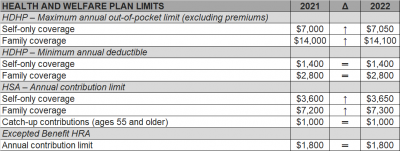

The Internal Revenue Service (IRS) recently announced (See Revenue Procedure 2021-25) cost-of-living adjustments to the applicable dollar limits for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted benefit health reimbursement arrangements (HRAs) for 2022. Many of the dollar limits currently in effect for 2021 will change for 2022. The HSA catch-up contribution for individuals ages 55 and older will not change as it is not subject to cost-of-living adjustments.

The table below compares the applicable dollar limits for HSAs, HDHPs and excepted benefit HRAs for 2021 and 2022.

Declaring that the state is “no longer in a state of emergency,” Florida Governor Ron DeSantis signed a bill on Monday, May 3rd, banning vaccine passports while issuing two executive orders immediately suspending and invalidating local government COVID-19 restrictions, including mask mandates. But the news doesn’t necessarily mean you should rush to ease up on your facemask requirements for workers or visitors, nor impact your decision to mandate vaccines for your workers. Below is a summary of the implications for Florida businesses.

Vaccine Passports Banned

As the vaccine rollout progresses, businesses and employers nationwide have been wondering if a “vaccine passport” – an official document certifying that an individual has been vaccinated against COVID-19 – can lead to a path back to normalcy. A Florida law now prohibits businesses operating in Florida from implementing those measures with respect to customers. The new law does not come as a surprise to most Floridians. On April 2, Governor DeSantis signed Executive Order 21-81 prohibiting vaccine passports. This new law, however, solidifies the ban and provides more guidance for businesses.

Specifically, the new law says that “business entities,” including for-profit and not-for-profit entities, cannot require that patrons or customers provide documentation certifying that they received the COVID-19 vaccine or certifying that they have recovered from the virus to enter or receive a service from the business. Licensed health care providers are exempt from this provision.

The law also provides that educational institutions, including both public and private schools, cannot require students or residents to provide documentation certifying that they received the COVID-19 vaccine or have recovered from the virus.

Importantly, the law does not prohibit private businesses from requiring that their own employees show proof of vaccination or certification that they recovered from the virus. Of note, recent guidance from the Equal Employment Opportunity Commission clarifies that it is generally permissible for employers to ask employees about whether they have been vaccinated, but employers should avoid further inquiries.

Further, the new law permits covered entities to continue to use screening protocols (such as temperature checks) in accordance with state or federal law to protect public health.

Governor Eliminates Current Local Restrictions After Florida Surgeon General Discourages Masks

On April 29, Florida State Surgeon General Dr. Scott Rivkees issued a Public Health Advisory rescinding prior public health advisories. Notably, the advisory states that fully vaccinated people should no longer be advised to wear face coverings or avoid social and recreational gatherings except in “limited circumstances.” Those limited circumstances are not defined, but the advisory appears to cover masking both indoors and outdoors.

Noticeably, the Surgeon General’s advisory is less restrictive than CDC guidance. Although the CDC recently announced that fully vaccinated people can forego masks in certain situations (for example, if they are indoors with other vaccinated people, indoors with unvaccinated people from the same household, or outdoors in spaces that are not crowded), the CDC generally recommends that fully vaccinated people continue to wear masks or face coverings in other scenarios.

To follow the Surgeon General’s advisory, Governor DeSantis issued a pair of executive orders on May 3 suspending and invalidating local government COVID-19 restrictions, including mask mandates. These orders effectively eliminate all existing coronavirus-related restrictions imposed by local governments. This means that local orders requiring, among other things, masks, sanitizing, and capacity limits are no longer effective. The orders do not affect restrictions issued by school districts.

Noticeably, the governor’s orders only prohibit local governments from issuing and enforcing COVID-19 restrictions using their emergency procedures. They specifically allow local governments to enact ordinances under regular enactment procedures. Thus, it is possible that local governments will counter the governor’s orders by enacting ordinances continuing to require such measures as masking and distancing.

