Prior to each year’s Medicare Part D annual enrollment period, plan sponsors that offer prescription drug coverage must provide notices of creditable or noncreditable coverage to Medicare-eligible individuals.

The required notices may be provided in annual enrollment materials, separate mailings or electronically. Whether plan sponsors use the federal Centers for Medicare & Medicaid Services (CMS) model notices or other notices that meet prescribed standards, they must provide the required disclosures no later than Oct. 15, 2017.

Group health plan sponsors that provide prescription drug coverage to Medicare Part D-eligible individuals must also disclose annually to the CMS—generally, by March 1—whether the coverage is creditable or noncreditable. The disclosure obligation applies to all plan sponsors that provide prescription drug coverage, even those that do not offer prescription drug coverage to retirees.

Background

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 requires group health plan sponsors that provide prescription drug coverage to disclose annually to individuals eligible for Medicare Part D whether the plan’s coverage is “creditable” or “noncreditable.” Prescription drug coverage is creditable when it is at least actuarially equivalent to Medicare’s standard Part D coverage and noncreditable when it does not provide, on average, as much coverage as Medicare’s standard Part D plan. The CMS has provided a Creditable Coverage Simplified Determination method that plan sponsors can use to determine if a plan provides creditable coverage.

Disclosure of whether their prescription drug coverage is creditable allows individuals to make informed decisions about whether to remain in their current prescription drug plan or enroll in Medicare Part D during the Part D annual enrollment period. Individuals who do not enroll in Medicare Part D during their initial enrollment period (IEP), and who subsequently go at least 63 consecutive days without creditable coverage (e.g., they dropped their creditable coverage or have non-creditable coverage) generally will pay higher premiums if they enroll in a Medicare drug plan at a later date.

Who Gets the Notices?

Notices must be provided to all Part D eligible individuals who are covered under, or eligible for, the employer’s prescription drug plan—regardless of whether the coverage is primary or secondary to Medicare Part D. “Part D eligible individuals” are generally age 65 and older or under age 65 and disabled, and include active employees and their dependents, COBRA participants and their dependents, and retirees and their dependents.

Because the notices advise plan participants whether their prescription drug coverage is creditable or noncreditable, no notice is required when prescription drug coverage is not offered.

Also, employers that provide prescription drug coverage through a Medicare Part D Employer Group Waiver Plan (EGWP) are not required to provide the creditable coverage notice to individuals who are eligible for the EGWP.

Notice Requirements

The Medicare Part D annual enrollment period runs from Oct. 15 to Dec. 7. Each year, before the enrollment period begins (i.e., by Oct. 14), plan sponsors must notify Part D eligible individuals whether their prescription drug coverage is creditable or non-creditable. The Oct. 14 deadline applies to insured and self-funded plans, regardless of plan size, employer size or grandfathered status

Part D eligible individuals must be given notices of the creditable or non-creditable status of their prescription drug coverage:

According to CMS, the requirement to provide the notice prior to an individual’s IEP will also be satisfied as long as the notice is provided to all plan participants each year before the beginning of the Medicare Part D annual enrollment period.

Model notices that can be used to satisfy creditable/non-creditable coverage disclosure requirements are available in both English and Spanish on the CMS website. Plan sponsors that choose not to use the model disclosure notices must provide notices that meet prescribed content standards.

Notices of creditable/non-creditable coverage may be included in annual enrollment materials, sent in separate mailings or delivered electronically. Plan sponsors may provide electronic notice to plan participants who have regular work-related computer access to the sponsor’s electronic information system. However, plan sponsors that use this disclosure method must inform participants that they are responsible for providing notices to any Medicare-eligible dependents covered under the group health plan.

Electronic notice may also be provided to employees who do not have regular work-related computer access to the plan sponsor’s electronic information system and to retirees or COBRA qualified beneficiaries, but only with a valid email address and their prior consent. Before individuals can effectively consent, they must be informed of the right to receive a paper copy, how to withdraw consent, how to update address information, and any hardware/software requirements to access and save the disclosure. In addition to emailing the notice to the individual, the sponsor must also post the notice (if not personalized) on its website.

In Closing

Plan sponsors that offer prescription drug coverage will have to determine whether their drug plan’s coverage satisfies CMS’s creditable coverage standard and provide appropriate creditable/noncreditable coverage disclosures to Medicare-eligible individuals no later than Oct. 15, 2017.

