This simple change in OSHA’s rulemaking requirements will improve safety for workers across the country. One important reason stems from our understanding of human behavior and motivation. Behavioral economics tells us that making injury information publicly available will “nudge” employers to focus on safety. And, as we have seen in many examples, more attention to safety will save the lives and limbs of many workers, and will ultimately help the employer’s bottom line as well. Finally, this regulation will improve the accuracy of this data by ensuring that workers will not fear retaliation for reporting injuries or illnesses.

The new rule, which takes effect Jan. 1, 2017, requires certain employers to electronically submit injury and illness data that they are already required to record on their onsite OSHA Injury and Illness forms. Analysis of this data will enable OSHA to use its enforcement and compliance assistance resources more efficiently. Some of the data will also be posted to the OSHA website. OSHA believes that public disclosure will encourage employers to improve workplace safety and provide valuable information to workers, job seekers, customers, researchers and the general public. The amount of data submitted will vary depending on the size of company and type of industry. The electronic submission requirements do not change an employer’s obligation to complete and retain the injury & illness records.

OSHA will provide a secure website that offers three options for data submission. First, users will be able to manually enter data into a webform. Second, users will be able to upload a CSV file to process single or multiple establishments at the same time. Last, users of automated recordkeeping systems will have the ability to transmit data electronically via an API (application programming interface). OSHA is not yet accepting electronic submissions at this time. Updates will be posted to the OSHA website at www.osha.gov/recordkeeping when they are available.

The rule also prohibits employers from discouraging workers from reporting an injury or illness. The final rule requires employers to inform employees of their right to report work-related injuries and illnesses free from retaliation, which can be satisfied by posting the already-required OSHA workplace poster. It also clarifies the existing implicit requirement that an employer’s procedure for reporting work-related injuries and illnesses must be reasonable and not deter or discourage employees from reporting; and incorporates the existing statutory prohibition on retaliating against employees for reporting work-related injuries or illnesses. These provisions become effective August 10, 2016, but OSHA has delayed their enforcement until Dec. 1, 2016.

The new reporting requirements will be phased in over two years:

OSHA State Plan states must adopt requirements that are substantially identical to the requirements in this final rule within 6 months after publication of this final rule.

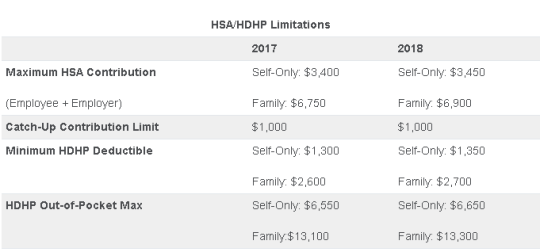

On May 4, 2017, the IRS released Revenue Procedure 2017-37 setting dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for 2018. HSAs are subject to annual aggregate contribution limits (i.e., employee and dependent contributions plus employer contributions). HSA participants age 55 or older can contribute additional catch-up contributions. Additionally, in order for an individual to contribute to an HSA, he or she must be enrolled in a HDHP meeting minimum deductible and maximum out-of-pocket thresholds. The contribution, deductible and out-of-pocket limitations for 2018 are shown in the table below (2017 limits are included for reference).

Note that the Affordable Care Act (ACA) also applies an out-of-pocket maximum on expenditures for essential health benefits. However, employers should keep in mind that the HDHP and ACA out-of-pocket maximums differ in a couple of respects. First, ACA out-of-pocket maximums are higher than the maximums for HDHPs. The ACA’s out-of-pocket maximum was identical to the HDHP maximum initially, but the Department of Health and Human Services (which sets the ACA limits) is required to use a different methodology than the IRS (which sets the HSA/HDHP limits) to determine annual inflation increases. That methodology has resulted in a higher out-of-pocket maximum under the ACA. The ACA out-of-pocket limitations for 2018 were announced are are $7350 for single and $14,700 for family.

Second, the ACA requires that the family out-of-pocket maximum include “embedded” self-only maximums on essential health benefits. For example, if an employee is enrolled in family coverage and one member of the family reaches the self-only out-of-pocket maximum on essential health benefits ($7,350 in 2018), that family member cannot incur additional cost-sharing expenses on essential health benefits, even if the family has not collectively reached the family maximum ($14,700 in 2018).