However, the state’s guidance does not mean that private businesses cannot – or should not – enforce their own policies. The orders only prohibit local governments from issuing and enforcing restrictions on individuals or businesses using emergency powers. Local governments may still enact such procedures using regular procedures. Businesses can still generally enforce their own measures, including mask mandates, if they choose to.

What Should Employers Do Now?

Pushing forward to a new normal, Florida employers should be aware of how to proceed. Despite the state’s guidance, you should continue to enforce safety measures.

Florida recently passed a new COVID-19 liability protection law for businesses. Although very favorable to businesses, the law requires that businesses make a “good faith effort to substantially comply with authoritative or controlling government-issued health standards” to gain its protection. If there are different sources of guidance in effect, a business may follow any of them. This means that although they are different, a business can likely be protected from liability by following either Florida or CDC guidance. However, an employer may have stronger defenses and be able to undercut possible claims earlier by following CDC guidance, which takes a more conservative approach than current Florida guidance.

Further, OSHA requires that employers maintain a workplace free of recognized hazards. COVID-19 is such a recognized hazard. By not following CDC guidance, a Florida employer may open themselves to exposure under OSHA’s General Duty Clause, even in the absence of a state mandate.

Employers should also consider the business realities of having unmasked employees. Among other things, customers and vendors may not feel comfortable entering your business if they see employees unmasked, even if they are vaccinated.

Finally, because the Surgeon General’s recommendations only apply to fully vaccinated people, your business may have an inconsistent patchwork of some employees wearing masks while others are not. This may result in a situation where different standards apply to different employees depending on their vaccination status. Employers should avoid this, as OSHA has issued guidance stating that businesses should not treat unvaccinated employees differently than vaccinated employees. Additionally, inconsistency among employees wearing masks may inadvertently reveal who is and is not vaccinated, which may be disruptive and may unintentionally single out employees who do not get the vaccine, including for medical or religious reasons.

The sudden and prolonged isolation brought on by COVID-19 has greatly impacted the normal routines and activities of the entire workforce. While the ongoing vaccine rollout inspires hope for a COVID-free future, the emerging virus variants and the harsh winter weather experienced across the United States after over a year of social distancing have raised further concerns about employee mental health issues and engagement in 2021.

As many employers continue to manage a partially or entirely remote workforce – some of which may shift to a permanent off-site or hybrid workplace model – they’re faced with the challenge of keeping employees connected. Since social health plays an important role in determining an overall sense of wellbeing and a large number of individuals aren’t socializing with coworkers, peers and friends like they used to, it’s important for workplace leaders to provide their people with opportunities to make meaningful connections. The wellbeing of your workforce depends on it.

The mental wellbeing of your workforce is best supported by positive social interactions. Remote workers who have struggled with feelings of loneliness and social isolation are more likely to feel lonely, anxious and depressed, which is why it’s important for organizations to provide plenty of opportunities to engage with their co-workers. Encouraging employees to work together on collaborative tasks, scheduling weekly team meetings (they don’t have to focus on work!) and empowering employees to create and interact with interest-based groups within their digital wellbeing platforms are just a few easy ways to help your people feel connected.

Providing employees with mental health resources is a must. Beyond offering up mental health benefits like mindfulness tools and live health coaching, remote workers can also engage through activities like guided team meditation or virtual yoga sessions. According to MetLife, 79% of employees who report good mental health are less likely to feel detached from their organization. Additionally, 86% of workers who feel that they are mentally healthy are more likely to be productive at work. Rather than simply considering workplace mental health resources as an addition to an employee benefits package, putting an emphasis on mental health as a main component of a company’s culture is an essential business move in 2021.

Countless employees are missing the bustling workplace environment. The constant Zoom meetings and digital interactions lack the sense of social connectedness once accustomed to. Finding unique ways to make regular meetings and virtual communication more engaging is critical for maximizing employee performance. Casual video chats and remote social happy hours are a great way to use technology as an advantage and initiate a stronger connection among employees while working remotely. Additional ways to promote more social interactions among employees include scheduling group exercise breaks or starting a workplace wellbeing challenge. To ensure everyone is able to participate, consider designating employees who really know their way around the virtual world as leaders for a multigenerational workforce. By opening more channels of communication, the remote work environment will improve for everyone and increase employee engagement as well as productivity.

Around 66% of workers are struggling to stay socially connected, which is negatively affecting their wellbeing. Fortunately, by encouraging your remote workforce to prioritize their mental health and social wellbeing, organizations are likely to see a significant increase employee engagement and productivity as employee wellbeing improves.

The American Rescue Plan Act of 2021 (ARP) allows small and midsize employers, and certain governmental employers, to claim refundable tax credits that reimburse them for the cost of providing paid sick and family leave to their employees due to COVID-19, including leave taken by employees to receive or recover from COVID-19 vaccinations. The ARP tax credits are available to eligible employers that pay sick and family leave for leave from April 1, 2021, through September 30, 2021.

Here are some basic facts from the IRS website about the employers eligible for the tax credits and how these employers may claim the credit for leave paid to employees who take leave to receive or recover from COVID-19 vaccinations.

An eligible employer is any business, including a tax-exempt organization, with fewer than 500 employees. An eligible employer also includes a governmental employer, other than the federal government and any agency or instrumentality of the federal government that is not an organization described in section 501(c)(1) of the Internal Revenue Code. Self-employed individuals are eligible for similar tax credits.

Eligible employers are entitled to tax credits for wages paid for leave taken by employees who are not able to work or telework due to reasons related to COVID-19, including leave taken to receive COVID–19 vaccinations or to recover from any injury, disability, illness or condition related to the vaccinations. These tax credits are available for wages paid for leave from April 1, 2021, through September 30, 2021.

The paid leave credits under the ARP are tax credits against the employer’s share of the Medicare tax. The tax credits are refundable, which means that the employer is entitled to payment of the full amount of the credits if it exceeds the employer’s share of the Medicare tax.

The tax credit for paid sick leave wages is equal to the sick leave wages paid for COVID-19 related reasons for up to two weeks (80 hours), limited to $511 per day and $5,110 in the aggregate, at 100 percent of the employee’s regular rate of pay. The tax credit for paid family leave wages is equal to the family leave wages paid for up to twelve weeks, limited to $200 per day and $12,000 in the aggregate, at 2/3rds of the employee’s regular rate of pay. The amount of these tax credits is increased by allocable health plan expenses and contributions for certain collectively bargained benefits, as well as the employer’s share of social security and Medicare taxes paid on the wages (up to the respective daily and total caps).

Eligible employers may claim tax credits for sick and family leave paid to employees, including leave taken to receive or recover from COVID-19 vaccinations, for leave from April 1, 2021, through September 30, 2021.

Eligible employers report their total paid sick and family leave wages (plus the eligible health plan expenses and collectively bargained contributions and the eligible employer’s share of social security and Medicare taxes on the paid leave wages) for each quarter on their federal employment tax return, usually Form 941, Employer’s Quarterly Federal Tax Return PDF. Form 941 is used by most employers to report income tax and social security and Medicare taxes withheld from employee wages, as well as the employer’s own share of social security and Medicare taxes.

In anticipation of claiming the credits on the Form 941 PDF, eligible employers can keep the federal employment taxes that they otherwise would have deposited, including federal income tax withheld from employees, the employees’ share of social security and Medicare taxes and the eligible employer’s share of social security and Medicare taxes with respect to all employees up to the amount of credit for which they are eligible. The Form 941 instructions PDF explain how to reflect the reduced liabilities for the quarter related to the deposit schedule.

If an eligible employer does not have enough federal employment taxes set aside for deposit to cover amounts provided as paid sick and family leave wages (plus the eligible health plan expenses and collectively bargained contributions and the eligible employer’s share of social security and Medicare taxes on the paid leave wages), the eligible employer may request an advance of the credits by filing Form 7200, Advance Payment of Employer Credits Due to COVID-19. The eligible employer will account for the amounts received as an advance when it files its Form 941, Employer’s Quarterly Federal Tax Return, for the relevant quarter.

Self-employed individuals may claim comparable tax credits on their individual Form 1040, U.S. Individual Income Tax Return

Now that the country is on course to see all adult Americans eligible for COVID-19 vaccination in a matter of days, and an increasing number of employees are returning to the workplace, vaccination status is likely to be an increasingly common topic over the coming weeks and months. Which leads to these inevitable questions: when and how can employers ask their workers whether they’ve been vaccinated without getting into hot water? Whether it’s an innocent question asked while trying to make conversation or an inquiry posed to determine whether someone can return to normal duties, you need to understand your legal rights and obligations regarding this serious topic. Missteps can easily lead to legal complications.

A Simple Vaccine Question is Okay, But Be Wary of Going Further

The Equal Employment Opportunity Commission has indicated in recent guidance that it is generally permissible for employers to ask employees about COVID-19 vaccination status. That’s because this simple question alone is not likely to elicit information from the employee about possible medical conditions, an inquiry that otherwise would invoke federal or state disability laws.

And in many cases, the answer to that question alone may be all you really need. If you don’t really need to know anything beyond a simple “yes” or “no” to the question of whether they have been vaccinated – and in most cases, you won’t – the EEOC suggests warning employees not to provide any other medical information in response to your question to make sure you don’t inadvertently receive more information than you want.

If you require proof of vaccination, you should ask the employee to provide documentation from the immunization source showing the date(s) the vaccine was administered. To avoid potential legal issues related to this process, you should affirmatively inform employees that they do not need to provide any additional medical or family history information. The documentation you receive should be treated as a confidential medical record.

But issues could arise if you venture further than asking this simple question. Asking follow-up questions could trigger obligations under the Americans with Disabilities Act (ADA) and the Genetic Information Nondiscrimination Act (GINA) depending on a variety of factors, so you need to tread cautiously if you take the questions any further.

Going Further with Your Inquiries

That’s not to say you can’t or shouldn’t ask anything further than eliciting a simply yes-or-no answer. There may be circumstances where it is advisable or even necessary to ask more. In those cases, the key considerations relate to the kinds of questions posed and the kinds of responses provided. These are the situations that raise potential legal issues that will likely require you to confer with your lawyer.

Questions about why the employee isn’t vaccinated

If you need information about why the employee has not yet been vaccinated, you might end up eliciting information about the employee’s medical status. Therefore, you can only pose such questions if they are “job-related and consistent with business necessity.” As the EEOC has said, you meet this standard if you have a reasonable belief, based on objective evidence, that an employee who is not vaccinated would pose a direct threat to the health or safety of themselves or others. This can be a challenging and complicated hurdle to clear. You should coordinate with legal counsel to determine whether you can meet this standard in your situation.

If you are treating workers differently based on vaccination status – for example, not allowing them to participate in certain work activities, work in certain locations, interact with the public or other employees, etc. – and you have confirmed with counsel that you have a valid justification for doing so, you may need to ask additional questions to assist with an interactive process. It may be that you need to provide reasonable accommodations to those workers unable to be vaccinated due to underlying medical conditions or sincerely held religious justifications. Each situation will require a case-by-case, fact-specific analysis, and you should be prepared to engage in substantive interactive process discussions related to any accommodation requests.

Questions about how the vaccination process went

If your managers are asking follow-up questions to find out how the employees fared after vaccination – especially after the second dose of Moderna and Pfizer vaccines – you need to recognize that this can be a slippery slope. Such questions could reveal information related to disability status (see above) that you would otherwise not want to know about. Caution your managers to tread carefully when asking such questions, even if their intent is innocent, and train them to know what to do if they receive information that should lead to human resources involvement.

Questions to help with an employee leave program

It is always permissible for your managers to ask about the medical status of an employee in order to help administer an employee leave program that includes absences for vaccine side effects, whether due to federal or state law or due to company policy. As with any such inquiries about medical status, however, make sure your managers know that they need to keep the information confidential to protect the privacy of any medical records received, and to only ask questions that lead them to gather the type of information necessary.

What Steps Should You Take Right Now?

On April 7, 2021, the U.S. Department of Labor (DOL) issued eagerly anticipated guidance on administering COBRA subsidies under the American Rescue Plan Act of 2021 (ARPA). The guidance includes Frequently Asked Questions (FAQs) and various Model Notices and election forms implementing the COBRA Premium Assistance provisions under ARPA, while also announcing the launch of a page dedicated to COBRA Premium Subsidy guidance on its website.

Since ARPA was enacted, employers have been preparing to comply, albeit with many open questions. ARPA requires that full COBRA premiums be subsidized for “Assistance Eligible Individuals” for periods of coverage between April 1, 2021, through September 30, 2021. While this guidance answers important questions on the administration of the subsidies, it does not address many other details on the minds of employers. For example, this guidance does not cover important nuances such as what is an “involuntary termination” in order to qualify for subsidized coverage, how existing separation agreement commitments to subsidize COBRA should be viewed, or details on how the corresponding payroll tax credit will work.

The FAQs are largely directed to individuals and focus on how to obtain the subsidy and how subsidized coverage fits with other types of health coverage that may be available, including Marketplace, Medicaid, and individual plan coverage. We hope that employer directed guidance will follow to fill in the gaps.

Employers will be happy to know that the FAQs confirm a few points that will impact administration. First, eligibility for coverage under another group health plan, including that of a spouse’s employer, will disqualify the employee from the subsidy. Employees must certify on election forms that they are not eligible for such coverage and will notify the employer if they subsequently become eligible for coverage (individual coverage, such as through the Marketplace or Medicaid, will not disqualify an otherwise eligible individual from subsidized COBRA). Failure to do so will subject the individual to a tax penalty of $250, or if the failure is fraudulent, the greater of $250 or 110% of the premium subsidy. The availability of other coverage (which the employer may not know about) does not impact the employer’s initial obligation to identify potential Assistance Eligible Individuals and provide the required notices and election forms.

Soon after enactment, there were also questions circling about whether ARPA applied to small employer plans not subject to COBRA, but rather state “mini-COBRA” laws. The FAQs confirm that the subsidy also applies to any continuation coverage required under state mini-COBRA laws but also notes that ARPA does not change time periods for elections under State law. Further guidance would be welcome on obligations related to small insured plans. The FAQs also confirm that plans sponsored by State or local governments subject to similar continuation requirements under the Public Health Service Act are covered by the ARPA subsidies.

One area that has caused great confusion is how the right to retroactively elect COBRA coverage (to the date active coverage was lost) due to the DOL’s extended deadlines fits with this new election right. While there is more to come on this, the DOL helpfully confirmed that these are two separate rights and thankfully, the FAQs note that the extended deadlines do not apply to the 60-day notice or election periods related to the ARPA subsidies.

The most significant part of the guidance (that we knew was coming but are still happy to see sooner rather than later) are the Model Notices and election materials. The guidance package confirms that employers have until May 31, 2021, to provide the notices of the opportunity to elect subsidized coverage and individuals have 60 days following the date that notice is provided to elect subsidized coverage. Individuals can begin subsidized coverage on the date of their election, or April 1, 2021, as long as the involuntary termination or reduction in hours supporting the election right occurred before April 1, 2021. As previously noted, in no way do these timeframes extend the otherwise applicable 18-month COBRA period.

The Notices include an ARPA General Notice and COBRA Continuation Coverage Election Notice, to be provided to all individuals who will lose coverage due to any COBRA qualifying event between April 1 and September 30, 2021, and a separate Model COBRA Continuation Coverage Notice in Connection with Extended Election Periods, to be provided to anyone who may be eligible for the subsidy due to involuntary termination or reduction in hours occurring before April 1, 2021 (i.e., generally involuntary terminations or reductions in hours occurring on or after October 1, 2019).

Plans will also have to provide individuals with a Notice of Expiration of Period of Premium Assistance 15-45 days before the expiration of the subsidy — essentially explaining that subsidies will soon expire, the ability to continue unsubsidized COBRA for any period remaining under the original 18-month coverage period and describing the coverage opportunities available through other avenues such as the Marketplace or Medicaid. Employers are highly encouraged to use the DOL’s model notices without customization except where required to insert plan or employer specific information.

With the release of the model notices, employers and COBRA administrators now largely have the tools to administer this new election right. The FAQs remind us that the DOL will ensure ARPA benefits are received by eligible individuals and employers will face an excise tax for failing to comply, which can be as much as $100 per qualified beneficiary (no more than $200 per family) for each day the employer is in violation for the COBRA rules. Accordingly, employers will want to begin or continue conversations with COBRA administrators to ensure notices are timely provided to the right group of individuals.

Florida Governor Ron DeSantis signed a new law — the most aggressive of its kind compared to others passed across the country — that protects businesses, educational and religious institutions, governmental entities, and healthcare providers from COVID-19 lawsuits. The new law, which became effective on March 29, shields those covered under it if they can essentially demonstrate a good effort to follow guidelines to prevent the spread of COVID-19. The law is designed to reduce potential liability for COVID-19 claims by imposing high evidentiary burdens and will provide a powerful deterrent to suits filed arising from or related to COVID-19. What do employers need to know about this new law?

Florida’s COVID-19 Shield Law, Explained In A Nutshell

To ensure plaintiffs think twice before filing a lawsuit alleging injuries due to COVID-19, the new law requires that plaintiffs meet the standard for gross negligence and plead any allegations claiming a COVID-19 legal violation “with particularity.” This heightened requirement imposes a higher standard on an individual than if they were merely filing a general negligence or intentional tort claim.

This means that a plaintiff cannot generally point the finger and claim they experienced some COVID-19 injury while working, visiting, or performing some task at or with a covered establishment. From now on, a plaintiff will have to allege facts that identify the who, what, when, where, and how the injury happened in specific detail or their case will be bounced from court.

Before a plaintiff can even access the doors of the courthouse, the law requires that a plaintiff show on the face of the complaint that the defendant deliberately ignored COVID-19 prevention guidelines. Further, they will need to submit into evidence a signed affidavit from a doctor stating with reasonable medical certainty that an injury or death caused by COVID-19 was a result of the defendant’s actions. If a court determines that the plaintiff has not met their duty, the case will be dismissed and can only to refiled if the plaintiff complies with this provision.

As a result of the new law, if a plaintiff is able to survive the statutory immunity, they must still show by clear and convincing evidence that the defendant was at least grossly negligent and that the defendant’s gross negligence was the proximate cause of their alleged COVID-19 related injury, which is not an easy showing. Prior to the new law, proof of liability for COVID-19 claims could have already been challenging largely due to the difficulty of proving causation.

Key Takeaways for Employers

Entities covered by the law should be aware that it is retroactive – but does not apply to cases that have already been filed. The new law provides a one-year statute of limitations from the date that the alleged injury accrues.

You should first make sure that you fall under the definition of the entities that are protected by the new law if you wish to be protected by this litigation shield. Additionally, you will need to be able to objectively demonstrate that you complied with federal, state, and local COVID-19 prevention guidelines. Critically, you will not just be expected to comply with the guidelines but should also focus on the ability to demonstrate compliance in the event compliance is disputed.

You can demonstrate your compliance by publishing written policies and procedures designed to implement the latest CDC guidance to reduce the potential for the spread of COVID-19, providing training to all employees regarding effective COVID-19 mitigation efforts, and designing your workplaces to allow for appropriate social distancing.

Federal and state anti-discrimination agencies have issued guidance for employers that want to require workers to get a COVID-19 vaccine—but at least one lawsuit has claimed that employers can’t mandate a vaccine that is approved only for emergency use. While this argument might not hold up in court, employers should be aware of the risks associated with a vaccine mandate.

When employees refuse a vaccine, the employer should address their concerns and explain the reasons why the company has adopted a mandatory vaccination policy. An open dialogue and education will be key, as will following FDA updates in this regard and consulting with legal counsel.

There are many reasons why an employee may be unwilling to receive a COVID-19 vaccine, and employers may need to explore reasonable accommodations, particularly with employees who have disability-related and religious objections to being vaccinated.

Distribution of COVID-19 vaccines has been issued under the Food and Drug Administration’s (FDA’s) Emergency Use Authorization (EUA) rather than the FDA’s usual processes. But the FDA has said that the vaccine has met its “rigorous, scientific standards for safety, effectiveness and manufacturing quality” and that “its known and potential benefits clearly outweigh its known and potential risks.”

An employee who recently filed a lawsuit challenging an employer’s vaccine mandate argued that the EUA states that people must have “the option to accept or refuse administration of the [vaccine]” and be informed “of the consequence, if any, of refusing administration of the [vaccine] and of the alternatives to the [vaccine] that are available and of their benefits and risks.”

Although the employee in the case works in the public sector, many employment relationships in the private sector are at-will, which means either the employer or the worker can terminate the employment for any lawful reason. An employer that mandates a vaccine may argue the consequence of refusing a vaccine is being fired.

“Consensus in the legal community has been that, at least in the private sector, employers may require at-will employees to be vaccinated, subject to accommodations that may be required for medical or religious reasons,” said Kevin Troutman, an attorney with Fisher Phillips in Houston, and Richard Meneghello, an attorney with Fisher Phillips in Portland, Ore.

The U.S. Equal Employment Opportunity Commission (EEOC) has issued guidance indicating that employers generally can mandate COVID-19 vaccinations. “The EEOC specifically addressed vaccinations that are authorized or approved by the FDA,” noted Anne-Marie Vercruysse Welch, an attorney with Clark Hill in Birmingham, Mich.

The California Department of Fair Employment and Housing (DFEH) also recently said that the Fair Employment and Housing Act (FEHA) generally allows employers to mandate vaccines that have been approved by the FDA. The DFEH specially noted that the FDA has authorized and recommended three COVID-19 vaccines—all of which have been authorized under an EUA.

But vaccine mandates may still be risky for employers. It is possible that employees who are terminated for refusing to receive a vaccine authorized by the FDA under an EUA could try to pursue claims for wrongful termination in violation of public policy. The viability of such claims will depend on applicable state law regarding a potential public policy exception to at-will employment and how courts—state and federal—construe the EUA wording.

The regulatory framework is still unclear and a number of states are considering legislation that would prohibit employers from requiring employees to receive a COVID-19 vaccine. If these bills become law, the uncertainty regarding the EUA issue will become moot in those states, at least as of the time the laws go into effect.

The EEOC issued guidance stating that employees may be exempt from employer vaccination mandates under the Americans with Disabilities Act (ADA), Title VII of the Civil Rights Act of 1964 (Title VII) and other workplace laws.

California’s guidance noted that the FEHA prohibits employers from discriminating against employees or job applicants based on a protected characteristic—such as age, race or sex—and requires employers to explore reasonable accommodations related to a worker’s disability or sincerely held religious beliefs.

“If an employee has a medical condition or sincerely held religious belief that would prevent them from being able to be vaccinated, their employer must go through the interactive process to determine if a reasonable accommodation is available,” Welch said. She recommended that employers have accommodation forms available to employees to begin the interactive process and document the steps the employer took to attempt to arrive at a reasonable accommodation.

Accommodations could take various forms, depending upon the employee’s job and setting. Employers may offer remote work, change the physical workspace, revise practices or provide a leave of absence. In each situation, the employer must determine whether an accommodation would enable the employee to safely perform the essential functions of their job.

Some employees might refuse to receive a vaccine for reasons that aren’t legally protected, such as a general distrust of vaccines. Employers need to be very thoughtful as they consider whether to mandate vaccines because employers may have to fire a material portion of their workforce who refuse to be vaccinated or allow some employees to ignore a company policy–which can lead to discrimination risks and employee morale issues.

“Most employers are encouraging vaccination rather than requiring it,” Welch observed.

Coburn recommended that employers focus on the following measures to encourage employees to receive a vaccination:

Employers that want to offer incentives should be mindful of wellness program limitations and offer alternative ways for employees who cannot get vaccinated to receive the incentives, Coburn noted.