultural guest worker visa program would also be established. A portable, at-will employment based visa (W-3 visa) and a contract based visa (W-2 visa) would replace the current H-2A program.

As many as 337,000 new three-year visas would be available for farm workers. After five years, an annual visa limit based on market conditions would be set.

The bill would allow current undocumented farm workers to obtain expedited legal status. Undocumented farm workers who “have made a substantial prior commitment to agricultural work in the U.S.,” show that they have paid all taxes, have not been convicted of any serious crime, and pay a $400 fine would be eligible to adjust to legal permanent resident status.

Spouses and minor children would receive derivative status.

Next Steps

Hearings have been scheduled before the Senate Judiciary Committee to review the bill and a committee vote is expected in May. The bill would then go on to the full Senate.

According to a recently released by Gallup-Healthways Well-Being Index, lost productivity due to workers’ poor health is costing the U.S. approximately $84 billion a year.

On average, 77% of workers either had one or more chronic conditions or had a higher-than-normal body mass index (BMI), according to the Gallup index, which surveyed 94,366 American adults working in 14 occupational categories. The respondents with chronic conditions or a high BMI reported missing work about one-third of a day more each month, on average, than those workers with a normal BMI and no chronic conditions. That lost time costs U.S. businesses from $160 million a year for agricultural workers to $24.2 billion a year for white collar professionals.

The index, conducted from Jan. 2 – Sept 10, 2012, asked respondents if they had ever had a health condition such as asthma, cancer, depression, diabetes, heart attack, high blood pressure, high cholesterol, or recurring physical pain in the neck, back, knee, or leg.

The index collected data from the respondents on their height and weight so researchers could calculate their BMI. Respondents were classified as “obese” if they had a BMI of 30 or higher, as “overweight” if they had a BMI of 25-29, or as “normal” if they had a BMI of 18.5-24.9.

The 14 occupational categories that researchers examined were: professionals (excluding physicians, nurses, and teachers), management, services, clerical or office, sales, school teaching, nursing, transportation, manufacturing or production, business ownership, installation or repair, construction or mining, physicians, and agriculture.

86% of transportation workers had higher than normal BMIs or at least one chronic condition- the highest among the 14 categories. They reported missing 0.41 more work days a month than their healthier counterparts.

“This amounts to an estimated $3.5 billion in absenteeism costs per year that would be recouped” if employees were not overweight or had not been diagnosed with a chronic condition, researchers wrote.

As employers increasingly engage in improving the health of their workers, including implementing and strengthening the effectiveness of wellness programs, there are substantial potential savings that remain on the table from getting more employees to work each day as their health improves over time.

Under the 2013 Health Insurance Portability and Accountability Act (HIPAA) privacy and security rules provisions, employers must update their health information disclosure policies and retrain employees to ensure compliance.

The Department of Health and Human Services (HHS) issued the new HIPAA regulations on January 25, 2013, to execute major changes that were mandated by the Health Information Technology for Economic and Clinical Health Act (HITECH) as well as the Genetic Information Nondiscrimination Act (GINA).

New Requirements for Business Associates

HIPAA regulations previously generally covered any business associate who performed or assisted in any activity involving the use or disclosure of individually identifiable health information, such as third-party administrators, pharmacy benefit managers and benefit consultants. Under the new regulations, business associate status is triggered when a vendor “creates, receives, maintains, or transmits” personal health information (PHI).

The key addition in this part of the regulation is found in the word ‘maintains’ because any entity that ‘maintains’ PHI on behalf of a covered entity- even if no access to that information is required or expected- will now be considered a business associate.

This change has some important consequences for group health plans that rely on cloud storage as a repository for their PHI or that outsource information-technology support and other functions and do not have business associate agreements (BAAs) with such vendors.

If you give PHI to a vendor before a BAA is in place, you will be in violation of HIPAA, and if you are a vendor, you can’t receive PHI without a compliant BAA in place. There must be a compliant BAA in place first.

Another change is that plan sponsors must enter into a sub-BAA with agents or subcontractors who are retained to help a business associate with covered functions for an employer-sponsored health plan. Plan sponsors should include BAA language that states that a business associate can’t subcontract work without prior permission, and then to monitor compliance with those agreements.