The HDHP rules do not have a similar rule, and therefore, one family member could incur expenses above the HDHP self-only out-of-pocket maximum ($6,650 in 2018). As an example, suppose that one family member incurs expenses of $10,000, $7,350 of which relate to essential health benefits, and no other family member has incurred expenses. That family member has not reached the HDHP maximum ($14,700 in 2018), which applies to all benefits, but has met the self-only embedded ACA maximum ($7,350 in 2018), which applies only to essential health benefits. Therefore, the family member cannot incur additional out-of-pocket expenses related to essential health benefits, but can incur out-of-pocket expenses on non-essential health benefits up to the HDHP family maximum (factoring in expenses incurred by other family members).

Employers should consider these limitations when planning for the 2018 benefit plan year and should review plan communications to ensure that the appropriate limits are reflected.

Yesterday (May 4, 2017) , the House of Representatives narrowly passed the American Health Care Act of 2017 (AHCA), which contains major parts that would repeal and replace the Affordable Care Act (commonly referred to as Obamacare or ACA). The next obstacle the bill faces is making it through the Senate, which proves to be a formidable challenge.

The nonpartisan Congressional Budget Office has not had time yet to analyze the current version of the bill, but this is expected next week. The bill must now pass the Senate and could get pushed back to the House if it sees changes in the upper chamber.

In the meantime, here are some highlights we know about the bill based on how it is written today and how it would work:

We will continue to keep you up to date on the bill as it progress through legislation.

Late yesterday (4/4/17), the 7th Circuit Court of Appeals became the first federal court of appeals in the nation to rule that sexual orientation claims are actionable under Title VII. Their decision opened the door for LGBT plaintiffs to use Title VII to seek relief for allegations of employment discrimination and retaliation.

The April 4th ruling is important to employers because it broadens the class of potential plaintiffs who can bring workplace claims against them, and will require employers to ensure fair and equal treatment to all applicants and workers regardless of their sexual orientation (Hively v. Ivy Tech Community College).

The initial aim of Title VII of the Civil Rights Act of 1964 was to protect employees from race discrimination in the workplace. Just before it was enacted, however, Congress added a provision prohibiting discrimination based on “sex.” Initially, federal courts took the position that “sex” should be interpreted narrowly.

However, over the years, plaintiffs have sought a much broader interpretation of what should be covered as sex discrimination. Following the landmark 2015 Supreme Court decision which made same-sex marriage legal across the country, federal courts have grappled with determining which types of claims are actionable under the “sex” provision of Title VII. Meanwhile, the Equal Employment Opportunity Commission (EEOC) issued a July 2015 administrative decision ruling that “sexual orientation is inherently a ‘sex-based consideration’ and an allegation of discrimination based on sexual orientation is necessarily an allegation of sex discrimination under Title VII” (Baldwin v. Foxx).

Although this decision involved a federal employee and was only binding on federal employers, other lower federal courts have discussed the rationale behind the EEOC’s conclusion and seemed ready to adopt the same approach. Indeed, on November 4, 2016, the U.S. District Court for the Western District of Pennsylvania agreed with the EEOC and held that sexual orientation falls within the protection of Title VII (EEOC v. Scott Medical Center). However, no federal appellate court went that far – until now.

Kimberly Hively began working as a part-time adjunct professor for Ivy Tech Community College in South Bend, Indiana in 2000. She worked there for 14 years until her part-time employment contract was not renewed in 2014. During her employment, she applied for six full-time positions but claims never to have even been offered an interview, even though she said she had all the necessary qualifications and had never even received a negative evaluation.

Hively filed a federal lawsuit alleging sexual orientation discrimination under Title VII, and in 2015, the trial court dismissed her case. She appealed to the 7th Circuit Court of Appeals (which oversees federal courts in Illinois, Indiana, and Wisconsin), which initially agreed with the lower court by upholding the dismissal of her claim in July 2016.

The three-person panel of judges indicated that it had no choice but to deny Hively’s claim after reviewing a string of cases stretching back almost 40 years from across the country. The panel concluded that no other federal appellate court had decided that sexual orientation discrimination is covered under Title VII. The judges noted that we live in “a paradoxical legal landscape in which a person can be married on Saturday and then fired on Monday for just that act,” but indicated they were all but powerless to rule otherwise absent a Supreme Court directive or a congressional amendment to Title VII.

In October 2016, the full collection of 7th Circuit judges set aside the ruling and agreed to re-hear the case en banc, which means all the judges would hear the case together. Late yesterday, the en banc panel issued a final ruling overturning its initial decision by an 8 to 3 vote and breathing new life into Hively’s case. More importantly, however, the 7th Circuit created a new cause of action under Title VII for other LGBT employees in Illinois, Indiana, and Wisconsin.

In the opinion, drafted by Chief Judge Wood, the court concluded that “discrimination on the basis of sexual orientation is a form of discrimination” and that it “would require considerable calisthenics” to remove the “sex” from “sexual orientation” when applying Title VII. In addition, the court noted that efforts to do so had led to confusing and contradictory results.

In the end, the court concluded that the practical realities of life necessitated that it reverse its prior decision. It remanded Hively’s case back to the trial court for a new hearing under this broad new standard.

Employers in Illinois and Wisconsin are already subject to state laws protecting private workers based on sexual orientation, so yesterday’s decision should simply reaffirm their commitment to ensuring fairness and equality for these employees. For private employers in Indiana, however, the time is now to take proactive steps to ensure sexual orientation is treated the same as any other protected class – this includes reviewing your written policies, handbooks, training sessions, workplace investigations, hiring methods, discipline and discharge procedures, and all other aspects of your human resources activities.

As for employers in the rest of the country, it appears likely that yesterday’s ruling will be followed by decisions in other circuit courts similarly extending Title VII rights to cover sexual orientation. In fact, the plaintiff in a prominent case recently decided by the 11th Circuit Court of Appeals (hearing cases from Florida, Georgia, Alabama) has indicated she could seek a full en banc review of her case in the hopes of extending Title VII to cover LGBT workers in that circuit. It would not be surprising for the Hively case to be the first in a series of dominoes that brings about a new day for Title VII litigation across the country.

We can expect to see further judicial rulings in the coming years fleshing out this issue in more detail. For example, one issue not addressed by the 7th Circuit is how this new theory will affect religious institutions given that different standards apply to them under federal antidiscrimination laws. These and other considerations will be debated in courts across the country in the near future.

Even if these appeals court decisions do not immediately materialize, there are two other avenues whereby employers could still face immediate liability for such claims. The first is through state law. Almost half of the states in the country have laws prohibiting sexual orientation discrimination in employment (California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Iowa, Maine, Maryland, Massachusetts, Minnesota, Nevada, New Hampshire, New Jersey, New Mexico, New York, Oregon, Rhode Island, Utah, Vermont, Washington, and Wisconsin), and some additional states protect state workers from such discrimination (Alaska, Arizona, Indiana, Kentucky, Louisiana, Michigan, Missouri, Montana, North Carolina, Ohio, Pennsylvania, and Virginia).

Second, plaintiffs have successfully argued to various federal courts that Title VII sex discrimination covers claims where plaintiffs allege mistreatment based on gender non-conformity actions. This includes situations where employers are alleged to have discriminated against workers for failing to live up to stereotypical gender norms. Courts have noted that drawing a line that separates these “sex-stereotyping” claims from pure sexual orientation claims is “exceptionally difficult” because the distinction is often “elusive,” meaning that employers anywhere could face a Title VII claim akin to sexual orientation discrimination that would be accepted as valid by a federal court no matter what the federal appeals courts say. This concept was discussed in the 11th Circuit’s recent Evans v. Georgia Regional Hospital decision, and the court in fact permitted the plaintiff to proceed with her case on a stereotyping theory.

While possible that the Supreme Court or Congress will step in and reverse this trend, as a recent court stated, “it seems unlikely that our society can continue to condone a legal structure in which employees can be fired, harassed, demeaned, singled out for undesirable tasks, paid lower wages, demoted, passed over for promotions, and otherwise discriminated against solely based on who they date, love, or marry.” Employers should take heed and prepare for what appears to be an inevitable extension of workplace protection rights for LGBT workers based on their sexual orientation.

Until very recently, employers were at risk of receiving steep fines if they reimbursed employees for non-employer sponsored medical care – the Affordable Care Act (ACA) included fines of up to $36,500 a year per employee for such an action. Late in 2016, however, President Obama signed the 21st Century Cures Act and established Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs). As of January 1, 2017, small employers can offer these tax-free medical care reimbursements to eligible employees.

If an employee incurs a medical care expense, such as health insurance premiums or eligible medical expenses under IRC Section 213(d), the employer can reimburse the employee up to $4,950 for single coverage or $10,000 for family coverage. Employees may not make any contributions or salary deferrals to QSEHRAs.

The maximum amount must

be prorated for those not eligible for an entire year. For example, an employer

offering the maximum reimbursement amount should only reimburse up to $2,475 to

an employee who has been working for the company for six months. For a complete

list of medical expenses covered under IRC 213(d), see https://www.irs.gov/pub/irs-pdf/p502.pdf.

Employers may tailor which expenses they will reimburse to a certain extent,

and do not have to reimburse employees for all eligible medical expenses.

Much like other healthcare reimbursement arrangements, employees may have to provide substantiation before reimbursement. The IRS has discretion to establish requirements regarding this process, but has not yet done so. Although reimbursements may be provided tax-free, they must be reported on the employee’s W-2 in Box 12 using the code “FF.”

To offer QSEHRAs, an employer cannot be an applicable large employer (ALE) under the ACA. Only employers with fewer than 50 full-time equivalent employees can offer this benefit. Further, a group cannot offer group health plans to any employees to qualify.

Typically, an employer that chooses to offer a QSEHRA must offer it to all employees who have completed at least 90 days of work. The few exceptions to this rule include part-time or seasonal employees, non-resident aliens, employees under the age of 25, and employees covered by a collective bargaining agreement.

Employers may offer differing reimbursement amounts based on employee age or family size. However, such variances must be based on the cost of premiums of a reference policy on the individual market. It is currently unclear which reference policy will be selected or how permitted discrepancies will be calculated.

To be eligible for a tax-free reimbursement, employees must have proof of minimum essential coverage. It is uncertain how closely employers will have to scrutinize such proof, although guidance will hopefully be available soon.

Eligible employees must disclose to health exchanges the amount of QSEHRA benefits available to them. The exchanges will account for the reported amount, even if the employee does not utilize it, and will likely reduce the amount of the subsidies available. Employers should take this into account before adopting a QSEHRA.

In order to establish a QSEHRA, employers will have to set up and administer a plan. Group health plan requirements, such as ACA reporting and COBRA requirements, do not apply to QSEHRAs. But in order to properly provide reimbursements to employees, employers will likely have to establish reimbursement procedures.

Additionally, any eligible employees must be notified of the arrangements in writing at least 90 days before the first day they will be eligible to participate. For the current year, the IRS is giving employers who implement QSEHRAs an extension until March 13, 2017 to provide a notice. The notice must provide the amount of the maximum benefit, and that eligible employees inform health insurance exchanges this benefit is available to them. It also must inform eligible employees they may be subject to the individual ACA penalties if they do not have minimum essential coverage.

On February 23, 2017, the Centers for Medicare and Medicaid Services released an insurance standards bulletin allowing states once again to extend the life of “grandmothered” (aka transitional health insurance or non-ACA) medical policies to policy years beginning on or before October 1, 2018, as long as the policies do not extend beyond December 31, 2018. These plans will continue to be exempt from most of the ACA’s insurance reform provisions which otherwise became effective on January 1, 2014.

On November 14, 2013, facing political pressure from millions of consumers who were receiving cancellation notices for their 2013 coverage, the Obama administration announced in guidance that states could allow insurers to extend noncompliant coverage for policy years beginning before October 1, 2014, free from certain of the ACA reforms. In March of 2014, the administration extended the life of these “grandmothered” or “transitional” plans to coverage renewed by October 1, 2016 and eventually until the end of 2017.

While the original transitional decision could perhaps have been justified by the inherent authority in the executive to reasonably delay the implementation of new legal requirements, the extension of the original delay looked increasingly political and was harder to justify legally. It also likely did serious damage to the ACA-compliant individual market. Insurers had set their 2014 premiums in the expectation that the entire non-grandfathered market would transfer to ACA-compliant plans. Instead, healthier individuals likely remained with their earlier, health-status-underwritten coverage, making the pool of consumers that actually bought 2014 coverage less healthy than expected. The transitional policy very likely played a significant role in the large insurer losses in the individual market for 2014, and played a role in raising premiums going forward.

As of today, there are probably a little fewer than a million Americans still in individual market transitional plans, although the percentage of the individual market in transitional plans varies greatly from state to state, and many remain covered in small group transitional plans. It has been thought that consumers and employers prefer transitional plans because they cost less or have lower cost-sharing.

The Trump administration’s guidance states that it is based on a commitment to “smoothly bringing all non-grandfathered coverage in the individual and small group market into compliance with all applicable” ACA requirements. One must wonder, however, why four years will be enough for a smooth transition if three years was not.

The guidance gives states the option of extending the transition for a shorter (but not longer) period of time and also of applying it to both the small group and individual markets or to either market separately. States also have the option of authorizing part-year policies if necessary to ensure that coverage ends at the end of 2018.

On Feb. 15, the IRS announced on its ACA Information Center for Tax Professionals webpage that it would not reject taxpayers’ 2016 income tax returns that are missing health coverage information.

This information is supposed to be included on line 61 of the Form 1040 and line 11 of the Form 1040EZ to demonstrate compliance during the year with the Affordable Care Act’s (ACA’s) mandate that individuals have health insurance that meets ACA standards, or else pay a penalty.

Two crucial points regarding the IRS announcement should be stressed:

The IRS indicated that it will accept tax returns lacking this information in light of President Donald Trump’s executive order directing agencies to minimize the ACA’s regulatory burden. While the requirement to have ACA-compliant coverage or pay a tax penalty has been in place since 2014, starting this year the IRS was to have begun automatically flagging and rejecting tax returns missing that information.

“This action by the IRS doesn’t mean it won’t enforce the individual mandate,” said Lisa Carlson, senior Employee Retirement Income Security Act (ERISA) attorney at Lockton Compliance Services in Chicago. “This action simply means the IRS won’t reject a taxpayer’s return outright if the taxpayer doesn’t answer the health coverage question. The IRS reserves the right to follow up with a taxpayer, at a future date, regarding his or her compliance with the individual mandate, if the person’s tax return doesn’t provide information about his or her health insurance coverage during 2016.”

For those individuals who previously filed without providing health insurance information or who indicated that they did not carry coverage as was required, “whether the IRS will assess penalties depends on the retroactive nature of [a possible future] repeal of the individual mandate or its penalties,” Carlson said.

While the IRS announcement does not suggest that the agency won’t be strictly enforcing the individual mandate tax penalty, “we just don’t know” what enforcement actions the agency might take, said Garrett Fenton, an attorney with Miller & Chevalier in Washington, D.C., whose practice focuses on employee benefits, tax and executive compensation.

While it’s unclear how strenuous IRS enforcement actions might be, “the individual mandate and its related tax penalties are certainly still on the books, and it would require an act of Congress to change that,” Fenton noted. If tax filers leave unchecked the box indicating that they have ACA-compliant coverage, “the IRS may come back and ask them follow-up questions, and they still may get audited and potentially owe the tax penalty.”

The ACA is still the law of the land and prudent employers will want to continue to comply with the ACA, including the play-or-pay mandate and reporting requirements, including furnishing Forms 1095-C to employees and making all required filings with the IRS, until formal guidance relieves them of those compliance obligations.

Despite the IRS announcement, employers are still required to file their ACA reporting forms and those forms will be rejected if they do not contain the requisite information. Because the President has indicated that we may not see a repeal until 2018, employers will still be required to operate their health plans in an ACA-compliant manner until notified otherwise.

In the context of the employer mandate, waiver of penalties seems unlikely because these penalties are written into law and are a significant source of revenue for the federal government.

The bottom line: Those who are responsible for issuing and filing 1094s and 1095s on behalf of their organizations should continue to comply with all relevant laws, regulations, reporting requirements and filing specifications during the repeal-and-replace process.

The IRS issued Notice 2016-70 in November 2016, giving employers subject to the ACA’s 2016 information-reporting requirements up to an additional 30 days to deliver these forms to employees. The notice affected upcoming deadlines for ACA information reporting as follows:

The Treasury Department and the IRS determined that a substantial number of employers and other insurance providers needed additional time “to gather and analyze the information [necessary to] prepare the 2016 Forms 1095-C and 1095-B to be furnished to individuals,” Notice 2016-70 stated. This extension applies for tax year 2016 only and does not require the submission of any request or other documentation to the IRS.

Although the date for filing with the IRS was not extended, employers can obtain a 30-day extension by submitting Form 8809 (Application for Extension of Time to File Information Returns) by the due date for the ACA information returns.

Note: For small businesses with fewer than 50 full-time equivalent employees that provide employees with an ACA-compliant group plan, the rules are a bit different. If fully insured, the insurance company that provides coverage is required to send enrollees a copy of Form 1095-B and to submit Forms 1995-B (along with transmittal Form 1094-B) to the IRS in order to report minimum essential coverage.

If a small company is self-insured and provides group coverage, it must also provide employees and the IRS with Form 1095-B. But small business that offer insurance are not required to send Form 1095-Cs to employees or to the IRS.

Small business that do not provide group coverage are not subject to ACA reporting.

While Congress considers options to repeal and replace the ACA, businesses should prepare to comply with the current employer mandate through 2018. Businesses should pay close attention to decisions over the next few weeks, but be prepared to stay patient because significant details on employer obligations are unlikely to take shape for some time.

In one of his first actions in office, President Donald Trump signed an Executive Order to “Minimize the Economic Burden of the Patient Protection and Affordable Care Act Pending Repeal.” In a few short paragraphs, President Trump has given a very broad directive to federal agency heads, including the Department of Health and Human Services, to take steps to grant waivers, exemptions, and delay provisions of the ACA that impose costs on states or individuals.

Although the Order does not refer to employers specifically, the intent and breadth of its sweeping statements appear to direct agencies to take the same type of actions with regards to provisions of the ACA that similarly affect employers.

The Order does not itself effect any change, but rather acts as a road map to some of the desired changes of the administration, while urging the agencies to soften enforcement of pieces of the ACA until a repeal can be accomplished. It is clear that the Order cannot undo the ACA itself as that will take a coordinated act of Congress. Trump and Congressional Republicans still have much work ahead in agreeing on the legislation that will repeal and replace the ACA, including taking into account the unsettling effect such initiatives will have on the health insurance market in general.

The language of the Order addresses the actions of agencies in the interim period before a repeal occurs, but does not grant any powers above what already exist. The Order also acknowledges that any required changes to applicable regulations will follow all administrative requirements and processes, including notice and comment periods. However, it leaves the important question of how much discretion the agencies have and in what manner (and on what timetable) will they exercise that discretion.

We will continue to closely monitor agency reaction to the Executive Order, especially as it relates to the responsibilities of employers.

All OSHA 300A logs must be posted by February 1st in a visible location for employees to read. The logs need to remain posted through April 30th.

Please note the 300 logs must be completed for your records only as well. Be sure to not post the 300 log as it contains employee details. The 300A log is a summary of all workplace injuries and does not contain employee specific details. The 300A log is the only log that should be posted for employee viewing.

Please contact our office if you need a copy of either the OSHA 300 or 300A logs.

President-elect Donald Trump and Republican congressional leaders have announced repeatedly their intentions to repeal the Affordable Care Act (ACA) once President Barack Obama leaves office. But how that will exactly play out has been the topic of speculation by many.

Washington watchers expect that shortly after his inauguration on Jan. 20, President Trump and GOP leaders will try to pass a measure to repeal the ACA outright. That effort, however, will assuredly face a Democratic filibuster in the Senate, which would require at least 60 votes to overcome—and Republicans have only 52 Senate votes in the new Congress.

Facing a filibuster, Republicans are likely to turn to the budget reconciliation process, in which a simple Senate majority is needed to pass measures related to federal revenues and spending, as long as those measures are budget-neutral, meaning they neither increase nor decrease overall spending or revenue. Much of the ACA was originally passed by Democrats in 2010 using reconciliation.

For the parts of the ACA that are not directly related to federal spending, such as the insurance market reforms, Republicans may start negotiating with Democrats on changing the law in ways that can attract enough senators from both parties to reach the 60-vote threshold.

Opponents “cannot stand in the way of a repeal bill if the president goes out and says he wants it. They may be able to do some things to modify the transitional uncertainty, but it is happening,” said Randy Hardock, a partner at law firm Davis & Harman in Washington, D.C.

The taxes that the ACA imposed on employers will “go away,” he predicted. “But once they pass repeal, they won’t work on replace for two or three years, because the Democrats need to be brought to the table, and they’ll never cut a deal until the end” of the Congressional session.

“I do think they’ll pass a repeal bill, but I would speculate that they’ll try to do pieces of replace along with repeal,” said Katy Spangler, senior vice president, health policy, for the American Benefits Council, a trade association based in Washington, D.C.

The repeal bill that Congress passed last January, which was vetoed by Obama, “saved a half-trillion dollars” based on the elimination of direct federal subsidies for ACA coverage, she noted. If a similar bill is passed in 2017, those funds would be available to fund an ACA alternative—perhaps along the lines of a bill previously supported by House Budget Committee Chairman Tom Price, R-Ga., Trump’s nominee to be secretary of Health and Human Services. That measure would provide tax credits for people to buy insurance if they don’t have access to coverage through an employer or government program.

However, Spangler called it “a big gamble” to hope that the Senate will rule that money saved by repealing the ACA could be treated as a kind of budgetary fund that could later be used to make a replacement measure budget-neutral, when passed through the budget reconciliation process. “That’s a half-trillion-dollar gamble that [Republicans] might not be willing to take,” she said. “So maybe they do their version of the tax credits as part of that original repeal bill.”

Doing so, she suggested, “helps moderate Republicans know that you’re not just going to have 20 million people kicked off their insurance. And that gives you time to come back and get Democrats to perfect some of the market reforms and to perfect some other things to make [ACA repeal and replacement] better.”

On Jan. 3, Republicans introduced a resolution in the U.S. Senate to set up a reserve fund for future health care legislation under an ACA replacement bill, based on savings to be derived from the repeal of the Affordable Care Act.

While measures passed through the budget reconciliation process must be budget neutral, the resolution and related rules would give special protection to bills repealing or “reforming” the ACA, even if such bills cause a temporary increase in spending.

House Speaker Paul Ryan, R-Wis., said in a statement, “This resolution sets the stage for repeal followed by a stable transition to a better health care system. Today we begin to deliver on our promise to the American people.”

The New York Times reported that in the week of Jan. 9, according to a likely timetable sketched out by Rep. Greg Walden, R-Ore., incoming chairman of the House Energy and Commerce Committee, the House will vote on a budget blueprint, which is expected to call for the repeal of the Affordable Care Act. Then, in the week starting Jan. 30, Walden’s committee will act on legislation to carry out what is in the blueprint. That bill would be the vehicle for repealing major provisions of the health care law.

Carolyn Smith, a benefits attorney with Alston & Bird in Washington, D.C., agreed that the Republicans’ vetoed repeal bill from last January could be “a model for what they’re thinking about now. It’s been blessed by the Senate parliamentarian, so you know that everything in there works in reconciliation. It basically got rid of pretty much all the [ACA] taxes. It got rid of the Medicaid expansion with a delayed effective date.”

Left intact, Smith pointed out, were “all of the market reforms.” But, she said, “I don’t think that insurers are going to think it’s sustainable to have none of the risk adjustment and premium subsidies,” leaving them with a number of federal mandates, including required services that their health plans must cover.

“We’re going to need a road map for individual and small group market coverage [for plan year 2018] by April at the latest, given the timelines for filing products and rates, and getting approval by states,” said Kris Haltmeyer, vice president, health policy and analysis, for the Chicago-based Blue Cross Blue Shield Association.

The insurance industry will “need to see stability and that Congress will honor the [subsidy] commitments that have already been made for 2016 and 2017 for products that have been priced and are out in the market. And we need predictability going forward to see what the pathway is for the next two to three years.”

“There are a lot of challenges if you go ahead and repeal, even with a transition, and don’t provide signals to the health insurance market about what the industry is going to look like,” said Jeanette Thornton, senior vice president at America’s Health Insurance Plans, a Washington, D.C.-based trade association representing the health insurance community.

She agreed with Haltmeyer that “making design changes to benefits and networks takes time” and that “plans are developing products and rates in the spring for the following year. We’ve been stressing the need to have some certainly, some rules of the road, to understand what the market is going to transition to so we can be prepared and make those changes.”

With the market reforms and consumer protections that Republicans are signaling they want to keep, “what’s it all going to look like?” Thornton wondered. “There’s no shortage of work if you work in health policy right now.”