As many as 50,000 Americans may have died in 2016 as the result of an opioid-related overdose. This number continues to increase with no end in sight, as the use of prescription opioids to relieve pain has reached staggering levels. In 2012, more than 259 million prescriptions were written for opioids, with the current number undoubtedly being much higher. Drug overdose is now the leading cause of death for Americans under 50.

Prescription Drug Use Often Leads to Heroin Addiction

Opioids may be found in any medicine cabinet. This group of drugs includes the regularly prescribed painkillers oxycodone, hydrocodone, morphine, and fentanyl. These drugs interact with opioid reactors on nerve centers in the brain to create a pleasurable experience and relieve pain. Due to the relief they experience, consumers of these drugs often become dependent upon them. Once addicted, individuals may turn to heroin, which, although illegal, is often a cheaper and more accessible opioid. In fact, approximately four in five heroin addicts developed their addiction after taking prescription painkillers.

Studies show that in 2015, 2 million Americans had a substance use disorder involving prescription pain relievers, and 591,000 had an addiction to heroin. Nearly 23% of opioid users will eventually become addicted to heroin.

Effects on the Workplace

Employees may be prescribed opioids to relieve pain following a workplace injury, which could begin a path to dependency. But whether the origin of opioid use stems from a workplace injury or not, use of these drugs could have a dramatic impact on an employee’s performance. Opioid dependency often leads to drowsiness, shifting moods, anxiety, and depression. An employee with an opioid addiction may struggle to maintain regular attendance, achieve quality goals, or pose a safety hazard to him or herself and coworkers. Moreover, addiction to these drugs usually also causes financial issues because the addict is in constant search for a fix. This could lead to cases of workplace theft or embezzlement.

(more…)

The Occupational Safety and Health Administration (OSHA) announced the portal for electronic recordkeeping reporting will become available on OSHA’s website beginning August 1, 2017. Currently the website is down due to a possible security breech but we will keep you posted as the December 1st deadline nears.

OSHA previously issued a notice of proposed rulemaking that delayed the initial deadline for electronic reporting from July 1 to December 1, 2017. These events have combined to create some uncertainty for employers about whether and when they may be required to electronically submit recordkeeping data.

At this time, employers should wait until the proposed rulemaking is finalized, and it is likely that electronic recordkeeping will not be required until December 1, 2017, if at all. The proposed rulemaking indicated that “OSHA also intends to issue a separate proposal to reconsider, revise, or remove other provisions of the prior final rule”.

The health reform law imposes a number of fees, taxes and other assessments on health insurance companies and sponsors of self-funded health plans to help subsidize a number of endeavors. One such fee funds the Patient-Centered Outcomes Research Institute (PCORI).

The PCORI fee for calendar year plans is $2.26 per covered life for the 2016 plan year, and must be reported on (and remitted with) IRS Form 720 by July 31, 2017. For non-calendar year plans, if the 2015-16 plan year ended on or before Sept. 30, 2016, the fee is $2.17 per covered life. If the 2015-16 plan year ended between Oct. 1 and Dec. 31, 2016, the fee is $2.26 per covered life. In either case, the filings are similarly due by July 31, 2017. (Note: The Form 720 must be filed by July 31 of the calendar year that begins after the last day of the plan year.)

For self-funded plans, the employer/plan sponsor will be responsible for submitting the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee is not permitted for self-funded plans. The process for remitting payment by sponsors of self-funded plans is described in more detail below.

The IRS will collect the fee from the insurer or, in the case of self-funded plans, the plan sponsor/employer in the same way many other excise taxes are collected. IRS regulations provide three options for determining the average number of covered lives (actual count, snapshot and Form 5500 method).

The U.S. Department of Labor believes the fee cannot be paid from plan assets. In other words, the PCORI fee must be paid by the plan sponsor; it is not a permissible expense of a self-funded plan and cannot be paid in whole or part by participant contributions. The IRS has indicated the fee is, however, a tax-deductible business expense for employers with self-funded plans.

The filing and remittance process to the IRS is straightforward and largely unchanged from last year. On page two of Form 720, under Part II, the employer needs to designate the average number of covered lives under its “applicable self-insured plan.” The number of covered lives is multiplied by the applicable amount ($2.26 or $2.17) to determine the total fee owed to the IRS. The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.” Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’s software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

With the Republicans’ failure to pass a bill to repeal and replace the Affordable Care Act (ACA), employers should plan to remain compliant with all ACA employee health coverage and annual notification and information reporting obligations.

Even so, advocates for easing the ACA’s financial and administrative burdens on employers are hopeful that at least a few of the reforms they’ve been seeking will resurface in the future, either in narrowly tailored stand-alone legislation or added to a bipartisan measure to stabilize the ACA’s public exchanges. Relief from regulatory agencies could also make life under the ACA less burdensome for employers.

“Looking ahead, lawmakers will likely pursue targeted modifications to the ACA, including some employer provisions,” said Chatrane Birbal, senior advisor for government relations at the Society for Human Resource Management (SHRM). “Stand-alone legislative proposals have been introduced in previous Congresses, and sponsors of those proposals are gearing up to reintroduce bills in the coming weeks.”

These legislative measures, Birbal explained, are most likely to address the areas noted below.

(more…)

Repeal and replacement of the Affordable Care Act (ACA) by the American Health Care Act (AHCA) may be underway in Washington D.C., but until a final version of the AHCA is signed into law, the ACA is the law of the land. In fact, the IRS is currently issuing notices to employers that require them to disclose whether they complied with ACA large employer reporting duties, or their excuse for not doing so, where applicable.

The ACA required large employers to furnish employee statements (Forms 1095-C) and file them with the IRS under transmittal Form 1094-C, and the Internal Revenue Code (“Code”) imposes separate penalty taxes for failing to timely furnish and file the required forms. Large employer reporting was required for 2015 and 2016, even if transition relief from ACA penalty taxes applied for 2015. The potential penalties can be very large – up to $500 per each 2015 Form 1095-C statement ($250 for not furnishing the form to the employee and $250 for not filing it with IRS) – up to a total annual penalty liability of $3 million. The penalty amounts and cap are periodically adjusted for inflation.

Employers that failed to furnish Form 1095-C and file copies with Form 1094-C may receive the IRS notices, called “Request for Employer Reporting of Offers of Health Insurance Coverage (Forms 1094-C and 1095-C)” and also known as Letter 5699 forms. Forms may be received regarding reporting for 2015 or 2016. Employers that receive a Letter 5699 form will have only thirty days to complete and return the form, which contains the following check boxes:

The Letter also provides: “[i]f you are required to file information returns under IRC Section 6056, failure to comply may result in the assessment of a penalty under IRC Section 6721 for a failure to file information returns.”

Employers receiving Letter 5699 forms should contact their benefit advisors immediately and plan to respond as required within the thirty-day limit; it may be necessary to request an extension for employers that are just realizing that they have reporting duties and need to prepare statements for enclosure with their response. In this regard, the IRS offers good faith relief from filing penalties for timely filed but incomplete or incorrect returns for 2015 and 2016, but relief from penalties for failures to file entirely for those years is available only upon a showing of “reasonable cause,” which is narrowly interpreted (for instance, due to fire, flood, or major illness).

Large employers should not look to coming ACA repeal/replacement process for relief from filing duties and potential penalties. The House version of the AHCA does not change large employer reporting duties and it is unlikely the Senate or final versions of the law will do so. This is largely because procedural rules limit reform/repeal provisions to those affecting tax and revenue measures, which would not include reporting rules. Thus the reporting component of the ACA will likely remain intact (though it may be merged into Form W-2 reporting duties), regardless of the ACA’s long-term fate in Washington.

This simple change in OSHA’s rulemaking requirements will improve safety for workers across the country. One important reason stems from our understanding of human behavior and motivation. Behavioral economics tells us that making injury information publicly available will “nudge” employers to focus on safety. And, as we have seen in many examples, more attention to safety will save the lives and limbs of many workers, and will ultimately help the employer’s bottom line as well. Finally, this regulation will improve the accuracy of this data by ensuring that workers will not fear retaliation for reporting injuries or illnesses.

The new rule, which takes effect Jan. 1, 2017, requires certain employers to electronically submit injury and illness data that they are already required to record on their onsite OSHA Injury and Illness forms. Analysis of this data will enable OSHA to use its enforcement and compliance assistance resources more efficiently. Some of the data will also be posted to the OSHA website. OSHA believes that public disclosure will encourage employers to improve workplace safety and provide valuable information to workers, job seekers, customers, researchers and the general public. The amount of data submitted will vary depending on the size of company and type of industry. The electronic submission requirements do not change an employer’s obligation to complete and retain the injury & illness records.

OSHA will provide a secure website that offers three options for data submission. First, users will be able to manually enter data into a webform. Second, users will be able to upload a CSV file to process single or multiple establishments at the same time. Last, users of automated recordkeeping systems will have the ability to transmit data electronically via an API (application programming interface). OSHA is not yet accepting electronic submissions at this time. Updates will be posted to the OSHA website at www.osha.gov/recordkeeping when they are available.

The rule also prohibits employers from discouraging workers from reporting an injury or illness. The final rule requires employers to inform employees of their right to report work-related injuries and illnesses free from retaliation, which can be satisfied by posting the already-required OSHA workplace poster. It also clarifies the existing implicit requirement that an employer’s procedure for reporting work-related injuries and illnesses must be reasonable and not deter or discourage employees from reporting; and incorporates the existing statutory prohibition on retaliating against employees for reporting work-related injuries or illnesses. These provisions become effective August 10, 2016, but OSHA has delayed their enforcement until Dec. 1, 2016.

The new reporting requirements will be phased in over two years:

OSHA State Plan states must adopt requirements that are substantially identical to the requirements in this final rule within 6 months after publication of this final rule.

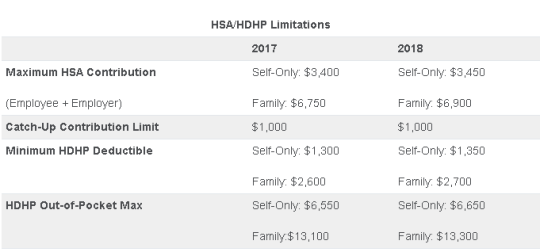

On May 4, 2017, the IRS released Revenue Procedure 2017-37 setting dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for 2018. HSAs are subject to annual aggregate contribution limits (i.e., employee and dependent contributions plus employer contributions). HSA participants age 55 or older can contribute additional catch-up contributions. Additionally, in order for an individual to contribute to an HSA, he or she must be enrolled in a HDHP meeting minimum deductible and maximum out-of-pocket thresholds. The contribution, deductible and out-of-pocket limitations for 2018 are shown in the table below (2017 limits are included for reference).

Note that the Affordable Care Act (ACA) also applies an out-of-pocket maximum on expenditures for essential health benefits. However, employers should keep in mind that the HDHP and ACA out-of-pocket maximums differ in a couple of respects. First, ACA out-of-pocket maximums are higher than the maximums for HDHPs. The ACA’s out-of-pocket maximum was identical to the HDHP maximum initially, but the Department of Health and Human Services (which sets the ACA limits) is required to use a different methodology than the IRS (which sets the HSA/HDHP limits) to determine annual inflation increases. That methodology has resulted in a higher out-of-pocket maximum under the ACA. The ACA out-of-pocket limitations for 2018 were announced are are $7350 for single and $14,700 for family.

Second, the ACA requires that the family out-of-pocket maximum include “embedded” self-only maximums on essential health benefits. For example, if an employee is enrolled in family coverage and one member of the family reaches the self-only out-of-pocket maximum on essential health benefits ($7,350 in 2018), that family member cannot incur additional cost-sharing expenses on essential health benefits, even if the family has not collectively reached the family maximum ($14,700 in 2018).

The HDHP rules do not have a similar rule, and therefore, one family member could incur expenses above the HDHP self-only out-of-pocket maximum ($6,650 in 2018). As an example, suppose that one family member incurs expenses of $10,000, $7,350 of which relate to essential health benefits, and no other family member has incurred expenses. That family member has not reached the HDHP maximum ($14,700 in 2018), which applies to all benefits, but has met the self-only embedded ACA maximum ($7,350 in 2018), which applies only to essential health benefits. Therefore, the family member cannot incur additional out-of-pocket expenses related to essential health benefits, but can incur out-of-pocket expenses on non-essential health benefits up to the HDHP family maximum (factoring in expenses incurred by other family members).

Employers should consider these limitations when planning for the 2018 benefit plan year and should review plan communications to ensure that the appropriate limits are reflected.