Presumption of PHI Breach Introduced

Under the previous rules, an impermissible use or disclosure of PHI- including electronic PHI- was a breach only if it posed a significant risk of harm to the individual. The HHS included in the new rules a presumption that any impermissible use or disclosure of PHI is a breach, subject to breach-notification rules.

Under the new rules, the only way now to get out of this presumption is by a demonstration that there is a low probability that the PHI was compromised.

To demonstrate low probability, the health plan or business associate must perform a risk assessment of four factors- at a minimum:

The HHS has indicated that it expects these risk assessments to be thorough and completed in good faith and to reach reasonable conclusions. If the risk assessment does not find a low probability that PHI has been compromised, then breach notification is required.

Action Advised for 2013

While the new regulations bring certainty to employer-sponsored health plans and their business associates on HIPAA compliance issues, they also emphasize the department’s intention to subject business associates and their subcontractors to heightened scrutiny.

Employers should review and revise their BAAs to ensure compliance with the security rule, paying special attention to the inclusion of subcontractors. Employers should also review and revise (or create) breach-notification procedures that detail how a risk assessment will be conducted. It is also important to train employees who have access to PHI on these updated policies and procedures.

The final regulations take effect September 23, 2013 and the HHS has provided another one-year transition period for some covered entities and their business associates that had a BAA in place on January 1, 2013. HHS also published an updated version of a template BAA, but it does not address all the unique situations that may arise between a covered entity and a business associate. Employers should ultimately ensure that their business associate agreements are appropriately tailored to their individual circumstances and business needs.

A provision of Health Care Reform requires employers to provide a notice to all employees regarding the availability of health coverage options through the state-based exchanges. The Department of Labor delayed the original requirement that the notice be distributed by March 1, 2013, as it was determined that there was not enough information regarding exchange availability.

The DOL recently issued temporary guidance along with a model notice. The DOL has issued the model notice early so employers can begin informing their employees now about the upcoming coverage options through the marketplace.

Two model notices were released by the DOL. One is for employers who currently offer medical coverage and the other is for those who do not offer medical coverage.

Employers are required to issue the exchange coverage notice no later than October 1, 2013. This will coincide with the beginning of the open enrollment period for the marketplace.

The notice must be provided to all employees, regardless of their enrollment on the group health plan. It must be provided to both full time and part time employees as well. Employers are not required to provide a separate notice to dependents. Employers will need to provide the notice to each new employee (regardless of their status) who are hired on or after October 1, 2013 within 14 days of their hire.

An exchange coverage notice must include –

The DOL also modified its model COBRA election notice to include information about the availability of exchange coverage options and eliminate certain obsolete language in the earlier model.

Please contact our office for a copy of the model notice(s).

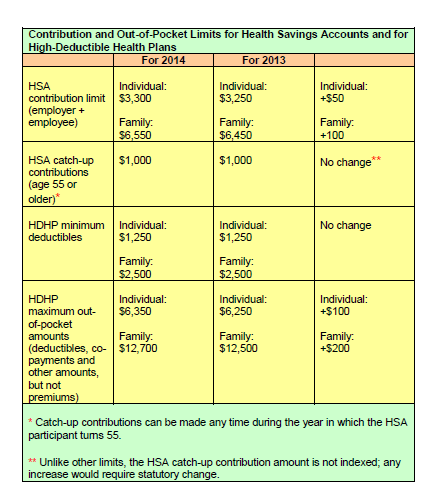

The Internal Revenue Service recently announced higher contributions limits to health savings accounts (HSAs) and for out of pocket spending under qualified high deductible health plans (HDHPs) for 2014.

The IRS provided the inflation adjusted HSA contribution and HDHP minimum deductible and out of pocket limits effective for calendar year 2014. The higher rates reflect a cost of living adjustment (COLA) as well as rounding rules under the IRS Code Sec 223.

A comparison of the 2014 and 2013 limits are below:

The increases in contribution limits and out of pocket maximums from 2013 to 2014 were somewhat lower than increases in years prior.

Those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses face a penalty of 20% of the funds used for those nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

Adult Children Coverage

While the Patient Protection and Affordable Care Act allows parents to add their adult children (up to age 26) to their health plans (and some state laws allow up to age 30 if certain requirements are met), the IRS has not changed its definition of a dependent for health savings accounts. This means that an employee whose 24 year old child is covered on their HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bill.

If account holders can’t claim a child as a dependent on their tax returns, then they can’t spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendant of these) who: